The emergence and consistent progress of Neobanks, innovations in digital banking applications, and increased use of smartphones have enabled businesses and individuals to access financial services and products from the location of their choice without having to visit banks personally.

The global shift toward digital banking continues to boom well beyond the pandemic era. In 2026, digital banking adoption is expected to reach 75% of global consumers, with neobank apps driving much of this growth due to their seamless mobile experiences and rapid feature innovation. Neobanks are utilized by the majority of new-generation users for everyday banking needs such as payments and budgeting, highlighting the necessity of a robust Neobank App Development Strategy that prioritizes mobile-first performance and usability.

So, are Neobanks online banks?

Although Neobanks are online-only banks, they are different from traditional banks that offer online banking. Neobanks do not have branches, and they cater to a specific range of services.

So, are Neobanks the future of the banking sector?

Yes, Neobanks are gradually changing the face of financial technology and possibly will eclipse traditional banks very soon. To elaborate further, let's take a look at what exactly Neobank is and how it differs from traditional banks.

What is a Neobank?

Neobanks, also termed as “cloud bank,” or “challenger banks,” are created by fintech firms that specialize in banking technologies to facilitate real-time, mobile, banking on the move. Although the concept started picking up back in 2009, today, neobanks stand as a digital disruptor with the potential to transform the banking sector. Recent industry data shows that neobank apps now support daily banking activities for nearly 80% of users, significantly outperforming traditional banks in usage intensity and customer engagement. This shift clearly demonstrates that neobank development has become increasingly important, driving demand for specialized neobank app development consultancy services particularly in delivering advanced practices that enhance customer experience and retention.

Neobanks are technology-driven online banking and financial establishments that offer only virtual services without having any physical offices. This new breed of banks allows banking customers to open their accounts, apply for loans & credit cards, and even trade finance using a web or mobile application without physically visiting the bank. The global Neobanking market is likely to touch USD 5056.7 billion by 2033.

The term "Neobank" is often confused with "Digital Banking" as both are based on online & virtual business models. But, there is a difference. Digital banks are the online subsidiaries of traditional banking establishments. Neobanks, on the other hand, are digital-only banks that completely work online and don't operate at physical branches, and depend on legacy back-ends.

Neobanks: A Quick History

After the popularity of the internet in the 1990s, traditional banks started finding ways to deliver online services to satisfy their customers and fulfill their growing demands. Though the online banking services were limited at first, the success of these efforts led many banking customers to use facilities like opening bank accounts, downloading forms, applying for loans, etc., through internet banking.

The convenience of internet banking gave birth to the digital-only banks, also known as Neobanks. The first fully-functional Neobank insured by FDIC began its operations on Oct. 18, 1995. The term "Neobank" became popular in 2016 when many fintech-based financial providers were challenging traditional banks as they could offer high-interest rates and minimum service fees because of their reduced overhead costs.

Prominent Players in Neobanking Globally

|

Neobank / Digital Bank |

No. Of Account Holders |

|

WeBank (China) |

430+ Million Customers |

|

NuBank (Brazil) |

110 - 127 Million Customers |

|

Revolut (UK) |

60-65 Mīllion Customers |

|

PayTM (India) |

60 Million Monthly |

|

Chime (USA) |

20-30+ Million Accounts |

|

KakaoBank (South Korea) |

25+ Million Customers |

|

Toss Bank (South Korea) |

20+21 Million Customers |

|

C6 Bank (Brazil) |

14+ Million Customers |

|

Cash App (USA) |

13+ Million Users |

|

Wise (UK) |

13+ Million Accounts |

|

Starling Bank (UK) |

3.6-4+ Million Customers |

|

Monzo (UK) |

12-13 Million Customers |

|

Bunq (Netherlands) |

12-14 Million Customers |

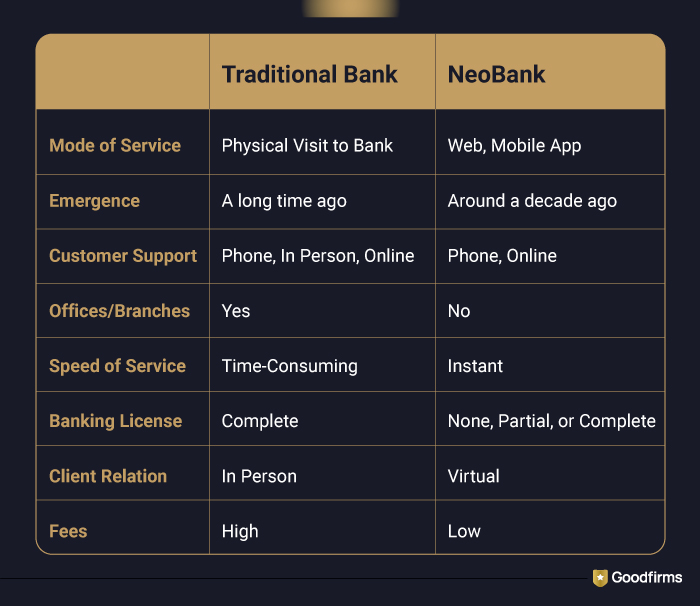

The Neobanks have the potential to bridge the gap between the services provided by the traditional banks and the present-time expectations of tech-savvy and modern customers in this digital era. Neobanks may not necessarily be fully licensed banks themselves but can partner with traditional banks holding the licenses for providing online banking services. With this global phenomenon in full spirit, what can new generation banks (Neobanks) offer that traditional banks cannot? To answer this question, let's proceed with comparing Neobanks with traditional banks and know their pros and cons.

In a nutshell, Neobanks offer the facility of getting the banking tasks done quicker, and more conveniently. Neobanks ensure robust compliance with security regulations, and continuous software testing and maintenance to sustain app performance, offer advanced encryption, biometric login, and real-time fraud protection which traditional banks fail to offer. Neobanks have attracted the market segment that desires to do their banking from their smartphone and computer with modern architecture that supports Integration with 3rd parties via APIs, enabling instant features like real-time payments, open banking data access, and embedded fintech services. Instead of visiting banks physically and waiting for hours in a queue.

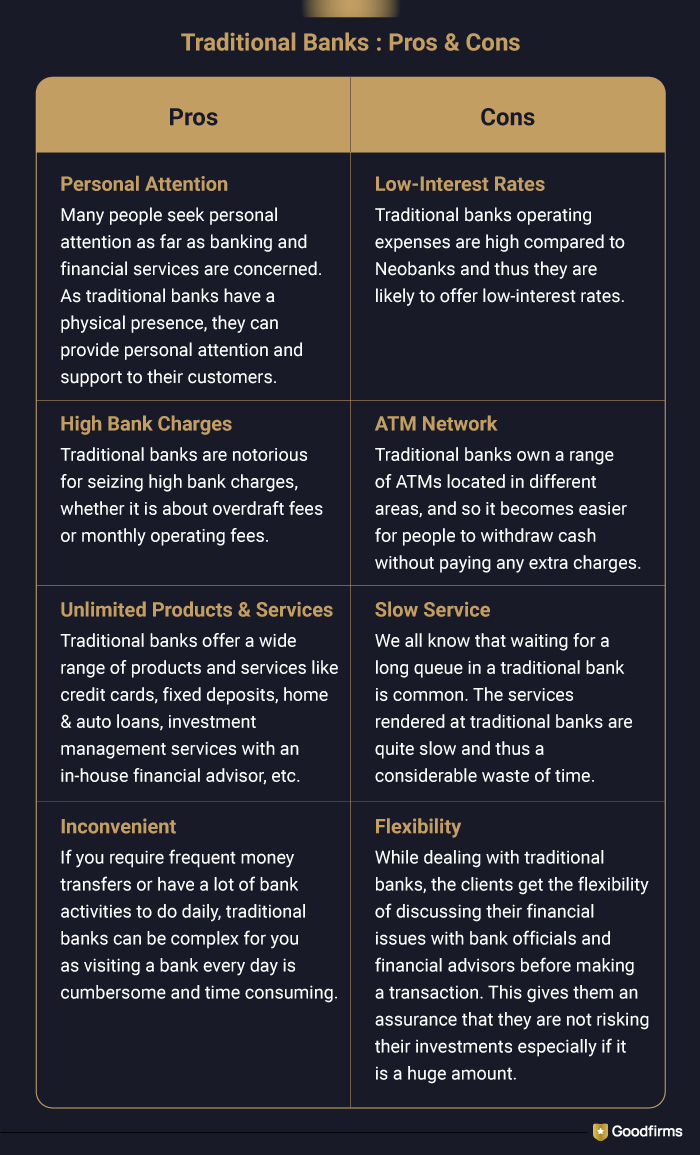

Despite the high adoption of Neobanks, they are still lagging behind in terms of achieving primary bank status. The reason is - many countries still have not digitally transformed their banking sector and are relying on cash transactions. Like every coin has two sides, Neobanks and traditional banks also have their own set of advantages and disadvantages. Let's have a glimpse over the pros and cons of traditional banks and Neobanks to determine the one that can take the banking experience to the next level and shape the future of the overall financial sector worldwide.

Are Neobanks Changing the Paradigm of the Banking Industry?

This substantial growth rate for neobanks is driven by their low-cost business model, which has benefitted the consumers in terms of reduced monthly charges on banking products and services. Neobank UX/UI Design attracts users with sleek, intuitive app interfaces that far exceed the user experience of many legacy bank apps.The high adoption rate by individuals and small & medium enterprises has been one of the most prominent reasons behind the success of the Neobanks ultimately changing the paradigm of the banking industry at present.

Future Is - Victory of Neobanks Over Traditional Banking Ecosystem

In the current scenario, the rise of neobanks is largely supported by the growing demand for digital banking services preferred by millennials. It is also gradually gaining the trust of consumers of all ages. The competition in the banking sector is intensifying as Neobanks are now serving the customers round-the-clock at minimum charges.

Fintechs, to strengthen their technical capabilities will rapidly invest in Custom Neobank Software Development or obtain a strategic planning through Neobank MVP Development as it is crucial for testing core features before scaling, allowing fintech teams to validate the market fit.

As a large customer base poses a real threat to the banks that are not innovating in terms of technology and investing in highly skilled technical resources. Like other sectors, banking also cannot be stagnant and needs to embrace better technology to deliver a competitive advantage. Better services, better branding, and cheaper services make it possible for Neobanks to get ahead of traditional banks and thus are likely to experience exponential gro

Key Takeaways

- Neobank is one of the fastest growing Fintech concept in 2025-26.

- Easy and quick access to banking services, transparent processes, low cost, round-the-clock remote services, quick transactions, and easy integration of third-party services are some of the prominent benefits of Neobank.

Conclusion:

Traditional banks and neobanks both have their set of advantages. You need to decide whether personal touch outweighs high-interest rates and low service charges or not. If you are looking for a mobile-native alternative for the traditional banks, then neobanks are your one stop destination. It is also worth considering a right combination of both types of banks, i.e., having multiple accounts at a traditional bank and neobank both. Fees for holding multiple accounts can be an issue. But, you can facilitate your business with the best of both the methods of banking - higher interest rates, low banking charges, and at the same time having access to in-person support whenever a critical situation arises. In the end, before choosing a bank, it is significant to determine the facilities that are most important to you and can benefit your business.

Neobanks - Lower fees, convenience, and higher interest rates.

Neobanks - Lower fees, convenience, and higher interest rates.

Traditional banks - In-person customer support and a broad network of ATMs.

Traditional banks - In-person customer support and a broad network of ATMs.

It is also a fact that with the emergence of blockchain technology and the popularity of cryptocurrency, the way people perform their financial transactions is gradually changing. Traditional credit and debit cards issued by traditional banks involve authorization, and it has been a cumbersome process. API-based cash cards issued -by Neobanks are tailor-made and offer services without any administrative hassles. Also, Neobanks have the potential to democratize the investment and make it more fractional to users.

Small and medium enterprises are adopting new technologies with speed and are considering Neobanks that facilitate managing all their finances from a single interface. In this scenario, the traditional banks are also moving towards this shift and transitioning to Neobanks as they need to meet the expectations of digitized customers and ensure the sustainability and growth of their business. Neobanks undoubtedly are filling the market gap in a huge way. They are here to stay and evolve.