As banks continue to strengthen, there have been some incredibly intriguing tasks that they are achieving these days that were once thought next to impossible. Strategy, technologies, and operations of all banking business model are working together in a symphony. Banking tool is one of the core assets of a banking business model. Some of the best banking software are customer-led and facilitates intelligent, smart banking.

In this blog, we will discuss the best 4 free and open source banking software solutions that banks and financial institutions of all sizes can implement for better results. These 4 free and open source software offers unique features to efficiently manage customer accounts, securely process transactions, and serve reliable digital banking services to the clients.

To continue forward the momentum and to understand what future banking might look like when free and open source technologies intervene with the banking process, do read the remaining part of the article.

To continue forward the momentum and to understand what future banking might look like when free and open source technologies intervene with the banking process, do read the remaining part of the article.

The Best 4 Free and Open Source Banking Platforms

#1 Cyclos

Cyclos is a scalable and reliable free and open source banking solution that comes with a pack of powerful features. The software is also available as a free-to-use version, and is available in an Open Source version too, which creates space for improvement. The current version of Cyclos is 4.16.

Developed by SOCIAL TRADE ORGANISATION (STRO), the software can be an ideal choice as it enables cost-effective and state-of-art banking.

Cyclos is one of the most secured, scalable, and flexible banking systems available in the market today.

The software is ideal for set-ups like; microfinance institutions, retail banks, and complementary finance dealing systems.

(Image Source: Cyclos)

Key Features:

- Mobile banking

- Online banking

- Ecommerce

- Pos & Cards

- SMS service

- Interactive Voice Response

- Multiple Identifier support

- Payment via QR code facility

- Payment via NFC card

- Supports multiple currencies

- Supports multiple transaction types

- Geolocation

- CRM

- Loyalty programs

- Analytics

- Customized reports

- Flexible payment authorizations

- Secured with ISO 27002, PCI and EBA

- Custom fee calculations

- Advanced payment methods to request, schedule and authorize payments

- Custom passwords

- API (restful and swagger implementation)

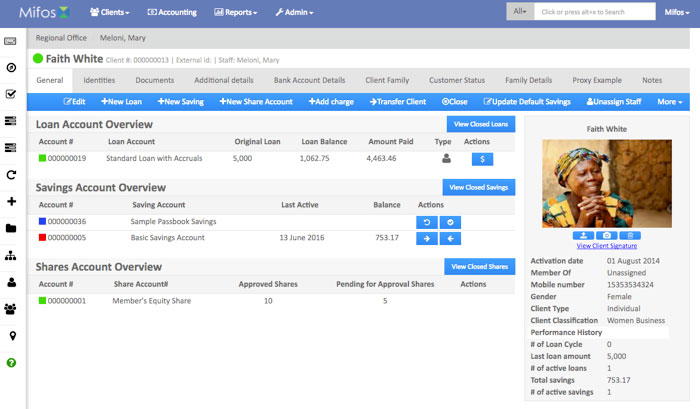

#2 Myfos X

Myfos X is yet another powerful financial and banking system that allows banking business models to work with a wider array of services and be customer-centric. It allows users to create, configure, and launch new credits and deposits easily. Sharing across branches is very easy. The software enables quick and easy client response.

As a free and open source banking software, Myfos X is ideal for all types of financial services including; Banks, lending institutions, Credit Unions, SACCOs, Savings organization, and financial companies.

The software can be deployed in any environment like; cloud, on-premise, online or offline.

This open source software is completely available via the Mozilla Public License 2.0.

(Image Source: Myfos X)

Key Features:

- Well designed dashboard

- Operatives & core platform architecture

- Responsive

- Caters to both Mobile and web clients

- Credit products

- Mobile payments

- Insurance

- Savings products

- No demographic boundaries

- Multiple delivery channels

- Multiple deployment environments

- Social and financial reporting

- Integrated real time accounting

- Cash management

- Guarantor management

- Client data management

- Entity management

- Workflow and risk management

- Cash management

- Support for multi-currency

- Supports multiple languages

- Loan and savings portfolio management

- Flexible product creation engine to instantly create, configure and roll out new credit

- Interest, penalties and fees

- Multiple lending methodologies

Mifox X is an extended platform for all types of financial services. The software is easy to download and can be configured to execute different types of work.

#3 MyBanco

MyBanco is again one of the most popular and powerful, free and open source core banking tools. Banks or any other banking business model can save money by using this software. The solution comes equipped with advanced features to log every transaction, allowing financial firms to keep track of each penny transferred. Apart from this, this powerful solution can process upto 1500 transactions per second making it a reliable choice for banks.

(Image Source: MyBanco)

Key Features:

- Quick and instant cross-communication via XBank – MyBanco’s cross-communication platform

- Customer management

- Deposits & withdrawals

- Transactions management

- Interest management

- Payments & transfers

- Customer relationship management

- Loan management

- Accounts management

- Cash and credit processing

- Support for paycheck advance/payday loans (one time payment loans)

- Graphical loan designer

- Native iPhone and Android apps

#4 OpenCBS

OpenCBS is an open source Core banking system perfect for financial institutions that are focused on agility. The software was originally referred to as Octopus Microfinance, a part of OXUS Development Network. The software is free to use and addresses areas like; microfinance, financial services, and collection, Loan management, and Customer Relationship Management. This easy to use software can be quickly customized as per business needs and can effortlessly connect with other core banking systems. The cloud version is hosted on Amazon Web Services that is beneficial for quick backups and recovery.

(Image Source: OpenCBS)

Key Features:

- Client management

- Loan management

- Delinquency management

- Savings management

- Transaction tracking

- Teller management

- Accounting

- Analytics & reporting

- Security & backup

- Multi-currency

- Multi-branch

- Ability to apply new KYC fields

- Task management with alerts

- Loan monitoring and repayment collection

- Delinquency management

- Document storage & tracking

Apart from above discussed free and open source banking software, businesses can also benefit from below mentioned banking solutions that offer unparalleled accuracy, efficiency, and performance. These software can help businesses streamline their banking functions with ease, ensuring proper ROI and growth;

Most Popular Banking Software Solutions

Finastra

Since 2017, Finastra is a top banking software delivering a unified and consistent solution. It has been helping financial institutions drive customer loyalty, increase competitiveness, and ensure effortless scalability of banking services through its universal banking software solutions. Operating from the UK, Canada, Singapore, UAE, and the USA, Finastra has been serving more than 8,100 customers from all over the globe, including community banks, universal banks, credit unions, retail banks, etc. Modular architecture, advanced analytics, hyper-personalized experience, AI integration, dynamic dashboard, loan management, etc., are some of the widely used features of this flexible solution. From quickly reacting to market demands and loan origination to payment management and ensuring compliance with regulatory standards, Finastra is a standalone choice helping banks achieve maximum results and performance.

SBS

Since 1968, SBS, earlier Sopra Banking Software, has been a top-notch choice for banks in digitizing their various operations associated with banking, lending, payments, compliance, etc. More than 1,300 clients benefit from this global financial technology software in terms of better profitability, productivity, and agility. Modular components, microservices, containers, and APIs make it highly configurable to seamlessly fulfill banking needs. Additionally, features like omnichannel banking, multiple delivery models, data-driven analytics, etc., are there that are designed to redefine the way business operations are performed. SBS is also known for robust security measures, including zero trust models, anomaly detection, bug bounty program, AI-based data security, etc., to safeguard financial and customer data of banks.

Oracle FLEXCUBE

The Oracle FLEXCUBE is another popular banking solution to achieve better competitive advantage, capitalization on market opportunities with enhanced security. A few notable features of this leading banking software are centralized product administration, extensive parameterization, relationship-based pricing, configurable workflows, intelligent automation, etc. Additionally, it complies with SAML 2, ISO 20022, and other legal requirements. Features to improve business performance and efficiency include multi tenancy, open architecture, localizations, and 24*7 banking without any downtime. Backed by Oracle’s four decades of experience, FLEXCUBE is a global financial management platform that automates various banking-related activities.

Temenos

Trusted by over 950 core banking and over 600 digital banking clients, Temenos is among the best-in-class banking solutions to seamlessly execute highly personalized and AI-supported banking functions. Retail and corporate banks of all sizes can benefit from this end to end and AI-driven banking software. It can also smoothly integrate with 150+ fintech solutions for financial crime mitigation, data analysis, machine learning capabilities, etc. Modular architecture is another notable feature of this agile banking software to efficiently meet banking needs and prevent any disruptions in the financial operations. Popular features include automation, investor servicing, fund management, payment processing, wealth management, and many more that are required for successful execution of comprehensive banking functions.

Alkami

Another software that made it to the list of best banking software solutions is Alkami. It is a certified banking solution capable of delivering a better banking experience, driving business growth, and innovating enhanced products and services. An intuitive interface, custom tailored insights, payment processing, performance tracking, personalized offers, fraud protection, and many more features are there for smooth digital banking operations. In addition, integration with around 270+ business applications is also supported to help banks achieve maximum scalability, security and efficiency. Banks, credit unions, and fintech partners can efficiently redefine consumer behavior and meet dynamic market demands by using this software.

Ncino

Ncino is a popular banking software that offers advanced banking-related features to digitize and transform financial tasks. More than 1,850 customers rely on this software to perform their functions associated with commercial banking, corporate banking, consumer banking, small business banking, etc. Loan origination, document management, credit analysis, deposit account opening, portfolio analytics, risk management, audit trail, and advanced automation are some major features that make it unique from its competitors. Features like real-time connectivity, paperless loan documentation, touchless transactions, credit report generation in real time, etc., can significantly improve banking operations.

Conclusion

Globally, some of the largest financial companies have transformed into institutions offering a wider range of financial services to markets without any boundary. With innovation and technology, banks are able to identify new business and markets and develop customized products and services. Banking solutions are the need of the hour.

We believe the perspective indicated in this article has been provocative and offers tactical actions you need to consider, and at the same time, even guide you with the right insight for tackling your future banking business.

Banks need to be readily accessible, powerful, and cost-effective to operate for customers of varied demographics and only reliable banking software can do that effortlessly.

Investing in the best Banking system that supports Cognitive Technologies & Artificial Intelligence can help in;

As we wait for the unveiling of what is next in the banking technology category, what do you think should be the next for the banks to tackle the future demands? Share your thoughts in the comments section below. If you have worked with any of the banking systems mentioned in this article, do share your feedback with us.

If you wish to refer to any other software category other than banking software, do look at our software directory.