India is a market as interesting as it is diverse. It's a nation on track to be the world's largest in terms of population and by extension, the largest global market. In the past decade or so, India has been the world's unofficial IT outsourcing capital, developing its own silicon valley. But if the numbers are to be believed, the Indian tech space is finally getting off the ground, globally, positioning itself as a lucrative market worth targeting in its own right.

India has around 5.2 million software developers, second only after the US globally. Software and app developers in India are worth millions of dollars, and startup funding in India's tech ecosystem is at an all-time high. With all of that coming together to position India as the next global digital superpower, let's dive into understanding what it takes to succeed in the Indian market.

India's Digital Economy of Scale

The term 'economies of scale' is a concept from economies that refers to the cost advantages companies enjoy when scaling up production. While the concept may not translate accurately into the digital realm—mainly because the cost of developing a digital product doesn't go down with a growing number of customers—scale still plays an important, perhaps more critical role in building successful tech companies.

While manufacturing may get cheaper as enterprises scale up, be it by investing in better production facilities, sourcing raw materials for lower prices, or improving efficiencies within the manufacturing process, a similar rule doesn't translate into building software.

Your average app developers in Bangalore, for instance, charge around 25$ an hour working on an app. Depending upon the demands and complexity of your project, this could cost anywhere between $12k to $82K for the entire project. And no, the price doesn't get cheaper with a growing number of pre-orders or early adopters. If anything, you might have to pay more to build reliable, scalable applications from the get-go.

Although, scale does become relevant in the digital economy, especially when it is combined with creative pricing. But before diving into that, let's have a look at some numbers.

Understanding India's Digital Economy

India is a developing economy with lots of new and upcoming users. To understand it better, consider its size and purchasing power.

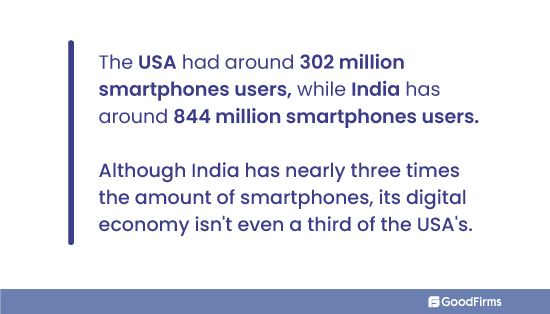

Internet penetration in the US was 90% in 2021, the same in India at the time was just 47%.

Yet the total number of smartphone users in the US capped at around 302 million in 2021, while in India, total smartphone users amounted to 844 million, more than twice the US market.

But this is just one piece of the puzzle.

The number of potential users is important when determining a market's strength and size, but their spending capacity matters as well.

The US is the undisputed global leader in the digital space. Its digital economy is worth trillions of dollars, while India lags leagues behind. India's digital economy is 'predicted' to reach the $800 billion to $1trillion mark by 2030 at best.

What does this tell us about the digital market in India?

It's that India's digital economy is huge (in terms of numbers) and holds the potential to double in the coming years. However, average Indian tech users aren't willing or capable enough of spending as much as consumers do in more mature markets.

Therefore, the secret to winning in the Indian tech space is to cast your net wide and not deep. Meaning companies in India can make money with scale, gathering a large customer base but with each customer only paying a fractional size of what someone in the US would pay for a similar service.

International brands like Amazon have understood this, while local Indian tech startups are catching up.

The State of the Indian Tech Market

Keeping the above analysis in mind, emerging tech startups in India have become hyper-focused on growth, aiming to secure a majority market share within their niche. Combine that with an agile development philosophy that relies on user feedback, and we have an ecosystem that promotes growth over value and expansion over figuring out what works in the market.

As a result, India has seen a surge in unicorn-sized startups that are yet to figure out the right product-market fit or turn profitable.

Just in a few recent years, India has seen more than 100 unicorns that have gotten to the size they are today from generous venture capital funding. Investors have poured Billions into emerging Indian tech startups, many of which are struggling to turn profitable.

As of September 2022, only around a fifth of these were profitable. The rest still need to figure out how to get there. And that, essentially, is the biggest challenge in the tech space in India.

App development companies in Pune and across India need to find a balance between scaling up rapidly as well as figuring out the right product-market fit. Funded by generous investments, countless companies have swelled up to gargantuan size but are nowhere near the break-even mark, let alone achieving profitability.

The most notable examples within these categories are companies like Paytm, Byju's, and Cred.

Paytm started out as a digital wallet but has now morphed into a full-stack fintech solution offering countless digital services. While the company's transformation and adaptability may be commendable, its profit margins aren't. Although Paytm may turn profitable in the coming decade, the fact that the company lost 75% of its valuation post-IPO really has its investors worried.

Indian ed-tech giant Byju's is a similar story, a promising venture that needs to burn cash at an alarming rate just to survive. Much like how India's demonetization boosted Paytm's adoption in the previous decade, the covid lockdowns were a great boost for ed-tech companies like Byju's. But despite raising millions worth of investment at a valuation of more than $20 Billion, Byju's booked a staggering 4500 crore rupees loss last year.

These aren't niche startups; companies like these understand the need for scale in the Indian market, which is what justifies their aggressive expansion, billion-dollar accusations, gargantuan marketing budgets, and crazy high CACs.

But if companies end up making losses despite heavy investments and securing a large user base, does that imply that it's just doom and gloom within the Indian market?

Zerodha Case Study: Growing Sustainably in India's Volatile Tech Space

Zerodha is an online stock broker launched to make stock trading accessible to India's tech-savvy, younger population by eliminating the middleman. The company has had massive success so far, with around 6 million daily active clients in 2022, making it India's largest stockbroker.

Zerodha is relevant to our discussion because it is a 'discount broker'. Traditional stock trading was a complex, tedious and expensive process, making it inaccessible to most of the Indian market. Zerodha solved these issues by embracing India's scale. They undercut the competition by charging considerably low brokerage and made most of their money with the volume of transactions taking place on their platform. This was a win-win both for the platform as well as its users.

I love Zerodha's example because it is an excellent lesson for startups dreaming of going big in emerging markets like India. Young companies do realize the value of scaling up quickly in India, which is why they focus extensively on aggressive expansion and expensive customer acquisitions. But none of it works if the inherent value your brand produces doesn't resonate with the large consumer market in India.

India may have some of the world's best software development talent, but ask any app developer in Hyderabad, Pune, or Chennai how challenging it is to build a live stock trading platform and they'll unanimously agree over the value Zerodha, and other digital discount brokers have created. Just the technical challenge of ensuring that buy and sell orders are placed at the right time over rapidly fluctuating market prices across a country with varying degrees of internet connectivity, is in itself a massive challenge to overcome. Add to that this is a massively regulated industry where brokers like Zerodha are constantly threatened by consumer protection laws eating into their profits.

The bottom line is that Zerodha leveraged technology to make financial opportunities accessible to millions of people at a fraction of the cost compared to traditional systems. The lesson here, thus, is that the secret to success in the Indian market is to leverage technology to create value that is deployable at scale.

Zerodha is also famously 'Bootstrapped to Billions' and spends almost next to nothing on marketing. This allows the company to forge its own path, at its own pace, without worrying about investors' interests or burning a hole in its wallet to acquire new customers. Zerodha's example, more than anything else, underscored the conveniently ignored fact that while foreign investments and extravagant marketing budgets may be good to have, they do not guarantee success.

Conclusion

While the Indian market may be a tricky space to crack, it is quickly emerging as a lucrative market worth targeting both for native and foreign tech companies. One of the biggest advantages of the Indian market is its size. But recognizing how the average Indian consumer earns and spends considerably less than the global average, companies need to rely on building cheaper but scalable solutions to remain profitable.

While brands in the Indian tech space may be well aware of the need to scale, the space is still young, and companies are yet to figure out what works best in their respective niche in the long run. All things considered, India, as a market and an economy, is only getting started. A massive amount of potential and innovation is yet to be realized in India's tech sector. But as a general rule of thumb for emerging tech startups in the country, creating value-driven solutions that are readily scalable with a cost advantage to consumers seems like a good blueprint to build a business strategy around. How the Indian tech space will evolve in the near future is an interesting question that continues to remain unanswered.