The increase in the Globalization of companies and dealing with multiple currencies has been accelerating the growth and sales of every business. But, you would also agree to the fact that Global expansion gives birth to complexity and fragmentation, which negatively affects the financial statements of a company. It can be a pitfall for companies not focusing on efficiency in treasury management and not being able to avoid financial risks successfully.

Treasury management refers to planning and organizing the financial aspects of the company to ensure funds are used in the best possible way, liquidity is maintained, the overall cost of funds is reduced, and operational and financial risks are tranquilized.

Inaccuracy in treasury management processes can lead to sizeable consequences. Not-so negligible mistakes can occur by maintaining cash registers using spreadsheets, misplacing a debit notice, or not having real-time data on your fingertips. Without accurate cash visibility, you are unable to forecast and make decisions like purchases, paying employees, etc., on time, and that can harm the reputation of your business.

The best solution to these issues would be to adopt the best treasury software for your business which allows you to have clear visibility of your cash and liquidity, control bank accounts, manage banking and financial transactions, and stay compliant with company policies and regulations.

Here, we have listed the 10 best treasury software, which you can consider deploying for your business. But, before you go through the details of these software, let’s have basic information about the treasury management software, its benefits, and the features to look for while selecting the one that suits your business.

What is Treasury Software?

A treasury software is an application that can automate the entire process of managing a company's cash positions, debits and credits, interest rates, and foreign exchange rates. It provides real-time visibility about your company's financial position, enables you to track payables and receivables, ensures that your funds are being used at the right place, and manage global, multi-bank payments.

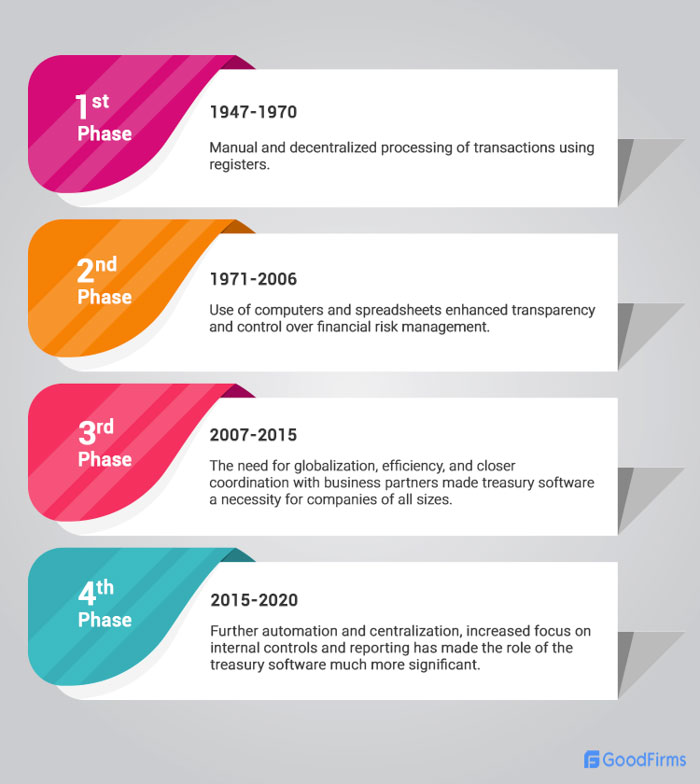

Evolution of Treasury Software

With the change in the business landscape, the treasury software has also evolved and is likely to evolve further. There are various challenges involved with treasury management like Forex Volatility, continuously shifting market restrictions, and regulatory changes, which has made treasury software a necessity for almost all the companies these days regardless of their size and type.

Benefits of Treasury Software

A treasury software provides 100% cash visibility, which is the fundamental requirement of an organization. Besides that, it can provide the below-mentioned benefits that can support you in making smart financial decisions and achieving strategic business objectives.

Features to Look for in a Treasury Software

It is an undeniable fact that no organization, whether big or small, can afford to lose the sight of their cash & liquidity positions and thus require a well-featured treasury software that can automate, record, and control their treasury functions.

But, the selection of the right treasury software can be easier said than done. Below-mentioned are some features you should look for in a treasury software before investing in one.

Cash Management

The treasury software you choose should allow you to easily view the historical data and forecasted information relating to the cash flow in the organization.

Centralized Payments

Whether it is about current payments or scheduling payments, your treasury software should allow you to manage all your global payments in a centralized and secure manner.

Analyzing Risks

Easily analyze risks with the help of your treasury software and design risk management strategies to benefit your organization in terms of profitability and sustainability.

Automating Accounting Tasks

Your treasury software should allow you to automate different accounting tasks like journal entries, and general ledger updates to save time and achieve accurate results.

Banking

The treasury software you choose should allow you to manage your multiple bank accounts, including downloading bank statements, analyzing bank fees, etc., from a single module.

Managing Financial Instruments

Your treasury software should help you in storing, tracking, and executing contracts, debt activities, FX exposures, and other documents with high-end security.

Ensuring Compliance

The treasury software you select should ensure that company policies and Government regulations are being adhered to throughout the entire workflow.

We understand that the selection of the right treasury software can be overwhelming, and so we have curated the below list of the 10 best treasury software, which you can consider and choose the one which is compatible with your type of business.

The 10 Best Treasury Software Comparison Chart

Before you go through the details of the 10 best treasury software, we would like to present the below chart helping you compare the features of these software easily.

The 10 Best Treasury Software

#1 OpenPro ERP

OpenPro has been the first web-based ERP solution in the market since 1998. It uses open source LAMP technology and includes advanced AJAX controls to customize and modify the system features seamlessly. It can work for a wide range of industries like Banking and Accounting, Financial markets, Government, and Non-profit organizations, schools, professional services, and many more. OpenPro is a powerful ERP software that is comprehensive, flexible, and above all, highly cost-effective.

Key Features

- Has the ability to import existing data from other systems

- Can generate regulatory reports

- Supports multiple currencies

- Includes highly intuitive interface

- Includes integrated spreadsheet exporter

- Can generate cash flow reports

- Seamless importing of data

- Can generate detailed and summary trial balance reports

- Generates audit trial reporting

- Allows web connectivity

If you have already used OpenPro ERP, please feel free to share your reviews here.

#2 C2Treasury

C2Treasury is a treasury software that can help you in achieving 100% bank connectivity and manage your cash and liquidity transactions. It helps in securely managing end-to-end payment processing. It includes user-friendly and self-service reporting tools that allow generating critical financial reports and sharing them with your team. It can also improve operational efficiency and accuracy of daily cash positioning for an organization. As it can be quickly implemented, it is preferred by several businesses worldwide.

Key Features

- Helps in cash forecasting and financial planning

- Ability to manage multiple bank accounts and reconciliation

- Can analyze bank fees

- Can automate hedging

- Ability to manage financial deals

- Can export relevant information and generate reports

- Ability to schedule reports delivery to internal and external stakeholders

- Can conduct a full audit trail for every transaction

- Can connect and centralize information from more than 10,000 bank accounts across the globe

If you have already used C2Treasury, please feel free to share your reviews here.

#3 GTreasury

GTreasury is a simple solution used for managing cash, payments, and risk activities with confidence. It gives you cloud access to integrated treasury management and risk management solutions and services. By using this software, all you experience is going to be a seamless workflow. Regardless of your business requirements, or the pace of your business growth, GTreasury can handle all the challenges pertaining to treasury management.

Key Features

- Provides complete information about the historical and projected cash flow within the organization

- Allows you to centralize all the global payments from a single interface

- Can manage all the financial instruments including FX exposures and contracts

- Helps in analyzing complex data and design risk mitigation strategies

- Automates journal entries and general ledger updates

- Can centralize all the bank activities, including bank account management, statements, etc.

- Ensures that your business complies with all hedge accounting standards

If you have already used GTreasury, please feel free to share your reviews here.

#4 Kyriba

Kyriba is a treasury software that allows CFOs and treasures to obtain the visibility over the entire financial position of the company and reports that help them in optimizing cash and liquidity, manage bank accounts, and financial transactions and ensure compliance with company policies and regulations. IDC, being one of the largest technology analyst firms in the world, has ranked Kyriba as the global leader for SaaS and cloud-enabled treasury and risk management applications.

Key Features

- Provides 100% cash visibility

- Helps in creating the perfect cash forecast

- Allows you to gain control of Global bank accounts

- Helps in managing in-house banking capabilities

- Enables you to manage different types of financial transactions

- Streamlines the process of Foreign Exchange Accounting

If you have already used Kyriba, please feel free to share your reviews here.

#5 Deluxe Treasury

Deluxe Treasury helps financial institutions, corporations, and non-profit organizations to succeed through digital and traditional financial services. It empowers organizations, whether large or small, with data-driven tactics and useful insights. This treasury software has consistently evolved and grown to meet the upcoming challenges and changing needs in the financial sector. Basically, it is a trusted advisor helping you to meet your financial goals securely.

Key Features

- Provides paperless onboarding experience to your customers

- Streamlines remittance and matching system

- Improves order-to-cash cycle

- Provides real-time visibility to cash flows, receivables, and payables

- Streamlines the process of deductions and exceptions handling

- Can easily sync with multiple ERP systems to provide advanced functionality

If you have already used Deluxe Treasury, please feel free to share your reviews here.

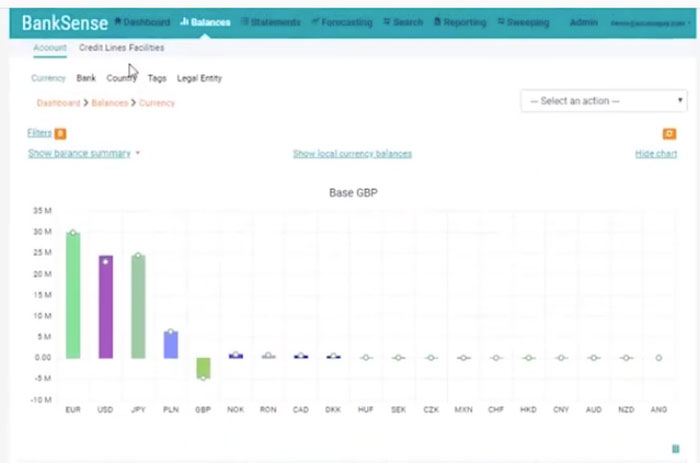

#6 BankSense

BankSense is one of the best treasury management solutions that is meant to provide a single access point to manage banking relationships, accurately deploy cash moves across accounts, and optimize the value of company capital. It provides complete financial transaction information of an organization on a real-time basis, which helps viewing balances by currency, bank provider, country, organizational business unit, or legal entity. It also allows treasurers to pool funds across accounts making the investment process seamless.

Key Features

- Can automate and schedule UK and international payments

- Provides finance and treasury reporting for smart decision making

- Centralizes and consolidates different applications used for finance and treasury

- Streamlines cash and management workflows

- Consolidates bank accounts and expands your banking network with ease

- Allows ERP to bank integration to streamline finance and treasury processes

- Ensures data security and compliance across finance and treasury

- Helps in viewing multiple bank accounts from a single platform

If you have already used BankSense, please feel free to share your reviews here.

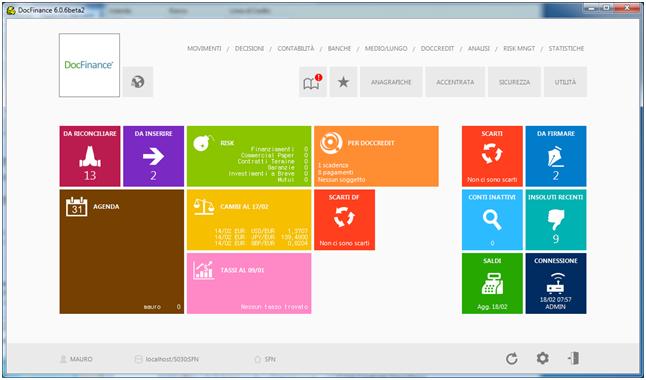

#7 DocFinance

DocFinance is a treasury software being used since 1988. It has a track record of having installed 3000 treasury management software in over 30 years. It is advanced treasury management that can integrate remote banking services with the company's information system. It provides an overview of cash flow and balances, which helps in improving the financial integrity and accountability. It has an intuitive dashboard that provides information about the daily financial activities which enable efficient planning in an organization. It records all the statistics relating to banking activities, including the rates and costs incurred, as that helps in managing the operational costs of a company.

Key Features

- Allows cash and debt management

- Helps in forecasting the cash flows

- Ability to manage foreign exchange risk, currency balances and swaps

- Records financial transactions automatically in accounting ledgers

- Can integrate with 300 national and international ERP systems

If you have already used DocFinance, please feel free to share your reviews here.

#8 Treasury and Risk Management

FIS offers award-winning treasury and risk management solutions providing digital, modern, and innovative treasury functions. It is available in the form of SaaS, private cloud, or on-premise environment. It enables organizations to manage their cash flows, risks, Foreign Exchange, interest rate, hedge accounting, in-house banking, and many more functionalities for enhanced visibility into cash and risk.

(fisglobal.com)

Key Features

- Allows cash position tracking, banking, and reconciliation

- Can customize/configure electronic funds

- Ability to integrate with FX platforms

- Manages FX contracts debt and investment instruments

- Can manage multiple bank accounts

- Allows managing in-house banking

- Supports multiple languages

- Includes the ability to create customized reports quickly

- Intuitive dashboard providing information about cash positions across legal entities and regions

If you have already used Treasury and Risk Management, please feel free to share your reviews here.

Openlink is a consolidated platform that provides an enterprise-wide view of commodities, treasury, and risk from a single interface. It can work for different types of business functions, and so the treasurers can have complete visibility relevant to cash management and treasury operations. It can also minimize manual processes ensuring accuracy and streamlined processes within an organization.

Key Features

- Can streamline different processes including setting up bank accounts, scheduling and automating payments

- Provides better control over global cash forecasting for different divisions of a global organization

- Includes single interface for managing debt and cash, commodity procurement, liquidity, credit, and risk management

- Can automate in-house banking to comply with corporate and government policies

- Ability to generate reports and share with stakeholders to keep them informed at each level of financial workflows

If you have already used Openlink Treasury, please feel free to share your reviews here.

#10 tm5

tm5 is the collaborative and strategic TMS that can take treasury to the next level by providing accurate cash & liquidity visibility and helps in strategic planning. It empowers the treasury and finance departments of the organization with reliable information about the financial happenings enabling them to prepare for the risks before time. It helps in establishing digital automation workflows, reducing manual errors. Precisely, it allows treasurers to have full control over their cash and financial activities.

Key Features

- Allows accurate cash & liquidity management

- Automates and schedules domestic as well as international payments

- Protects against currency risks and interest rate volatility

- Stores all the client data and financial instruments with high-end security

- Allows in-house banking helping to achieve cash flow transparency

- Enables streamlined and automated invoice confirmation and reconciliation

- Allows Global transaction banking

If you have already used tm5, please feel free to share your reviews here.

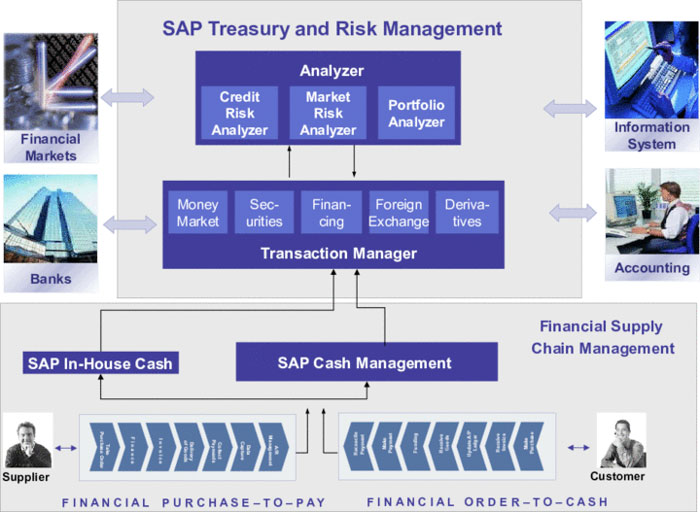

Besides these 10 best treasury software, we would also suggest you go through the details of one of the most popular treasury software solutions - SAP Treasury and Risk Management to know how it stands apart from the competition and why should you consider deploying it for your business.

SAP Treasury and Risk Management

SAP Treasury and Risk Management is a treasury software that can help you in forecasting cash flow, manage liquidity, and mitigate risk accurately. It provides real-time analysis, audit trails, and compliance reporting relevant to cash flows, financial transactions, commodity positions, and market data. It can increase productivity within your organization by automating processes and helping to collaborate most systematically.

(sap.com)

Key Features

- Helps in monitoring risk positions, currency conversion rates, commodity price changes

- Enables you to stay compliant with regulations like IFRS9 and EMIR

- Helps in gaining visibility over available cash and balance

- Automates repetitive tasks like payments

- Monitors all investments to protect against the risk

- Includes debt and investment management features helping you to ensure gaining maximum returns

- Can extend functionality by activating cloud-based solution apps

If you have already used SAP Treasury and Risk Management, please feel free to share your reviews here.

Conclusion

In today's competitive business scenario, the market is crowded with a plethora of treasury software which can cater to every organization's needs. Whether it is SaaS, cloud-based, or a bespoke solution, you need to be specific while selecting the treasury software as cash and liquidity is considered as the most sensitive facet of an organization.

To widen your selection, we also recommend you to go through treasury software like AccessPay, Innovative Treasury, CashSolutions, Trinity TMS, Fusion Treasury, and Insight360.

You can also go through the complete list of treasury software here, well researched and curated by the Goodfirms team, and find the one that exactly suits your business requirements.

If you have used any of the treasury software mentioned above, please leave your valuable feedback here.

Are you looking for the best software for other business sectors? Browse all software categories and stay tuned for future updates.

(

( (

(

(

(

(

(