Just the thought of going bankrupt will send shivers down the spine of an individual - be it a salaried employee, an organization's CEO, or even a business owner. In what is becoming commonplace in the digital era, the corporate sector is suffering from bankrupt entities - both established firms and once-heralded start-ups. Corporate bankruptcy signals the organization or individual’s inability to pay off their financial liabilities, or debt, to creditors and lenders. In such situations, the entity files a bankruptcy petition.

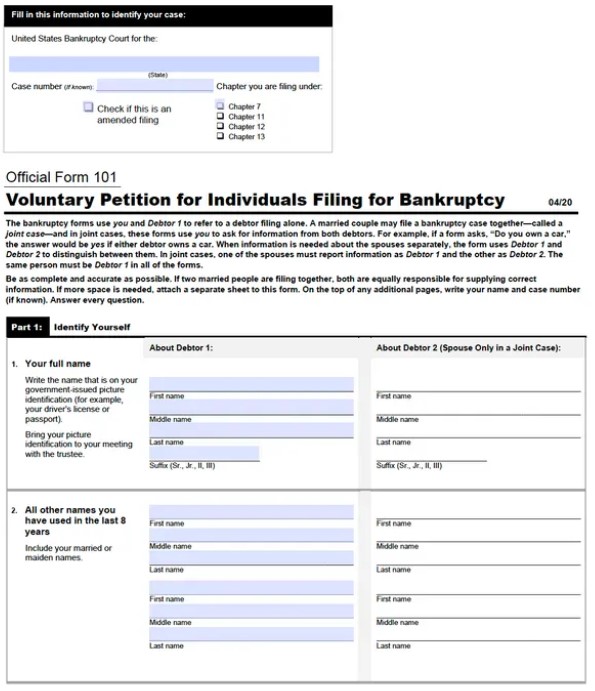

Bankruptcy is a legal process that proceeds the debtor’s petition. As part of the system, the debtor’s tangible assets undergo an evaluation to estimate their true worth. Liquidation of the assets follows, and the proceeds from the sale help pay off creditors. Meanwhile, forgoing the debtor’s debts enables them to get a fresh start. Corporate bankruptcy follows a different path depending on the nature of the bankruptcy petition filed. A company can restructure its assets and operations if it believes it can return to profitability. Simultaneously, in the other case, complete liquidation of the organization is the only way out of the debt trap for investors.

With rising cases of bankruptcy around the corporate sphere, bankruptcy professionals and lawyers need the best resources to help clients with various aspects of the process, from client and document management to electronic filing of legal forms and managing court appointments, besides a lot more tasks. Bankruptcy software comes with the great purpose of easing out the tasks mentioned above. This blog aims to enlighten readers about the features, advantages, and simplicity in the usage of an online bankruptcy tool, along with an exclusive listing of some of the best free and open source bankruptcy software. These bankruptcy systems will help service the extra value offered from prospective clients while at the same time helping law firms and attorneys with private practices generate additional revenue ( and thereby profit) with its multitasking capabilities and integrations.

So, do not wait longer. Delve into the best Free and Open Source Bankruptcy Software.

Reasons for Bankruptcy in Business

- Firms oscillate between multiple reasons as to why their business model failed. Some of the more prominent causes are as follows:

- Poor Business Conditions (Geo-Political turmoil, recessions, etc.)

- Lack of Financial Solidity (Poor Cash Flows, High Debt, Poor Investor Relations)

- Inefficient Asset Solvency

- Incorrect business Investment Decisions

- Legal Procedures and Lawsuits

- Human-caused Accidents Resulting in Substantial Payouts

- Natural Disasters requiring a substantial financial outlay

- Fraudulent activities of Upper Management and/or Investors

- Lack of Product/Service Innovation (Leading to lower competitiveness, market share, and revenue)

Types of Corporate Bankruptcy

The Corporate bankruptcy code sees businesses petition under three distinct types of bankruptcy codes - Chapter 7 Bankruptcy, Chapter 11Bankruptcy, and Chapter 13 Bankruptcy.

- Chapter 7 Bankruptcy - Often referred to as “Straight Bankruptcy,” a Chapter 7 bankruptcy is filed when shuttering the business remains the only option. Business dissolution occurs when the debts are too big to be paid off, incapable of being supported at the current level of income, and reorganization will not save it. Chapter 7 bankruptcy ensures that all business assets are sold off under the view of a trustee appointed by the bankruptcy courts. The business owner gets a ‘discharge’ on the completion of proceedings, making them free of the debt. Businesses that are corporations or partnerships ineligible to apply for a Chapter 7 bankruptcy.

- Chapter 11 Bankruptcy - A more lenient form of bankruptcy, Chapter 11 bankruptcy offers businesses a chance to turn profitable by shedding non-performing assets and divisions - essentially making the business lean. A bankruptcy court-appointed trustee oversees business reorganization and works with the upper management to formulate a plan to ensure creditors are paid their dues after the sale of non-performing assets and divisions. Chapter 11 bankruptcy discharges only a portion of the debt, with the creditors playing a vital role in assessing and ratifying a plan to pay them out. At the same time, the company continues to operate in its new avatar.

- Chapter 13 - Though Chapter 13 bankruptcy primarily helps individuals navigate bankruptcy, it also helps sole proprietorship businesses and/or small businesses file petitions for the same. Chapter 13 is very similar to chapter 11 bankruptcy; in this case, small proprietorships are indistinguishable from their owners, and thus, the business heads for reorganization. The owner stays in charge of the business and makes a repayment plan to investors, which needs ratification from all parties involved.

Challenges associated while preparing, filing, and managing bankruptcy

Filing for Bankruptcy is a major step. Every move needs planning to ensure investors and the business (employees and other stakeholders). There are, however, several challenges associated with the entire process. First, Organizations need to determine what form of bankruptcy best suits their business - Chapter 7 or 11, depending on their financial situation and underlying business performance.

Second, valuing the assets is of prime importance in the case of liquidation. Following the federal court directed method of estimating the worth of assets before liquidation is a must to ensure business creditors know how much of their investment they are likely to get back through the bankruptcy proceedings and the exemptions considered during the process. Ensuring coordination with the valuators, creating, submitting, and filing corresponding forms, alongside asset-related papers, is important.

Third, depending on the type of bankruptcy filed for, there are a number of forms and documents that need filling - all pertaining to assets, previous balance sheets, investments taken by the business, etc. Managing all of these forms and documents, by concerned personnel, without misplacement is necessary. Traditional document storage mechanisms are tedious, and there is a strong possibility of documents being lost, mismanaged, or forgotten about altogether.

Fourth, the bankruptcy attorney has numerous clients to deal with through the course of his tenure simultaneously. Managing these clients, their court dates, their bankruptcy settlements, arranging fees per case, etc., becomes too onerous a task for the professional to maintain independently. Last, time management is critical for most attorneys. As they charge by the hour, law professionals of bankruptcy also have numerous deadlines, multiple clients, and form submissions to take care of during any given time. Companies must also represent the legal charges as part of time consulted on their expenditures bill. Therefore, it makes sense to track the time invested.

What is Bankruptcy Software?

Bankruptcy software is a suite of digital tools that helps lawyers handle many layers of their business, not limited to their case management or electronic filing of forms, but also important aspects of lead and client management, court date scheduling, creditor data, and client background verification. A thorough bankruptcy system fulfills administrative work for professionals, speeding up time-consuming processes through efficient workflow designs. At the same time, online bankruptcy software automates, schedules, and helps execute critical case related components and billing and payment information.

Features embedded within bankruptcy software for consumers ensures clients have a dedicated portal to upload and contact attorneys through the software while filing for Chapter 7 bankruptcy, Chapter 11 bankruptcy, or Chapter13 bankruptcy. Also available are components such as auto-population, secure online payment modules, and leading data protection.

Importance of Bankruptcy Software

From an attorney's perspective, bankruptcy solutions and corporate bankruptcy software are a boon for those attempting to increase their profitability and efficiency. The following points highlight the importance of bankruptcy software:

- Shifting case management into the cloud

- Automation of repetitive tasks

- Access to creditor and petitioner database for verification

- Lesser time taken for payment and billing purposes

- Faster access to courts and correct scheduling

- Lower client churn rates

- Remote data access and working capabilities

- Cost Optimisation

- Reminders on case follow-ups, legal preparations

What are the time-saving features of the best bankruptcy software?

The best features that make bankruptcy software indispensable for professionals are as follows:

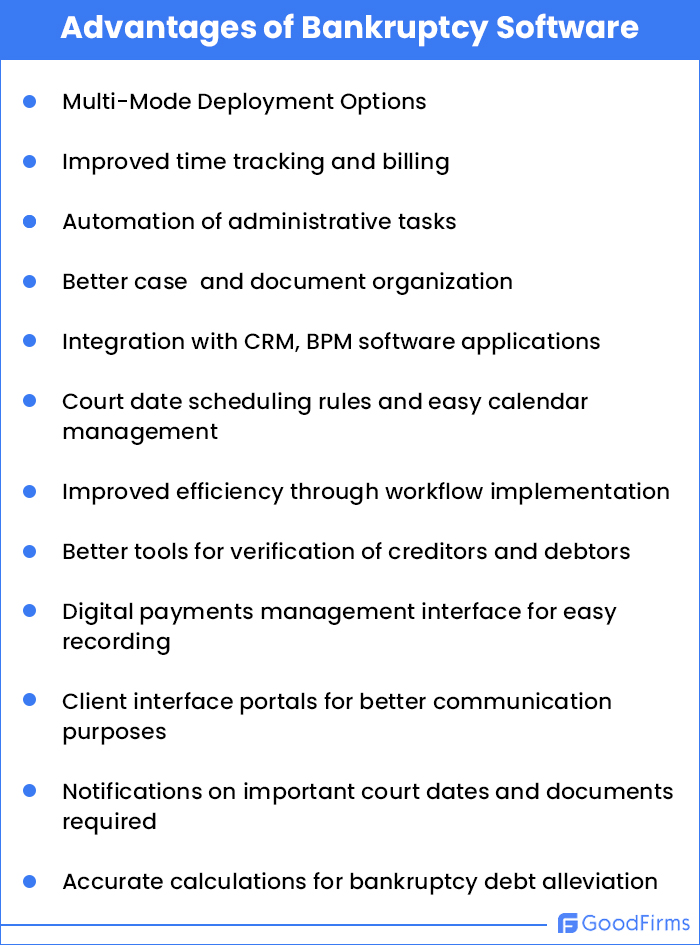

Advantages of Bankruptcy Software

Attorneys in the digital era need the best software solutions to match their needs and evolving complex digital bankruptcy procedures. The most important advantages of bankruptcy software are as follows:

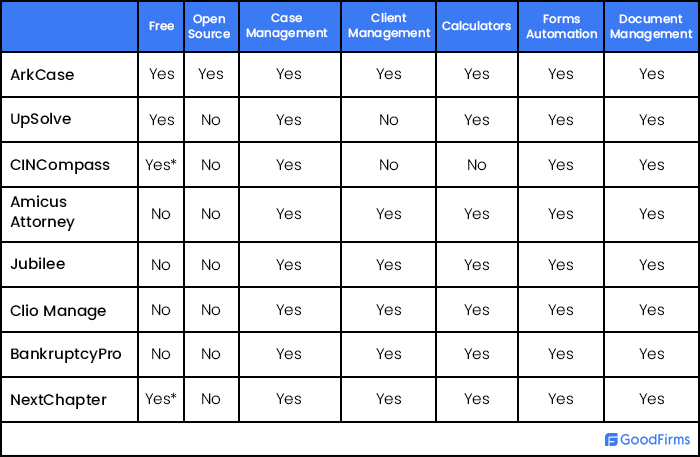

Are There Any Free and Open Source Bankruptcy Software?

The market for digital bankruptcy systems is vast. With established companies throwing their hat into the ring, the competitive landscape is fiercer than ever. This is from where free and open source bankruptcy software derives its strength and values to consumers. Yes, there is free and open source bankruptcy software. The following sections will have detailed descriptions of the same.

Best Free and Open Source Bankruptcy Software

* - Free Trial

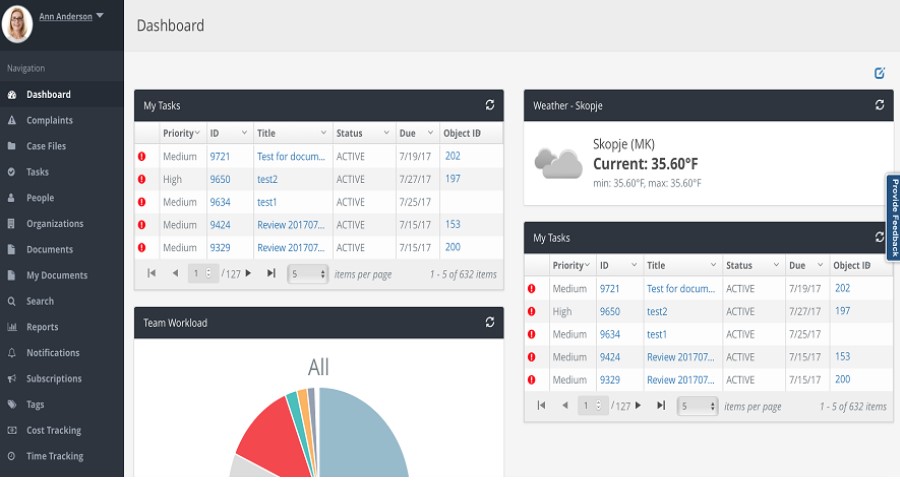

#1 ArkCase

ArkCase is a case management software that doubles up as a free and open source bankruptcy software. The online bankruptcy software’s Enterprise Resource Planning (ERP), Enterprise Content Management (ECM), and Business Process Management (BPM) modules make it a one-of-a-kind option for buyers. The bankruptcy case management software is FedRAMP compliant and available on the cloud. Furthermore, the free bankruptcy software’s Public Access Portal allows prospective clients to directly submit their cases into the portal. ArkCase promises to increase productivity, meet all deadlines.

Source: ArkCase

The best features of Arkcase open source bankruptcy management software are:

- Alerts/Notifications

- Calculators

- Calendar management

- Case Management

- Client Management

- Document Management

- Electronic Filing

- Forms Automation

- Time Tracking

#2 Upsolve

Upsolve is a free bankruptcy software that aims to help low-income American families avail of bankruptcy services. It also helps small and medium scale businesses either get access to a free evaluation before filing for bankruptcy, or file for bankruptcy themselves under chapter 7, chapter 11, or chapter 13, bankruptcy codes. The free bankruptcy software company calls on its Harvard Law School roots, the United States (US) Governments Legal Services Corporation funding, and nonprofit company charter to help organizations and families alike. The online bankruptcy tool is accessible through an application and simplistic interface.

Source- UpSolve

The critical features that set Upsolve apart are:

- Alerts/Notifications

- Calculators

- Case Management

- Court Notice Management

- Document Management

- Exemption Management

- Forms Automation

- Legal Forms Library

- Time Tracking

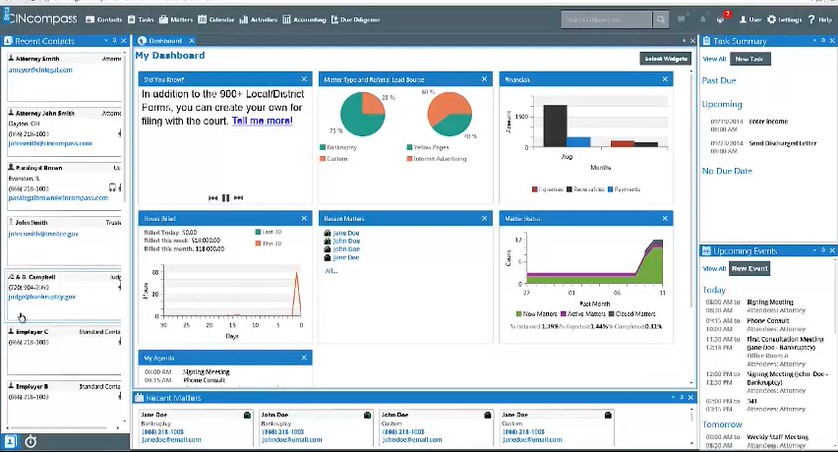

#3 CINcompass

CINcompass is a bankruptcy software that offers a free trial. The online bankruptcy system is cloud-based and offers remote case handling and team collaboration capabilities. Data security assurance with an ICSA-certified firewall and industry best encryption is unbeatable while providing reliable infrastructure in the free bankruptcy software. The bankruptcy software for attorneys also has inbuilt due diligence integration (direct credit access, client communication, and payment history, etc.) and appropriate workflow solutions to boot. CINcompass bankruptcy case management software also offers free training and technical courses on the software. Lead management and CRM tool integration are available as well, and an advanced accounting tool ensures proper financial management.

Source- CINcompass

The features of CINcompass are as follows:

- Case Management

- Calendar Management

- Court Notice Management

- Electronic Filing

- Forms Automation

- Legal Forms Library

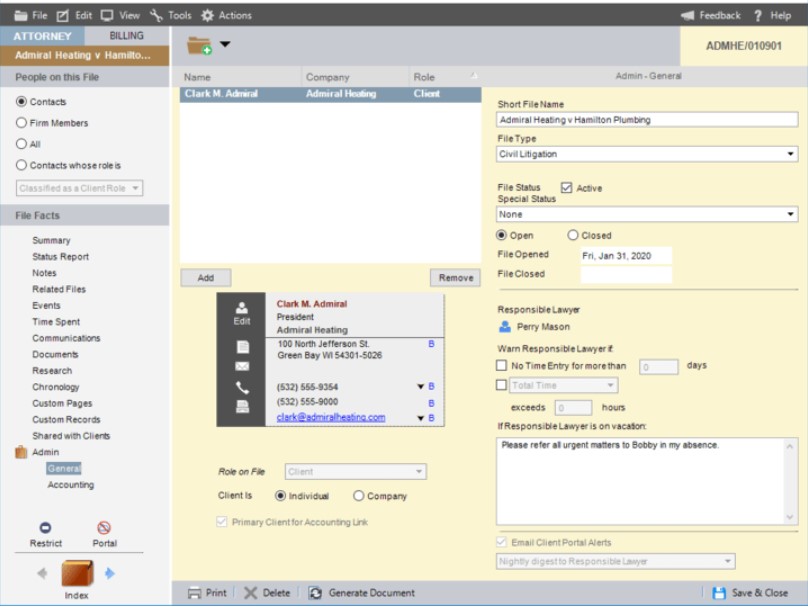

#4 Amicus Attorney

Amicus Attorney offers a bankruptcy software with a free trial to prospective buyers, created by AbacusNext. A unified dashboard serves to highlight all relevant data on a per case basis, while features like Rule-Based Calendaring assures users of data regarding court cases and documents at their fingertips even in the free bankruptcy software version. A client portal on the online bankruptcy software allows direct, streamlined communications between all parties involved and workflow tracking to ensure meeting of all deadlines. The bankruptcy petition preparation software has integrations such as Abacus Exchange Pay (APX) - to help the billing and accounting related payments proceed faster - and Amicus Cloud Service to ensure secure data storage and remote access

Source- Amicus Attorney

The helpful features of Amicus Attorney bankruptcy software are as follows:

- Alerts/Notifications

- Calculators

- Calendar management

- Case Management

- Client Management

- Court Notice Management

- Document Management

- Forms Automation

- Time Tracking

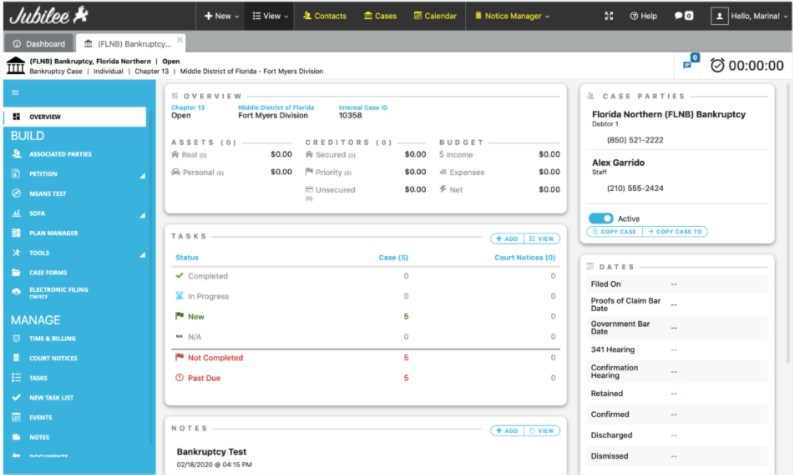

#5 Jubilee

Jubilee is LegalPRO’s cloud-based bankruptcy software. One of the best bankruptcy software around, it assures reduced cost of operation for attorneys, and the best technical support too. The bankruptcy case management software is integrable with a variety of law solutions such as a Clio case management software BK PAcket, and certificateofservice.com. CIN Legal Data Services provides all due diligence data ahead of a case. The software interface itself is easy to navigate and auto-populated data entry with the help of third-party integrations is extremely helpful.

Source - Jubilee

The best features of Jubilee are as follows:

- Alerts/Notifications

- Calculators

- Calendar management

- Case Management

- Client Management

- Court Notice Management

- Document Management

- Electronic Filing

- Exemption Management

- Forms Automation

- Legal Forms Library

- Time Tracking

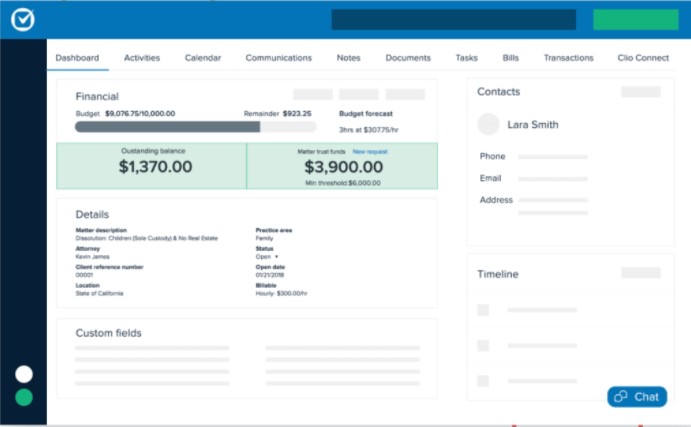

#6 Clio Manage

Clio is a legal case management software with underlying bankruptcy software capability. Clio helps independent legal practitioners, small businesses, and corporate houses in matters extending from Civil Law, Family Law, and Real Estate Law. The online bankruptcy system comes integrated with CRM and leads management modules while covering the entire gamut of bankruptcy software features. Whatsmore, round the clock weekly technical support and industry-leading security processes (GDPR, Malware protection, etc.) come packed together. Lawyers can also easily access their billing and accounting modules to ensure timely and correct payment.

Source - Clio Manage

The best bankruptcy software features of Clio Manage are as follows:

- Alerts/Notifications

- Calculators

- Calendar management

- Case Management

- Client Management

- Document Management

- Forms Automation

- Time Tracking

#7 BankruptcyPRO

BankruptcyPro is one of the best bankruptcy software available in the market. The online bankruptcy software comes laden with validation features such as US Postal Service address validation and is easily integrable with third-party software. The bankruptcy software for attorneys is also replete with an ECF Wizard to shorten the form filling time while filtering through cases is now possible. Additionally, a creditor database helps verify addresses and proof of ID of those claiming a repayment from the bankruptcy proceedings.

Source- BankruptcyPro

Some of the most important features of BankruptcyPRO are as follows:

- Alerts/Notifications

- Calculators

- Calendar management

- Case Management

- Client Management

- Document Management

- Electronic Filing

- Exemption Management

- Forms Automation

#8 NextChapter

NextChapter is one of the most popular bankruptcy software available for use in the United States. The bankruptcy solution offers a free trial and is richly laden with important features such as Clio and third-party integrations, client communications, and bankruptcy court auto filing. It is an online bankruptcy software with its complete operations in the cloud. The bankruptcy law software allows you to contact a virtual attorney from its staff to help with bankruptcy-related purposes, while attorneys can manage leads and execute CRM functions. The bankruptcy software company was recently taken over by FastCase.

Source - Next Chapter

The best features of NextChapter are as follows:

- Alerts/Notifications

- Calculators

- Calendar management

- Case Management

- Client Management

- Court Notice Management

- Document Management

- Electronic Filing

- Exemption Management

- Forms Automation

- Legal Forms Library

- Time Tracking

The market is bound with splendid options that fulfill all of an attorney’s bankruptcy software needs. Be it free bankruptcy software or paid versions, options such as Qwikfile, EZBankruptcyForms, Paralegal Documents, and Standard Legal all have the necessary features, connectivity, and optimal price to attract consumer interest. One of the most popular options in this regard is Best Case.

Let's read more about the popular bankruptcy software for consumers below.

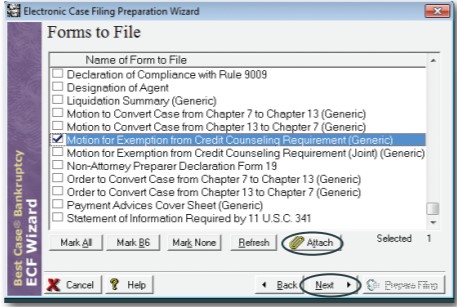

Best Case

Best Case is a popular bankruptcy software that combines the benefits of an ECF wizard, quick filing of forms, and scheduling court dates on rules and principles to avoid PACER late charges. The bankruptcy software for attorneys makes it easy to import creditor information while at the same time ensuring the integrity of the data stored within its system. Best Case also promises regular software updates and round-the-clock Technical Support, alongside a training program. The bankruptcy system also includes the community to offer feedback and surveys to improve its software. Features such as workflow automation and technical data checks ensure maximum productivity for clients and professionals.

Source - Best Case

The most important features of Best Case are:

- Alerts/Notifications

- Calculators

- Calendar management

- Case Management

- Client Management

- Court Notice Management

- Document Management

- Electronic Filing

- Exemption Management

- Forms Automation

- Legal Forms Library

- Time Tracking

Conclusion

A recent study by the AACER group showed that there was an 11 percent increase in commercial chapter 11 bankruptcy filing, while the yearly count of all bankruptcy cases till December 2020, stood at close to 30,000. Another statistic shows that California in the US leads the way for the most corporate bankruptcies in a Yearly study. Reports also indicate that American businesses are churning out bankruptcies, even though the rate of filing decreased in August 2020.

These statistics point to the need for viable systems to assist filers in their petitions, secure their clientele through superior service, and maintain documents securely for future references - all of which bankruptcy software can do effortlessly. With the advent of machine learning, automation, and artificial intelligence through every sphere of modern digital life, bankruptcy solutions can grow even more useful - with thoughtful debt management suggestions, pre-filing surveys, and much more - for everyday persons and professionals.

Let us know your opinion on the article in the comments section below. Share your experience with any of the above mentioned free and open source bankruptcy software in our feedback section. Steaming ahead to purchase your ultimate bankruptcy software for attorneys? Well, head over to our Buyer’s Guide of free and open source bankruptcy software for the best advice on choosing software that fits your purpose. Not looking for bankruptcy software? Head over to our extensive Software Directory for the best categories in digital innovation.