Barclays engaged us to redesign and replatform its multi-channel client experience, consolidating dozens of legacy systems across retail banking, private wealth, and corporate treasury into a single, coherent UX framework. The goal: enable self-directed, human-assisted, and automated financial interactions across digital, branch, and advisory touchpoints—while meeting stringent compliance, audit, and accessibility standards.

The scope spanned both customer-facing interfaces and internal advisor tools, bridging decades-old infrastructure with the modern expectations of personalization, speed, and transparency.

Taming Integration at a Global Financial Scale

Barclays’ digital experience was built on a complex stack of:

Legacy mainframe systems with fragmented data schemas

Middleware from CRM and wealth platforms

Bespoke FX, payment, and compliance tools across multiple markets

Regulatory overlays tied to UK, EU, US, and APAC jurisdictions

Our team partnered with Barclays Technology and Enterprise Architecture to build a UX abstraction layer capable of:

Pulling real-time data across siloed systems without compromising consistency

Rendering context-appropriate interfaces for personal banking, SME users, and high-net-worth clients

Supporting user journeys across devices, from mobile-first app users to high-security desktop terminals used in regulated investment contexts

We deployed adaptive interface logic, where every component rendered differently depending on the client’s product portfolio, risk profile, region, and access tier—while drawing from a single, normalized experience schema behind the scenes.

UX Governance Aligned with Risk, Compliance, and Audit Readiness

Every design decision had to stand up to scrutiny from:

Internal compliance teams and external regulators (FCA, PRA, SEC, ESMA)

Accessibility audits (WCAG 2.2 AA, soon AAA for key user flows)

Fraud and cybersecurity leads focused on multi-factor, step-up authentication, and behavioral anomaly detection

We created a compliance-aware design system, where:

Microcopy passed through legal review workflows

Interaction components carried risk-tier metadata (e.g. for wire transfers vs. account views)

UX patterns mapped to audit-traceable steps—especially in flows like customer onboarding, KYC refresh, and complaint resolution

We also embedded UX risk checkpoints into agile delivery cycles—so design and compliance could collaborate upstream, avoiding late-stage rework.

The result: faster delivery, fewer escalations, and greater confidence across legal and regulatory stakeholders.

Driving Strategic Coherence Across Products and Brands

Barclays operates in both retail and investment banking—with client journeys that often cross from personal to business to wealth services. Our challenge was to design an experience that felt seamless, not stitched together.

We worked with the Chief Digital Officer and Group Strategy to define:

A customer journey architecture that spanned digital, branch, and relationship-managed contexts

A persona stack based on behavioral segmentation (not just account type), feeding personalization engines and product relevance scoring

A component-based experience model, where features like account overviews, chat support, or trade confirmations behaved consistently across digital properties, yet respected brand tone and visual grammar differences across units

This model allowed Barclays to present a single, strategic digital face to customers—without diluting the specialism of its business lines.

Transforming Internal Teams and Experience Capability

To institutionalize the shift, we helped Barclays:

Stand up a global DesignOps function, integrated with delivery squads and legal

Train 100+ designers, PMs, and engineers in experience governance, pattern reuse, and trust-by-design

Create an internal UX maturity map, helping business units self-assess, plan improvements, and measure design impact over time

We also contributed to a component observability system, tracking live performance, accessibility compliance, and error reporting at the UX layer—allowing real-time monitoring of customer experience health.

Business Results Tied to UX Clarity and Trust

Six months post-launch:

Call center volume dropped 23% in regions where new onboarding and transaction flows went live

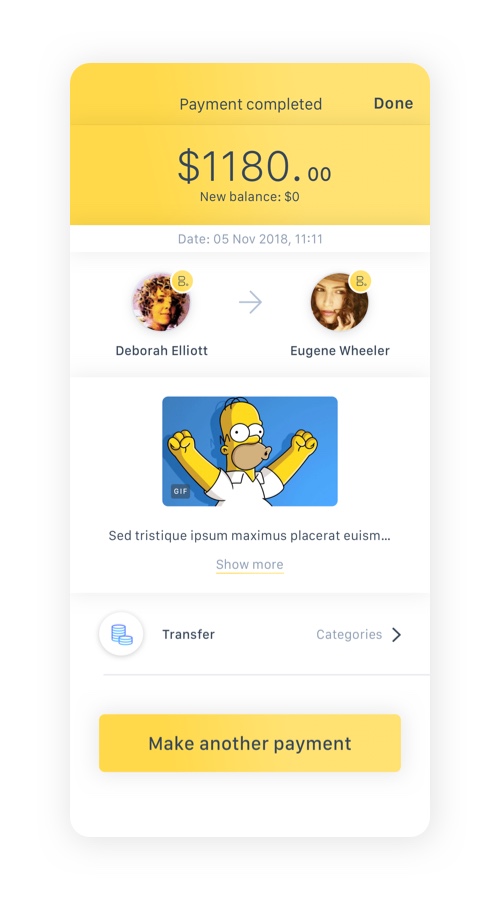

Time-to-complete for international payments decreased by 41%, with clearer step-by-step flows and real-time error handling

Net trust score among business clients rose by 19 points, correlating with increased self-service usage and fewer escalated service tickets

Legal teams reported a 58% drop in copy escalations, thanks to the pre-cleared component library and compliance-by-design workflows

Barclays now sees UX as a core driver of trust, efficiency, and loyalty in a digitized, multi-market financial world.

.png)

.png)

.png)

.png)

.png)