Inventory accounting is critical for most companies to function. Considered a part of traditional accounting, it deals with the valuation and calculation of changes in inventoried assets of the organization. Evaluation of these assets is vital, with companies looking to use them to drive revenue and profit in future operations.

The two types of inventory systems in the application are the perpetual and periodic inventory systems. Both of them have their advantages and disadvantages. Yet, inventory management systems are evolving, and companies need to pick and choose their best bets in a rapidly changing supply and demand sphere.

This blog looks to highlight all aspects of this particular inventory management system, with an intention to provide the buyers with the correct perspective to make their purchase decision.

What is Perpetual Inventory?

Perpetual inventory is a form of inventory accounting. It records the sale and/or purchase of goods and assets (inventory) continuously, keeping them up to date. Perpetual inventory is extremely critical in tracking the real-time movement of inventory. Updates are made immediately as and when a product is sold, or raw materials are processed.

Other dependent factors such as Cost of Goods Sold (COGS), Cost of Inventory Purchases, and Cost of Ending Inventory are also updated to keep track of financial aspects in inventory management systems.

The formula for the same is extremely simple:

Beginning inventory + receipts - shipments = Ending inventory

Perpetual inventory is an intensive exercise, not just technologically but also monetarily. It is practiced mainly by the large scale businesses with enough flow of goods - be it raw materials or finished products - which can compensate for the investment in the infrastructure required.

What is an AI Perpetual Inventory System?

An AI perpetual inventory system involves the use of technological advances - such as Artificial Intelligence, Machine Learning, Point-of-Sales (POS) machines, barcode scanners, and Radio Frequency Identification (RFID) Tags - to optimally track, record, predict, and notify personnel on inventory status in real time.

The Perpetual Inventory accounting has grown in popularity since the 1970s when computing powers escalated rapidly. The perpetual system of Inventory rapidly replaced periodic inventory systems in many large scale organizations due to its effectiveness and accuracy in recording and storing data.

Despite its simple implementation, an AI perpetual inventory method requires significant investment in technological capabilities and is often never used by small or medium scale businesses.

How does an AI Perpetual Inventory System work?

An AI Perpetual Inventory System uses data capture devices, POS devices, RFID tags, barcodes, IoT sensors to proactively track inventory movements across different facilities. The central database stores information, such as the Perpetual Inventory System card, which is updated regularly on a transactional basis. Whenever items move in or out, data capture devices send the stocks information to the central database, updating stocks in real time. Changes to the accounting records are also done in real time.

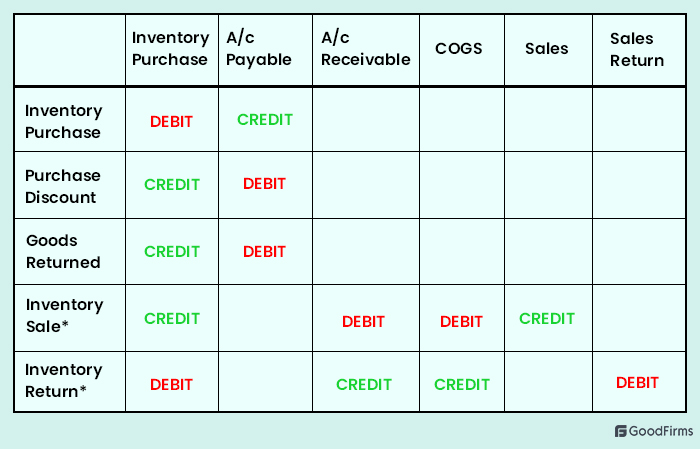

A journal entry mechanism is displayed below to understand how the system records data. Keep in mind here that - Accounts Payable is the amount of money owed to the supplier, Accounts Receivables is the amount which is expected or has been received for a sale. COGS is the total value of an item sold from the merchandise inventory.

* The Sales and Return functions have to record two simultaneous transactions within the Perpetual Inventory accounting system

What are the Perpetual Inventory Costing Methods?

Perpetual Inventory methods operate under three different costing methods-

First In First Out (FIFO)

In this costing method, the cost of the oldest inventory goods units are assigned to the Cost of Good Sold (COGS). In other words, this model of calculation assumes that goods or raw materials sold are done so in the order that they are purchased.

For Example - Assume you purchased 100 units of product X at the cost of $10 and a month later you purchased 50 units of the same product X at $20. Assume that product X is a raw material for another product, Z.

Now, when the new product is sold, the cost associated with the first 100 units of product Z would include the price for the first 100 units of Product X, i.e., $10. The subsequent 50 units of Product Z sold would consist of the new purchase cost of product X, $20.

In FIFO, the ending balance of Inventory is usually the most recent cost associated with the purchase of raw materials. In perpetual inventory systems, companies assign a card to record and navigate through the quantity, and dollar amount of goods called a Perpetual Inventory card. Every product is associated with one. The quantity, dollar balance of these cards are updated in real-time.

Last in First Out (LIFO

An antonym of the FIFO method, the LIFO method assigns the most recent costs to the COGS. In other words, it assumes that the most recent sales are associated with the recently purchased materials.

For Example - Assume you purchased 100 units of product X at the cost of $10 and a month later you purchased 50 units of the same product X at $20. Assume that product X is a raw material for another product, Z.

Now, when there is a sale of a new product, the cost associated with the first 50 units of product Z would include the price for the first 50 units of Product X, i.e., $20. The subsequent 100 units of Product Z sold would include the new purchase cost of product X, $10.

LIFO ensures evaluation of the leftover Inventory at lower costs while approximating higher costs to the newest sales. A “LIFO Layer” is formed when there’s a significant gap between current and old prices.

LIFO also records costs on a Perpetual accounting card, so that costs and goods sold are updated regularly.

Moving Average (MA):

In this form of accounting, the total number of items in an inventory and the total cost of all inventory items, irrespective of differentiated sourcing costs, is estimated. A total inventory average is arrived at. This average cost is used as COGS in the inventory system.

For example, assume you purchased 100 units of product X at a cost of $10, and a month later you purchased 50 units of the same product X at a cost of $20. Assume that product X is a raw material for another product Z.

The average cost of the inventory is [(100x10) + (20x50)]/(100+50) = 2000/150 = $13.33/Unit.

Moving average gives us the most balanced value of the inventory, much more than LIFO or FIFO.

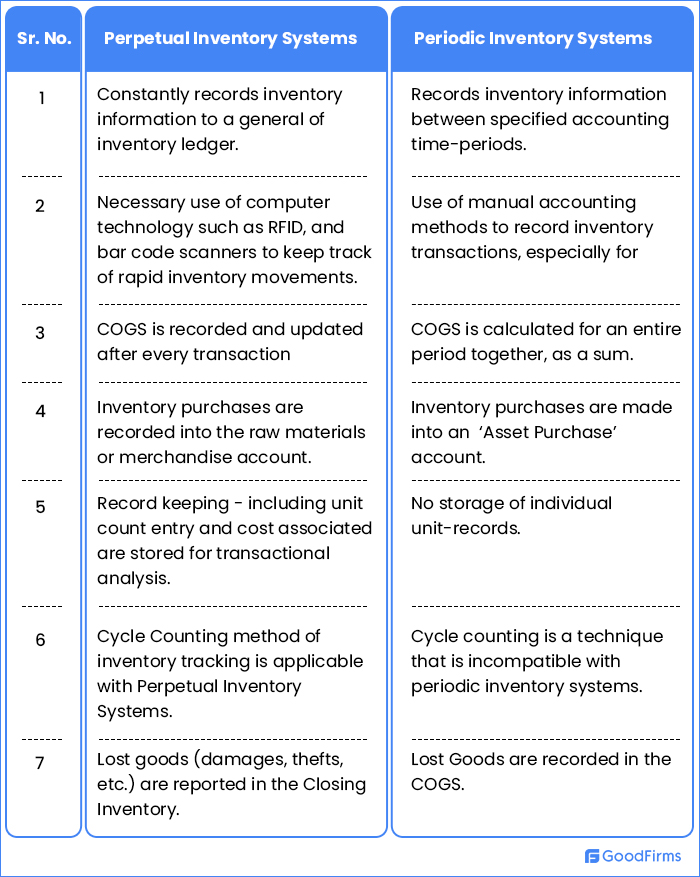

Difference between Perpetual and Periodic Inventory Systems

What are the Advantages of AI Perpetual Inventory Systems?

Key advantages of AI Perpetual Inventory Systems are as follows -

.jpg)

What are the disadvantages of an AI Perpetual Inventory System?

- AI Perpetual inventory systems are very expensive to implement.

- Specialized training on the LLM models and system must be provided to employees, which is also costly.

- AI perpetual inventory systems do not have a safeguard for entering faulty data at the start of recording during intervals. Hence, this could be a bane with respect to widespread miscalculation. This is also time-consuming.

- It can only be implemented in high-frequency sales organizations and/or in specialized industries - like jewelry trading.

- They also carry high maintenance costs.

- Unexpected events can lead to miscalculated demand forecasting.

How AI Perpetual Inventory Systems Can Help Inventory Managers?

Through AI perpetual inventory systems, inventory managers can analyze historical as well as real time data to predict demand, identify inefficiencies, automatically trigger purchase orders, dynamically adjust prices, etc., without any error. AI perpetual inventory systems provide better insights into inventory to significantly improve operational efficiency, minimize overstocking, and driving profitability. AI algorithms can also detect suspicious inventory patterns, such as sudden shrinkage or unusual transactions, to report any potential fraud or theft.

Few Common Questions on Perpetual Inventory System

Do you include discounts when using a perpetual inventory system?

Yes, discounts are recorded when using perpetual inventory accounting. When used on the seller side, all discounts are recorded in what is called a contra-revenue account called sales discounts by a perpetual inventory method.

Generally, discounts are not recorded until payments are received, as the seller will look to make sure whether the buyer will want the discount or not. Receiving payments will affect the customer side of the transaction.

What is the role of Economic Order Quantity in a perpetual inventory system?

Economic Order Quantity (EOQ) is a celebrated inventory calculation method, which helps managers estimate the absolute number of units of a product to order in an inventory to minimize holding, shortage, and order costs. EOQ is popular because it helps companies arrive at an optimal order quantity to minimize the operational costs of inventory.

In perpetual accounting, records of inventory movement are being updated constantly. This helps managers ascertain the goods whose demand must be met with immediate and prompt supply. The analysis of real-time updates by the perpetual system of Inventory aids decision-makers to estimate the quantity to be ordered with respect to the quantity shipped so as to minimize inventory costs. It also arrives at the minimum Inventory needed to be held so as to fulfill orders within a particular time period.

This is nothing but EOQ - placing orders to match demand and just match inventory targets. Perpetual accounting makes handling EOQ extremely efficient, which results in cash saving in inventory handling and supply chain. The resulting funds may be used for the improvement of other business branches.

When Can One Use an AI-Perpetual Inventory System?

An AI-perpetual inventory system is vital when businesses need to operate in an environment of fluidity. This involves a non-closure of the warehouse or inventory space for physical counting and checks of goods in the system. The perpetual inventory system carries out numerous inventory functions on COGS and goods/items present in a minute. Therefore, all transactions are up to date without the need for constant checks.

In this case, the volume of goods shipped in and out becomes vital too. Inventory control is significant for big companies with tons of materials to handle over short periods of time. Large scale organizations need Inventory control to estimate supply and demand. AI-perpetual inventory methods help them achieve this.

AI-perpetual Inventory systems also require significant investment on the technology side. This includes training LLM models, a strong database to handle real-time data recording, security, as well as inventory side devices like POS machines and bar code scanners.

Key Takeaways of the AI-Perpetual Inventory System

Some of the key takeaways of the AI-Perpetual Inventory Accounting are as follows -

- It is used by large-scale organizations with a frequent flow of specialized inventory goods (E.g., Jewellery, Metals, etc.)

- It is expensive to implement, but its benefits on inventory control and finances are many-fold.

- Managers get real-time insights and visibility into stocks, sales, and demand.

- AI perpetual inventory systems can automatically generate purchase orders when required.

- AI makes it easier to efficiently maintain inventory records across multiple facilities.

- Enhanced demand and supply forecasting based on a deep analysis of multiple factors.

- Human errors and discrepancies can be significantly reduced.

- AI perpetual inventory systems offer smart dashboards, analytics, and smart recommendations for enhanced decision making.

- It is easier to derive data and analyze trends in inventory control with AI perpetual inventory management systems than periodic inventory management systems.

- As perpetual inventory systems fail to record thefts or leakages, the physical exam of stocks needs to be done once in a certain period of time. If variances in data are found, then correction is required over digital mediums into the databases to update inventory measures.

- AI-powered perpetual Inventory systems provide accurate financial metrics and figures.

- Training must be provided to employees to facilitate ease of use.

- Moving Average (MA) is the most effective method to track inventory in perpetual accounting, with FIFO and LIFO proving difficult and/or obsolete to implement.

Conclusion

AI-Perpetual accounting’s advantages are exceptional, but they come at a high cost. These inventory management systems form the backbone of most large-scale organization inventory systems.

With the demand for adequate forecasting tools growing, perpetual inventory systems have found popularity in areas that were least likely. As major e-commerce giants like Amazon look to shed excess inventory bulk, perpetual inventory systems’ usage will grow far and wide, despite the limitations brought on by its price.

Please do leave your review of our article, alongside any observations, in the Comments Section below.

Feel free to share any feedback you may have of Inventory Management Systems used by you in the past, or continue to use presently.

On the wrong software page? Goodfirms’ exclusive and expansive Software Directory will help you navigate to the right software of your choice.