Key takeaways

- In Australian Fintech, 67% of firms are actively deploying AI, while 45% are deploying Generative AI, well above global averages.

- Narrow AI is the backbone of Australian fintech, used in fraud detection, lending, compliance, and risk management with proven ROI and strong regulatory acceptance.

- Generative AI is gaining ground, but most use cases are still internal and low-risk (knowledge search, document review, call summaries, developer productivity).

- Most Australian firms are AI-enabled, not AI-transformed. AI supports decisions but rarely makes them.

- The main barriers are not technological, but skills shortages, unclear ownership, and weak governance, which are slowing the move from pilots to scale.

According to the 2025 Broadridge study, 67% of financial services firms in Australia use AI, surpassing the global average of 57%. Of these, 45% are actively deploying generative AI, which is significantly higher than the worldwide average of 31%.

AI Adoption in Financial Services: Australia vs Global (2025)

| Metric | Australia | Global Average |

| Overall AI Adoption | 67% | 57% |

| Generative AI Adoption | 45% | 31% |

However, what makes Australia stand out is not just its adoption but also the depth of its investment. Nearly three-quarters (74%) of Australian firms are making average to significant investments in GenAI, signalling long-term commitment rather than early-stage experimentation.

But then today, across the Australian fintech ecosystem, Narrow AI remains the backbone powering:

- Fraud detection

- Lending decisions

- Compliance workflows,

- Internal reporting

The best part about the widespread deployment? 94.6% of AI adopters reported positive outcomes, with 43% stating they were “very satisfied.” This level of satisfaction suggests that AI adoption is delivering measurable value, not just productivity gains on paper. As AI adoption accelerates across Australian fintech firms, they are turning to AI Development Services in Australia to translate AI goals into production-ready systems.

Why AI Matters More in Australia’s Fintech Ecosystem Than Elsewhere

Australia’s fintech market is scaling rapidly, and AI is a key driver of growth.

According to IMARC Group's report, Australia's fintech market was valued at $ 4.1 billion in 2024 and is projected to grow to $ 9.5 billion by 2033, growing at a CAGR of 8.90%.

Another study by MotorIntelligence valued Australia’s fintech market even higher at $11.78 billion in 2025 and $23.69 billion by 2030, advancing at a 15% CAGR.

As transaction volumes, regulatory complexity, and customer expectations increase, manual or rules-based systems are no longer sufficient. In Australia, AI has moved from a competitive advantage to an operational necessity, driven by leading finance software development companies building AI-driven platforms for lending, payments, and fraud prevention.

Key takeaways: Why AI Adoption Is Higher in Australia

- Rapid fintech market growth

- Increasing regulatory complexity

- High transaction volumes

- Mature Narrow AI foundation

- Strong institutional investment appetite

AI Adoption Across Australia’s Financial Services Sector: 10 Years in the Making

The use of Narrow AI is far more common than generative AI in Australia.

-3.jpg)

As per the KWM/Sapere survey and other studies, the Australian finance industry has been mainly using Narrow AI for almost 10 years now.

Examples of Narrow AI in use in Australia:

- Fraud detection and prevention

- Abuse detection

- Cybersecurity threat detection and monitoring

- Stress testing and risk management

- Document processing

- Traditional chatbots

- Customer tailoring and personalisation

This pattern is not unique to Australia, but is observed globally. Research analysing 78 AI use cases across the world’s top 50 banks shows that Traditional (Narrow) AI still dominates, with Generative AI representing a smaller but growing share. If you are looking for Narrow AI deployments, rely only on mature machine learning development services that offer proven ROI and regulatory acceptance.

Key takeaways: Why Narrow AI Still Dominates

- Proven ROI and regulatory comfort

- Easier integration with legacy systems

- Lower data and privacy risk

- Clear ownership and accountability

Narrow AI vs Generative AI in Australian FinTech

| Dimension | Narrow AI (Traditional ML) | Generative AI (GenAI) |

| Primary function | Predicts, classifies, detects, and scores based on historical data | Generates text, code, summaries, insights, and scenarios |

| Maturity in Australian finance | In production for ~8–10 years | Mostly 12–18 months of pilots and early deployments |

| Typical fintech use cases | Fraud detection, AML monitoring, credit scoring, risk models, stress testing, transaction monitoring | Knowledge search, document review, call summarisation, draft responses, scenario simulation |

| Decision role | Automates or supports defined decisions | Augments human judgement rather than replacing it |

| Regulatory acceptance | High — well understood by regulators | Emerging — requires additional controls and oversight |

| Explainability | High (rules, models, thresholds can be audited) | Moderate to low (outputs are probabilistic and contextual) |

| Risk profile | Lower and predictable | Higher due to hallucinations, data leakage, and bias risk |

| Data requirements | Structured, labelled historical data | Large volumes of unstructured data (text, voice, documents) |

| Integration with legacy systems | Easier, aligns with existing banking workflows | More complex — often sits as a layer on top of existing systems |

| Governance and ownership | Clear ownership (risk, compliance, IT) | Often unclear — shared between IT, legal, risk, and business |

| Current adoption pattern in Australia | Core operational backbone | Internal productivity first, customer-facing later |

| Business impact today | Operational efficiency, loss reduction, risk control | Productivity gains, faster analysis, process augmentation |

| Strategic role | Enables AI-enabled organisations | Becomes transformational only when paired with governance and redesign |

The Rise of Generative AI in Australian Fintech

Today, Generative AI’s use is lower compared to Narrow AI. One key reason for lower adoption is that Gen AI is relatively new to the finance industry.

The majority of financial firms have been piloting or experimenting with Generative AI for only the past 12 to 18 months.

The lower use of Generative AI can be attributed to the following reasons:

- Privacy concerns

- Data security

- Difficulty in integration

- Skill shortages

- Funding

- Uncertain regulatory environment

source: srgexpert

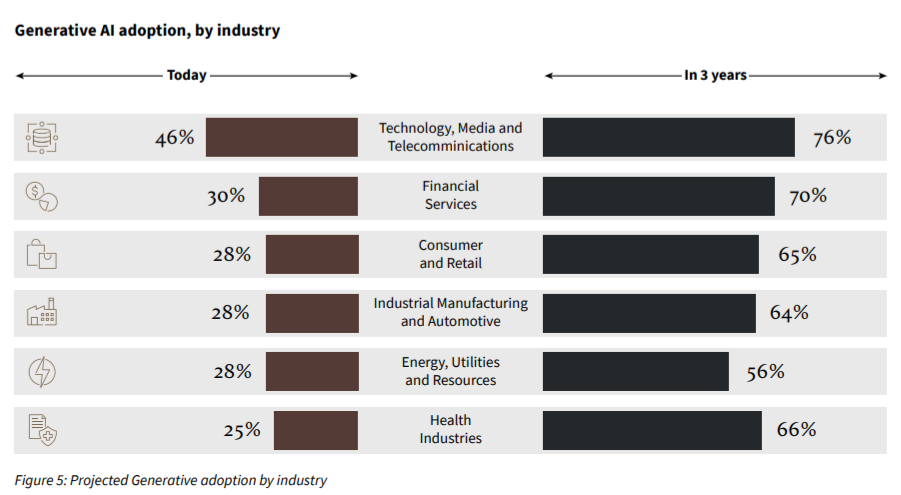

Despite these challenges, Generative AI use is expected to more than double over the next three years.

Crucially, firms are prioritising internal, lower-risk use cases before exposing GenAI to customer-facing workflows.

Key takeaways: What’s Slowing GenAI Adoption

- Data security and privacy risks

- Integration challenges

- Talent shortages

- Regulatory uncertainty

- Unclear governance models

Where Generative AI is Delivering Early Value - Use cases for Generative AI

Due to perceived risks associated with Generative AI, financial institutions are prioritizing internal use cases over external ones, as the lower risks inherent to internal use cases can yield significant productivity gains.

1. Internal Productivity & Knowledge Work

Generative AI puts your internal office affairs in order by speeding up software development, boosting employee efficiency, and turning unstructured data into actionable insights.

i)Increased Employee Productivity

Employees are utilizing Gen AI chatbots to quickly and accurately find information that helps them address customer queries. Such chatbots have been said to have significantly increased the efficiency and accuracy of the staff seeking specific information. Productivity gains of 9-12% per agent are already being reported. Chatbots are also being deployed to assist staff in navigating internal policies and procedures, such as maternity leave, annual leave, and other relevant benefits.

ii)Developer augmentation

Software development teams are utilizing GitHub CoPilot to accelerate coding and debugging. And even to analyse existing code. According to this study, one respondent reported a 43% increase in code generation productivity after using GitHub CoPilot.

iii)Dealing with unstructured data

80 to 90% of the data held by large enterprises, including financial institutions, is said to be unstructured. Generative AI helps withtext extraction, analytics, and reporting, and even forregulatory or client obligations. If organizations are not yet using Gen AI, they can partner with data analytics and data science service providers to extract value from unstructured financial data.

2. Business Processes Transformation

The financial industry is combining Gen AI with Narrow AI, where existing processes are repeatable.

i)Reviewing internal documents

Generative AI can play the role of an intelligent document analyst and examine large volumes of internal data, such as policies, procedures, contracts, and compliance manuals, to identify Inconsistencies between documents, duplications or outdated clauses, gaps where required controls or disclosures are missing, and misalignment with current laws and regulations.

ii)Creation of marketing/website content

Use Generative AI to draft initial versions of social media posts, website copy, pitches, and other marketing content.

iii)Automated call notes

This exercise involves using Generative AI to transcribe customer or internal calls and automatically generate concise summaries capturing key discussion points, decisions, and next steps, instead of consultants or relationship managers manually writing notes after each call.

iv)Generating documentation

Generating the first draft of responses to complaint letters normally takes 2-4 hours by human authors. Generative AI can do that in a matter of minutes with the right prompting, and it also improves the quality of the first draft.

v)Automating quality assurance

Automating quality assurance means using generative AI to review recorded customer calls against service and compliance criteria, especially for routine and repeatable interactions. A human QA can only sample a few calls; an AI system can evaluate every interaction on a continual basis.

vi)Scenario modelling

Scenario modelling using Generative AI to create simulated situations that help financial companies test systems, controls, and decision-making to identify vulnerabilities in security systems.

Instead of delving into historical data and informing you about scenarios that have happened before, it answers what could happen.

These use cases signal process augmentation, not yet full reinvention.

AI Leaders vs AI Followers in Australian Fintech

The Australian finance industry is experimenting with and adopting Generative AI. AI leaders are those who are implementing AI at scale.

For example, CommBank, one of the top global AI-investing banks, has reported:

- The use of AI safety and security features has resulted in a 50% reduction in customer scam losses.

- Generative AI-powered suspicious transaction alerts resulted in a 30% reduction in customer-reported fraud.

- AI-powered app messaging resulted in a 40% reduction in call centre wait times over the last financial year.

However, the financial industry as a whole appears to be taking baby steps in its adoption of Generative AI. In fact, there are a good number of AI Followers in the Australian finance industry that are yet to make significant investments in Generative AI.

AI Followers face challenges such as:

- Legacy systems may slow the implementation of Generative AI technologies and use cases, despite the financial capacity

- Digital-first organisations may lack human resources and capital to roll out Generative AI at scale

- Multinational firms work on low-risk models due to cross-border regulatory risk

AI Adoption in Australian Banks Is Broad—but Not Yet Transformational

Australian finance companies are utilizing AI.

However, the fact is: the deployment has been narrow, functional, and experimental rather than revolutionary.

In other words, most AI deployments are centered around low-risk areas such as

- Financial reporting and reconciliation

- Fraud and anomaly detection

- Chatbots and internal virtual assistants

- Credit risk assessment and scoring

Capgemini’s research highlights the lack of strategic, enterprise-wide AI roadmaps, indicating that high adoption in specific areas has yet to translate into a transformational capability. The Capgemini Research Institute’s World Retail Banking Report (2024) reveals that globally, only 6% of retail banks have developed an enterprise-wide AI roadmap capable of driving transformation at scale, despite 80% of banking executives believing that generative AI represents a major technological leap.

This disconnect highlights a critical distinction:

- AI-enabled banks use AI to optimize existing workflows

- AI-transformed banks redesign operating models, decision rights, and customer journeys around AI

In Australia, most institutions currently fall into the AI-enabled category, where AI augments existing workflows rather than redefining them. In most institutions, AI operates as a decision-support layer, not a decision-maker.

This creates a critical divide between two types of organizations:

|

Dimension |

AI-Enabled | AI-Transformed |

| Primary Goal | Efficiency | Reinvention |

| AI Role | Decision support | Decision engine |

| Deployment | Siloed use cases | Embedded across workflows |

| Human Role | Manual approval | Oversight & exception handling |

| Business Impact | Faster execution | New operating logic |

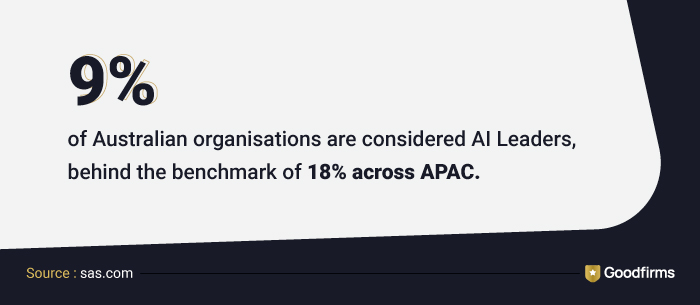

Further reinforcing this maturity gap, SAS and IDC’s Data & AI Pulse APAC 2024 study found that only 9% of Australian organisations qualify as “AI Leaders”, compared to an APAC average of 18%. The remainder are either piloting disconnected use cases or scaling selectively without a unified AI strategy.

Most Australian institutions remain AI-enabled, not AI-transformed. AI supports decisions—but rarely makes them.

Key takeaway: Australia’s AI Maturity Snapshot

✔ Strong Narrow AI adoption

✔ Proven operational outcomes

✔ Serious GenAI investment intent

✖ Limited enterprise-wide AI transformation

✖ Governance and ownership gaps

The Scaling Gap: Models Are Advancing Faster Than Organisations

Australian fintech firms are building AI models faster than they can operationalise them.

In Australia’s fintech and financial services sector, AI is advancing faster than many organizations can handle. Companies are rapidly building, testing, and launching models, but the systems to support and manage AI are not keeping pace. As a result, there is a widening gap between what can be done and what is actually practical.

Recent research in Australia highlights this gap. A 2024 survey by Australian FinTech found that over 55% of Australian companies are testing AI in some areas of their finance teams, but only 15% have managed to use AI throughout their entire business. So, while many are trying out AI, few have made it a routine part of their operations.

Data scientists and business owners are still not working in sync.

One major challenge is unclear ownership. Data science or technology teams often lead AI projects, while business leaders use the results but do not take responsibility for them.

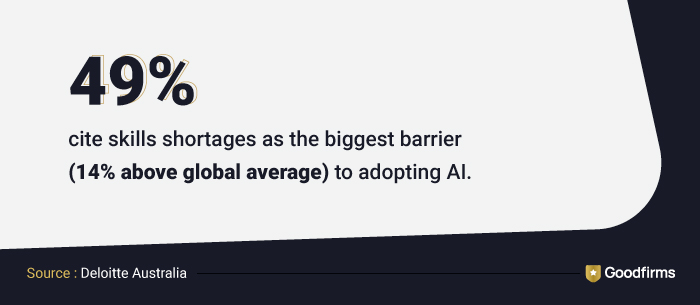

According to Deloitte Australia’s "State of Generative AI in the Enterprise" (2024), 49% of Australian business and technology leaders cite a lack of technical talent and skills as the biggest barrier to adopting AI, which is 14% higher than the global average.

Accuracy is the primary blocker to scaling AI beyond pilots.

This lack of alignment often leads to a familiar problem. AI models perform well in tests, but the real trouble starts when dealing with real-world challenges, unclear decisions, or other business needs.

Final takeaway: The AI gap in Australian fintech is about scale—not capability.

Transformation will come from redesigning how firms operate, not from smarter models alone.

What’s Next for AI in Australian Fintech

Australia is ahead in Narrow AI adoption and is serious about Gen AI investment.

But the next phase will not be about firms that use AI to streamline and optimise workflows. It will be about organizations that rebuild their operating models around AI.

The opportunity is no longer about experimenting with models; it’s about redesigning systems to let AI operate at scale.

AI in Australian Fintech - FAQs

1. Why does Narrow AI dominate Australian fintech today?

Narrow AI dominates in Australian fintech because it delivers ROI, blends easily with legacy systems, and follows strict regulatory requirements. Use cases include fraud detection and prevention, abuse detection, cybersecurity threat detection, monitoring, stress testing, and risk management, all of which are well-understood and low-risk.

2. How widely is Generative AI adopted in Australian financial services?

Nearly 45% of Australian financial firms are actively deploying Generative AI, which is well above the global average. However, most deployments are experimental and carried out within a few departments of the organization rather than enterprise-wide.

3. What is holding back GenAI adoption in Australian fintech?

GenAI adoption in Australian fintech is not widespread because of data privacy concerns, integration challenges, skill shortages, regulatory uncertainty, and unclear governance models.

4. Is Australia ahead of global peers in AI investment?

Yes. Almost 74% of Australian firms are making average to significant investments in GenAI, indicating long-term commitment and not short-term experimentation.

5. What’s the difference between AI-enabled and AI-transformed banks?

AI-enabled banks use AI to optimise existing processes, while AI-transformed banks redesign existing processes, decision rights, and customer journeys around AI as a core decision engine.