The most conservative estimates show that the breathtaking increase of fraud results in multiple damages, including loss of billions of dollars globally. How to help companies and individuals as well retain not only their material goods but also keep their information safe and sound?

Probably, we should seek a way out of this protracted deadlock in the digital transformation and take the benefits it can offer when implemented properly. What else? Entrust the struggle with these “bad guys” – fraudsters – to the several emerging techniques in detecting fraud. Keeping in mind that the technology does not stand still and is continuously evolving at a high pace, we should be sure; it can and WILL help more accurately and quickly detect undesirable behavior and protect innocent people from violations.

So, let’s start our journey to recent advances in fraud detection technology.

Fraud Essentials: What Does It Actually Mean?

It is essential first to define the term fraud. Fraud is an intentionally deceptive action designed to gain something unlawfully or unfairly. In civil meaning, it is the distortion of facts. In the criminal sense, it is when the theft has occurred in the fraud.

The Association of Certified Fraud Examiners, the largest anti-fraud organization, defines fraud as “the use of one’s occupation for personal enrichment through the deliberate misuse or application of the employing organization’s resources or assets.”

Commonly, in the Cambridge Dictionary, we can find two definitions:

- The crime of stealing money by deceiving people.

- Someone who deceives people by saying that they are someone or something that they are not.

Where, When, and Why?

Fraud can take place in many areas of daily life, influencing almost every industry, such as eCommerce, BFSI, government, real estate, insurance, or something else.

With the expansion of technology, fraud is increasing as well as bringing shocking losses. Every person and business can fall victim to it, and the situation is aggravated by the creativeness on how fraudsters invent more mind-boggling methods to cheat.

That does not seem to be a surprise. The more the market is growing, the more adventurous perpetrators become. For instance, in retail: eCommerce sales are expected to reach $632 billion by 2020, being the tidbit for fraudsters. We also cannot ignore the mobile payment market, which is expected to increase to $4.5 billion by 2023.

Writing fake checks, selling fake items, untruthful report of the income to tax authorities. We wish that were the whole list. To round up the most efficient techniques to fraud detection, let us provide some examples of swindles one should be aware of.

With the always-connected users and digital transformation being always ahead of the game, cybercrimes are taking a special place in the whole fraud picture. Yet in 2017, the most common type of fraud was theft. Comparing to 2018, according to the ENISA Threat Landscape Report, information theft, loss, and so on were the most popular crime types against companies. Now, we see that data protection is occupying the first row of the central cinema, and ransomware seems to be a perfect weapon to steal it.

Internet Fraud is Skyrocketing

Still keeping a huge amount of data on our computers and mobile devices ignoring secure cloud services, we de facto say, “Taking a piece of malware, send me a phishing email and take control over our sensitive information.” What else, more and more victims make a serious mistake by paying the ransom and then for their data unlock, which causes more criminal activities.

DDoS attacks keep growing alongside with spam, phishing emails, social media swindles, data breaches that are also taking their positions in the fraud world. As we have already mentioned, the methods are more creative than we can imagine.

The favorite cyberattack method also includes Cryptojacking used to infect the computer and further mine cryptocurrency. Even though the value of cryptocurrencies is decreasing, mining for virtual currencies is still the item of interest for fraudsters.

All cybersecurity issues show that the problem lies not only in the criminal nature of fraudsters but also in ill-conceived users’ behavior.

How to improve it and become more attentive?

- Limit the information you are sharing online and do not get in the dialog with third-parties about your confidential information.

- Do not reuse passwords across online accounts (“Password123” is not okay!)

- Carefully read EULA (end-user license agreements)

- Doubt whether the email you receive is legitimate

We believe you can take proactive actions and protect yourself just being a little more knowledgeable after reading these examples.

Emerging Technologies – Our Saviors!

With the increased complexity and speed of fraud attacks, traditional and outdated approaches to fraud prevention and detection barely cannot define the violation, be it a long-standing predictive model or established rules. For instance, the transaction will be classified as a suspicious one if it does not follow them.

Rules and models are often unreliable in the sense that they include the human factor. They can make a mistake resulting in violation of innocent people identifying perfectly legitimate transactions as violated ones or, on the contrary, can skip a breach.

To keep up with the emerging fraud attempts, one should implement artificial intelligence (AI) and machine learning (ML) in online fraud detection procedures.

AI is a much broader sphere that replicates human mental processes. Machine learning is one of the components of AI, and its main task is to analyze data and make decisions with minimal human intervention.

For the following reasons, ML and AI are more effective than traditional fraud prevention methods:

- More scalable in handling big data

- Faster by deviating from ad-hoc rules

- Able to perform tedious work without getting tired to analyze risks

- Perfect tools to optimize costs on onboarding employees to understand and manage typical fraud prevention and detection approaches.

Remember all the spheres where ML has been a huge success- Siri, Netflix recommendations, Google search, and more. Fraud detection is another area where machine learning is transforming both processes and results.

Having walked all over the public eye for some years, AI and ML can quickly and carefully identify potentially fraudulent transactions or attacks with less or no human involvement. This technology is believed to be dual-purpose when it is utilized both by hackers (in phishing, social engineering, etc.) and their opponents.

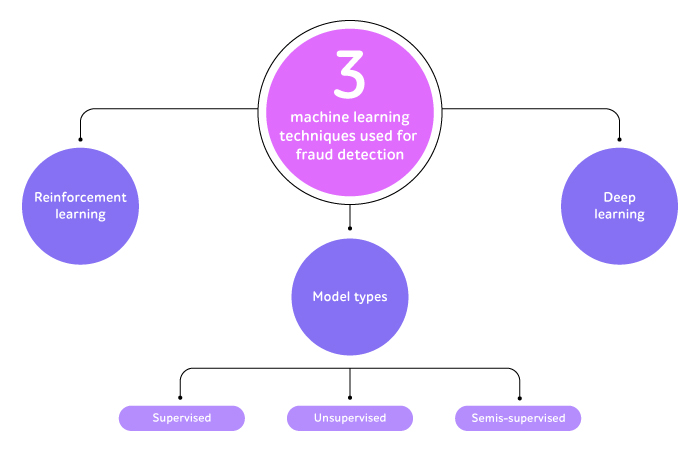

In a broad sense, we can highlight the following ML model types.

- Supervised ML

The set of information is labeled as valid or, on the contrary, fraudulent, and the algorithms learn to analyze the discrepancies between them by creating a function for further proper identification of the transaction. The data will be more precise if the system can process a large amount of information at the start of the work.

- Unsupervised ML

Models work with unlabeled data; it is not the point. The algorithms evaluate the data and consider everything that does not fit its derived instruction set as a suspicious item. Unsupervised ML is perfect for detecting unprecedented methods.

- Semis-supervised ML

It combines the strongest features of the above-mentioned ML systems being trained upon a combination of labeled and unlabeled data. It can work out when data cannot be labeled at all or when the support of a human is required.

Apart from these three learning types, reinforcement learning algorithms can come to the arena helping create a powerful tool by determining ideal behavior in the defined conditions. The reinforcement learning machine continuously learns from the environment to get the needed actions that can mitigate risks. It is important to ensure your detection model is working as required. It is also essential to update and maintain it to match the ongoing needs.

By introducing deep learning techniques into fraud detection approaches, we ensure that it can train itself with no human or other intervention to make reliable predictions, much like the human brain. Neutral networks can help collect information within tight deadlines and analyze input-output relationships more precisely.

Despite the fact that there are advantages of ML and AI, and these are believed to be the next-gen fraud detection advances, we should keep in mind their imperfections too. Machine learning can predict fraud and identify it, but, unfortunately, it is more like a black box that cannot explain the reason for the prediction and identification. Moreover, in the case of unsupervised models, a human is not able to realize the logic of the system and guarantee it is working properly.

So are there any other technologies to detect frauds at a high-level?

A Multi-tiered Approach to Fighting Against Fraud

It comes clear that the combination of techniques can help provide effective fraud detection and that the fragmented methods are no longer enough.

Many businesses use fraud detection software to prevent fraud. There are some very good free and open-source fraud detection software options also available to them.

Furthermore, why not try to implement advanced rule engines that can identify sophisticated cases catching transactions that differ from normal scenarios? Yes, the rule engine and ML have always been competitors. Nevertheless, in this particular case, they can be combined to create a powerful platform. With the ability of machine learning to analyze enormous amounts of information, a combination of these two advances can help get a perfect detection mix.

Blockchain is also quite sustainable to manipulations presenting a decentralized, shared ledger where the blocks are linked to the previous ones. Only verified users can store, view, and share information, which makes fraud more difficult. For companies that do not yet conduct payments in digital currencies, blockchain can become a silver bullet. But it cannot entirely prevent fraud.

In financial trades, the validation process is incredibly slow, meaning that blockchain can parse the order but not go beyond the process and assess whether the fraud occurred. It can validate that inputs or outputs are valid as data, not more.

Blockchain can be considered a good way to prevent fraud, but until we depend on human behavior, we have criminals even here.

Another component is the mobile environment. Only by taking into account the diversity of devices, operating systems, programs installed on each of them, their multiple combinations, you can take action to struggle with mobile fraud with better outcomes. Remember that checks will provide more accurate results when conducted on real devices, as simulators and emulators can draw incorrect conclusions.

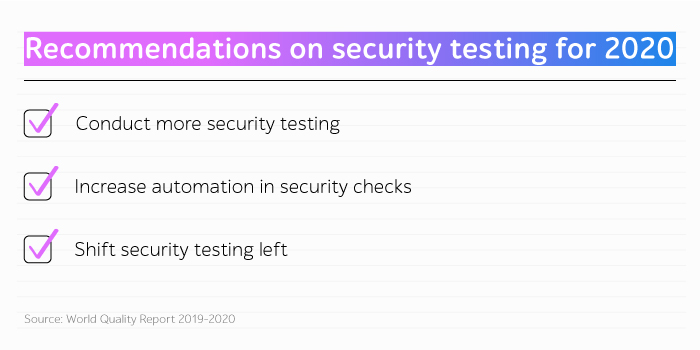

Apart from adopting up-to-date tools, businesses must conduct timely security testing and make it harder for criminals to manipulate. These checks can ensure the system is not full of loopholes leaking to production.

The latest edition of the World Quality Report 2019-2020 highlights that the businesses should provide more security testing including, security assessment, vulnerability scanning, penetration testing, and more. The other issue is to automate wisely at all software development lifecycle stages; this is how you can increase the speed of delivery and quickly find bottlenecks. And, another significant recommendation is to shift security testing left, which means to test earlier, thus, mitigating software risks.

Final Lines

Many companies around the globe have already started to implement data science against fraud activities. At the very moment, ML is considered the most promising technique helping prevent and detect fraudulent cases protecting people and businesses from significant losses. However, ML is still in its infancy, and we advise to combine advanced techniques for better detection results.

For individuals, the most optimal choice to keep their data and money safe is to become more attentive and accurate in their actions, caring about what and when they do with sensitive information.

Last but not least, you can use the top fraud detection software listed by GoodFirms such as Fingerprint, Simility, ipQualityscore, Fraudlabs Pro, etc. If you have already tried a fraud detection software, don’t forget to post a review here!

Ultimately, with intent and timely action, we can effectively combat fraud.