Let me begin this article with a bold claim - This is going to be the simplest, most profound explanation of the terms like treasury, treasury management, treasury functions, and how technology is doing its bit to take it all to the next level. But, before we get into any of that, let me offer you a little perspective.

The Evolution of the Business Structure

Business as a practice has existed for thousands of years through the barter system, which at some point evolved and became the foundation of what we call Capitalism today. However, these were all one-to-one dealings of goods and services for the most part until industrialization kicked in.

Basically, the businesses only had roles like manufacturing and selling that were assigned to one person each. These later became functions that required teams of people. Began in the 18th century, industrialization allowed business owners to start organized trade; hence, the term “organization.”

Rise of Business Organizations

As more and more businesses started flourishing and expanding geographically, a series of entirely new and diverse job roles popped up, which led to people having more specific tasks to do. This kept on getting complex as the businesses kept growing. Eventually, the emergence of organizations that dedicated an entire function (which they called a “project”) came into existence.

Outsourcing as an Introduction

Large scale organizations started hiring these companies for the treasury functions that they would have taken so much time to perform by themselves. They realized that life is too short for setting up a function from scratch, so they hired these companies that specialized in specific function. This form of hiring was later termed as Outsourcing.

The Game Changers

To cut it short, this was as complex as organizational structures could possibly get - or so we thought. There were two things that eventually took this all to the next level. Trade barriers where removed and the birth of Internet which eventually paved way for digitalization.

Role of Internet

As soon as the Internet arrived, it offered a worldwide connectivity to everyone who had access to it. Large business organizations had their own websites, and by this point, all they needed was the contact information of the corporations sitting offshore, to outsource them for their particular operations. This then evolved into Staff Augmentation, which is like specialized Outsourcing.

Back in the day, you only had websites that could be accessed for gathering certain information from their webpages. At present, forget websites, you have interactive and visually appealing social networking apps and functional Software solutions that can ease out several tasks. Basically, the connectivity is down at the granular level, i.e., everyone is directly connected to everyone, potentially.

Mitigating both financial and operational risks can be challenging in the modern business structure, and this is one of the reasons why Treasury Management is considered to be the core business function of any organization. Now, if you are wondering, “What is this Treasury you are talking about?” Well, generally speaking, any funds or anything valuable that belongs to a particular state or institution is known as a treasury.

In the context of business, it’s the cash, working capital, or any holdings that belong to an organization. The planning, organizing, and controlling of these holdings and working capital is really necessary in order to get rid of the operational and financial risks, maintain the firm’s liquidity, and reduce the overall cost of funds.

According to Treasury Strategies, 68% of the finance professionals see the treasury’s importance increasing over the next three years. Large banks have always had a stronghold over the provision of treasury management products and services, until now.

There is a trend that has started witnessing large corporations having treasury departments that manage the cash. Apart from that, they also manage policies, strategies, and everything that has to do with the corporation's financial matters.

What are the Core Functions of Treasury?

We have briefly discussed the functions of Treasury Management above, but they only tell you so much. So let’s dive deep into the core functions deeply so as to have a broader perspective:-

Cash Management

From collection and retention to disbursement of cash, everything is performed in such a way that the company’s liquidity is maintained. Managing the funds of the firm, and whether to invest the surplus cash earned or to raise money from external sources are all the dilemmas that treasury management will take care.

The purpose of cash management is to have an adequate degree of control over the cash position, so as to have a predictable outcome and to avoid the risk of insolvency and utilize the surplus cash in some productive manner.

Liquidity Management

By definition, liquidity is an asset’s ability to convert into cash. The degree of ease will vary depending on the forces of demand and supply. Therefore, if an asset is easily converted into cash, it will be known to have a “high-liquidity” and similarly “low-liquidity” if it can’t be encashed easily. You get the idea.

There is a degree of liquidity that must be maintained in a business organization so that the operations can run smoothly. There are times when an organization has to fulfill its financial obligations, and if you don’t create a provision account for contingencies like payment to suppliers, employees, and creditors, then you are unnecessarily creating a risk that could not have existed in the first place.

Risk Management

The external business environment is a dynamic realm. It changes without any prior notice, and the authorities have to act in accordance with the change so as to not fall victim to one of the classic blunders, so many others make.

A Treasury Management needs to keep itself updated with any changes in Government policy amendments. Speaking of the treasury, did you know that 75% of global treasury professionals see cash forecasting as their top treasury and risk management challenges?

Everything from financial and market risks, currency and foreign exchange risk, commodity price risk, interest rate risk, and other market risks in management are the types of risks that need to be on a Treasury Management’s radar. Terrible things aside, having great treasury management gives your business a great deal of edge over other businesses.

Optimum Utilization of Resources

Everything from manpower, money, material, machinery, even time, is a business resource. However, the utmost priority for treasury management is monetary resources. Treasury management makes sure that the resources are being utilized efficiently and effectively. It is highly imperative for two reasons:-

- If the resources are over-exhausted, then it means that you haven’t created a provision account for your firm’s liabilities, which would subsequently raise the risk of you not being able to pay off your debts.

- If the resources are underutilized, then the cost you’re incurring is of another nature. You’re basically wasting your resources and not earning any money that could have been easily generated.

Investment Management

This is an entirely distinct function that has everything to do with the corporation’s investments. The three primary goals of any treasury management are to maximize the return on investments, keep a check on the date of maturity of investments in accordance with the business needs, and needless to say, minimization of risks.

They have to research the investment opportunities and select the ones that are the biggest bang for your buck and keep themselves aware of the external environment that could affect the rate of depreciation. They must also keep a margin for any unforeseen event that may dip or surge the return on these investments. If any of these is not happening, then your treasury management could probably be dragging your company towards insolvency.

Bank Relations

Apparently, this can make or break your company’s fortune. Banks have the power to provide you with all that tasty cash that your company could be longing for, but how much they offer you depends entirely on your company’s reputation. Collateral and credit requirements are the main expectations they have of you.

However, here’s the secret - Generally, if the bankers at small scale banks have known the entrepreneur for a long time, they are likely to offer a loan to them, based on personal rapport. If they know where you live, or know your family, or have seen you in the bank availing the loan often and making timely payments, all of them pile up to your credit. But to create and maintain that rapport, you require a competent treasury management team.

Credit Rating Agency Relations

In case you didn’t know it already, there are organizations that are able to assist the banks with a list of parameters based on which it is able to offer the details of your creditworthiness to them. They have the tools to assess the financial condition of your company and play a great role in the likeliness of you getting a loan from the bank.

Typically, large scale banks rely on these credit rating agencies. Therefore, building and maintaining relations with these agencies is slightly different. Here, the credit agency’s review team will request certain information about your company, and your treasury management has to be prompt and accurate in their responses.

Role of Technology in Treasury Management

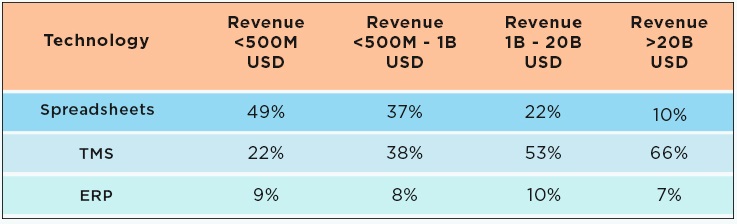

Back in the day, a treasurer would sit down in front of their PC and create a log of all the relevant transactions in an excel sheet. But technology has been accelerating, and we now have ERP and TMS as well. Which of these systems is good for treasury management? Let’s find out.

Spreadsheet

For decades, Spreadsheet has been the go-to software for all the companies for treasury management. Surprisingly, it’s just as relevant in today’s world and is, in fact, termed as a great tool for serving complex processes, running audit routines, and for communicating with other systems. It serves as a complex and multidimensional database.

Spreadsheet and Excel are barely any different except for the fact that Excel is the rich cousin that possesses more functionalities. Nevertheless, companies that typically generate revenues below 500 million USD, half of their treasury practitioners say that they are working mostly with Excel.

A spreadsheet works as a complementary tool alongside other software like ERP and/ or TMS. However, when we talk about reliability, efficiency, process optimization, and availability of data even, solely relying on Spreadsheet might not be the wisest decisions amidst all the risks that the modern world possesses.

ERP

According to Treasury Today, 70% of Corporates who employ a treasury workstation use a specialized TMS system. However, this data also suggests that in 2014, 40% of these companies were implementing an ERP treasury module, which was a spike from 19% in 2006. This drive is not necessarily coming from the treasury department but from the boardroom.

Oftentimes, the Enterprise Management System (EMS) is confused with TMS, but an ERP system has a wider focus than a specialized TMS. You can imagine its treasury module as a branch of the system and not exactly the heart of the system itself. Even though it may sound like a disadvantage, this actually offers a number of benefits since the treasury is fully integrated on the same platform as the rest of the company, allowing for consistent passage of data.

Treasury Software

Treasury Management System, also known as TMS or Treasury Software, is a process-oriented, complex application that incorporates database technology and communication abilities in order to interact and provide. Basically, the best Treasury software can automate the process of managing important financial operations of a company.

One of the USPs of TMS is the wide variety of functions it offers. Having over 120 modules, TMS covers a plethora of activities ranging from cash management, debt and derivatives, hedging, to even forecasting and risk management.

Revenue from Technologies

About 65% percent of treasury professionals say that they are turning to technology so as to help out their teams to master treasury and risk management challenges. The use of technologies could vary from region to region, by a significant amount.

For instance, Treasury management professionals in Canada (59%) and New Zealand (47%) heavily rely on Excel, while they barely use it in places like Germany (21%) and the Benelux region (18%).

Conclusion

Efficient treasury managemnt is very critical. The major conflict these days to manage the treasury functions is usually between TMS and ERP. When it comes to treasury management, there is always confusion while choosing the right treasury management software solution and the right way is to refer the list of best Treasury Software prepared by Goodfirms.

OpenPro ERP, Kyriba, SAP Treasury and Link Management, tm5 are some of the best Treasury Software solutions that you can rely upon.