The UK artificial intelligence market seems poised for a gold rush, with at least one business embracing AI every 60 seconds. Supported by UK AI government initiatives such as the National AI Strategy, the AI Opportunities Action Plan, and Special AI growth zones, more than half of the UK companies are utilizing AI to enhance productivity, drive revenue, and refine their operations.

Yet there’s a clear divide in AI adoption between small and large-scale companies. Agile AI startups in the UK are deeply using it in their operations to scale and grow, while large-scale companies are mostly using it at a surface level, such as enhancing basic efficiency. This secondary research report aims to understand how the UK AI market is performing in terms of adoption and the issues it faces, while also enabling decision-makers to identify proven AI development companies in the UK.

UK AI Market — Key Facts

- The UK AI market is projected to grow at a 28.16% CAGR through 2033.

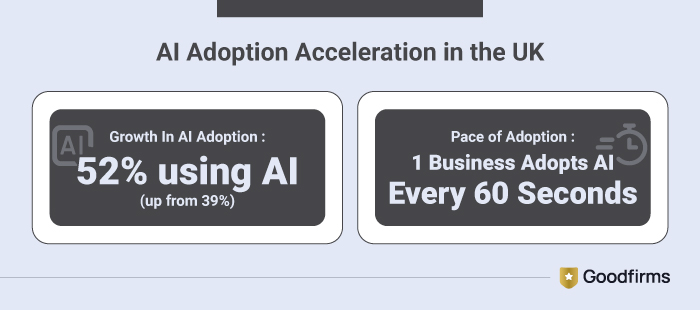

- More than 52% of UK businesses use AI, up from 39% last year, with one business adopting AI every 60 seconds.

- UK firms are investing an average of £15.94 million annually in AI, with spending expected to surge by 40% within two years.

- 92% of AI-adopting UK businesses report revenue growth, with an average 28% revenue uplift.

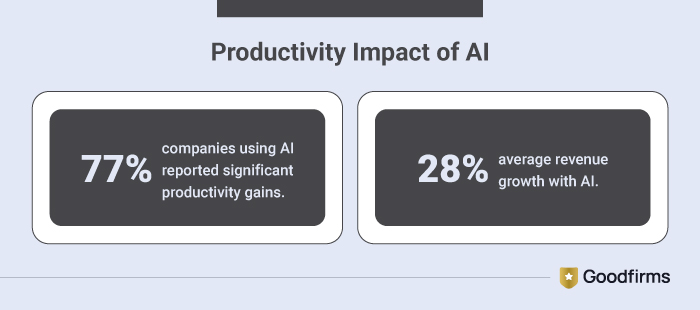

- 77% of UK companies using AI report productivity gains.

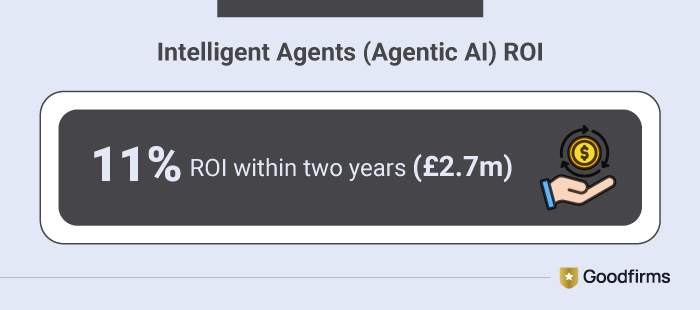

- 11% of AI ROI will come from agentic AI within the next two years.

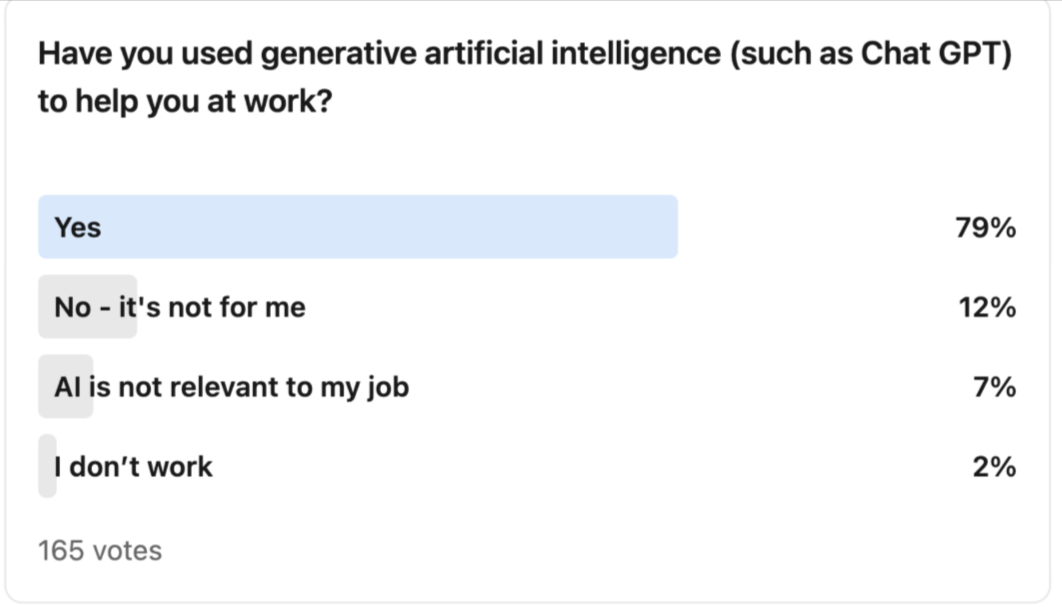

- 79% of UK professionals use generative AI tools at work, including ChatGPT.

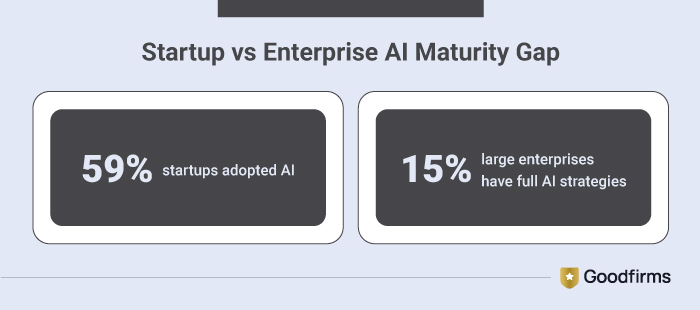

- 59% of UK startups have adopted AI, while 15% of large enterprises have a comprehensive AI strategy in place.

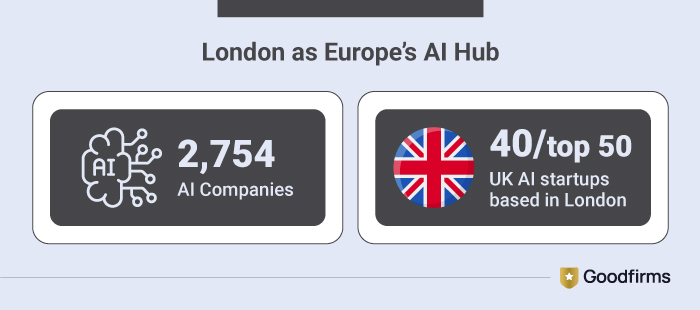

- London hosts 2,754 AI companies, earning it the reputation of ‘Europe’s leading AI hub.’

- The UK AI workforce grew 72% between 2022 and 2024, which translates into 86,139 employees.

- 5,862 AI companies operate in the UK, a 58% increase from 2023.

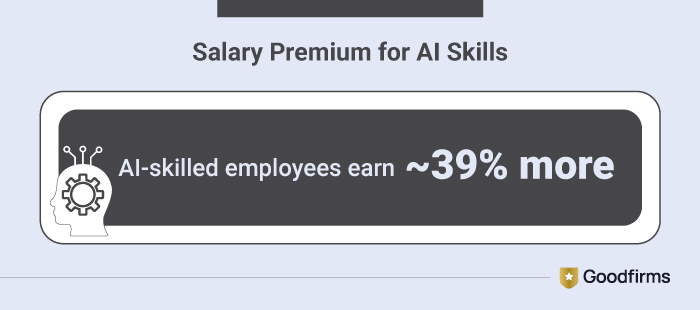

- UK workers with AI skills earn 39% higher salaries than non-AI employees.

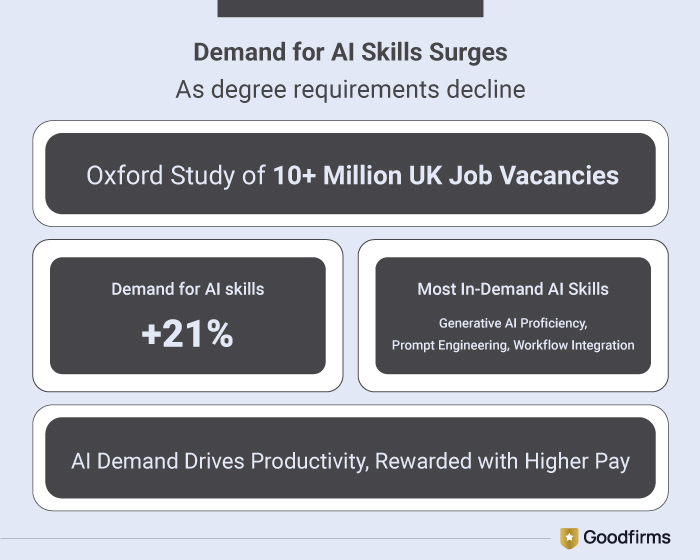

- Demand for AI skills in the UK increased 21% between 2018 and 2024, while degree requirements declined.

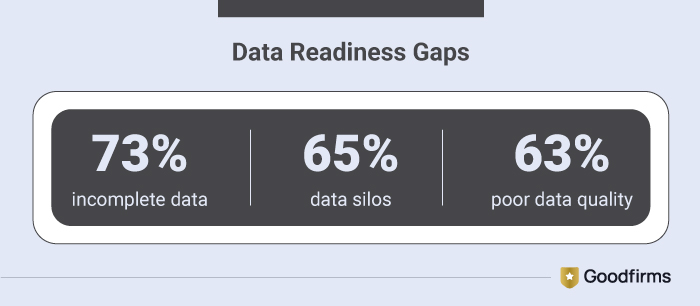

- 73% of UK businesses face data readiness challenges, including data silos and poor data quality.

As AI adoption accelerates, businesses are increasingly partnering with top artificial intelligence developers and AI consulting firms in the UK to move beyond experimentation and adopt and deploy AI at scale.

#1. UK AI MARKET - Scale, Spend, Economic Impact

The UK is no longer using AI on a trial-and-error basis but is using it at scale, backed by strong government support and enterprise adoption, transforming the UK AI market into a significant economic growth engine.

Here’s what the data says:

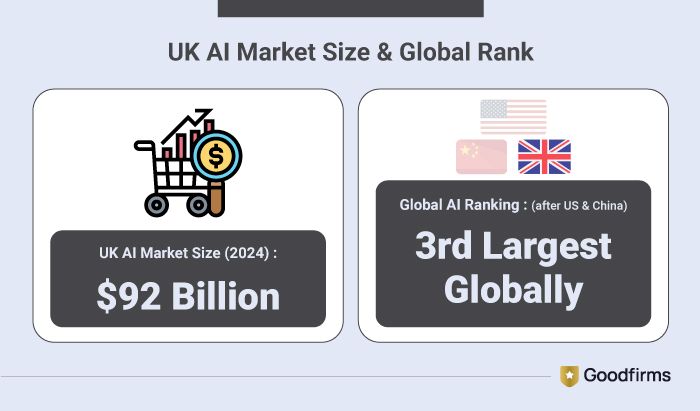

1. The UK AI market is the third-largest worldwide, valued at $92bn in 2024

The UK’s AI sector is the third-largest globally, after the US and China, and the largest in Europe, with a value of $92 billion in 2024. With AI adoption growing across various sectors, the market is projected to grow at a 28.16% CAGR through 2033, positioning the country among the fastest-growing AI economies.

This growth is being driven by artificial intelligence companies building AI software, platforms, and industry-specific solutions across finance, healthcare, retail, and manufacturing.

Plus, thanks to active UK AI government initiatives such as the National AI Strategy and the AI Opportunities Action Plan, sustained investment continues to flow into research and development.

UK startups aren’t adopting AI on a trial basis. They are embedding it in their core operations to scale faster and stay competitive.

The UK AI market spans hardware, software, and services. But one segment is clearly at the forefront: AI Software. AI software is adaptable to a wide range of applications and sectors. Any workflow. Any use case. This adaptability is enabling enterprise-wide adoption, laying the foundation for the UK’s next phase of AI-led growth.

Source: gov.uk

2. UK firms are investing £15.94 million in AI this year, with spending expected to surge by 40% within two years

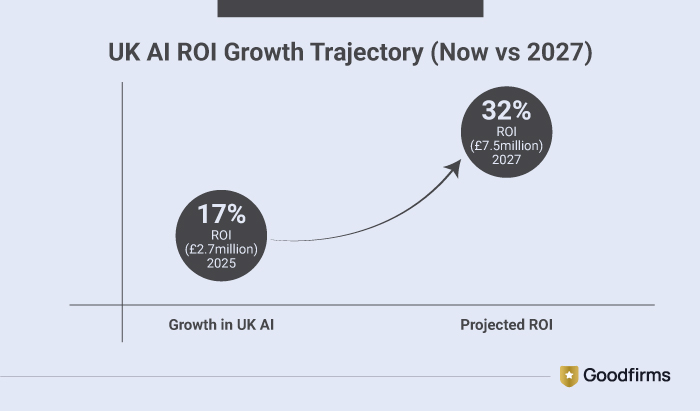

According to a new study from SAP, "The Value of AI in the UK: Growth, People & Data," UK businesses are realizing a 17% (£2.73m) return on AI investments, with an ROI forecast to double to 32% (£7.53m) by 2027.

Almost 92% of UK businesses reported that AI usage increased their revenue by 28%, a significant uptick from 2023, when only 64% of companies reported similar revenue increases from AI.

A portion of these financial returns is attributable to agentic AI, which are AI systems capable of autonomous decision-making and adaptive action. Such systems enhance efficiency, streamline operations, and facilitate the implementation of new business strategies, thereby significantly contributing to the overall return on investment observed in UK firms.

UK businesses interested in capturing this ROI consistently are increasingly working with AI development companies, generative AI specialists, and data analytics partners who can align AI initiatives with business requirements.

Source: SAP AI UK report: The Value of AI in the UK: Growth, people & data

3. 11% ROI will come from intelligent agents (read: Agentic AI) within two years

A portion of this ROI, that is, 11% will come from Agentic AI adoption within two years. Agentic AI is being programmed to function across finance, supply chain management, and workforce planning.

Source: SAP AI UK report: The Value of AI in the UK: Growth, people & data

4. One business adopts AI every 60 seconds in the UK

More than 52% of the businesses are using AI, up from 39% last year, and at least one business is harnessing the technology every 60 seconds, according to the latest edition of Amazon Web Services’ (AWS) study, “Unlocking the UK’s AI Potential” report.

The majority of these businesses are startups that leverage AI and integrate it deeply within their organizations to make internal processes more efficient or to build entirely new products and services.

While startups are using AI at an accelerated pace, large enterprises have a lot of catching up to do. The latter is still tinkering with AI at the surface level, mainly focusing on data analysis and scheduling assistants, and nothing more.

Source: AWS UK AI report unlocking Europe's AI potential

#2. AI ADOPTION in the UK- High Usage, Tangible Returns, and Uneven Readiness Across Industries

Enterprises and startups alike are using AI. But then, it’s startups that are leveraging AI the most and experiencing significant productivity gains. Large-scale investment in AI is primarily driven by the need for cybersecurity, operational efficiency, and data-driven decision-making.

5. 77% of UK businesses that adopted AI have experienced significant productivity gains

UK businesses are already realising the benefits of AI investment. 77% have reported significant productivity gains. 44% of them reported improved decision-making, and 47% leverage AI to speed up their business expansion.

To sustain these gains, UK businesses are investing in AI and business intelligence services that embed AI directly into operational workflows.

Source: AWS UK AI report unlocking Europe's AI potential

6. 79% of the Brits use generative AI (such as ChatGPT) to help them at work

According to a 2024 Forbes Advisor poll of 165 respondents, the vast majority (79%) have used generative AI (such as ChatGPT) to help them at work.

Source: Forbes.com

7. Nine in 10 UK businesses are looking at AI to address key business issues

Nine in 10 UK businesses, technically that’s 89 percent of UK businesses, are solving problems with AI, thanks to improvements in data analysis, business intelligence, customer experience, and reduced operational costs.

In 2024, businesses have already invested, on average, £235,600 in AI and emerging technologies, with 68 percent planning to increase this investment in the next 12 months.

Large corporates, with 250+ employees, are investing heavily in AI with an average investment of £400,000, compared to £225,500 from medium enterprises (50-249 employees) and £125,250 from small businesses (10-49 employees).

Source: Barclays UK AI investment study

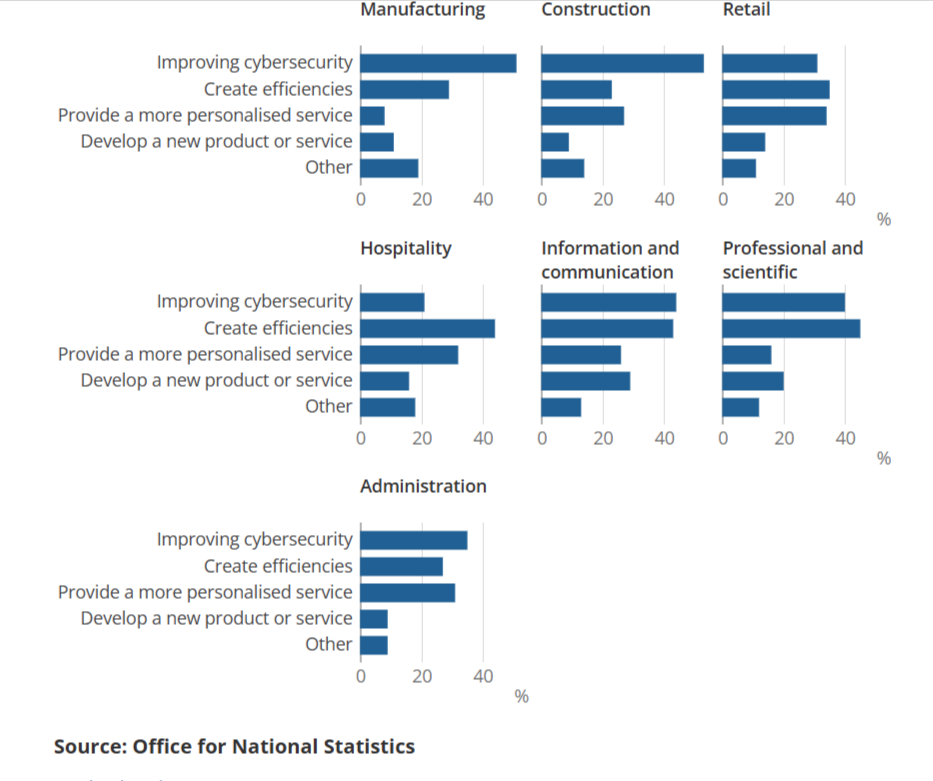

8. UK construction and manufacturing industries prioritise improving cybersecurity through the use of AI

UK businesses are leveraging AI to solve two real operational problems: strengthening cybersecurity and driving efficiency at scale. Customer-facing apps like personalised services are crucial in retail, hospitality, and tech, while innovation-led uses, such as new product development, still lag.

Overall, UK firms are primarily using AI to secure systems, with a greater focus on securing systems, streamlining processes, and enhancing service delivery.

Source: gov.uk

9. 59% of UK startups have adopted AI

Startups have successfully adapted AI, with minimal hiccups, to roll out new products for their customers, thereby revolutionizing their industries in the process.

Realizing its benefits, of the 59% startups, 31% companies have a comprehensive AI strategy, and over a third, that’s 34% of the startups, have reached Stage 3 of AI adoption (the most advanced stage of AI adoption)

In contrast, only 15% of large companies have a comprehensive AI strategy, and only 14% have reached the third stage. This gap in AI usage means large enterprises are progressing slowly. Given that 48% of the UK’s turnover depends on large enterprises, their slower adoption of AI may limit the overall economic benefits that AI could deliver to the UK. This lag could hinder the country from fully leveraging AI to gain a competitive edge in the global market.

Source: AWS UK AI report unlocking Europe's AI potential

#3. INFRASTRUCTURE - Compute, Policy, Geography, & Scale Powering UK’s AI Ambitions

Investments in computing, cloud infrastructure, and data readiness are driving AI growth in the UK.

As AI models grow larger and more compute-intensive, UK businesses will increasingly need the help of cloud computing providers, big data companies, and data engineering firms in the UK to support scalable AI workloads.

10. London is Europe’s AI Powerhouse

London now hosts 2,754 AI companies, making it one of the world’s most concentrated and dynamic AI hubs. Its AI ecosystem resembles that of the San Francisco Bay Area, the No. 1 City in AI innovation, and comfortably outstrips major European rivals, such as Berlin and Paris.

The city also ranks second in terms of AI talent, with 1800+ AI specialists on LinkedIn skilled in data science, machine learning, and platform engineering, and supported by industries such as advanced manufacturing and energy management.

Survey data indicating that 78% of businesses would be more likely to adopt AI technology if they observed its uptake in the public sector reinforces the argument that public sector leadership plays a critical role in accelerating AI innovation. Source: unlocking Europe's AI

This finding suggests that businesses closely monitor government initiatives as a signal of both technological feasibility and institutional legitimacy. When the public sector leads in AI adoption, it not only reduces perceived risks for private firms but also establishes standards and best practices that the private sector may emulate.

Source: Forbes.com, Railsware.com

11. The UK government is launching AI Growth Zones (AIGZs) to fast-track AI infrastructure development

The UK government will create dedicated AI Growth Zones (AIGZs) to speed up AI infrastructure development. The designated regions will be given priority over other regions in terms of power and planning approvals to quicken AI infrastructure growth on UK soil.

The first AIGZ will be launched at Culham ( UK Atomic Energy Authority headquarters) and will be positioned as a prototype for high-performance computing and AI development. This public-private partnership is expected to deliver benefits to the local area, the UKAEA’s fusion energy mission, and the UK’s AI infrastructure.

Proposed development plans building one of the UK’s largest AI data centres - starting at 100MW capacity and scaling to 500MW.

The pilot aims to deliver secure, dedicated public-sector compute capacity through private-public partnership models.

Expected benefits from AIGZ include job creation, improved local and energy infrastructure, and advancements in sustainability.

Besides this, the government aims to clear regulatory pathways, reduce bottlenecks, and ensure AI labs can scale compute capacity without long delays.

Source: gov.uk

12. 10-year Commitment to build World-Class AI Compute Roadmap

AI’s progress largely depends on sustained investment in computational power (compute). In other words, AI’s lifeline is data centers equipped with large and complex computers that train AI models and perform inferences (to complete tasks and answer questions).

Its 10-year national AI compute roadmap will adopt a learning by doing approach. To achieve this, the UK is developing a three-layer compute strategy.

To achieve this, the UK is developing a three-layer compute strategy:

- Sovereign AI compute, a public sector property, to promptly and independently allocate compute to national priorities such as AI research, academics, and startups; not to mention offer AI compute for critical services during market disruption.

- Domestic computing, privately owned, will position the UK as a leading AI economy and ensure the UK’s economic security. The objective is to create more jobs, investments, and new AI-based service businesses.

- International compute with like-minded countries will give the UK access to complementary capabilities and facilitate joint AI research in areas of shared interest.

The main component of this plan is a 20-fold scale-up of the AI Research Resource (AIRR) by 2030, which will boost the UK's computational capacity. This expansion will enable the UK to train multiple advanced AI models simultaneously, thereby supporting large-scale national projects, advancing research and innovation, and ensuring the UK maintains a competitive position in the rapidly evolving global AI landscape.

Source: gov.uk

13. 20× Expansion of AIRR to ensure high amounts of computing power for high-value national projects

The AI Research Resource (AIRR) acts as a compute scaffolding (read: backbone) of advanced supercomputers offering AI compute capacity for researchers, academia, and industry.

As demand for large-scale computing increases, the UK plans to boost AIRR’s capacity by at least 20 times by 2030. It will evolve from a single facility into a distributed network of mission-driven compute clusters across the UK, combining data, compute, and top-tier AI talent. With this strengthened scaffolding, the UK can train multiple advanced AI models each year to support high-value national priorities.

To ensure the strategic allocation of sovereign compute, the government will appoint mission-led AIRR Program Directors, modelled on DARPA and ARIA. The appointment of these directors will ensure significant amounts of computing power are allocated to high-value national projects. This will prevent thin, scattered AI investment in the UK, thereby strengthening the UK's offer to researchers, startups, and innovators planning to settle here.

Source: gov.uk

#4. TALENT - The AI Workforce Powering the UK’s Economy

A rapid rise in the AI workforce, AI-native companies, and rising demand for hands-on AI skills are driving the UK’s AI boom. As more non-tech businesses adopt AI, employers are paying less attention to formal degrees and more to their technical skills—fueling higher salaries and new roles, such as prompt engineers. This shift aligns with broader industry trends explored in GoodFirms’ coverage of AI skill demand, prompt engineering services, and the future of AI jobs.

14. The UK AI employment sector has grown by 72%, from 50,040 in 2022 to 86,139 workers by 2024

Since the artificial intelligence sector study began in 2022, total Full-Time Equivalent (FTE) employment across both dedicated and diversified UK AI companies has grown by 72% - from 50,040 employees in 2022 to 86,139 employees in 2024 ( an increase of 36,099 people).

In 2024:

- 36% of AI workers are employed in dedicated AI companies (approx 30,667 employees)

- 64% of AI workers are in diversified companies (approx 55,524 employees)

Revenue and employment estimates

|

Metric |

2022 |

2023 |

2024 |

|

Revenue |

£10.6 billion |

£14.2 billion |

£23.9 billion |

|

Employment |

50,040 |

64,539 |

86,139 |

|

Revenue Change (%) |

34% |

68% |

|

|

Employment Change (%) |

29% |

33% |

Source: Perspective Economics

The share of AI employment in diversified companies is rising sharply, up by 11 percent compared to 2023, meaning that more non-AI-focused companies are rapidly expanding their AI teams.

Tech titans like Amazon, Google DeepMind, IBM, and Meta have added the majority of the revenue and employment. At the same time, generative AI model providers Anthropic and OpenAI’s London operations have mainly contributed to the UK’s AI employment since 2023.

Source: gov.uk

15. 5862 AI firms dominate the UK AI Landscape, a 58% increase from 2023

According to the UK government’s AI Sector Study 2024, the UK’s AI ecosystem has expanded, with more than 5,800 AI companies, which is a 58% increase from 3,713 firms in 2023.

95% of these businesses are SMEs, indicating a significant opportunity for new AI businesses that are being backed through funding. Which means only 5% are large companies.

Size profile of UK AI companies

|

Business size |

Percentage |

|

Micro |

70% |

|

Small |

15% |

|

Medium |

9% |

|

Large |

5% |

Source: gov.uk

16. Of the 5,862 active UK AI companies, 56% are dedicated AI companies, and 44% are diversified

In 2023, the share of dedicated companies (core AI companies) was 59%, and that of diversified companies (non-core AI companies) was 41%.

Although a modest 4 percent rise between 2022 and 2024, it signals an ongoing integration of artificial intelligence across the entire economy, as non-AI-focused companies are increasingly focusing on AI.

For the uninitiated, dedicated AI companies are those that sell AI products, services, platforms, or hardware solutions as their core business. In short, they make their revenue from AI itself.

Diversified companies, on the other hand, offer AI services as part of their large suite of products and services. It does not rely on AI services as its core business.

Dedicated and Diversified AI companies by size

|

Firm size |

Dedicated |

Diversified |

Total |

|

Large |

8% (n=24) |

92% (n=296) |

100% |

|

Medium |

32% (n=171) |

68% (n=361) |

100% |

|

Small |

43% (n=383) |

57% (n=513) |

100% |

|

Micro |

66% (n=2,714) |

34% (n=1,400) |

100% |

Diversified AI companies are primarily moving the AI revenue needle; in 2023, a 96% increase was observed from these companies. (n = £ 9.3 billion of £9.7 billion).

On the other hand, the revenue of dedicated AI companies increased by 9% from £4.4 billion to £4.9 billion between 2023 and 2024.

Source: gov.uk

17. UK AI-skilled Employees are paid around 39% more than those in non-AI roles

Now, this is a universal trend and not limited to the UK market. As their value increase, AI is enabling workers to charge premium wages. But then, every country will have its own unique salary structure, and the U.K. market is paying 39% extra to those with AI knowledge.

In fact, AI-powered workers in the most highly automatable roles are also earning substantial sums, which suggests that concerns about AI devaluing automatable roles have no basis.

Source: AWS UK AI report unlocking Europe's AI potential

18. The demand for AI-specific skills has surged by 21% between 2018 and 2024, while degree requirements have declined

According to Oxford’s study of 10+ million UK job vacancies, AI skill demand surged by 21% between 2018 and 2024, while degree requirements declined. In 2018, nearly 36% of AI job postings required both AI skills and a degree, but by 2023, only 31% companies demanded degrees.

The most in-demand AI skills in the UK include proficiency in generative AI, prompt engineering, and workflow integration capabilities. These automatically translate into an increase in productivity, and employers reward with higher compensation.

Source: blog.theinterviewguys, ox.as.uk

19. Job listings for AI prompt engineers grew 180% in the past 12 months in the UK and 209% year-on-year

The surge in demand for AI prompt engineers is primarily attributed to the broader adoption of AI technologies, such as ChatGPT and other generative AI tools.

The average salary of a prompt engineer is £72,500, while those in senior roles command £87,500.

Prompt engineers are one of the most sought-after professionals in the AI sector. Finance, healthcare, education, and ecommerce sectors are planning to hire AI prompt engineers to boost their quality and efficiency of AI interactions in terms of productivity, customer service and product development.

Source: itbrief

#5. RISK - Gaps, Friction & Structural Weaknesses Holding Back AI Scale

Despite the UK's rapid adoption of AI, the country faces structural challenges that could slow down AI adoption and diminish returns. AI literacy gaps, fragmented adoption, shadow AI usage, and weak data foundations are creating friction between ambition and execution. Without connecting the dots between people, governance, and data readiness, these gaps limit AI’s capability to make a real economic impact.

20. Four in 10 companies cited a shortage of AI-skilled workers in the UK workforce

AI Investment is heavily skewed toward Staff Training and Development in the wake of a significant workforce gap for AI knowledge workers. Business leaders identify AI and digital technology skills as the most in-demand skills.

Businesses are focusing AI investment on staff training and development (42 percent), improving digital products (37 percent), and R&D (37 percent).

The technical skills shortage is especially being witnessed in financial services (52 per cent) and IT & telecoms (48 per cent), as well as in the tech sector itself (51 per cent).

Source: Barclays UK AI investment study

21. 70% of UK businesses still aren’t sure if AI is really delivering on its potential

The fragmented adoption of AI is making businesses skeptical about its potential, according to a SAP study. Most of the UK businesses are showing only remote interest in AI. They have yet to step on the AI gas, full throttle.

The stats below speak loudly and clearly about why UK businesses are doubtful about AI’s potential.

- 42% of UK businesses describe their investment in AI as piecemeal

- Nearly 37% of UK businesses admit that their AI investment decisions are made at the departmental level.

- About 15% describe their investment as ad hoc.

- Merely 7% are pursuing AI through a strategic, enterprise-wide plan.

Given that AI adoption in the UK remains largely experimental, it is unsurprising that perceptions of its potential vary among businesses. The reported skepticism, as indicated by the statistic that 70% of UK businesses are uncertain about AI’s ability to deliver on its promises, may reflect the fragmented and preliminary nature of current implementations rather than a fundamental shortcoming of the technology itself.

According to Leila Romane, Managing Director of SAP UK & Ireland: “UK businesses have the ambition, talent, and data to lead in AI, although too many are still treating it as a ‘technology project’ rather than a holistic business transformation.”

According to another study, the key barrier to AI adoption is the digital skills gap.

Source: AWS UK AI report unlocking Europe's AI potential, SAP AI UK report: The Value of AI in the UK: Growth, people & data

22. Nearly half (46%) of UK businesses state that a lack of AI Literacy has slowed down their business

AI literacy is expected in 47% of the new UK jobs, but only 27% of UK businesses seem prepared to plug in the AI gap. The demand for AI skills can be gauged from the fact that employees with strong AI skills are being paid 39% more than those without AI skills.

The lack of digital skills is hampering the recruitment process. UK businesses reported that they take an average of 5.5 months to hire an employee with sufficient digital skills, while 41% of UK businesses reported that it’s tough to hire people with the requisite digital skills.

Source: AWS UK AI report unlocking Europe's AI potential

23. 43% Companies Report Security Vulnerabilities due to Shadow AI

Shadow AI? That’s unapproved AI tools.

Employees are adopting AI blindly, and most employees are adopting unapproved tools. So what’s the unapproved use of unapproved tools costing - 44% of businesses have seen data or IP exposure, and 43% are reporting security breaches.

Employees are enthusiastic adopters of AI technology, but 68% of organisations say their staff use unapproved AI tools - known as ‘Shadow AI’ - at least occasionally.

Shadow AI Risks in the UK: 44% of businesses have already experienced data leakage due to shadow AI, and 43% reported security breaches due to shadow AI.

60% of companies confessed that usage of unapproved tools is on the rise, as employees haven’t undergone comprehensive AI training, which means that they are ill-equipped to use AI responsibly. Though 71% are focused on reskilling and upskilling staff, progress has been inconsistent.

The point is: AI investment and people investment should go hand in hand. As Romane echoes, “Right now, employees are running ahead of their organisations, using AI tools because they see the opportunity, although they are not always aware of the risks involved. If we give them the training, sanctioned tools, and create safe opportunities for experimentation, that energy can become a real driver of transformation and growth.”

SAP AI UK report: The Value of AI in the UK: Growth, people & data

The UK AI Trajectory: Gains Today, Gaps to Close Tomorrow

AI is at the front and center of public and private sector companies. The return on investment has been reasonable, at 28%, which is sure to keep companies. Aiming for more. The UK government is laying solid groundwork. National AI Strategy, the AI Opportunities Action Plan, and Special AI growth zones are all sure to pump UK AI growth forward. But then, the question remains: Will the large-scale businesses be equally comfortable embracing AI like the startups? Only time will tell!

Right now, the truth is, without large-scale businesses employing AI, UK AI’s growth will be slow and steady.