Table of Content

- What is Periodic Inventory?

- What is COGS or Cost of Goods Sold?

- Simple Formula for Calculating CGOS

- When to Use the Periodic Inventory System?

- Ideal Business Candidates for Periodic Inventory

- How Periodic Inventory System Caters Different Business?

- How Does the Periodic Inventory Work?

- When to Use the Periodic Inventory System?

- The Pros and Cons of Periodic Inventory System

- Perpetual Inventory System

- The Dual: Periodic Versus Perpetual Inventory Management System

- Cost Flow Assumptions in Periodic Inventory Management Method

What is the first impression that you get when you hear about the inventory management system? Most people may associate it with retail or an e-commerce store, which heavily depends on inventory management.

The inventory management system can be defined as a combination of both hardware and software technologies, methods, and procedures. The main aim of the inventory management system is to monitor the stock, items, assets, and supplies so that products can be sent to the right vendor or the customers. The inventory management is used in a plethora of industries.

The hardware components help to scan and read the barcode levels and software provides a central database to analyze the data and prepare a forecast for the future.

There are two types of the inventory management system:

- Periodic Inventory Management System

- Perpetual inventory management system

The difference between periodic and perpetual inventory systems is that periodic inventory provides insights at the end of the accounting period. The perpetual inventory system provides real-time updates whenever the inventory moves.

What is Periodic Inventory?

The Periodic Inventory System is a procedure, which involves valuing, recording, and physical counting of inventory at a definite interval. This inventory valuation process helps business enterprises to determine COGS or Cost of Goods Sold. The businesses can update their inventory towards the end of an accounting period, which in turn helps them to identify the beginning and ending stock.

The Periodic Inventory System also allows the firms to maintain a separate account for delivery costs and the main inventory account. The enterprises can even keep a track record of expenses associated with ingoing inventory accounts. One of the crucial aspects of the periodic inventory system is that unlike the perpetual inventory system, it does not count or record inventories on a day-to-day basis.

Thus, in simple words, the periodic inventory system enables a business enterprise to trace the inventory sales and purchases at regular intervals throughout an accounting period. The company can also save sales and purchase records until a specific timeframe and input them in batches. For example, a retail clothing store that utilizes a periodic inventory system can determine the cost of goods sold (COGS) and update records in the inventory to optimize the simple workflow, enabling efficiency.

What is COGS or Cost of Goods Sold?

Before proceeding with the detailed discussion on the periodic inventory system, it's essential to shed some light on the cost of goods sold or COGS. Also known as ‘Cost of Sales,’ the cost of goods sold, or COGS, is the direct costs that the companies incur to sell the goods. The cost includes the cost of raw materials and labor to manufacture a product. But you do not need to cover other expenses such as salesforce and distribution costs.

The Cost of Goods Sold (COGS) may vary depending on your level of inventory. For instance, if you have purchased bulk items, then, of course, it’s a reasonable affair but you need to consider the storage space.

Please do note that if you have to calculate the gross profit and margin, then COGS needs to be subtracted from sales revenue. Also, higher COGS leads to lower margins. Also, the COGS changes its value based on the accounting standards used during the calculation.

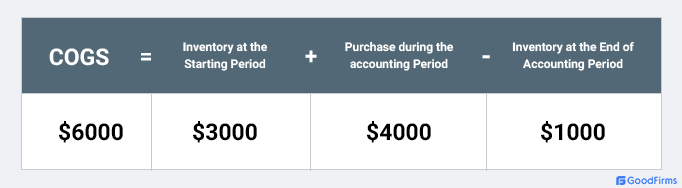

Simple Formula for Calculating CGOS

COGS= (Inventory at the Starting Period) + (Purchase during the accounting Period) – (Inventory at the End of Accounting Period)

Let's explain this further with an example. Suppose an XYZ firm has an inventory of $3000 in the starting period. It pays $4000 for purchases and then finds out that the physical count and end inventory cost is $1000. Thus, the calculation is-

$6000 = $3000 + $4000 - $1000

When to Use the Periodic Inventory System?

So far from the discussions, you can make out that the periodic inventory management system is a handy customer for all small business retailers and enterprises. It is based on a simple approach that you have to value and count your inventory only after a certain period and not continuously. These business firms do not follow any specific relation between the purchased goods and the final sold item.

For instance, the accessory retail business has to count the inventory on a continuous note to check out the ending inventory. Hence, it can use the periodic inventory method.

Even businesses with less stock keeping units or SKUs and a simple supply chain management process can adopt the periodic inventory system. Also, for those running a seasonal business, this inventory system can be useful to calculate the profit.

In a nutshell, you can use the periodic inventory method if-

- You do not have to manage a large stock of goods

- You want a simplified approach to managing your inventory goods.

- You aim to slowly and stealthily grow your business, and you don't want to indulge in some fast-paced market competition.

- Your business has a small-volume transactions of sales.

- More convenient for seasonal businesses.

Ideal Business Candidates for Periodic Inventory

Which type of business enterprises do you think will reap the benefits of a periodic inventory system?

Generally speaking, the periodic inventory system is best suited for all small business firms, such as retail enterprises. For example, these may include grocery, clothing stores, convenience, and large discounted stores. Such small scale businesses have higher inventory or stock, but their value is lower. A periodic inventory system helps businesses to save both time and resources.

Periodic Inventory System is also suitable for startups that have less stock or a few warehouses as starting. Besides, business enterprises that do not have an ample amount of purchase or sales can also implement periodic inventory management. The good news is that periodic inventory management software helps to streamline and simplify the task.

You first need to consider which periodic inventory management software will suffice the needs of your business.

How Periodic Inventory System Caters Different Business?

Grocery Stores

(Source: flickr)

Grocery stores have a large inventory of small products. They can make periodic adjustments on their stock to save on labor costs. The method helps them to keep their time. In addition to that, the stores can manage and maintain their inventory records up-to-date apart from reducing incidents like shoplifting.

Clothing Stores

(Source: Photo by Tembela Bohle)

The periodic inventory method can prove to be a handy option for clothing stores. These stores usually have high volumes of sales, and most of the items are moderately priced. Periodic inventory allows them to record and maintain the sales hassle-free without day-to-day updates of each product. Also, a lot of returns and exchanges are involved in this business; it's better to wait until the end of a specific period.

Large Discount Stores

(Source: Photo by Artem Beliaikin on Unsplash)

There are various discount retail stores such as Wal-Mart that sell a variety of items and have a vast inventory of goods. The use of periodic inventory accounting helps these stores to check their stock in less time more precisely.

Convenience Stores

(Source: Photo by Robert Nagy)

Even the convenience stores sell an extensive array of products at affordable prices. The periodic inventory saves them from incurring extra labor costs as these retail stores can work with a small group of staff.

Bookkeeping Stores

(Source: Photo de Anaïs Berland)

Bookkeeping stores have a plethora of books in the inventory with a simple business structure. With sales and rental book service structure, the periodic method comes in handy for book stores to find out inventory overview with ease. Therefore, managing balance sheets and daily records becomes straightforward enabling productivity.

Bakery

(Source: Photo by Jeswin Thomas)

Bakeries have to manage unprocessed and processed materials in the inventory. By storing dairy products, sugar, salt, yeast, eggs, etc., bakeries tend to make processed food and manage sales. But the issue of overstocking and understocking the products that have a short shelf life makes it challenging to manage the supply chain. Periodic inventory management enables bakeries to get an overview of the stock and track the inventory after the specific accounting period.

How Does the Periodic Inventory Work?

You are aware that periodic accounting includes physical counting and valuation of inventory goods at a specific period. The warehouse staff and retail store employees keep a track record of stock at regular intervals.

The information gathered during the periodic inventory method proves handy for preparing the accounts, journal entries, and ledger books. The accountant records all transactions of the company in a purchase account, keeping an eye on the inventory and reduction of cost of goods sold. The balance gets added to the beginning inventory for the specified accounting period. You can do the inventory calculations towards the end of the year.

But one has to exclude the account for damaged and broken items. It is essential to conduct physical counting to determine the number of tangible goods in the store.

The business enterprises also take into account various reports such as the bi-annual, quarterly, or monthly that were previously recorded during the year.

You don't need to update the General Ledger account if you are purchasing items for reselling. You can make a debit from temporary account purchases. Hence, in most cases, the temporary account starts with a zero balance.

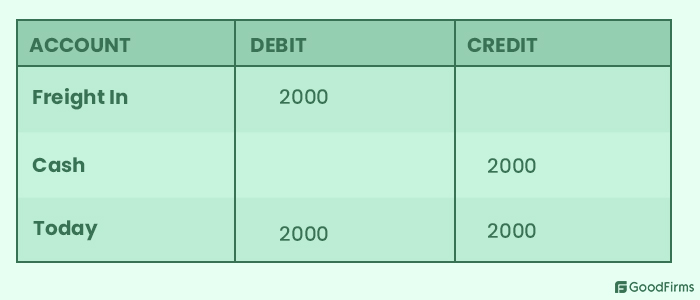

Now let's come down to contra accounts. The accountant makes some adjustments from purchasing goods to general ledger contra accounts. The role of a contra account is to equate the balance based on the related account. You can consider this as the final statement.

The purchase discounts, the purchase returns, and allowances all fall within the category of contra account. You have to consider the cost of delivery on a separate note from the central inventory account. You can monitor the delivery costs of inward bound inventory in Freight In and Transport In accounts. It also plays an essential role in enhancing the value of the stock. You can refer to the table below to get a more precise understanding of the periodic inventory method.

The Pros and Cons of Periodic Inventory System

Now that you have got answers to the vital questions of how periodic inventory works and when it’s used, it's time to focus on some of its major pros and cons.

First, let's begin on a positive note and focus on the significant benefits.

Pros of Using Periodic Inventory System

1. Hassle-Free Implementation

One of the first positive features that go in favor of the periodic inventory system is hassle-free implementation. It means that you can easily align this inventory management with your business model in minimal time. Since it involves physical counting of the inventory, you can do it according to your convenience. It also helps your business to roll out once in a year.

2. Best Inventory Management Method for Small Business

The Periodic Inventory System has been primarily considered a big boost for small business and firms. Indeed, it can benefit a small business operating with only a few staff members. It is also helpful for companies where the orders are not placed in large volumes and frequently.

3. Cost-Effective Adoption

If you are looking for a cost-effective inventory management system within your budget estimate, then the periodic inventory method will go. You don't have to make a substantial investment, and it saves both your time and resources.

4. Easy to Use

The periodic inventory system has gained the attention of business owners due to its reduced usage. You can use it in a simplified way as per your needs.

5. Less Staff Requirements

Managing the inventory for a small business requires physical counting and managing of stock and goods, which can be done by existing staff. This method is generally used by the small businesses and startups where the inventory storage runs as per customer demand enabling that does not need extra staff.

Cons of Using Periodic Inventory System

Periodic Inventory Management also has a few drawbacks to highlight below.

1. Little Source of Information

Due to the physical counting of inventory and after a particular gap of time, the entrepreneur may not be able to gather substantial information required to manage the stock.

2. Miscalculation of the COGS

You may have conducted the cost of goods sold and products and checked the availability of the goods during the stocking period. But you may find that the figures and actual numbers are mismatching when you carry out the physical inventory count.

3. Increased Disparities

Another major disadvantage of periodic accounting is that it gives birth to more discrepancies. The reason is that the physical counting of inventory is done towards the closing period of accounting. There is no update available before that. So, you may find problems in getting the actual figure of the stock from beginning to end.

4. Lose Control over Inventory

This issue is again related to not counting the physical inventory regularly and keeping your account books updated. You may not get the actual picture of your stock and expense when you want to check it. Hence, you may fall short of the real demand in the market as you may or may not have the item in your stock. Loss of control can lead to shrinkage or overstocking of the product, which results in an ultimate loss.

5. Limited Scope for Scalability

Many business enterprises consider a periodic inventory system as a time-consuming process. It enables limited and slow growth. But considering the fast-paced and competitive scenario, today, it may not lead to a favorable outcome.

6. Risks of Stock Shortcomings and Overstocking

Businesses using the periodic method may sometimes find it challenging to match with the inventory in real-time. Therefore, businesses face the issue of stock shortcomings and overstocking of the goods. Inaccurate data until the next accounting period makes it quite challenging for businesses to manage inventory effectively.

Perpetual Inventory System

Another popular and widely used inventory management system is the Perpetual Inventory System, which is quite different from the periodic inventory. As the name implies, this system allows the stock managers to manage and maintain inventory perpetually. It means you can keep a constant watch on your inventory items and balances. The inventory stock also gets updated automatically whether the product is incoming or outgoing for sale.

Perpetual Inventory System offers various benefits such as-

- You get more grip and control over your stock and inventory unlike the periodic inventory system.

- This inventory management approach allows you to reduce your stock shrinkage and save from incurring a colossal loss.

- Since you are only storing the necessary items and in the required amount, you are saving additional storage costs.

- Since you are gaining more control over inventory, it prevents over-stocking of goods.

- Perpetual Inventory System makes use of the technology and software, allowing you to get real-time inventory updates.

- Since you are monitoring your inventory in real-time access, you get a better understanding of the customer's demands and preferences.

- Perpetual Inventory System provides a more accurate picture of your business status and inventory in place.

- The inventory system can well align with other inventory management methods such as FIFO, LIFO, and EOQ, etc.

- It provides an opportunity to all business enterprises to centralize their inventory management system. It helps them to initiate the omnichannel approach.

- You can also find valuable information from one system. Also, you don't have to depend much on the manual physical count.

Let's discuss the Shortfalls-

The Perpetual Inventory System has only a few drawbacks.

- This inventory management system may be a time-consuming process since it does not involve physical manual counting.

- Perpetual Inventory System may prove to be a costly affair for small business firms and startups.

- Minor errors in inventory management and discrepancies may even arise in this inventory management method like a periodic system.

The Dual: Periodic Versus Perpetual Inventory Management System

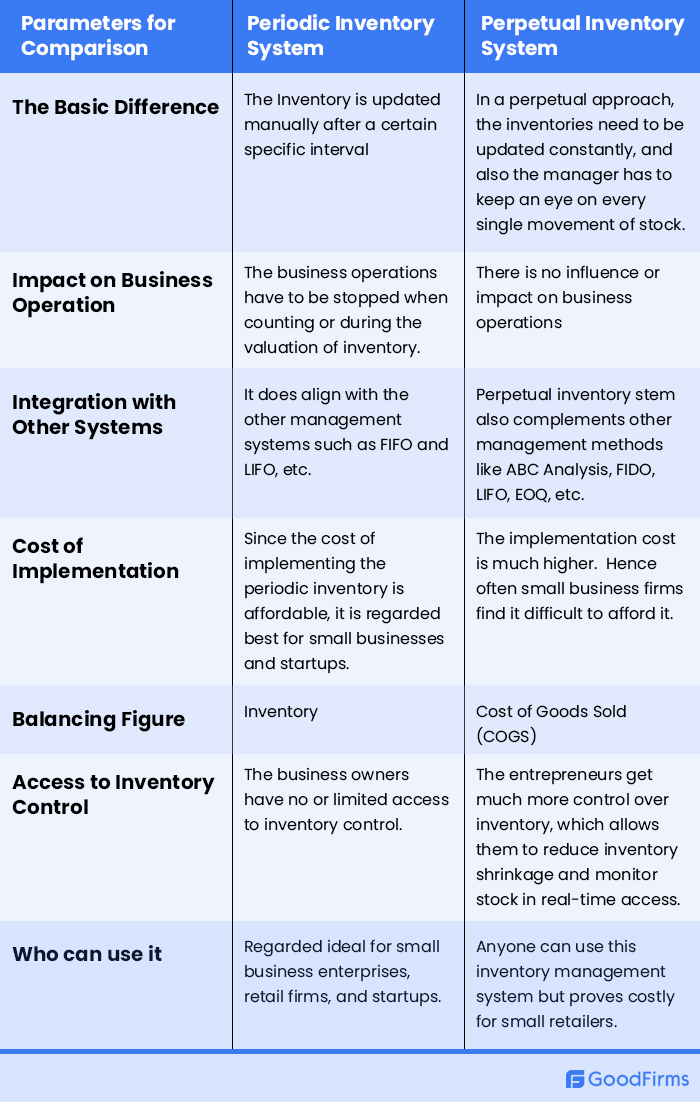

Now that you are familiar with both the periodic accounting and perpetual inventory management system, it is viable to make a comparison between them.

You can say that periodic accounting and perpetual inventory systems are two different management and accounting methods that help you track your stock. But if you make an overall honest comparison, the perpetual inventory system is far superior and better as opposed to the periodic inventory accounting. It is because it provides faster, more accurate, and real-time data to all inventories. It helps businesses to make quick and successful decisions related to consumer demands.

For a clear and precise understanding, please go through the table below.

Critical Differences in a Nutshell

- Periodic Inventory System does not have access to real-time stock monitoring as opposed to the perpetual inventory system.

- Periodic inventory system largely relies on physical counting and verification, whereas perpetual inventory is based on book records.

- The inventory is manually maintained and managed in periodic inventory as compared to perpetual inventory, whereas the stock needs to continuously update after every transaction.

- The periodic inventory records the loss of goods and items in the cost of goods sold. On the other hand, you have to record the same in ending inventory when using the perpetual system.

- The regular workflow and business operations get disrupted and stopped during counting and verification in periodic inventory, whereas perpetual does not create any hindrance in the business workflow process.

Cost Flow Assumptions in Periodic Inventory Management Method

The cost flow assumptions in an inventory management system take into account the value of the goods from the starting inventory period. It also includes the purchase expenditures of new inventory to calculate the cost of products sold and determine the closing inventory figure.

The Cost Flow Assumption is categorized into three categories-

1. FIFO or First-in, First-out

2. LIFO or Last-in, First out

3. WAC or Weighted Average Cost

Talking about the cost flow assumptions in periodic inventory accounting you will find some similarities with the perpetual inventory system primarily related to the formulas. But the difference lies in the method of calculation. Cost flow assumptions help to determine the closing inventory and COGS in periodic inventory. Ultimately, it decides how effective and viable your inventory management skills are.

Periodic FIFO

FIFO or First-in, First-out is a type of inventory management method in which the value of the closing inventory gets calculated. The business owner assumes that the goods are brought first to get sold first. Thus, the leftover inventory becomes the new purchase stock. When you are adopting Periodic FIFO, you have to commence with the physical counting of the stock.

Periodic LIFO

When you have planned to implement the Periodic LIFO or Last-in, First out, your focus should remain on selling the latest purchased inventory first. Like FIFO, the calculation in LIFO also starts with physical verification of the stock.

Weighted Average Costing in Periodic Inventory

The Periodic Weighted Average Costing (WAC) is a type of inventory management that uses an average to allocate the closing stock value. Weighted Average Costing allows the valuation of inventory in stock. It is assumed somewhere between the latest and oldest produced or purchased goods.

The formula for WAC is WAC=BI + P / units for sale.

The Role of AI in Inventory Management

Inventory management has seen several challenges with traditional methods of organizing stock and goods. There were a lot of disruptions in the operations with data inaccuracy in the volume, leading to the shortcomings of stocks or overstocking the inventory. With an overstock of goods, the cost of holding these items increases the expenditure of the businesses. Therefore, new tech tools were introduced that performed basic tasks such as data entry of the product sale and purchase, tracking of the stock levels, alert notifications, reporting, and analytics. These tools have helped the businesses, but not entirely, since there are challenges like the manual efforts to learn these tools, no advanced optimization, a reactive approach, and less likely to be predictive.

Artificial Intelligence has totally changed the game, eliminating the big burden of inventory management from businesses. How?

Well, the AI-powered tools have concentrated on collecting the data of stocks, accounting, sales, and other relevant information to provide predictive analysis according to previously found patterns. Also, these tools have helped businesses resolve common tickets issued by customers according to predefined rules and previously addressed issues in ticket support. Using predefined rules and collected data of inventory, AI-powered tools offer intelligent decision-making utilizing probability, future trend prediction, and specifying patterns.

The use of AI in inventory management addressed the majority of complicated challenges and optimized the process. The vague stock levels figures that were once known for creating chaos are now being accurate enabling data accuracy. The manual efforts of ticket support, data entry, bookkeeping, and other stuff that drained the energy of the workforce are now being addressed with the co-operation of AI and human efforts. With the functionalities like AI chatbots and personalized recommendations customer satisfaction has been reached to new heights optimizing the workflow.

The Final Words

The article has covered almost all the crucial aspects of the periodic inventory system with extensive detail on most points. After reading this article, you know what inventory management, periodic inventory system, and COGS are, and how to calculate it. The article also provides substantial information on how and when to use the periodic inventory system and which industries can benefit from it.

You also learned about the significant pros and cons of this inventory management system and how it is different from the perpetual inventory system. You must have also realized that inventory management and control are an integral part of your business model. You have to choose any of the stock management systems based on your specific business requirements. If you are keen to learn more about inventory management have a look at the buyer’s guide specially created by the experts at Goodfirms.