Have you ever wondered just how far mobile phones have come since they were first introduced in 1984? Mobile technology has advanced leaps and bounds over the last four decades, from its humble beginnings as a mobile phone to the AI-enhanced powerhouses we use today.

Another important sector that has gone through tremendous change in the past few years, much thanks to the growing mobile technology, is Finance and Banking. Long gone are the days when people had to take time off work and stand in long lines outside of banks just for trivial tasks like updating their passbooks or checking their bank balance. Welcome to AI in Banking!

Today, we have at our disposal a plethora of banking and payment apps that can smoothly complete any transaction we require with utmost security. Artificial intelligence has revamped the workings of banking and payment apps through its intuitive and evolving technology. Therefore, through this article we seek to enlighten readers about the role of AI in banking and payment applications and how it is the future of Fintech.

“People need banking, not banks.” – Ranjit Sarai, President’s Choice Financial

Influence of AI on Banking and Payment Apps

Information is Gold and in the current century banking and financial institutions are well aware of this fact. The data consumed and analyzed by mobile apps through machine learning is an opportunity that lies beyond the four walls of an institution. This way AI is able to crunch unprecedented amounts of data into information that is used to transform the ways banking and payment apps function and improve user experience.

The disruptive technology of artificial intelligence plays a key role in polishing the data figures, investment predictions, detecting fraudulent information amongst other things. The speed and accuracy displayed by this technology is unmatched in human agents that promote financial tools to their clients.

As per a report by Business Insider, “The aggregate potential cost savings for banks from AI applications is estimated at $447 billion by 2023.” This simple fact suggests that more than 80% of the banks are aware of the potential benefits of integrating AI into their banking apps.

Automation through AI and machine learning has been a big giveaway to what the future holds in terms of the benefits of relying on AI for mobile app developers, and banking and payment apps are no stranger to those. With the help of AI online transactions have become much more secure and we can see the rise of multiple online payment apps such as ApplePay, SamsungPay, and even GooglePay. Machine learning in banking has greatly improved the entire banking experince.

On the front end, AI is being used by banks to make client identification and verification easier, to imitate human assistance through chatbots and voice assistants, to strengthen customer relationships, and to deliver personalized insights and recommendations.

Banks are also using AI in middle-office tasks to detect and prevent payment fraud, as well as to strengthen anti-money laundering (AML) and know-your-customer (KYC) regulatory checks.

Key Applications of AI in Banking and Payment Apps

To dive deeper into how AI is being used to improve your banking services, let's take a look at the key areas where AI in Banking and Fintech is being employed by mobile app developers and financial services.

1. Cybersecurity and Fraud Detection - Cybersecurity during online banking is the utmost priority of all banks, financial institutions, payment app companies and most of all the users. Therefore, one of the most important roles of AI in mobile banking is detecting fraudulent activities and preventing them.

With the help of AI, tracking loopholes in the security and privacy features of any app could be a cakewalk as machines are known to have higher accuracy than humans. AI powered apps can track user activity and detect strange patterns that can minimize risk and alert authorities and the customers when fraudulent activities occur on their accounts.

Example: Companies like Datavisor provide banks and financial institutions with specialized AI-based financial fraud detection solutions that claim to detect 30% fraudulent transactions with almost 90% accuracy.

2. Chatbots - Chatbots are one of the most friendly examples of how AI can help replace human assistance in real-time banking requirements. They are available 24/7 and pop up immediately once you log into your banking app to assist you for a smooth and hassle-free experience.

By including the feature of chatbots into their banking apps, banks are conveying the message that they are available round the clock for the needs of their customers. Additionally, chatbots are able to track the pattern of user-enquiry and give customized solutions as per requests to customers.

Example: A smart example of a great chatbot in a banking app is Erica, a virtual assistant in Bank of America who can help you manage your card, get your account information, and help you manage your payments amidst other things.

3. Financial Planning and Recommendation - A majority of young adults struggle with the aspect of proper financial planning. The banking and payment apps can now understand your financial appetite and suggest to you the perfect investment plans as per your budget and risk behavior.

“We’re one to two years away from a machine that can debate with you on your investment hypothesis.” – Pavel Abdur-Rahman, IBM

Previously all the recommendations made by bank agents regarding a customer’s loan and credit eligibility were made based on their credit history and score while now the AI in banking apps can go beyond that to determine the creditworthiness of the customer.

Example: Ocrolus is a company based in New York that makes intelligent automation software to help lending institutions make smarter decisions when assessing the funding potential of businesses or individuals. It is an app that showcases the prowess of AI in Fintech.

4. Tracking Financial Trends - People who rely on financial apps to track the trends in the financial market are often assisted by the predictions made by the app. Advanced machine learning helps the app to process large amounts of data to make highly accurate market predictions for various financial tools like stocks and investment schemes.

Not only do the apps track daily, weekly and monthly trends, but also warn the user of potential risks if they sense anything based on their data report. This way AI helps customers make smarter decisions.

Example: Alphasense is an AI powered search engine that helps banks and financial institutions discover changes in the trends in the financial market. It is especially useful for brokers and traders. It is an excellent example of AI in Fintech.

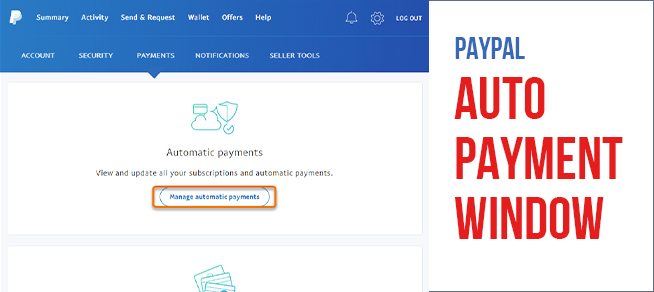

5. Automated Bill Payments - AI powered apps allow users to automate their bill payments. They can sync the billing cycle to make the most suitable payment schedule so that you don’t fall behind in any of your payments.

This is a highly popular feature in payment apps as it helps you keep your busy schedule without any default in payment of your bills. Different bills are generated at different times throughout the month and it can be a hassle to remember each one of them. Through the auto-debit facility that many banks and payment apps provide, you get notified of the bill due date and about the auto-payment transaction when it occurs.

This way you avoid paying hefty late fines on your bills or EMIs.

(Source: Paypal)

6. Heightened Security - If you use a banking or payment app you must have come across the latest security feature of biometric login into your account. This is another example of how AI helps in securing your money and information with the banks. Passwords and pins can often be stolen so biometric login or biometric permission for an online transaction adds another layer of security to your money.

The simplicity of the matter lies in the fact that you don’t require to re-upload your biometric information on the application, it takes the data from your mobile device and uses that primary biometric information for your account. AI in banking has vastly improved the cybersecurity measures employed by banks for customers.

Many banks across the globe have already adopted this technology to detect unauthorized entry into the account of users. Bank of America and Standard Chartered bank are good examples for the global audience to understand.

(Source: Standard Chartered)

7. Data Collection and Analysis - Banking and financial institutions record and track millions of transactions daily. Just by volume, collecting and storing these humongous amounts of data is an impossible task for human employees. Therefore, AI not only collects and stores that data, it helps segregate it and analyze it to make highly accurate financial reports for the institutes to audit.

This structured data can then be used in an array of fields such as credit risks, frauds, financial stability, debt and equity options as well as future strategic plans for the bank.

Example: Kensho, another great example of AI in banking, is a strategic partner of global financial firms like JP Morgan and Bank of America. It provides them with machine intelligence and data analytics to help lower financial risks.

8. Reduction in Operational Costs - When used internally, AI helps reduce errors that can be caused by manual human processes. It eliminates any unnecessary data or process to save time and energy of the employees as well as suggests efficient use of resources.

AI assistants, much like voice assistants, can help reduce the burden of repetitive and redundant tasks from human labor. As per a report by Accenture, AI in banking can reduce operational costs by nearly 30%.

This way bank employees can focus on other high priority tasks which require human intervention and satisfy their clients and customers with their services.

9. Regulatory Compliance - Regulatory compliances for online banking and transactions keeps changing to provide a more secure and well-rounded experience for users but sometimes it can come off as a hassle.

Imagine that you have to complete an online transaction and as soon as you log into your e-wallet or bank app, the first thing that pops up is a KYC requirement notification. You might get a little confused and annoyed but the good part is that with AI it can be completed online within seconds and allow you to go back to smoothly transacting.

This happens because banks are one of the most regulated sectors in every economy of the world. There are frequent updates and changes in policies, with the help of AI powered apps, you only get informed about the aspects of policies that directly affect you or your mobile banking and payment needs.

Automating such regulatory compliances make banking a smoother and more efficient experience for both users and bankers, thus highlighting the positives of using AI in banking and fintech.

10. Enhanced Customer Experience - Technology evolves to make a better and more convenient experience for customers. Same is the case with integrating AI into banking and payment apps. A smooth and secure customer experience that improves the relationship between the bank and its customers.

The ease in transacting online or getting your queries answered irrespective of the time and place makes mobile banking so much more convenient for customers. Having control over your banking and payment information and history just a click away makes you feel secure about your future options as well.

Banks and payment companies are working harder to automate more and more aspects of banking so that the customer doesn't have to face any inconvenience and continues their services. Understanding customer behavior and personalizing recommendations accordingly has helped banks sell more schemes and credit to customers who find it easy to access.

Chatbots like Erica, Bank of America, can easily manage your complete credit and debt profile convincing you to come back for more.

(Source: Bank Of America)

Wrapping Up

In conclusion, AI is the cornerstone of all future technology irrespective of the sector or industry. The benefits of integrating AI and machine learning into banking and payment apps are hard to ignore as you have already read. Given the circumstances of a generation that is highly invested in tech and finance, the ease, convenience and accuracy of AI will go a long way for mobile app developers interested in developing apps for Fintech. In short, people change and so do their banking habits. Experts who learn to adapt to these trends are the ones who survive and flourish in the end.