For many small businesses, accountants and bookkeepers, Xero is not a new name. Started in 2006 in a small way in New Zealand to help small businesses, Xero today stands as the most searched accounting software catering to nearly three million+ subscribers worldwide. The Accounting tool company claims to be working closely with its customers, partners, and other stakeholders to push the product forward, making Xero the most sustainable product. So, what exactly is Xero Accounting software all about? Is it hyped to rank high in the search engine? Or is it really packed with powerful, functional features that allow companies to manage everything related to accounting and bookkeeping – right from paying bills to managing multiple currency accounting? Here, Goodfirms has come out with its unbiased review of Xero, which surely can enlighten you with adequate facts, the pros and the cons, the good and the bad (if any) of this top-performing accounting tool.

All about Xero:

While searching for accounting software or the billing and invoicing tool, you will certainly explore an extensive range of options. But if you have just started your venture or own a small business, the one optimum solution that can pose to suffice all your accounting and bookkeeping needs is Xero.

Widely accepted by the users as the most comprehensive and customizable tool for growing small businesses, this accounting service is packed with an array of exceptional features that are functional and ideal for the current business models. Xero has earned more positive reviews than negative reviews, thus becoming a popular accounting platform choice among prospective buyers.

Xero accounting scores high on various parameters such as ease of use, scalability, intuitive dashboard, automatic data capture, affordable pricing, and many more. On the contrary, several reviews suggest that Xero is not a suitable and viable option for big businesses as it cannot efficiently manage large volumes of quotes and delays payment processing for a large sum. There are also a few lagging areas like customer support and limited features in the starter plan, etc.

Goodfirms herewith presents a transparent and unbiased review of Xero based on its factual analysis and facts. The review team has thoroughly researched and studied this accounting software to help our readers understand the product.

Goodfirms’ Xero review is based on various parameters, such as the product's core features, the pricing models, the strengths and the weaknesses, original customer reviews, upgrades, and much more. Goodfirms has also thoroughly compared and prepared a list of possible Xero alternatives, all within a similar price range, to help prospective customers make an informed decision.

Goodfirms’ Review of Xero: The Accounting Software

The year 2021 marked 15 years since the registration of Xero. Xero is a cloud-based accounting software tool developed for startups, small businesses, mid-sized enterprises, accountants, and bookkeepers. With consistent enhancements, this accounting solution today performs as an extensive accounting tool with various functions. These include streamlining the billing, invoicing, and payroll functions with the focus on efficiently managing finances.

Xero mobile application for Android and iOS operating systems was released in 2011. The features of Xero accounting software are ideal for startups and small businesses. The software caters to the requirements of a plethora of industries ranging from retail, e-commerce, non-profit, restaurants, construction, legal, hospitality, information technology, and many more.

It is critical to note that all Xero products are based on the Software-as-a-Service (SaaS) model. The software uses a Single Unified Ledger solution enabling users to work on the exact accounting or ledger page, regardless of their operating system and location.

The software also helps small enterprises and startups in acquiring capital funds that help to grow their Business. During September 2021, Xero made a few changes to its software - technological upgrades like a refreshed design, search by customer account number and emails, improvements in the current features, new features in invoicing & employee expenses, auto-assigning contacts as suppliers or customers, removal of the sort, merge options, reminder function, etc. The facility to do bulk actions across multiple pages is also not available now. The changes, according to the company, are rolled out in a phased manner.

The new interface is hard to use, says a user.

Why do we need to fix something that is not broken, says another.

Invoicing is taking a long time and is frustrating! says another user.

Xero claims that the company is in the process of testing, learning, and refining. Things will fall into place as the upgrades are all done and functional, says the company. A few months back, the company rolled out Xero Analytics Plus, which is its AI-powered solution aimed at helping users to manage their short-term cash flow and Business snapshot to predict future financial performance.

In mid-November 2021, Xero reported a hike of 23% in its operating revenue, indicating its first-half revenue as $506 million and serving nearly 3 million subscribers. These numbers highlight its strong position within the small business economy.

When two masters join, then it is undoubtedly for a massive revolution. Xero, the accounting platform for small businesses, signed a new integration with Shopify on November 11, 2021. The company also made an intelligent move around the same time by acquiring LOCATE, a cloud-based inventory management company in the US. This acquisition adds to its other latest acquisition of Planday, Trickster, and Waddle, which the company is proud of as it added up to its revenue.

Xero accounting service thus, not only focuses on its feature enhancements but also focuses on building its alliances.

Can Xero Help You in Efficient Accounting Practice? Goodfirms’ Analysis:

When choosing the best accounting software for small businesses, you must consider a few critical factors. Goodfirms has simplified your task by evaluating Xero on different selection criteria to determine whether it fulfills all the requirements.

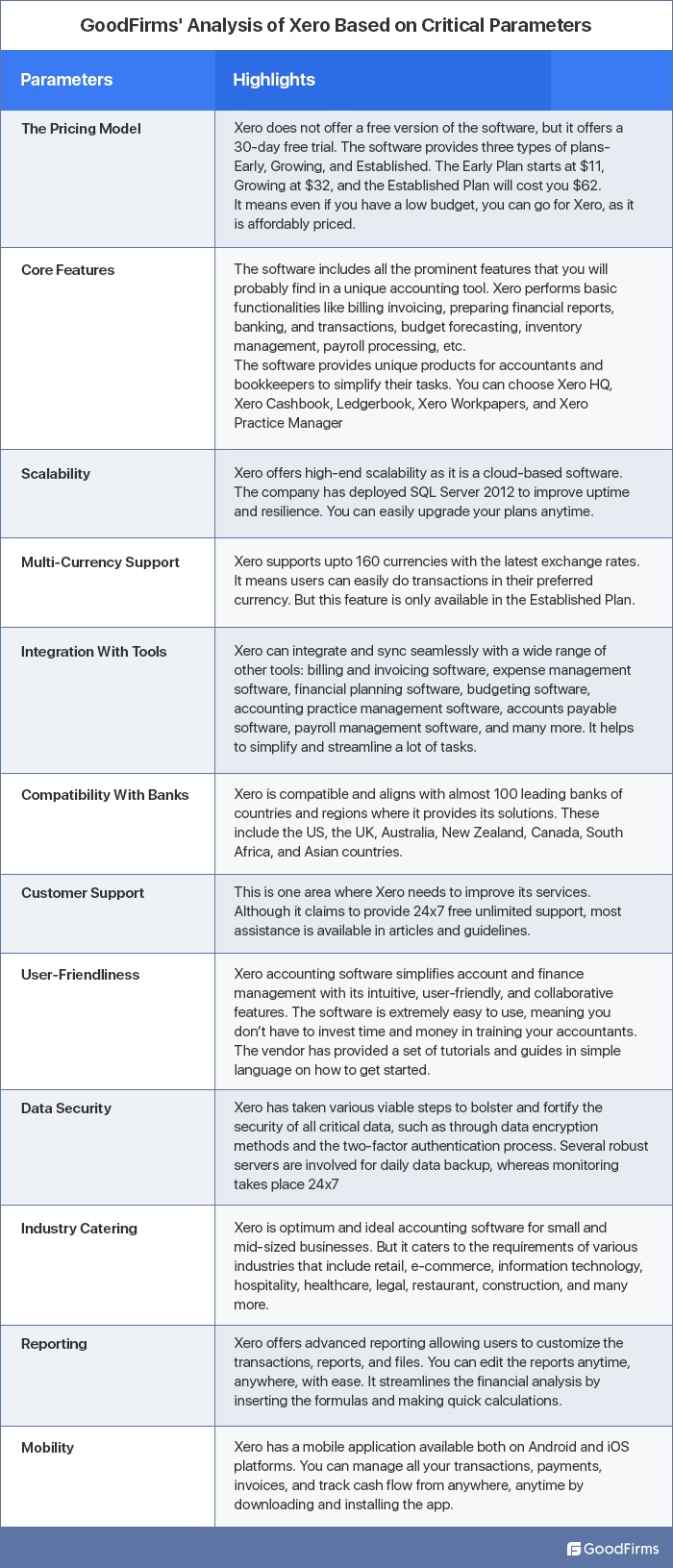

These factors include the pricing, the core features, integration with other tools, scalability, data security, compatibility with banks, user-friendliness, customer support, and many more. You can view the results of this evaluation test in the table below-

Features of Xero for Small and Mid-Sized Businesses (The Prominent Ones)

Xero is a robust online accounting system that also provides next-generation invoicing and billing solutions. The software lets you automate various tasks related to invoicing, data capturing, inventory management, preparing financial reporting, and much more. Furthermore, you can align with your bank seamlessly with an everyday reconciliation process and get access to cash flow updates in real-time.

Xero provides many useful features that can prove handy for startups, small and mid-sized firms. Goodfirms has listed the most prominent ones below. Take a look at these-

Xero Accounting Dashboard

Xero provides a single unique dashboard that enables you to access everything from one place. You can check your bank balance, monitor invoice, bills, and track cash flow with the help of simple charts and graphs.

Task Automation

Xero efficiently automates an array of tasks related to accounting, billing, and invoicing, preparing purchase invoices, sending invoice reminders, and recording all transactions in your accounting system. Also, Xero automates the task of data entry, such as entry related to sales taking place on e-commerce platforms like Amazon, eBay, etc. Furthermore, it automates accounts payable to reduce errors and streamline approvals.

Real-time Collaboration With Banks and Clients

Xero provides a new innovative collaboration tool known as Discuss allowing your clients to seamlessly communicate with you and gain more information about the products. You can connect to your bank in real-time and set up automatic bank feeds. Keep track of the cash flow instantly to know where the cash is coming from.

New Xero Bank Reconciliations

Xero has transformed the bank reconciliation process allowing customers to view the transactions in two ways - compact or zoomed view. Plus, it has added features like Single Touch Payroll Phase especially for Australian clients. Xero has worked to improve designs and make them human-centric providing more accessibility and a better reconciliation experience.

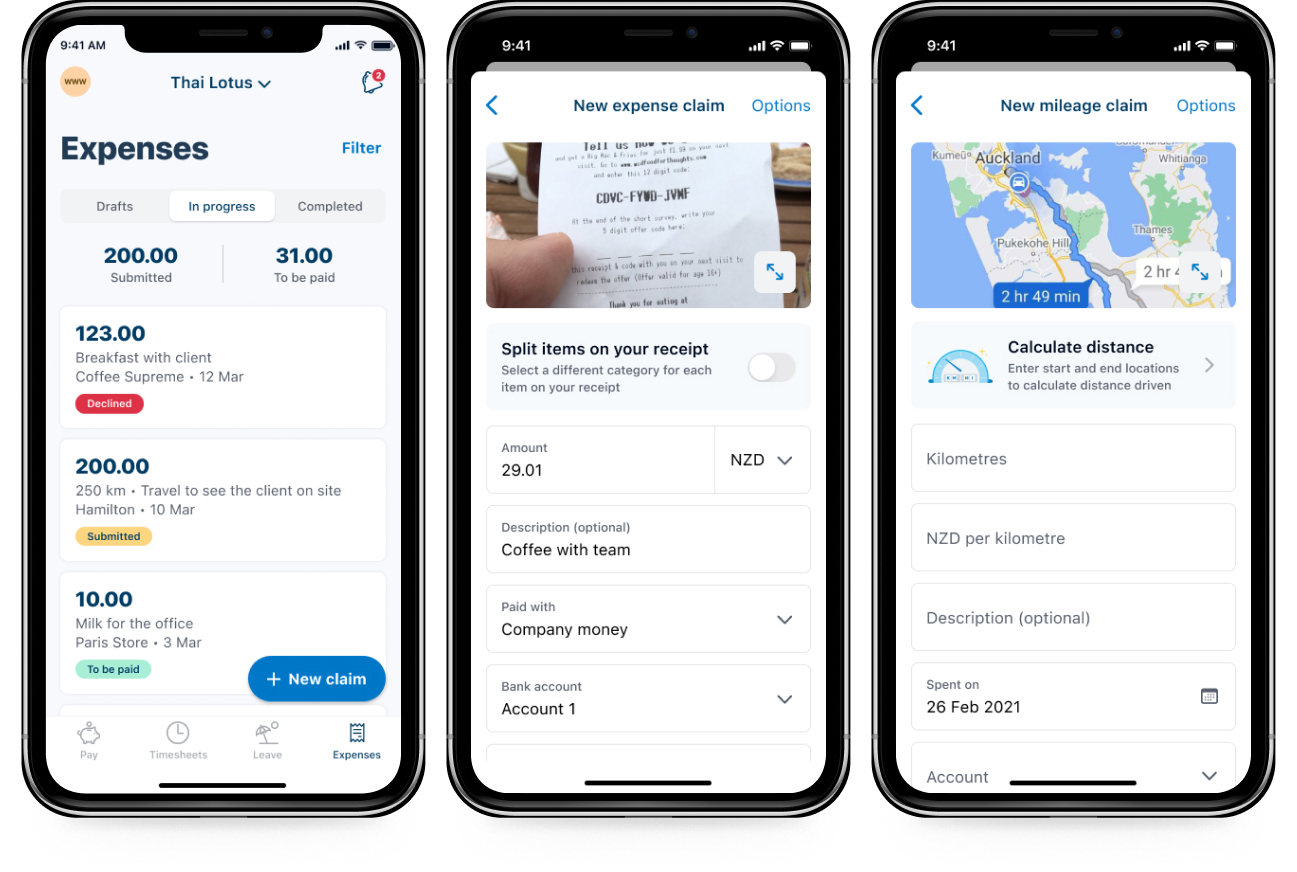

Expense Claims with Xero Me App

Xero had integrated the Hubdoc’s technology with Xero Expenses to automatically process expense claims. Now, it has walked a mile further and synced the expense technology with Xero Me App. The app is available for customers of Australia, New Zealand, and the UK. The app allows submitting timesheets, managing leave requests, and monitoring payslips.

Reporting

One of the innovative and prominent features of Xero is the ability to provide different types of reporting.

First, let’s talk about visual reporting. Xero visual reporting provides you with real-time insights into financial performance. It brings all your data in one place and simplifies integration with other apps. The cash metrics help you to keep track of cash and revenue generation so as to make more informed decisions.

Furthermore, Xero has made enhancements in reporting with a few updates. The advanced reporting feature enables you to search and access reports in new ways, customize the content, add cell annotations, and create management reports.

Add Ons

The add ons include Xero Expense that helps to capture and monitor spendings, costs, and reimbursements. The feature allows you to approve expense claims through an expense tracker.

The add ons also include Xero Projects using which you can create projects and tasks. The software helps you track the project profit, send quotations to clients, and get paid for the work done quickly. You can even calculate the time taken to complete the project.

Third-Party Apps

Xero’s accounting system can simply and seamlessly integrate with a number of popular and useful third-party applications. For example, for streamlining payment, it syncs with Stripe, Veem, or PayPal. Similarly, to improve customer relationships, it integrates with top CRM tools like HubSpot CRM, for e-commerce you have Shopify, A2X, etc. For each of the features or tasks, there is a list of third-party integrations.

Single Touch Payroll Phase 2

Xero’s Single Touch Payroll for customers is noted to collect more information on employee payment, income, and tax offering customers a deferral. Other facilities include a tax file number declaration, the basis of employment, the reason why an employee has been terminated from employment, types of income, country code, and more.

Enhancement in Inventory Management

Xero’s acquisition of the inventory management tool LOCATE is aimed at automating the manual and repetitive tasks and efficiently managing the supply and demand chain so that you never run out of stock. The tool will increase sales and profitability.

Xero Mobile Application Store

Xero has upgraded its App Store and marketplace where small businesses can easily purchase useful tools based on their needs. The accounting software company has changed the layout design of the app store to simplify the navigation process. Also, you will get more details and reviews on the app with improved customer service.

Latest New Features of Xero Added in November 2021

Xero has recently made some new product releases and features in November 2021. A few critical ones include-

- Customers worldwide can now have more leverage to customization features in reporting. They can add more footers and text blocks to their reports. They can also view all the standard reports with a single click from anywhere.

- The WorkflowMax features enable users to use progress invoice templates.

- Xero Analytical Plus allows users to filter expenses and customize data to analyze the business performance.

- The US customers can gain quick access to reports with Xero New Report Center.

Features of Xero that give the Accountants and Bookkeepers the Efficiency and Accuracy (The Prominent Ones)

Xero has become more than a handy asset for accountants and bookkeepers. The tool enables them to enhance their efficiency by bringing all data they need in one place. Xero introduced advanced software for accountants that can improve their efficiency, optimize pricing plans to attract new clients. They can gain more control over the workflow process and boost revenue generation. It allows them to grow and improve their practice. The software vendor provides a host of free products apart from the exclusive tools.

Xero for bookkeepers aims to escalate productivity and accuracy. Bookkeepers have access to automatic bank feeds, assuring them of working with accurate data. Plus, there are automated functionalities that simplify their work and enhance efficiency.

The key features of Xero for accounting includes-

Streamlined Collaboration with Clients

Xero for Business is an all-in-one accounting software that provides every single detail in one place including expenses and payroll, etc. Also, businesses can connect and collaborate with clients in real-time

Xero Cashbook and Xero Ledger

This feature enables the accountants and bookkeepers to add new small clients. They can directly link up with the bank to import the data directly. It also offers automated bank reconciliation and helps to generate powerful reports. The accounts can effectively manage clients’ accounts and integrate with practice tools to exchange data.

Efficiently Manage Clients Staff With Xero HQ

Xero HQ is a useful product that helps accountants to understand the clients’ business model and work quickly. They can view all the clients’ information in one place and streamline operations. The tool helps them to gather crucial data to provide them with more customized solutions.

Accounting Practice Management

If you want to boost your accounting practice, manage workflows, invoices, and timesheets, then Xero Practice Manager can be used to allocate work to staff, track and create invoices, and build customized reports. Xero also syncs with XPM to keep payments, clients, etc. in the loop.

Simplified and Streamlined Compliance

Reduce manual work and tedious tasks by streamlining and simplifying the compliance process through templates. Digitize workflow and customize work programs using Xero Workpapers. Auto-populate tasks and assign them to staff. Keep a track of the work’s progress and status of completion.

Xero Free Tools

If you become a Xero partner, you get access to all free tools of Xero and Xero HQ. Xero also provides a specialist that works with you to grow your practice. Xero also claims to provide discounts on subscriptions to all its partners.

# Xero Tax Software

Xero provides specialized tax software for accountants and bookkeepers, enabling them to select additional synced tools to streamline the workflows. Transfer the customer’s Xero trial balance into CCH Access Financial Prep and enter all data digitally. You can also align Xero with CrossLink Business to directly import the customers’ balance sheet and income statement.

# Multi-Factor Authentication (MFA)

Multi-factor authentication is an incredible feature that allows you to bolster the security with an additional second layer, which is intricate to crack. Xero provides MFA to prevent unauthorized access into an account and protect confidential data from leaking. You can easily set up your MFA with Xero.

# Xero in the Local Community

Xero in the local community is an exclusive benefit or feature for the US customers, which allows them to get support from the country-wide teams quickly. They need to select their region to get the assistance.

# Xero Solutions for Enterprise Firms

Xero also provides specialized solutions for large accounting firms in the US by creating a cloud-powered platform. The software helps in offering a seamless onboarding experience and chalking out a future workflow plan strategy.

Pricing and Plans of Xero Accounting Platform

One of the prime reasons users implement and use the Xero accounting software tool is its affordable pricing model. Although the accounting system does not offer a free version, it provides a 30-day free trial period against all its plans.

Xero offers three types of plans - Early, Growing, and Established. The following table will give you a better overview of the pricing and different plans.

Xero Aligns With Gusto

Xero allows all its clients and businesses to align their accounting software with a leading payroll application and HR system, Gusto, which will enable you to file the payroll taxes automatically, simplify onboarding, and help accountants in growing their practices along with many more benefits. To use Gusto with Xero, you need to pay an additional fee of $39 alongside your monthly subscription plan.

Strengths and Weaknesses of Xero Accounting Software

The first question that triggers the mind is whether Xero is an ideal option for small businesses, as it claims. Well, this is not new as every software vendor speaks high about their product. So, the experts at Goodfirms carried out a meticulously detailed analysis to evaluate this accounting software on different grounds.

Check the table out to get an overview of the pros and cons of the Xero Accounting Practice software to decide whether Xero fits the requirements of small business owners as claimed by the company.

Strengths and Weaknesses of Xero for Small Businesses and Mid-Sized Firms

Xero also claims that it is a specifically developed software for accountants and bookkeepers that simplifies their tasks and improves their efficiency. But does it stick to its claims? Let’s find it out.

The Strength and Weakness of Xero for Accountants and Bookkeepers

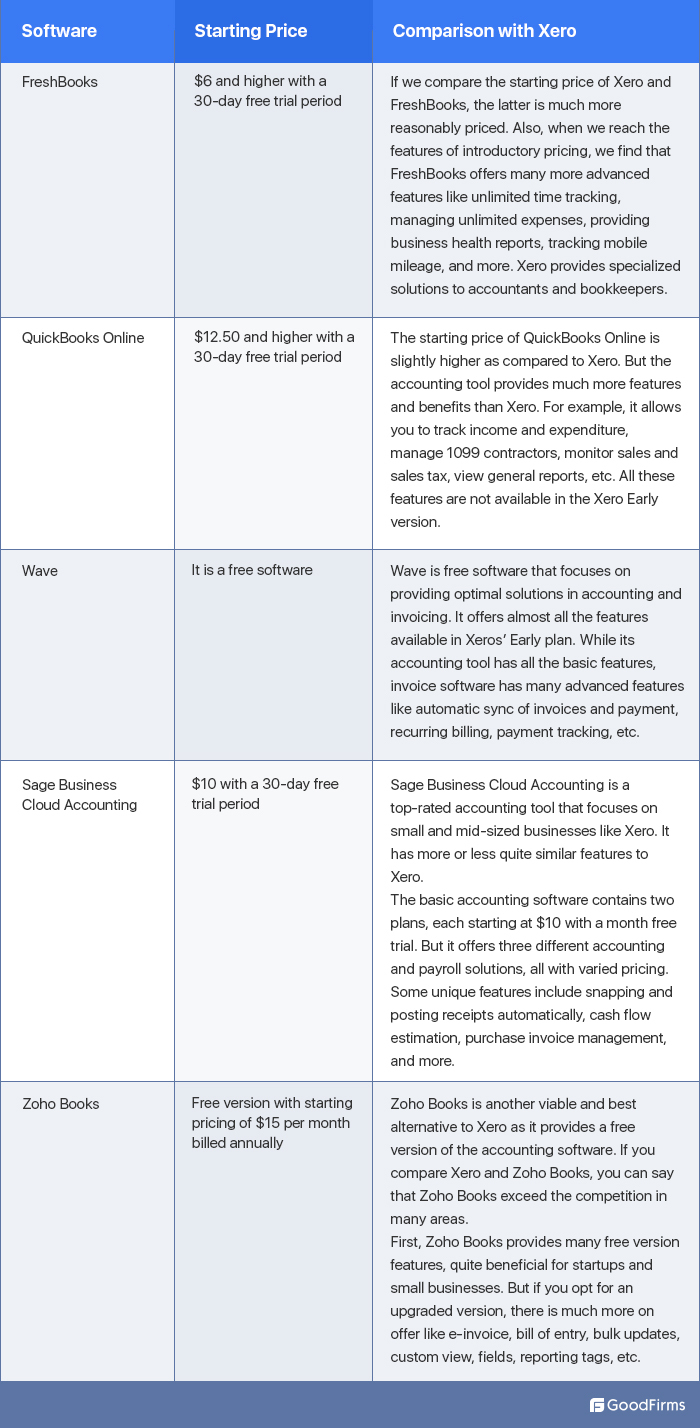

Since Xero has a few downsides, many users and prospective buyers can consider its alternatives that can suffice their specific business requirements in terms of features and budget estimates. Goodfirms has listed a few viable alternatives to Xero below;

Xero Alternatives

Does Xero Offer a De-stressed Accounting Practice? Goodfirms Assessment:

There is no denial that Xero has been exceptional in providing advanced accounting systems alongside invoicing and billing solutions. It is a perfect match for small enterprises and mid-sized companies. But like every software tool, it too has a few pitfalls. Some features can be upgraded and simplified to improve customer satisfaction.

Different customers faced different challenges and have given their genuine reviews based on their experience.

Goodfirms analyzed the problematic areas and found that most customers face a few common issues. So, here’s our assessment of the main challenges-

- To begin with, Xero does not have a proper customer support channel. If you have any issues, you cannot get in touch with the company’s representative over the phone or by email. Also, there is no option for live chat. Xero needs to introduce a proper communication channel.

- Another area where Xero has to work is adding more features in its Early Plan. If we compare the basic starter plan of Xero with its competitors, we find that the price range is almost similar. Still, Xero is offering invoicing, billing, quotes, and bank reconciliation with certain limitations. If you want to unleash features like multiple currency use and expense claim management, you have to go for the most advanced version. This can prove a bit expensive for some small businesses. The software vendor should add more features in the Early Plan.

- Most users agree that Xero offers a seamless installation experience, but the learning curve can become a little intricate. Some users find it difficult to understand. Xero Central provides a few learning programs and course topics on banking, accounting, and bookkeeping in the form of articles, guides, videos, and webinars. The course can be simplified further.

- Xero becomes very slow if it has to process a large transaction amount and operate high sales volumes. This is why many experts do not consider it a suitable tool for big companies and corporations. The developers should work on eliminating this issue.

- While accessing the challenges, Goodfirms also found that a few customers have pointed out that Xero does not connect or integrate with small banks, But this may be the bank’s fault. Xero should align with more banks to increase its customer base.

- Users are also not happy with the limited functionality and features of the Xero mobile application. Also, users have complained about bug issues, especially in the iOS version. So, app developers and testers need to work on rectifying the bottleneck.

- Customers suggest that Xero can add more customizable elements in the reporting, templates, and dashboard. It can add graphics and images to make reports look more visually appealing.

- Businesses do not receive an email from Xero when they make an invoice payment. They have to log in to their account to check the status, which is both time-consuming and frustrating. Also, there is no option of any partial payment. If someone has to make a partial payment, they have to do it manually. You can only provide one payment option per invoice to your client. This is a significant drawback that needs to be eliminated.

- Xero does not have its own payroll systems. The software vendor has aligned with Gusto to offer this solution and charges an additional $39 to provide it.

- Some products, such as tax solutions, Xero local community, multi-factor authentication to fortify security, are exclusively and only available for US customers. The features should be made accessible to global customers.

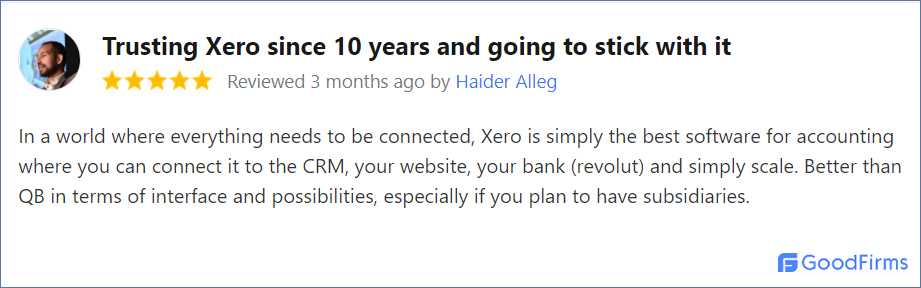

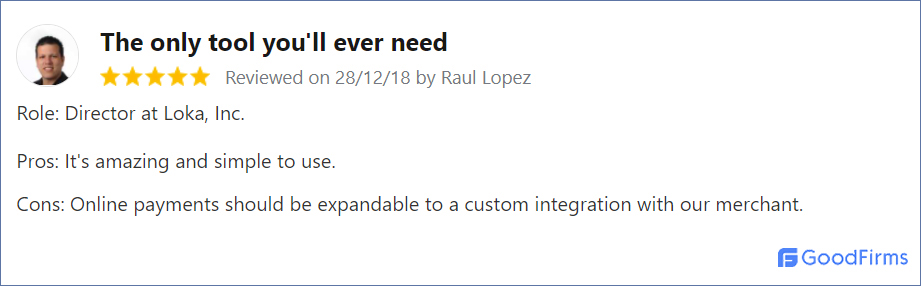

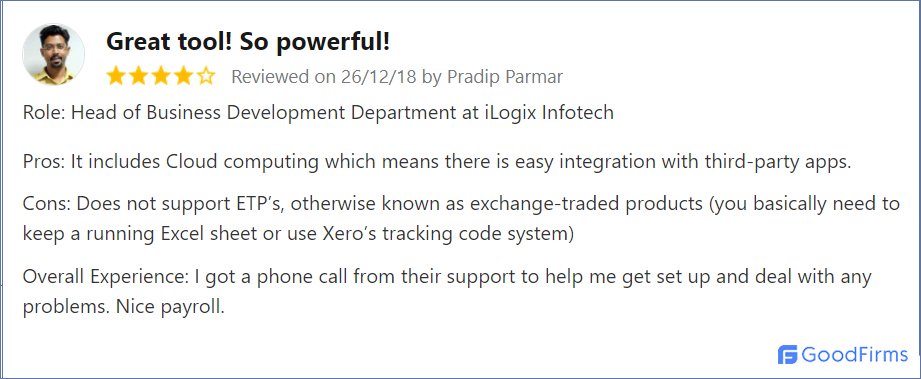

Original Reviews From the Users of Xero: Gathered by Goodfirms

Various company CEOs, managing directors, accounting managers, accountants, and bookkeepers have given their reviews, shared experiences, and recommendations about implementing and using the Xero accounting system on the Goodfirms platform. Take a look at them below before investing in this software.

Goodfirms’ Final Verdict of Xero Accounting Software

After reviewing Xero on various parameters, we can say Xero is a viable option for startups and small businesses, provided the company enhances its support system. The features are user-friendly and contemplate one another. Xero also serves as an inventory management system helping businesses to manage their stock levels professionally. The tool can also seamlessly integrate with other software enabling companies to digitize budgeting, financial planning, auditing, expenditure tracking, and accounts management.

Despite having a few downsides, such as the limited reconciliation feature, time-consuming payment processing, and lack of automatic recurring payments, many accountants, bookkeepers, and customers recommend it firmly, stating that the tool is worth its price.

We hope that this review will help all those planning to invest in accounting software decide whether Xero is worth supporting. If you have used this software before, please share your thoughts and experience about what you liked and disliked about Xero. We are all ears to it!

.jpg)