Saudi Arabia is steadily shedding its old-school image as an oil-driven nation.

Powered by Vision 2030, the Kingdom is flexing its mobile-first muscle, with mobile penetration reaching a staggering 98%.

Giga-projects, AI infrastructure, AI talent pipelines, and a fast-maturing startup are all acting as a scaffolding for this shift, enabling mobile app development companies in Saudi Arabia to build the Kingdom’s digital backbone.

But then, here’s what truly sets the Saudi mobile market apart: This market is not chasing global mobile trends; it’s setting them.

As the Kingdom hyperfocuses on Vision 2030, the voracious need for apps is taking shape.

Fintech. Hospitality. Energy. Ecommerce, Education. You name it. Every sector has become app-dependent. Citizens aren’t just using apps; they're relying on them.

This report examines 10 macro forces transforming Saudi Arabia into one of the world’s fastest-rising hubs for mobile app development.

#1. Vision 2030: A Launchpad for Mobile App Development Companies in Saudi Arabia

Vision 2030, a brainchild of Crown Prince Mohammed bin Salman, was introduced in 2016. It aims to reduce Saudi’s dependency on oil and transform the country into a global hub for technology, tourism, and innovation.

Saudi Vision 2030 Core Pillars:

- Improve the quality of life of citizens by strengthening the cultural, social, and health sectors

- Focus on non-oil sectors, including technology, renewable energy, and tourism.

- Enhance Government transparency, efficiency, and long-term sustainable growth.

Vision 2030 actively prioritizes digital platforms, mobile-first services, data, and AI as the new pillars of future growth.

Every ministry. Every public service. Every smart city program.

All moving towards mobile delivery.

Why it Matters: Vision 2030 creates a predictable and conducive environment for digital transformation. Industries can leverage mobile apps to accelerate their operational and delivery processes, aligning with the Kingdom’s ambitious goals. Such clarity can attract app investors, accelerate product development, and incentivize both global and regional companies to establish R&D and innovation teams within the Kingdom.

#2. Family Offices, UHNWIS, and PIFs Driving Mobile App Development in the Kingdom

Middle Eastern Family offices and ultra-high-net-worth individuals (UHNWIs) are increasingly shying away from traditional real estate and Western economies investment. Instead, they are keen on forming strategic collaborations with the Kingdom’s sovereign wealth funds, that is, the Public Investment Fund (PIF), and play an active co-creator role in shaping the region's future.

A case in point: In February 2025, the U.S. AI-chip startup Groq received a $1.5 billion investment commitment from Saudi Arabia for the export of advanced AI-inference chips to the country and even to build a new data centre in Dammam. These multi-million-dollar deals in AI and hardware signal a Kingdom’s initiative to build strategic tech capabilities onshore rather than outsource their requirements.

Why it matters: Saudi Arabia’s shrewd move to enter strategic partnerships (like Groq) for AI capabilities and independent data centers exhibits its strong inclination to create a strong in-house app ecosystem:

- AI capabilities - enable the development of smarter and more advanced applications.

- Data centers - offer low-latency and secure infrastructure for hosting local apps

- Local hardware capacity - supports AI, cloud, and high-performance app loads

In other words,

When UHNWIs and sovereign funds invest in AI and digital infrastructure, it automatically creates a fertile ground for custom apps to be built, deployed, and scaled inside the Kingdom.

Also, with larger amounts of capital circulating within Saudi Arabia, and multiple players like family offices, UHNWIs, and PIF having their tech agendas clear, local app startups can be confident that the Kingdom has their backs in the form of:

- acquisitions

- strategic partnerships

- venture funding

- high-value exits

This encourages more founders and investors to build app startups in Saudi Arabia rather than abroad, emboldening the Kingdom’s position as a global mobile app development hub.

#3. Smart-city projects (NEOM and Beyond) Creating Massive Demand for Saudi App Developers

NEOM, Saudi Arabia’s flagship smart-city initiative, is a living laboratory for experimenting with new technologies and urban solutions.

Spanning 26,500 square kilometers and powered entirely by 100% renewable energy, this smart city is situated along the Red Sea coast in northwest Saudi Arabia.

The regions include:

- The LINE - a 170-km-long linear city designed to be car-free, street-free and will feature a high-speed rail system to replace cars.

- Oxagon - an octagonal floating industrial city

- Trojena - a mountain resort that will host the 2029 Asian Winter Games

- Sindalah - a luxury island resort

Each of these regions is being engineered as a hyper-connected, high-tech environment with a focus on sustainability, automation, and digital-first citizen services.

As the infrastructure of these giga projects scales, so will the demand for:

- logistics apps

- tourism apps

- IoT dashboards

- AR/VR apps

- Service and operation management platforms

Why it matters: Saudi Arabia’s smart-city project offers something unique to product teams - Unmatched Scale. Developers can scale their app from prototype to city-wide deployment much faster than most markets.

If you can build a super app that unifies transportation, energy, and hospitality services in one seamless interface, you will find immediate, high-value customers within smart-city initiatives. You can even position your product as a flagship solution for the future of urban living.

#4. Mobile-First, Digitally Active, High-Spending User Base Accelerating Mobile App Innovation

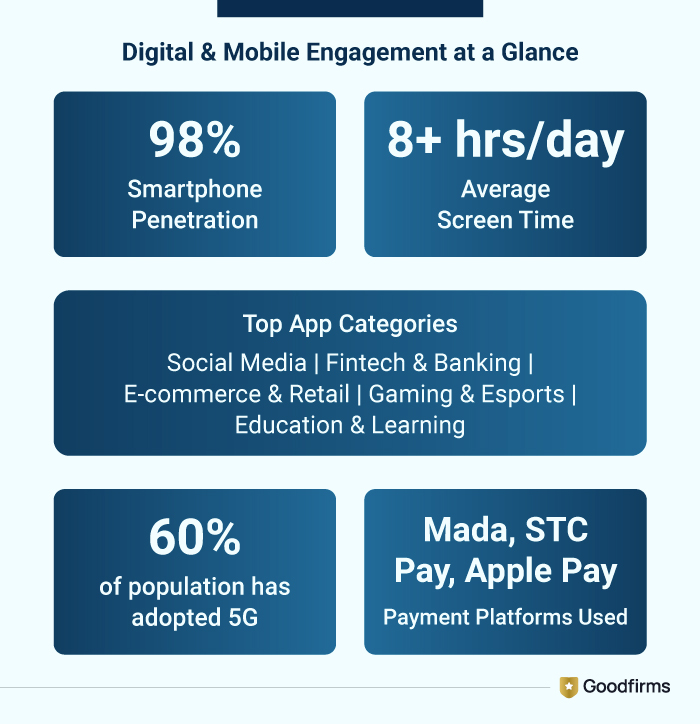

Saudi Arabia’s smartphone penetration is quite significant, over 98%, which is one of the highest in the world. An average Saudi citizen spends 8 hours per day in front of the screen using media, banking, payments, ecommerce, entertainment, and education.

No doubt, Gen Z and millennials form a larger proportion of this population. However, even parents and older demographics are increasingly adopting apps for health, education, and financial purposes. This widespread digital behavior has earned the Kingdom the label of “testbed for innovation,” especially in fintech, govtech, and on-demand services.

Plus, the Kingdom’s leveraging global payment platforms, such as Google Pay and Alipay+, provides opportunities for app monetization in the form of subscription billing, in-app purchases, and cross-border payments.

Why it matters: Consumer apps, such as gaming, travel, delivery, retail, and fintech sectors, offer significant monetization opportunities in Saudi Arabia. This enables Android app developers to scale their apps faster and profitably compared to emerging markets.

#5. Startup Momentum Boosting Local Mobile App Development in Saudi Arabia

Saudi Arabia boasts a thriving startup ecosystem and has grown by 236.8% over the past year. The kingdom currently has 1,733 startups and has raised $10.5 billion in funding.

Today, the Kingdom’s startup ecosystem is ranked #38 worldwide as per the Global Startup Ecosystem Index 2025, a 27-spot jump, the best among 110 countries.

Saudi Arabia's busy startup industries include transportation, ecommerce, retail, and foodtech.

Government programs such as the NTDP, MCIT, and Monshaat play a strategic role in promoting the Kingdom’s startup landscape.

NTDP’s ‘Relocate’ initiative assists international tech companies and talent in establishing operations in Saudi Arabia, while the Empowers Accelerators program enhances the capacity and quality of local accelerator programs.

Why it matters: A liquid, well-funded startup environment, where there’s plenty of money pouring in, allows growing companies to hire skilled app developers, invest in advanced tools, and build high-quality products faster. More capital in the market means faster innovation cycles and a stronger mobile app development ecosystem.

#6. AI Talent Advancing Saudi Arabia’s App Development Landscape

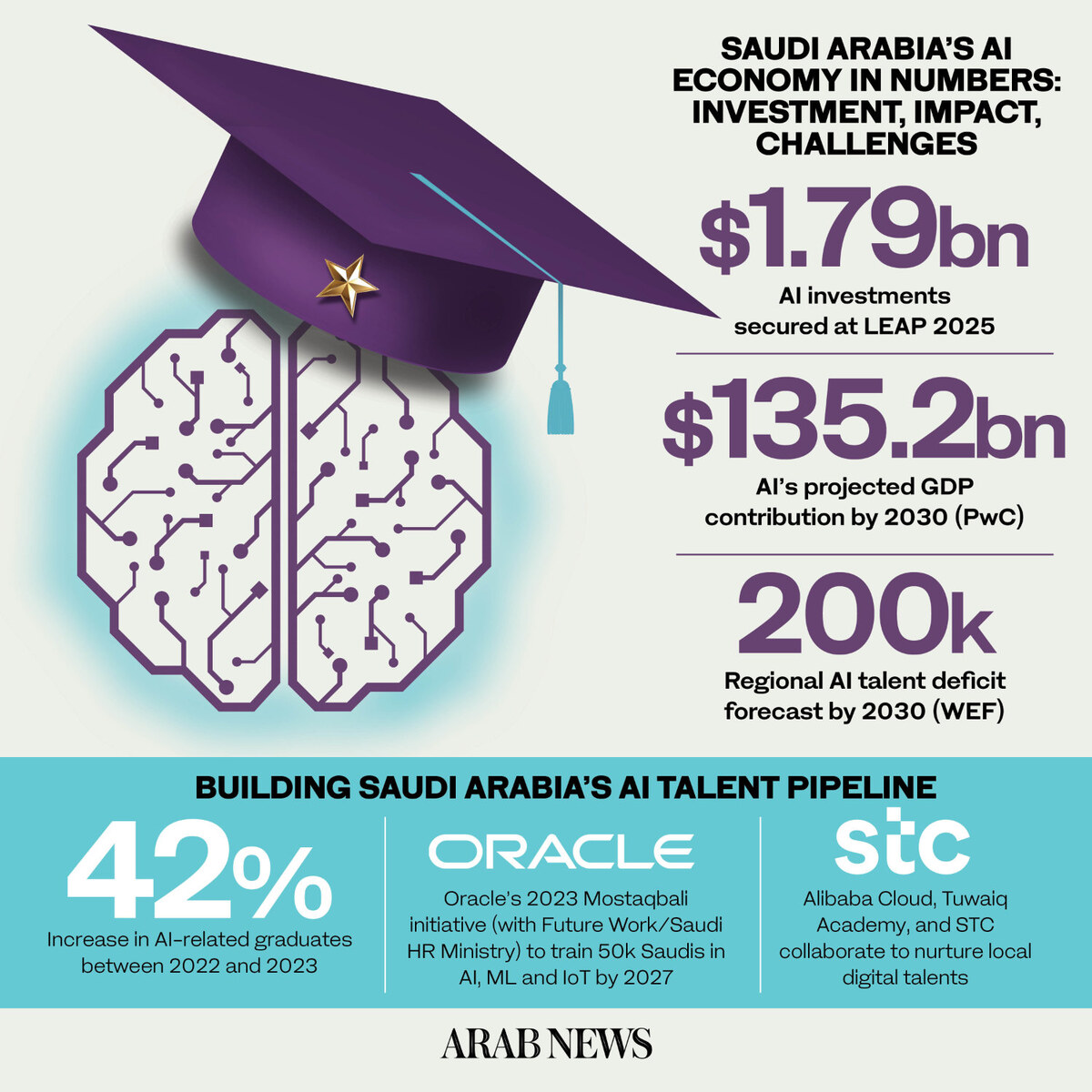

Saudi Arabia’s mission is clear: to become a global hub for AI.

In line with this ambition, the Kingdom already ranks 1st in the Arab world and 14th globally in AI readiness.

But then, this impressive standing is not good enough to meet the Kingdom’s high-tech ambition. In other words, demand for AI talent is more than the supply, prompting a massive national investment in talent development.

Today, 86 percent of Saudi universities offer AI-focused undergraduate degrees while Saudi Arabia’s National Strategy for Data and AI aims to train 20,000 specialists to fill highly skilled AI roles by 2030.

Local Institutions are stepping up. King Fahd University of Petroleum and Minerals has launched flexible AI and data-science master’s tracks, while government entities like SDAIA and Tuwaiq Academy are funding nationwide boot camps across all skill levels.

Tuwaiq alone trains more than 1,000 people daily and offers certifications in partnership with global organizations, including Apple, Amazon, Meta, Alibaba, Dell, CompTIA, OffSec, IBM, and Microsoft.

Why it matters: Saudi Arabia’s growing local talent pool makes onshore product and app development increasingly viable for both local and international businesses. As more AI experts and developers enter the workforce, the Kingdom is better equipped to nurture and scale a mature and innovation-driven app ecosystem.

#7. Competitive Costs Giving Saudi Mobile App Companies a Global Edge

Riyadh, Saudi Arabia’s capital, driven by overarching leaps in AI, IoT, and AR/VR, is emerging as one of the most competitive app development hubs.

Mobile app developer rates in the Kingdom typically range between $25 $55 per hour, which is quite low compared to Western markets.

Mobile App Development Costs in GCC: Saudi vs UAE vs Qatar

|

Country |

Basic App (USD) |

Medium App (USD) |

Complex App (USD) |

Notes |

|

Saudi Arabia |

$5,500 – $27,000 |

$27,000 – $108,000 |

$108,000 – $270,000+ |

Affordable talent + high-quality output |

|

UAE |

$11,000 – $33,000 |

$33,000 – $132,000 |

$132,000 – $330,000+ |

Higher cost due to expat workforce & overheads |

|

Qatar |

$8,500 – $30,000 |

$30,000 – $120,000 |

$120,000 – $300,000+ |

Growing tech ecosystem, limited developer pool |

The local app developers are good at rolling out apps for industries such as ecommerce, retail, transportation, healthcare, and fintech, leveraging technologies such as React Native, Flutter, Artificial Intelligence, blockchain, IoT, and AR/VR integration.

Why it matters: Riyadh offers a balance between affordability, talent, and technology, enabling both startups and enterprises to build high-quality apps that match global standards.

#8. Arabic-First UX Raising Demand for Culturally Native App Development

I cannot stress enough how important it is for a Saudi app to look, feel, and function in a very Arabic way. The Saudi users expect high-quality Arabic UI/UX.

This means the app should have an RTL layout, i.e., a right-to-left language, because Arabic is an RTL language.

Also, the color, images, and content in the app should align with the Kingdom’s religious and social sensitivities.

Another important aspect is that Arabic has multiple dialects: Egyptian Arabic, Saudi Arabic, and Emirati Arabic. Which means you need to know your target audience’s Arabic dialect to ensure clear communication.

Another crucial nuance: Arabic has a unique numeral system compared to English. Therefore, Arabic-first app developers ensure that numeric values are formatted correctly and often provide users with both Arabic and Western numerals.

These are just a few of the many factors that need to be considered while launching an app in the Saudi region. The picture below covers all the remaining factors that enable it to offer a truly Arabic-native experience.

Why it matters: Culturally resonant apps perform better. Saudi app development companies are better positioned to design such apps as they can be more hands-on with iterations based on features that matter to Saudi users (e.g., local holidays, identity/logistics flows, language nuances).

#9. Enterprise Digital Transformation Creating Opportunities for App Teams

Saudi Arabia’s leading sectors, including energy, hospitality, healthcare, and transportation, are actively embracing digital transformation, with mobile apps as the primary touchpoint for citizens, users, operators, and field teams.

Energy: Energy companies are deploying AI and data analytics to optimize operations across the entire energy value chain. Mobile apps are used for field operations, asset monitoring, and real-time decision-making.

Hospitality and Tourism: Withgiga-projects like NEOM, The Red Sea Project, and Diriyah Gate in the pipeline, the Kingdom is building fully connected, IoT-driven destinations. Guest experience apps, staff coordination apps, and operational dashboards would become crucial for delivering seamless, hyper-personalized experiences.

Healthcare: Saudi Ministry of Health and major private healthcare groups are scaling telemedicine apps, mobile EHR access, patient portals, and remote diagnostic tools. The world's largest virtual hospital, the SEHA Virtual Hospital, will be linking over 150 physical hospitals with mobile platforms that will act as the main channel for patients.

Transport & Logistics: Logistics companies are digitalizing container tracking and enhancing supply chain management using mobile apps that are integrated with AI, IoT, and potentially blockchain. The government's National Industrial Development and Logistics Program (NIDLP) is accelerating the launch of app-enabled logistics hubs and automated ports.

These sectors are on the lookout for product teams for their mega projects. Since many of these projects are driven by states or conglomerates, mobile product teams can secure long-term contracts, platform licenses, and city-wide deployments for smart city initiatives.

Why it matters: For app development teams and SaaS teams, securing a single major contract in Saudi Arabia can significantly accelerate their growth and reputation in the region.

#10. Gaming & Esports Opening New Doors for Mobile App Creators in Saudi Arabia

Saudi Arabia is emerging as a global powerhouse in gaming and Esports, thanks to its youthful population, strong digital infrastructure, and billions in strategic investments. The Kingdom boasts of 23.5 million gamers, which is 67% of the population, making it one of the most engaged gaming markets. The upcoming Esports World Cup and the Olympic Esports Games in 2025 further underscore Saudi Arabia’s ambition to become a global hub for gaming excellence.

NEOM is leading the charge by building the region’s first gaming hub, comprising a high-tech gaming campus featuring game development studios, motion capture facilities, and incubation zones. Additionally, the teaming up of NEOM and the MBC group in setting up an AAA game development studio signals a shift from being a gaming consumer market to a serious producer of high-value games for local and international markets.

Why it matters: Saudi Arabia’s gaming boom unlocks massive opportunities for app development teams. With millions of active players, government-led tournaments, and high-budget studios, demand for mobile games, gaming companion apps, esports analytics dashboards, and creator tools is sure to grow exponentially in the future. For app development teams, this means a fast-growing market that’s hungry for new titles, immersive experiences, and even long-term partnerships with publishers and gaming ecosystems.

Vision 2030 Powering Saudi Arabia’s Mobile-First Economy Dreams

Saudi Arabia’s unique blend of being an oil-driven, digitally active nation is accelerating the Kingdom's transformation into a mobile-first economy. Investment in AI talent and infrastructure, NEOM smart-city ambitions, a thriving startup ecosystem, competitive app development costs, sovereign-backed funding, enterprise-scale digital adoption, and an increasingly active gaming population are all collectively powering this shift. Together, these forces are positioning the Kingdom not just as a passive participant in the global mobile revolution, but as a leader.

For developers, founders, investors, and global enterprises, the message is clear: Mobile App Development Companies in Saudi Arabia are building one of the most important mobile markets in the world. This market will shape the next decade of app innovation in the Middle East by mobilizing capital, talent, culture, and ambition at unprecedented speed.

Saudi Mobile Market FAQs

1. What is driving mobile app development growth in Saudi Arabia?

Saudi Arabia’s mobile app growth is driven by Vision 2030, heavy smartphone penetration, AI investment, smart-city projects like NEOM, and strong startup funding.

2. How does Vision 2030 impact mobile app development in Saudi Arabia?

Vision 2030 focuses on digital services, AI, and smart cities, creating sustained demand for mobile apps across various sectors, including fintech, healthcare, logistics, tourism, and government services.

3. Is Saudi Arabia a good market for mobile app startups?

Yes. Saudi Arabia is a favorable environment for mobile app startups, offering high user spending, sovereign-backed funding, rapid app adoption, and large-scale projects that enable startups to scale quickly.

4. What is the average app development cost in Saudi Arabia?

In Saudi Arabia, a basic app can be developed within a budget of SAR 10,000 to SAR 100,000, while a complex app requires a budget of at least SAR 400,000, with costs potentially exceeding SAR 1,000,000. Factors such as AI, ecommerce, platform, and team expertise all play a prominent role in driving the price up and down.

5. What makes a Mobile App Development Company in Saudi Arabia essential for modern businesses?

A mobile app development company in Saudi Arabia is essential for modern businesses planning to launch an app in this Kingdom. The app has to have Arabic UX/UI and should be culturally nuanced to ensure it meets local user needs in terms of color, images, and content. More importantly, it adheres to strict data compliance, integrates emerging technologies, and even generates new revenue streams to give your app a competitive edge in the marketplace.

6. How long does mobile app development take in Saudi Arabia?

Mobile app development in Saudi Arabia takes about 2-4 months for basic apps, 4-6 months for medium-complex apps, and 6- 12+ months for highly complex apps.