GSTMate Accounting Software

How GSTMate Helps Small Businesses Stay GST Compliant Without Hassle

The GST Compliance Challenges Faced by Small Businesses

Small businesses usually struggle with:

Manual invoice creation without GST-ready formats

Complicated GSTR return processes

Tracking Input Tax Credit (ITC)

Managing purchases and sales with GST entries

Lack of real-time stock and POS integration

These gaps often lead to errors, missed deadlines, and penalties. GSTMate fills this gap with automation, accuracy, and simplicity.

Why GSTMate Is the Ideal GST Accounting Software for Indian SMEs

1. Built-in GST Logic

GSTMate automatically applies correct tax rates, HSN/SAC codes, and segregates CGST, SGST, and IGST based on the customer location—ensuring 100% GST compliance.

2. GSTR-1 and GSTR-2 Reports in One Click

With GSTMate, businesses can generate GSTR-1 and GSTR-2 reports instantly based on sales and purchase records. These reports are structured exactly as per GSTN standards.

Small businesses usually struggle with:

Manual invoice creation without GST-ready formats

Complicated GSTR return processes

Tracking Input Tax Credit (ITC)

Managing purchases and sales with GST entries

Lack of real-time stock and POS integration

These gaps often lead to errors, missed deadlines, and penalties. GSTMate fills this gap with automation, accuracy, and simplicity.

Why GSTMate Is the Ideal GST Accounting Software for Indian SMEs

1. Built-in GST Logic

GSTMate automatically applies correct tax rates, HSN/SAC codes, and segregates CGST, SGST, and IGST based on the customer location—ensuring 100% GST compliance.

2. GSTR-1 and GSTR-2 Reports in One Click

With GSTMate, businesses can generate GSTR-1 and GSTR-2 reports instantly based on sales and purchase records. These reports are structured exactly as per GSTN standards.

2015

India

- Financial-services

- English

- Hindi

Industries

-

Financial-services

Licensing & Deployment

-

Open Source

-

Cloud Hosted

-

iPhone/iPad

-

Android

-

Windows

Support

-

Email

-

24x7 Support

Media

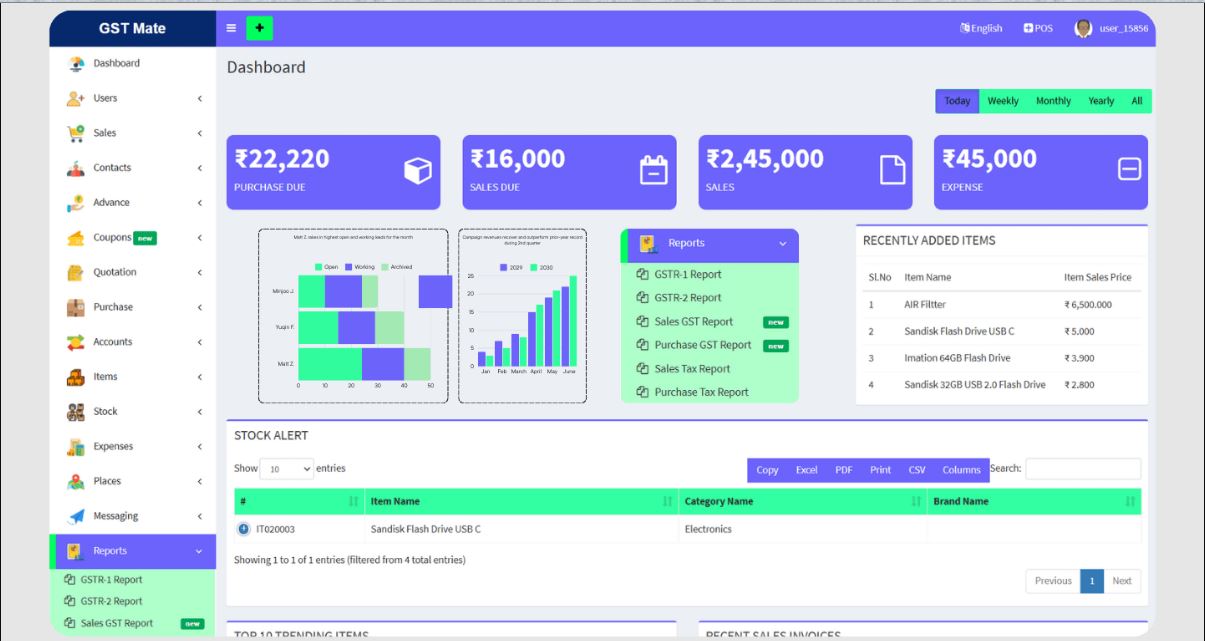

GSTMate Accounting Software Core Features

Focus of Accounting Feature

- Bank Reconciliation

- Billing & Invoicing

- Budgeting and Forecasting

- Expense Tracking

- Financial Reporting

- Fund Accounting

- Payroll Management

- Project Accounting

- Purchase Orders

- Tax Management

GSTMate Accounting Software Pricing

Pricing Type

-

Contact Vendor

Preferred Currency

-

USD ($)

Free Version

-

Yes

Payment Frequency

-

Quote Based