Through bullish Bitcoin rallies, overpriced NFT runs, and grandiose Metaverse ambitions, Blockchain has remained one of the Tech world's favorite obsessions for quite some time now. Blockchain technology is said to be on course to disrupt a number of different industries, including but not limited to manufacturing, healthcare, logistics, and obviously, finance.

However, implementing blockchains within existing high-demand industries isn't as simple as setting up a protocol in the background and forgetting about it. Blockchain could be a groundbreaking digital technology, but it has its own shortcomings that prevent mainstream adoption. While leading blockchain development companies around the world are hard at work trying to build solutions robust enough to be dependable in an ever-changing tech landscape, we are still a long way from having Blockchain maximize its potential.

So what are these challenges?

There could be many, depending on your specific blockchain use case. However, the biggest issue that plagues Blockchain's usability and reputation is scalability. When criticizing Blockchain scalability, the most common example that comes to the surface is Bitcoin.

Although that's an exaggeration, in the sense that faster blockchains are feasible, the greater point here is that blockchains aren't at the same level in terms of speed and scalability as the traditional systems they so often challenge to replace.

So what exactly is the challenge here? Why can't blockchain transactions be instantaneous? And what solutions are we building to address these challenges? Let's address these one at a time.

An Over-Simplified Guide to How Blockchains Work

Strictly speaking, in terms of decentralized and public blockchains, these are open ledgers that each participant gets a copy of. Every instance of the Blockchain needs to be updated with the record whenever a transaction is made.

In a traditional digital ledger, the central authority controls and updates the records/data. Blockchains are different because the mechanism to justify or verify the transactions is baked within the program itself.

This is why blockchains are decentralized because they don't need a central authority to validate the data; the network does it for itself.

So how does this work? By building something called a Consensus Mechanism.

What is a Consensus Mechanism?

In order for transactions to be accepted on a blockchain, they must be verified and validated by the majority of nodes or participants. Participants use a consensus mechanism to validate a block. The most popular consensus mechanism to use is 'Proof of work' (PoW), which is also what Bitcoin uses.

PoW works by having participants compete to solve a complex computational problem. Whenever a block is ready to be formed, the network broadcasts its information to all the nodes, who then try to find a solution or nonce. A nonce is just a random number that, when combined with the block's data and passed through a hash function, will create a 'hash.'

I know this may be too much to take in, so let me break this down with an analogy.

Think of a giant pile of jigsaw puzzle pieces. Your goal is to finish a puzzle made out of two pieces that fit exactly together. One of which you already possess and the other you'll have to find from the pile. Finding the correct puzzle piece can be a challenge to you, but once you do find it, it can be easy for your friends to verify that you've found the right one.

PoW Blockchains work the same way. The piece you've got available to you is your block data; these are the transactions that'll go into the Blockchain. The piece you need to hunt down is the nonce. When combined together, these two complete the puzzle which is your hash.

The difficult process of finding the missing puzzle piece (or nonce) is the computational problem. It is basically just a random number that, when combined with the block data and entered into a hash function, produces a unique but valid hash. This is how blocks are mined.

One important point to remember about all of this is that blocks are difficult to mine but easy to verify. Comparing this to our analogy, we can say it is more difficult to find the right piece from the pile than to verify if the puzzle is complete or not.

Mining can be made easier or difficult by changing the constraints that define a hash as acceptable. How and why we want to vary mining difficulty is an interesting concept in itself but perhaps too broad for this post.

Coming back to the consensus mechanism.

Finding the nonce takes a lot of computing power. Essentially, miners need to try generating (or guessing) random nonce value, combine it with the block data, and see if they end up on a valid hash. If they do, they can broadcast their solution to the chain, and others can easily verify (reversing the hash function) if the block is valid.

Alright, hope that was an easy-to-understand yet somewhat comprehensive explanation.

But why is any of this a problem? How does this impact blockchain scalability?

Why Proof of Work isn’t Scalable?

The reason why the Bitcoin blockchain takes 10 minutes to mine a single block is that it was designed to do so. The Bitcoin network changes the mining difficulty based on the mining resources available at a given time to ensure that the network always takes the same amount of time to mine a single block.

In theory, we could have a really quick blockchain by reducing the mining difficulty, which would essentially mean that finding the nonce number would be made much easier. However, we can't make it too easy since that could make it easier for attackers to manipulate the chain.

How? Let me explain.

Miners need to go through a certain number of nonces before finding a valid Hash. High mining difficulty implies that more nonces are needed to be tried per second. This is also known as hash rate; in simple terms, it is the number of hashes a system can compute per second.

If the time to mine each block remains constant, then increased mining difficulty demands an increase in the network's total hash rate. And what do attackers need if they wish to manipulate the Blockchain? At least 51% control over the network's computing.

But since the hash rates are high, they'll need a ridiculous amount of computing power to match the needed hashes per second for more than half the network. In plain English, higher mining difficulty makes it so that attackers need impossibly high computing power to execute an attack.

This means mining needs to be kept intentionally resource-intensive under a PoW consensus mechanism. That leads us to 3 bottlenecks when talking about PoW scalability.

Speed, Size, and Resources.

Speed: Because Proof of Work mechanisms require participants to put in the "Work," in this case solving math problems, the process of mining takes longer than just verifying a simple transaction. The harder your problem, the more secure your network will be, but the longer it'll take for participants to mine individual blocks. If you try to reduce the per-block mining speed, the computational demand for mining will go up, pushing the network towards centralization.

Size: With every transaction and block added, the size of the Blockchain grows. And as adoption accelerates, blockchain size grows exponentially. Large blockchains quickly become impractical for the average user, and alternate solutions like pruning, SVPnodes, or off-chain transactions need to be added to maintain the chain's practicality.

Resources: Since proof of work is designed to be resource-intensive, it can be difficult for average users/miners to compete with mining farms. Not to mention, some of the larger PoW blockchains consume a ridiculous amount of power to maintain, making Blockchains a growing environmental concern.

Potential Solutions for Blockchain Scalability

As Blockchain demand and usage continue to rise, the need for scalable blockchain solutions grows as well. There are three major approaches blockchain development companies can take here: Improving their consensus Layer 1 and Layer 2 solutions.

Layer 1 Solutions

These require a redesign of the Blockchain's core elements from the ground up. Or one could say Layer 1 solutions are not external solutions but improved and upgraded blockchains.

These can be created by adopting a new consensus architecture, breaking the chain into smaller, more manageable parts, or changing the underlying protocol to improve performance. Layer 1 solutions are typically deployed for more than just scaling up chains. They lay the foundation for building dApps and support features like tokenization and decentralized government.

Proof of Stake:

Proof of Stake is one of many consensus mechanisms that have been heavily proposed and implemented to improve blockchain scalability. It is undoubtedly the most popular Layer 1 solution out there.

While PoW is like a computational lottery, proof of stake selects nodes to verify based on the amount of native currency they put up on stake.

Participants risk losing their collateral deposit as well as their reputation if they are caught trying to make fraudulent blocks. Losing reputation reduces your chances of getting to validate the next block while depositing higher collateral increases your odds of the same.

The advantages are obvious. PoS systems are energy efficient and less resource intensive, with dramatically faster block mining speed and higher throughput rate, which makes the network significantly more scalable.

If none of that makes sense, just remember that with Proof of Stake there is no 'problem solving'; instead, the nodes with the higher bids are preferred.

Ethereum recently upgraded its network to a proof-of-stake consensus model. While the change has reduced the network's energy consumption by more than 90%, its true impact is hard to assess, especially amidst the ongoing crypto winter.

Layer 2 solutions

Layer 2 solutions, unlike their layer 1 counterparts, are designed to improve scalability while being 'off-chain.' Think of them as augmentations on top of the existing chain but still separate from it. These allow for faster transactions and reduce the strain on the network. Popular Layer 2 solutions include concepts like state channels, roll-us, child chains, and more.

State Channels:

Say you have multiple back-and-forth transactions with a single party. State channels are separate off-chain channels that handle these transactions and report the final 'state' of the channel to the Blockchain in the end. Because state channels take the transaction away from the Blockchain, they reduce the load on the network while still maintaining the Blockchain's security and trustlessness. The Best example of state channels in action is Bitcoin's famous lightning network.

Roll-ups:

Roll-ups once again try to execute a bunch of transactions on other side or child chains and bundle up the data from them onto the main chain. What makes this interesting and secure is that the side chains need to report the minimum amount of transaction data required to validate the transaction on the main chain. Meaning anyone can validate the transaction later on; however, the main chain doesn't need to process each and every transaction. Best of both worlds, speed, and security.

We could go in-depth on the various Layer 2 solutions, dissecting in minute detail how each one is a slightly different implementation of the other. But this is a dummies guide, so suffice to know that most popular layer 2 solutions have a pattern: They off-load a bulk of transactions onto other chains or channels and record the final state of the network on the main Blockchain. Different solutions differ in their implementation of the said system, but the underlying idea remains the same.

Many Layer 2 solutions have cropped up in the last few years, some more powerful than others, but does any of this even work?

Case Study: How Polygon Solved Scalability for Blockchains

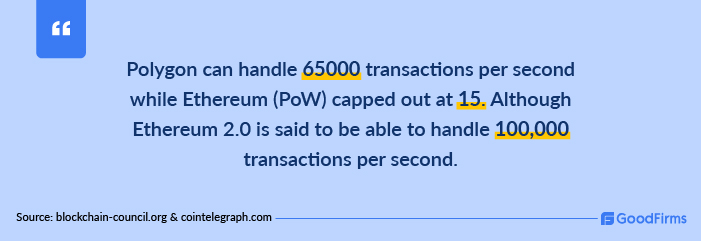

Polygon is a Layer 2 solution designed to improve scalability for Blockchains like Ethereum that brings together everything we've discussed so far to achieve greater scalability. Polygon uses PoS consensus Mechanisms on its side chains as well as offers Optimistic and Zero Knowledge Roll ups to improve Ethereum performance. Polygon's chain is compatible with Ethereum Virtual Machine and thus allows effortless migration of Ethereum-based Smart contracts onto Polygon.

Based primarily in Karnataka, India, Polygon was among the most prominent blockchain development companies in Bangalore. Founded by software engineers back in 2017, the company started out being known as Matic and was later rebranded to Polygon. For those confused, Polygon today is to Matic what Ethereum is to ETH.

Not to mention Polygon transactions are significantly cheaper. Polygon founders believe Ethereum's scalability is of little concern to their product, and blockchain development companies in Pune and Mumbai like Polygon, are focused on building the right tools and ecosystems that help build a decentralized internet.

Polygon itself has grown beyond just a blockchain and strives to provide sustainable, fast, and secure solutions for building dApps.

Key Takeaways: Has Blockchain’s Biggest Flaw Been Addressed?

Let's step back for a moment and adopt a wider picture. The world's first Blockchain was deliberately designed to favor the decentralization and security ends of the trilemma rather than scalability. Perhaps the anonymous inventor of Blockchain never anticipated how popular this invention would get, and hence the need to incorporate scalability within the system.

Within their original state, PoW blockchains are far from being scalable. But modern blockchain developers have found creative ways to tweak the original thesis enough to invent something that may fit our needs. While modern chains are considerably much more scalable, perhaps we need to approach the problem from the other far end.

Maybe instead of trying to scale Blockchains to an insane number of transactions per second, perhaps we should try to minimize trying to upload anything and everything onto the Blockchain. Recently, there has been a trend to forcefully integrate Blockchain into everything, perhaps as a way for companies to make themselves look more future-ready.

But maybe the missing piece in Blockchain's scalability solution is not the technology but its use case. Maybe we should use Blockchain for its intended use-case only, i.e., as a decentralized digital ledger and a decentralized currency protocol.