Customer experience (CX) is a competitive differentiator for every sector, and banking is no exception. Retail and Corporate banks that deliver customer-focused, personalized, and real-time services across all channels have the highest success rates.

As technological capabilities and knowledge improve, the banking industry aims to improve and find better ways to expand its limitations to serve customers. Core banking is one such service that allows users to bank anywhere, anytime, and anywhere. It involves interconnecting several banking operations of different branches of the same bank under a single safe platform. Such banking applications enable users to transact and operate from any branch anywhere via the core banking system.

But, with artificial intelligence (AI) ruling every field, delivering exceptional customer experiences with the help of AI is gaining more traction. To align with this demand, modern core banking attempts to provide real-time, predictive functionalities with (AI) artificial intelligence-backed banking tools to redefine retail and corporate banking customer experiences.

This blog highlights the importance of integrating AI in the retail and corporate banking sectors to boost customer experience and business growth.

What is Core Banking?

Whether it is for retail banking that caters to the consumers, or for corporate banking that caters to the large companies, the goal remains clear for all the banks - to serve the customers and deliver experiences exceeding the demand.

Exceptional customer experiences can be achieved when trust is retained, when banking is enabled wherever the customers want, and however they want, when digital channels are opened up, when customers save cost and time, when customers’ problems are resolved instantly.

Core banking functionalities include;

| Aspect | Functionalities |

| Customer Data management |

|

| Transaction Processing |

|

| Account Management |

|

| Loan and Credit Management |

|

| Risk & Compliance |

|

| Customer Relationship Management |

|

| Analytics & Reporting |

|

| Security & Access Control |

|

| Mobile & Online Banking |

|

| Investment Management |

|

| Tax Management | |

| Treasury & Cash Management | |

| Integration & API Management |

As the Digital Banking Market size is estimated to reach USD 23643.58 million by 2031, there will be an unprecedented demand for core banking services. Core banking is a facility or service offered by the majority of the banks where customers can access, operate and transact 24/7 from anywhere, in any branch of the same bank, and even from their mobile.

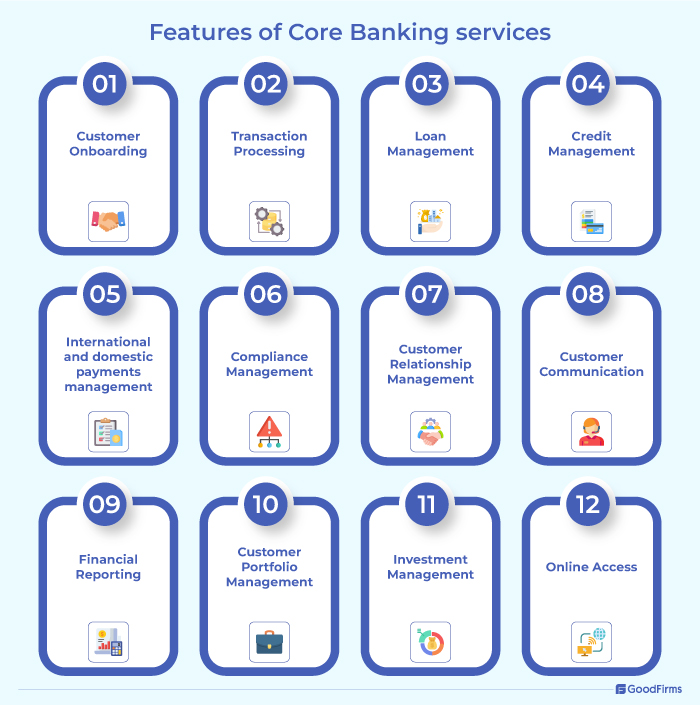

Features of Core Banking Services

Processing daily transactions across all branches globally involves various digitally automated real-time tasks right from customer on-boarding to investment management. This type of banking is in contrast to traditional banking, where basic banking operations are carried out at individual branches, most often manually updated (paper-based or maximum an excel sheet) with limited connectivity with the other branches and data. In this process, the customer service and experience is variable.

Tasks Under Core Banking services:

- Customer Onboarding

- Transaction processing

- Loan management

- Credit management

- International and domestic payments management

- Compliance management

- Customer relationship management

- Customer communication

- Financial reporting

- Customer portfolio management

- Investment management

- Online Access

Difference between Traditional banking and Core Banking:

Core Banking

- Centralized

- Customer can access anywhere across networked branches

- Real-time transaction processing

- Centralized customer data

- Automated and standardized workflows

- Facility to bank right from the mobile application or web application

- Exceptional customer experience

Traditional Banking

- Decentralized

- Customer can access only specific branches

- Manual and batch processing

- Individual branch-specific customer data

- Manual / Paper-based processes

- Online activity not possible

- Not a great customer experience, less convenient

Which Software is Used for Core Banking Services?

Core banking software is an application leveraged by the banks, credit unions, and financial institutions that functions as a centralized dashboard for both bankers and clients to carry out core banking functions. The software allows finance service providers to deliver omnichannel customer experiences.

The global Core Banking Software market size is expanding exponentially and is likely to touch USD 23293.55 million by 2027.

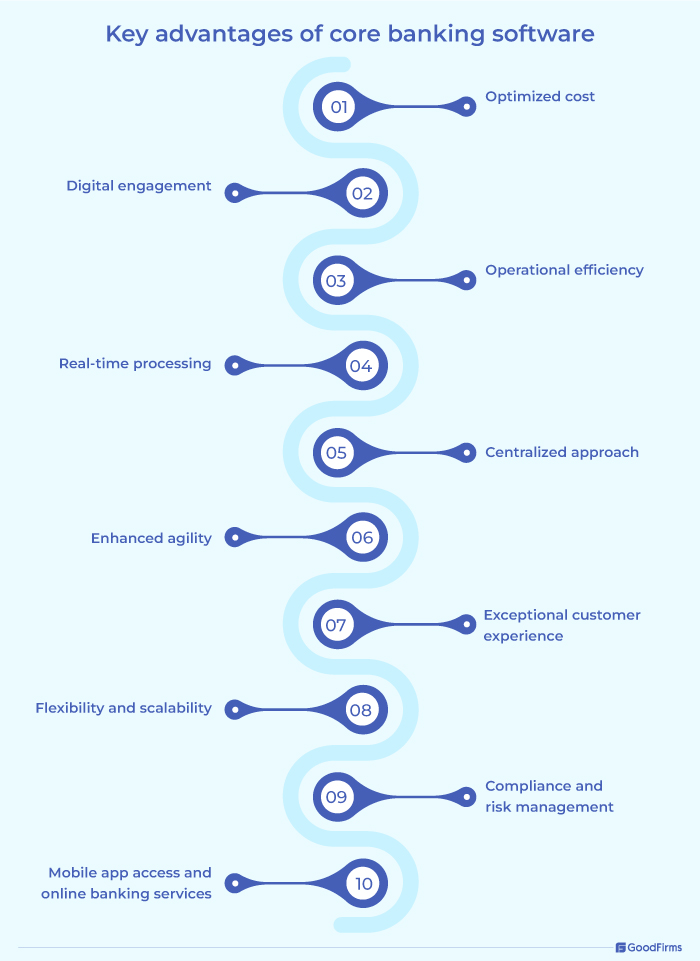

Advantages of Core Banking Software:

Modern core banking systems offer centralized and real-time services without the need for human intervention. Such automated facilities help in cutting the costs, increasing security, and enhancing customers’ experiences.

Benefits of core banking software

- Optimized cost

- Digital engagement

- Operational efficiency

- Real-time processing

- Centralized approach

- Enhanced agility

- Exceptional customer experience

- Flexibility and scalability

- Compliance and risk management

- Mobile app access and online banking services

Modern-day global retail core banking systems have undergone transformation with the integration of artificial intelligence and machine learning for operational and service excellence.

Evolution of Core Banking Software with AI

According to J.D. Power 2024 U.S. Retail Banking Satisfaction Study, despite the efforts put by many retail banks to improve the customer experience, many are missing the mark on critical customer touch points. The study clearly indicates that the customer trust is declining, loyalty is at risk, be it National bank, regional bank or midsize banks.

“In an AI-first bank, AI flows through various touchpoints in banking layers,” says HFS research.

AI-enabled core banking software comes as hope as this is the only next-generation, digital, retail and enterprise banking solution that incorporates artificial intelligence to optimize and streamline various core banking operations. This future-ready system is a shift from the legacy systems where banks can achieve a high level of cost efficiency and operational excellence with this customer-centric agile platform. Customers can save on the overall cost of maintaining a bank account, making retail and corporate banking more affordable and accessible.

“The bank's investments in AI in 2025 and 2026 will be higher than in 2024,”reportedly indicated the chief data and analytics officer at Citizens Financial Group. Another thought leader indicated that the implications of AI are profound. When core banking is integrated with AI technology, banks can optimize their operations.

Big banks are going all-in on AI, says a recent news. Benefits of AI-powered core banking are enormous. A few notable ones include;

- Automated and expanded service

- Omnichannel customer service

- Simplified operations

- Predictive and powerful analytics

- Actionable data insights

- Real-time quick resolution

- Virtual assistants

- Fraud detection and prevention

- Customized banking experience:

- Personalized product recommendations

- Enhanced security

Above all, AI-based core banking software helps banks make data-driven decisions and stay ahead of the market demands. With this system banks can expand their operations both physically, and digitally. As most of the workflows are automated, there are minimal or zero errors. With a centralized approach, customers benefit from easy accessibility and operations.

Traditional Banking Vs AI-Enabled Core Banking

| Aspect | Traditional Banking | AI-Enabled Core Banking |

| Workflow Efficiency | - Manual processes - Lower operational efficiency - Error-prone - Slower decision-making - High transaction processing time |

- Automated workflow with AI - Higher operational efficiency - Error-free - Quick decision-making - Real-time transaction processing |

| Customer Experience | - In-bank, email, or phone interactions - Limitations in customization - Service time limitations |

- Omnichannel interactions, chatbots, and other AI support - Personalized customer experience with AI, Data analytics - Round the clock customer service via multiple channels with AI support |

| Operational Cost | - High, due to manual processing | - Cost is low as workflows are automated |

| Scalability | - Legacy systems, low chance for scalability | - Highly scalable with the help of AI and cloud computing |

| Security | - Poor security, high risk | - Highly secured and encrypted |

| Compliance | - Manual compliance - prone to errors | - Automated compliance process |

Why is Artificial Intelligence (AI) + Customer Experience the New Digital Banking Suite?

Overcoming complexity, automating tasks, improving customer services, detecting fraud, enhancing security & compliance, and ensuring efficiency are the most noted benefits of combining artificial intelligence and customer experience. With a boundless potential for creativity and innovation, this combo is likely to improve the banking sector further in the near future.

For a retail and corporate bank to run smoothly, AI can be leveraged to forecast the cash flow, predict the demand, foresee the trends and iterate the performance with data-driven decision making.

Automating the day-to-day tasks reduces time, resources and costs involved in the operation. Automation also minimizes errors.

To sum up, AI-backed core banking applications deliver high-level benefits over traditional banking software by providing automation, efficiency, personalization, security, and enhanced customer experience. While several banks still use legacy core systems, a few have already modernized their core systems to meet the demand for new-generation services. Replacing the old infrastructure with a more efficient system requires comprehensive transformation across core processes, data structures, and IT architectures. But, by leveraging AI, banks and other financial service providers can offer optimized, more sophisticated, responsive, and cost-effective services to customers - be it retail or enterprise banking customers.

Top 5 Drivers for AI Integration in Core Banking

- With the help of artificial intelligence, banks can monitor transactions, customer activities and ensure that all transactions adhere to the regulatory requirements. AI can generate reports and send alerts when there are any deviations.

- Artificial intelligence systems can analyze every interaction of the customers, their feedback, reviews, etc and design a future plan for the customers. This helps in improving customer satisfaction, service, and their experiences. Real-time banking settlement is possible along with hyper-personalization.

- By automating mundane tasks, AI can bring in efficiency and speed. Transaction processing time is reduced with this.

- AI can lower the operational costs, enhance security, enable DDDM (data-driven decision making) through advanced analytics.

- AI can modernize a bank’s operational model, and help in capitalizing on new opportunities.

How AI is Redefining Retail and Corporate Banking Customer Experiences?

Banks have gone through several changes. From digital transformation, the banking sector had to immediately rush into the AI transformation, and quickly into AI maturity to surpass their performance, and sustain at the top. Retail and Corporate banks enhance the banking experiences of their customers and redefine their services by leveraging new-generation technologies, customer-focused plans, personalized services, and future focused/predictive practices. By mastering AI, banks can effortlessly redefine their customer experience in both retail and corporate banking, tailoring every service with utmost efficiency and satisfaction. This involves a combination of different capabilities.

Mastering AI Application in Retail Banking:

- Customized/Tailored banking services

- Data Analytics: Usage of customer data to improve customer satisfaction.

- AI and Machine Learning: Predictive analytics to recommend services or investment guidelines.

- Omnichannel banking services - (mobile, Web, branch, ATM)

- Use of APIs: Integrated software to ensure friction-free functions across all channels.

- Anytime, Anywhere Digital Banking

- Mobile Banking Applications

- Chatbots and Virtual Assistants

- Real-time Customer Support

- Enhanced Security - Biometric authentication, AI-based fraud detection, total encryption.

- Transparent Approaches

- Customer Feedback

- Enhanced Customer Loyalty Programs

Mastering AI Application in Corporate Banking:

- Customized financial services by analyzing the customer data, customer interaction, customer history, transactions, and feedback.

- Dedicated customer relationship managers to provide personalized and prompt support, and exceptional care.

- Efficiency in transaction processing by automating workflows, and analyzing the priorities.

- Online real-time payments processing

- Automated Treasury Services

- Comprehensive services via omnichannel digital platforms.

- Predictive Analytics: With AI banks can offer advisory services.

- Optimized Security and Compliance

- Streamlined Document management

List of Most-Promising AI-Core Banking Software

Core banking service providers, big or small, are currently modernizing their systems by investing in core banking software that is rich in AI features. The following are some of the best and most-invested AI-based core banking tools. Banks with legacy systems can adopt progressive core modernization by investing in these tools.

List Of AI-Enabled Core Banking Software Companies:

Goodfirms, the B2B listing, rating, and review platform is a one stop solution to find the most-affordable and reliable AI-enabled core banking software solutions and companies. Here are a few names that are found in the list curated by Goodfirms.

Leading Banks Rolling Out AI-Powered Core Banking Services

Globally, several banks are adopting AI-powered core banking software to optimize their operations, personalize their services, escalate customer experiences, and stay sustainable. Here are a few names that leverage AI.

As per the Evident AI Index Ranking the following 5 banks are at the top list of AI-core banks who are experts in innovation, leadership, and transparency:

(source: Evident Insights)

- JPMorgan Chase

- Capital One

- Royal Bank of Canada

- Wells Fargo

- UBS

1. JP Morgan Chase

JP Morgan Chase, the largest bank in the World, is committed to exceptional service, innovation, and sustainable growth. It currently serves millions of customers and is ranking first to integrate AI into its core banking services.The company uses “Thought Machine,” the core banking system, to automate various operational tasks, including fraud detection and customer service, and to improve decision-making.

2. Capital One

“We use AI and ML to look out for our customers’ financial well-being, help them become more financially empowered, and better manage their spending,” says Capital One.

Ranked second, the company uses artificial intelligence in its core banking service to deliver a top-notch experience and safe transactional operations.

3. Royal Bank of Canada (RBC)

RBC has wisely taken advantage of the advancement of artificial intelligence technologies, including generative AI, to optimize core banking operations. From predictive analytics to automated workflows, RBC knows how to transform the way it works and the experience it can create for its customers in a safe way. RBC is ranked third in the World to adopt AI for its core banking services.

4. Wells Fargo

Wells Fargo, an American financial services company, uses Dialogflow, Google’s conversational AI, to carry out its core banking services, draw insights from data, drive better growth, and deliver exceptional customer support.

“We have a strong position around open banking, meaning as the AI space evolves, we can create banking products that are super-charged with AI and be where customers are,” mentioned the company representative in a report.

5. UBS

As an investment bank and financial services company, UBS is one of the largest banks in the World and ranks at the 5th position to invest in AI to deliver safe, secured, and optimized banking experiences to its customers. The Swiss bank believes that AI is changing bank operations.

Future of Core Banking:

“In the last 30 years, no technology has promised to change everything across a business—until generative AI. Today, AI is the number one driver of business reinvention,” says Accenture.

Closing the effectiveness gap is critical for banks today. The future of core banking seems to be transformative only for those who are AI-Achievers, AI-builders, AI-experimenters, and AI-Innovators. Although other technologies like cloud computing, Blockchain and distributed ledger, APIs, and real-time smart solutions help in shaping the future of core banking, AI has a huge potential and role to play. Banks have to integrate artificial intelligence at a breakneck speed. The difference in customer satisfaction is relatively high. Retail and corporate banking customer experiences will surely be redefined with artificial intelligence and machine learning. Banks will be subjected to adopt this transformation as early as possible to achieve tangible value. Otherwise they will have to see another “Kodak Moment.”