About Recruitee

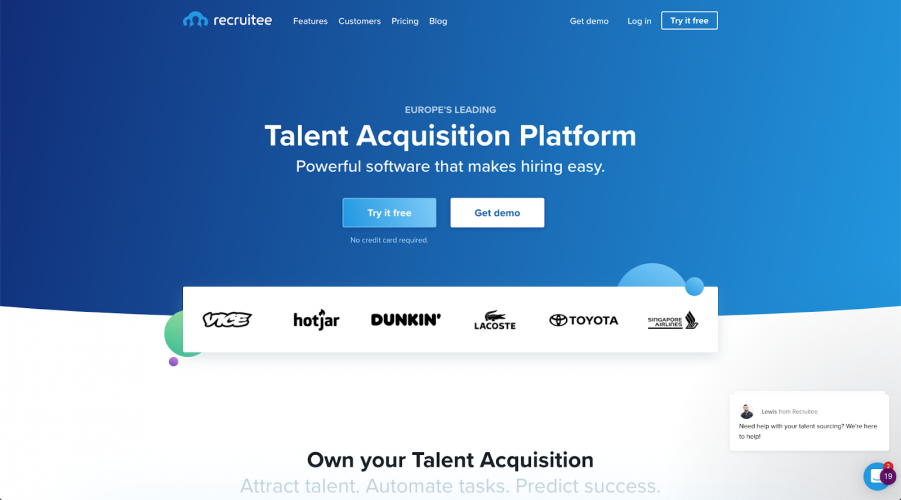

Recruitee was founded in Amsterdam in 2015 and quickly became a disruptive force in the European HR tech landscape. Starting with a mid-market focus, Recruitee would go on to become the go-to applicant tracking system for mid-sized business and corporate enterprises alike.

Recruitee is a standout success story amongst European bootstrapped b2b SaaS companies, having been listed by Deloitte Fast50, SaaSMag and others as one of the fastest growing b2b SaaS companies in Europe.

In 2017, one of our partners, Ferdinand Goetzen, joined Recruitee as Head of Growth and quickly became the Chief Growth Officer, leading marketing and growth activities for the company.

Goals and Context

When Ferdinand joined Recruitee, the team consisted of just a dozen people. Though still in the early stages of their ARR growth, the company clearly had product-market fit and boasted some of the hottest startups in the Netherlands as their customers.

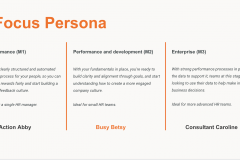

The main goal at the time was to establish Recruitee as a leading player for medium-sized businesses, with ambitions to expand into new geographic locations and eventually move up-market.

Ferdinand’s goal was to build a predictable and scalable growth engine, hire teams for marketing & growth, and work closely with other departments to help the business reach its commercial targets.

Key Initiatives

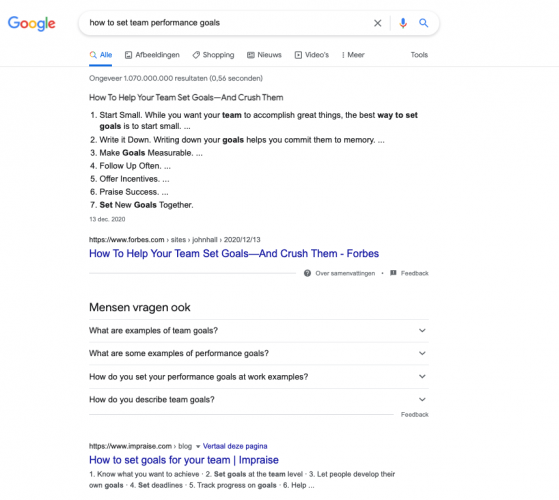

Building a scalable lead engine

We took a two-pronged approach to generating demand and leads at scale, running high-intent campaigns in parallel with awareness campaigns to create a ‘surround-sound’ effect for potential leads researching solutions in the market.

We leveraged paid channels like Google Ads and Gartner’s paid listings to quickly tap into existing intent in the market whilst relying on display advertising and LinkedIn ads to drive awareness and lift conversions.

In 2 years, we grew leads from paid ads 530% whilst keeping acquisition costs stable, with a fixed earnback period of 3 months.

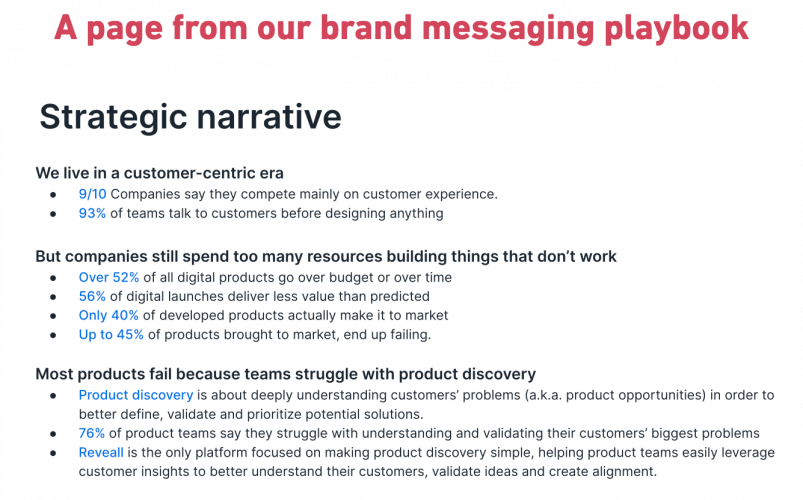

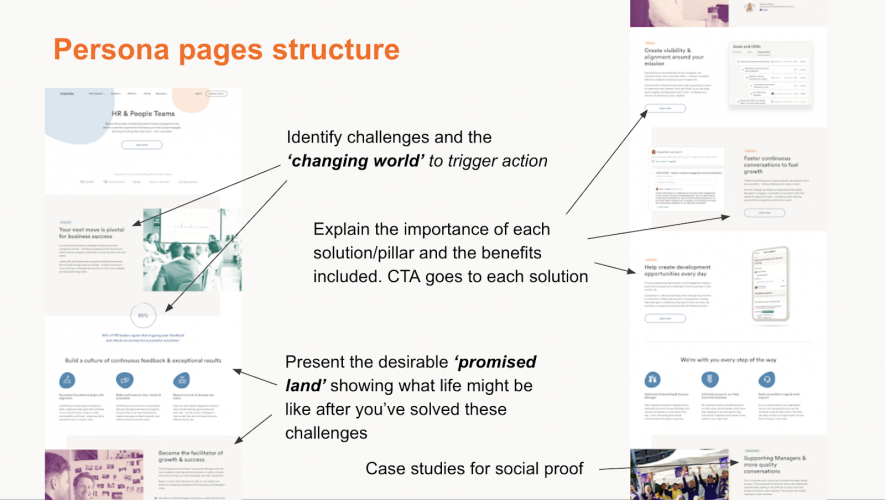

Generating demand through a leading brand

Being in a competitive market with a handful of well-established players with deep pockets, we knew that we couldn’t just rely on paid channels. Building a strong brand and generating demand would be crucial for generating business in a scalable way.

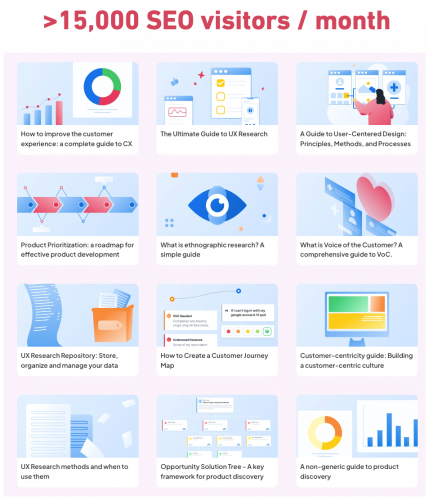

We sought to make the recruitment and HR tech space sexy and establish Recruitee as a rising star in the European SaaS ecosystem. The key to achieving this was creating thought leadership content and building a community around Recruitee. For this, we hired several content creators, including an in-house video and events team to ensure we could create the most engaging content in the market.

By combining SEO and thought-leadership content, we built ICP-specific content funnels aimed at educating the market and developing intent. Paired with online events, webinars, regular meetups and a major HR tech conference featuring some of the top professionals from across Europe (Talent Con 2019), we built a huge network and community of professionals around Recruitee.

As a result of our brand efforts, we generated on average over 5,000 email subscribers every month and saw direct traffic (i.e. brand awareness) become our leading source for new qualified leads and opportunities.

Expanding into new markets

Positioning Recruitee as a market-leader in Europe was part of our high-level commercial strategy. Expanding into new geographic markets became key to achieving this.

As an internationally operating b2b SaaS company, we had natural traction across different countries. Based on traction with certain markets (and importance of localization), we tested and validated localized approaches and if successful, opted to localize fully, with all localization being managed centrally from Amsterdam.

We hired a localization manager and built a team of freelancers who could translate and create content for different markets such as Germany and France. These two markets were particularly important as localization was key to competing with their local players.

A combination of localized paid ads, SEO, content and events (mostly trade shows) helped us expand into several new markets and established Germany and France as our 2 highest performing markets after the Benelux (our home turf).

Netherlands

Netherlands

.png)

.png)