ebanklT

Humanizing Digital Banking

- Banking

- Arabic

- English

- French

- German

- Italian

- Portuguese

- Spanish

Media

ebanklT Core Features

- Compliance Tracking

- Credit Card Management

- Customer Portal

- Financial Accounting

- Investment Banking

- Multi-Currency

- Online Banking

- Payments & Transfers

- Private Banking

- Retail Banking

- Risk Management

- Security Management

- Transaction Tracking

ebanklT Pricing

Pricing Type

-

Contact Vendor

Preferred Currency

-

EUR (€)

Free Version

-

No

Payment Frequency

-

Quote Based

Executive Interview of ebanklT

With a vast user base, GoodFirms provides a platform for potential clients to discover our company. The positive user experiences and authentic client reviews on the platform also helps raise awareness about our services and solutions and establish trust among potential clients.

We offer our bank clients convenient digital channels such as mobile and internet banking, along with our BFO e-contact center, all tailored to put customers first. The ebankIT Omnichannel Digital Banking Platform offers a fast and seamless digital banking transformation to financial institutions, delivering a humanized, personalized, and accessible digital experience. ebankIT solution is enhanced with flexible and robust full omnichannel capabilities and extensive customization capacity to future-proof the digital strategy of banks and credit unions, empowering them with a truly customer-first approach. As a co-founder and executive board member, I actively participate in the design and implementation of our innovative omnichannel solution; leading a variety of business development, product and project management, business analysis, and product operations functions.

We noticed there was a need in the market for out-of-the-box solutions and custom experiences and therefore we developed a software to meet those market needs. Furthermore, from day one, ebankIT has had for goal to collaborate with banks and credit unions to provide a more effective way for financial institutions to engage with their customers and members digitally. Additionally, ebankIT wanted to enable financial institutions to reduce costs per transaction, maximize efficiency with limited resources, expand wallet share, and capitalize on potential business models and revenue streams that arise in the digital world.

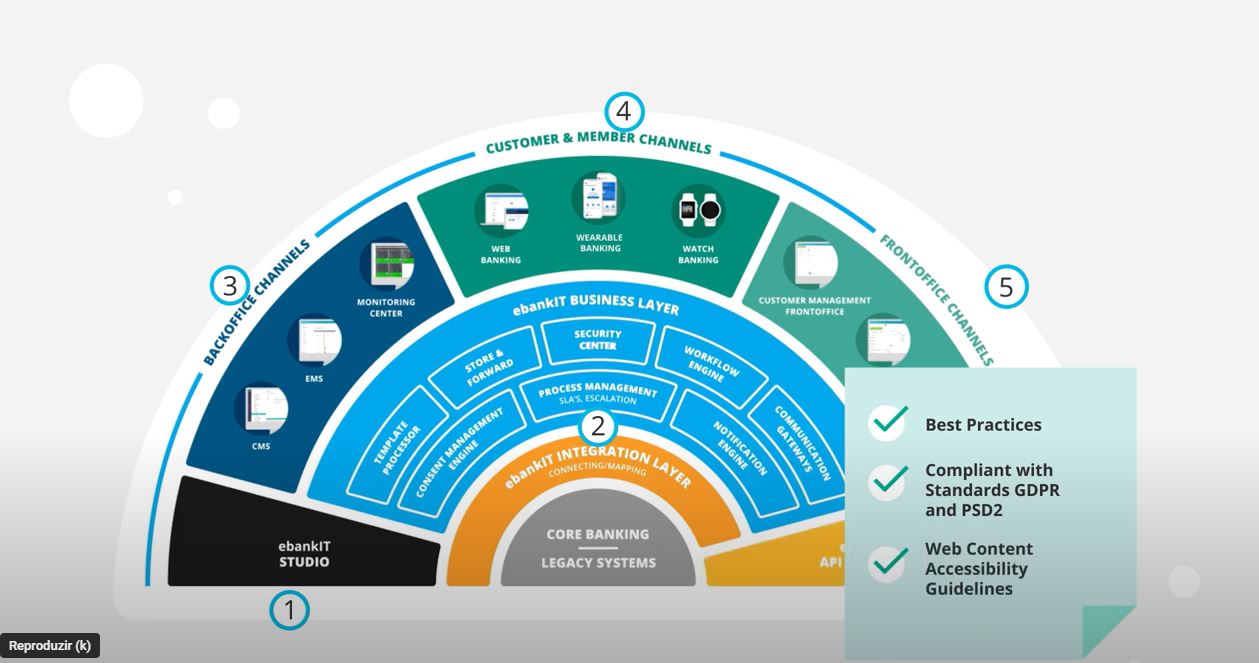

One of the main advantages of the ebankIT product is that it is an out-of-the-box platform because it has several business segments: corporate, and SME and provides interfaces for financial institutions to control their activities on digital channels. We allow a certain level of customization as well as a fast time-to-market which grants a competitive advantage. ebankIT also has well-structured and comprehensive applications for web, smartphone, and smartwatches, whose architecture is open with an API gateway to incorporate world-class innovations, and solutions from other fintech providers. The combination of these differentiating factors contributes to creating one of ebankIT’s strongest points.

Our solution is 100% optimized for financial institutions and verticalized for this industry to explore all the different characteristics of this sector.

ebankIT studio is one of the main tools that sets us apart from our competitors. It enables financial institutions to manage their digital platform autonomously at reduced costs and with minimal amounts of coding. With the ebankIT studio, the platform is fully customizable, empowering financial institutions to make changes with ease and without requiring extra IT support. This innovative solution further enables financial institutions to create tailor-made customer journeys that cater to the individual needs and preferences of their clientele.

All the clients that have bought ebankIT are live or in the process of going live, and we have an extremely low churn. Our clients seek a dependable partner who can offer advanced digital solutions and a clear innovation strategy while catering to their specific requirements. We view our clients as partners and strive for a collaborative relationship, aiming to deliver a secure and fully seamless digital experience for the end users.

At ebankIT, we have established long-term client partnerships that value collaboration.

At ebankIT Academy, we offer a range of training courses for our clients and partners to enhance their understanding and continually acquire new skills related to the ebankIT omnichannel platform. Our comprehensive training program equips clients and partners with the ability to effectively deploy, upkeep, and provide support for any ebankIT solution. We also offer an online repository of documentation, including FAQs, tutorials, and user guides through our online ebankIT enablement portal, which empowers banking staff to find quick answers to common queries and learn at their own pace.

Firstly, we have resources online available to our clients to answer their questions. Secondly, we have a support team that is available around the clock to address technical issues and emergencies promptly. Furthermore, our team regularly meets with clients to discuss the development of the project and gather their feedback, as well as share new updates with them.

Since its establishment, the company has maintained profitability and has consistently achieved double-digit growth every year. This year, we anticipate a growth rate of approximately 20%, and we expect this trend to continue in the future, as it has done in the past.

At ebankIT, we want to see ourselves as one of the main players in the digital banking financial sector. We strive to be at the forefront of technology and provide top-notch solutions. We are constantly exploring new trends, and looking forward to the future. We are already looking into integrating artificial intelligence into our solution to enhance the banking experience of millions of end users. Additionally, we believe that the metaverse will become a mainstream concept in the next ten years, and therefore, it is something we will work on as well. In ten years, ebankIT will keep offering a humanized banking experience for millions of banking clients, having reached new markets and established itself as a leader in innovation.

ebanklT Reviews

ebanklT Resources