Every organization, irrespective of the size, and type, will require financing to conduct a wide range of business purposes, not limited to expansion, product development, manufacturing, administrative processes, etc. One of the most popular methods to obtain credit for the activities mentioned is through a loan.

Obtaining a loan is by and large not a difficult task for businesses. Financial institutions, banks, FinTech organizations, and other economic and industrial establishments play a vital role in ensuring credit is available for companies. Companies can borrow different types of loans, viz. term loans (short term, mid-term, long time), SBA loans (small business), Invoice Financing, Merchant cash advances, trade credit loans, and business lines of credit, credit cards. Now, for firms to be eligible for these kinds of loans, they have to fulfill certain conditions - credit history and relevant borrower reports, business collateral, the total time spent in the business, and strength of the underlying financials of the company (cash flow, interest on business assets, etc.).

The process of obtaining a loan for businesses after ratifying data, as stated above, is called loan origination. Origination is the series of steps by which a borrower may obtain the funds required after approval. These usually constitute KYC procedures, ascertain creditworthiness, process application through necessary channels, and finally disburse the agreed amount. The entire loan origination process is of extreme importance as:

- It ensures creditworthy businesses obtain loans.

- Protects the lender from taking on bad debt.

- It documents the borrower’s history thoroughly so that future requests and approvals for loans are easy to process.

- Creates a clear channel of communication between authorities and borrowers.

As the number of businesses that require external financing grows, financial institutions are transferring the entire loan origination process online, automating several operations, and preparing for a growing case-load. Disbursement of loans is much easier these days, thanks to loan origination software. This blog seeks to highlight the advantages, features, implementations, and some of the best free and open source loan origination software which businesses in the lending sphere can latch onto to improve profitability, the entire lending chain, and ensure a thriving business ecosystem.

Read on to understand more about loan origination software.

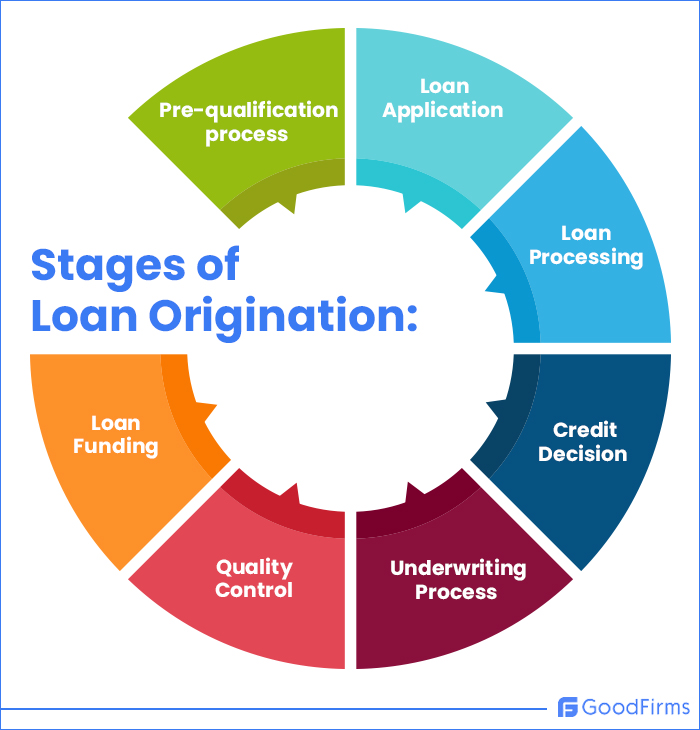

Explaining the Loan Origination Process (Stages)

Seven vital steps constitute the entire loan origination process. They are as follows:

- Pre-qualification process: The borrower has to submit a set of documents that prove their identity, income and tax history, and other relevant business information.

- Loan Application: The stage involves completing a form that creates an application for authority to process when attached to the document submitted. The application is platform-independent (mobile, desktop, cloud) and tailored to specific loan products.

- Loan Processing: All data cross-checking assures accuracy. The business loan origination system detects missing or incorrect fields, verifies identities, etc., thereby helping originators process the application in a streamlined and efficient manner.

- Underwriting Process - Business loans require significant underwriting. The ratification of creditor history through integration with financial record-keeping databases is essential. Considering risk scores and other bespoke criteria for the disbursement of funds is significant in underwriting. Calculating business income, current financial reserves, making adjustments on business conditions in an industry, LTV and DTI ratios, estimating the repayment method best suitable for both parties, etc., are significant considerations made in the underwriting stage of loan origination. Nowadays, the process is automated, proof-checked by an originator when necessary.

- Credit Decision - Assuming the borrower’s integrity in data provision, the lender may reserve the loan application for further probes, approve or deny the applicant’s request.

- Quality Control - Considered the final stage before the loan approval, quality controls steps reverify and analyze data against in-house and external standards, looking for deviations in payment or incorrect information.

- Loan Funding - The applicant receives the agreed amount, adhering to guidelines and rules for payment.

Loan Origination vs. Mortgage Origination

Loan origination differs from mortgage origination in many ways. Firstly, the products serviced are vastly different. Loan origination software can help businesses issue loans faster. The stages that include vetting of a borrower’s credit history, financial analysis, and verification of identification details encompass the entire loan origination process.

On the other hand, mortgage origination includes the processes followed before letting off funds to consumers to buy a specific home, or in many cases, borrowing money against the value of their pre-existing homes to pay off necessary dues. The mortgage and loan origination process also analyze different metrics before clearing an application. In loan origination, scrutiny of the borrower’s credit history through third-party applications occurs through presented financial data and documents. In mortgage origination, factors to consider include repayment modules and frequency, collateral attached, tenor pricing, etc.

The loan origination process involves no middlemen. The applicant fills up papers for a loan suited to their taste, and the banks vet the documents and creditworthiness before disbursing funds. However, mortgage origination requires a go-between, also known as the mortgage originator. Usually, these originators play an essential role in helping customers receive mortgage funds by submitting the necessary documents to the banks or financial institutes for funding.

Lending businesses tend to use loan origination software. On the other hand, mortgage businesses/originators use a mortgage origination system, usually packed with CRM features for business development. All mortgage origination software (which may also be loan origination solutions) have systems in place to communicate with banks, store documents, and manage clientele.

What is Loan Origination Software?

Loan origination software is a suite of digital tools that help financial Institutions and other lending entities digitalize the entire lending process. The best loan origination software often enables related businesses to make better, credit-worthy decisions on borrowers, automate administrative workflows, enhance applicant experience, optimize time-consuming manual processes, and streamline organizational performance to achieve better productivity. A loan origination tool will simplify the entire lending process and perform verification checks on the form to ensure accurate data entry. All loan origination solutions also come with multiple credit bureau integrations to shorten the time between application submission and loan disbursement.

Who can use a Loan Origination Software?

There are multiple users of the software in different industries as follows:

- Banks

- Credit Cooperatives

- Microfinance Institutions

- Non-Banking Finance Companies (NBFC)

- FinTech Ventures

- Independent Mortgage Originators

- Housing Financing Corporations

Why is Loan Origination Software Important for Financial Institutions?

Loan origination software is in demand, given the many benefits it brings to the buyers throughout the ecosystem. The biggest reasons why loan origination systems are necessary are as follows:

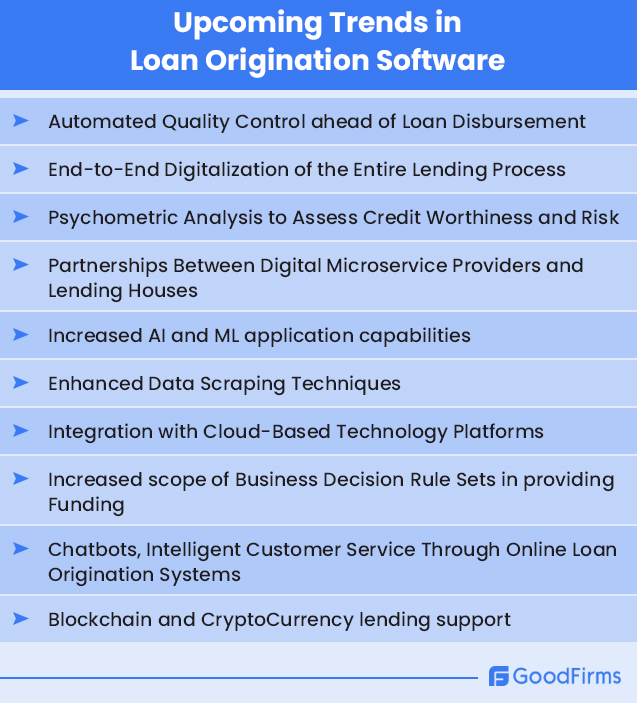

Upcoming Trends in Loan Origination Software

The loan origination software market is ever-evolving. The need to add newer features to the system to ensure timely funding while keeping oversight on creditor history is essential, like never before in the consumer era. As businesses and organizations look to scale up products and offering - especially in industries like FinTech and online microfinancing - some of the most critical trends to impact loan origination software systems are as follows:

Time-saving Features of Loan Origination Software

The critical features which make loan origination software irreplaceable for institutions and businesses alike are as follows:

- Audit Trail

- Compliance Management

- Customer Management

- Document Management

- Electronic Signature

- Loan Processing

- Native Integration

- Online Application

- Rapid Implementation

- Simplified Configurations

Critical Advantages of Loan Origination Software

Loan origination software helps understand the borrower’s creditworthiness and prevents dubious loans that could become Non-Performing (NPL) ones. The key advantages of Loan origination software are as follows:

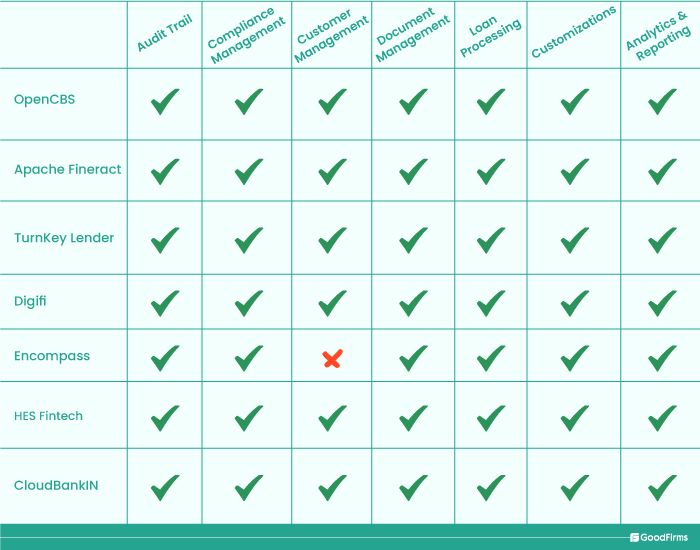

Is there any Free and Open Source Loan Origination Software?

The loan origination software market is replete with options. Standardized free and open source loan origination software, paid open source loan origination software (open API), and free loan origination software are popular choices for organizations. Let us take a look at some of the best options below:

Best Free and Open Source Loan Origination Software

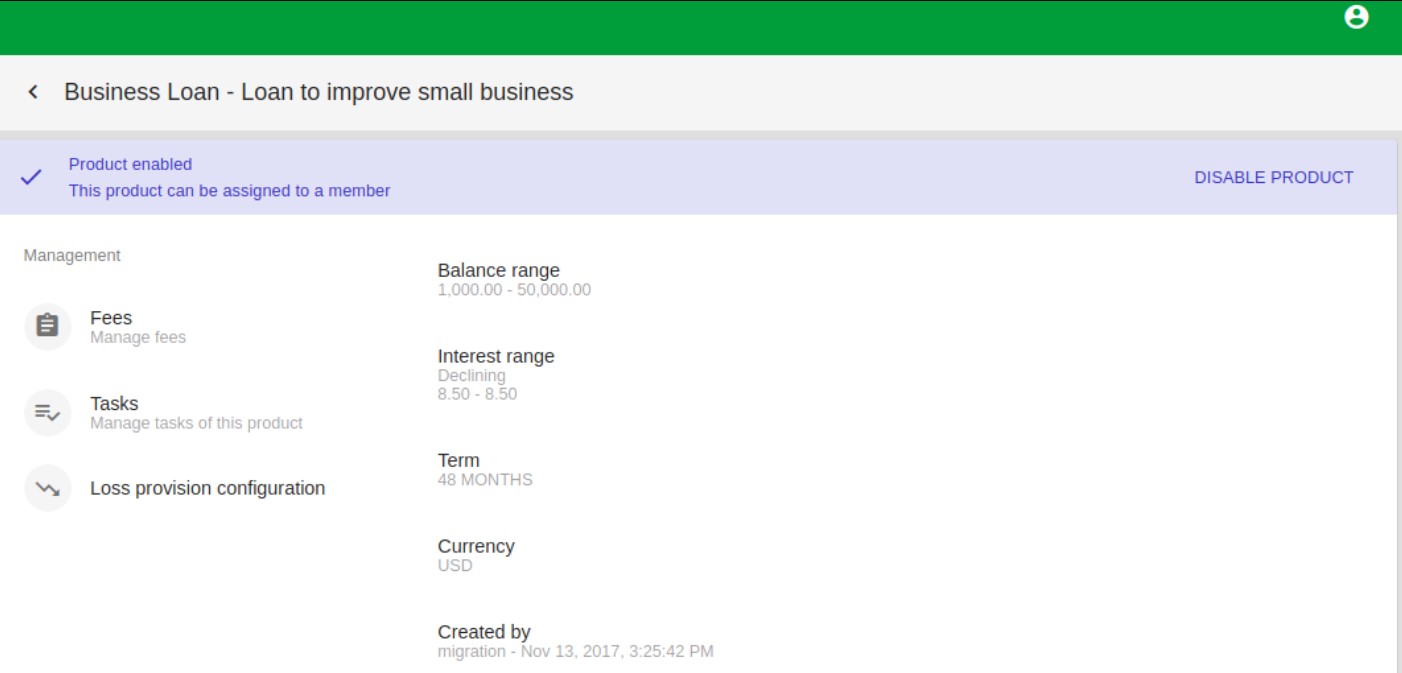

#1 OpenCBS

Open CBS is a banking management platform with free and open source loan origination software. As a Loan origination solution, it helps institutions digitalize the entire loan origination process - collateral registration to automated decisions based on background verification from different trusted resources. Completely operational in the cloud, the Hong Kong-based loan origination system software promises a customizable, affordable interface. It is nested with incredible security features (User authentication, encryption, audit trail) and useful third-party POS integrations, besides enhanced approval workflow engines and intelligent task management tools. This loan origination system is platform-independent.

Source - OpenCBS

The critical features of OpenCBS are as follows:

- Audit trail

- Compliance management

- Customer management

- Document management

- Loan processing

- Native integration

- Online application

- Rapid implementation

- Simplified configuration

- Multi-channel applications

- Ability to create and edit profiles with unlimited data fields

- Customised approval workflows to appoint responsible people, check external data sources, link with scoring systems, etc.

- Integrated task management to perform task and submit for approval

- Get basic statistics on approved loans and performance

#2 Apache Fineract

Apache Fineract is a free and open source loan origination software. Out of Apache’s trusted stables, the open source loan origination system offers a cloud-based and an on-premise software version. The loan origination tool is flexible enough to support any lending format, while its architecture makes it platform-independent. Accounting and document management, rule sets for business operations, and portfolio management are some of the core capabilities of the loan management system. There are two versions - Fineract 1.x and Fineract CN. CN has the robustness to support over 1000 transactions/second and combines well with other financial microservices to create newer lending and financial platforms. It comes equipped with a fully-licensed Apache User Interface.

Source - Apache Fineract

Apache Fineract has the following features:

- Audit trail

- Compliance management

- Customer management

- Document management

- Loan processing

- Online application

- Rapid implementation

- Simplified configuration

- Ability to recalculate and regenerate the schedule for the whole disbursement amount

- Transaction summary report generation

- Overpayment calculation

- Configurable credit allocations for loan product

- Disbursement on overpaid loan

#3 TurnKey Lender

TurnKey Lender is a free loan origination system that comes with Artificial Intelligence (AI) and Machine Learning (ML) to automate the entire credit scoring process, considering various risk data sets. The loan origination software is highly scalable and easily customizable, providing users with best-in-class security. The software also provides tools for lead generation and management, making it a robust CRM too. It also has dynamic form creation capabilities, besides Google Analytics Integrations, and easy flexible workflows.

Source - Turnkey Lender

The best features that make TurnKey Lender’s solution indispensable are as follows:

- Audit trail

- Compliance management

- Customer management

- Document management

- Electronic signature

- Loan processing

- Native integration

- Online application

- Rapid implementation

- Simplified configuration

- Built-in AML (Anti Money Laundering) and KYC (Know Your Customer) compliance checks

- Fully automatic ID and bank account verification

- 200+ built-in fraud detection rules

- Intuitive blacklists and watchlist management

#4 Digifi

Digifi is an open source loan origination software that is SOC2 compliant. The online loan origination system combines the company’s no code, rule-based engine to automate important underwriting decisions. Added to this, its machine learning capabilities are great for processing multi-version scorecards and complex data to arrive at funding decisions, besides improving continuously. This open source loan origination system will help the buyer modify loan origination workflows while ensuring accurate reporting and analytics with the system data. It also doubles up as a CRM, with capabilities such as client and document management, task and activity management, and email marketing integrations.

Source - Digifi

The attractive features of Digifi are as follows:

- Audit trail

- Customer management

- Document management

- Loan processing

- Native integration

- Online application

- Rapid implementation

- Simplified configurations

- Built-in reporting to generate performance reports

- Automation builder to implement triggers and actions

- Industry-leading configuration features to set up, manage, improve and deploy entire lending products

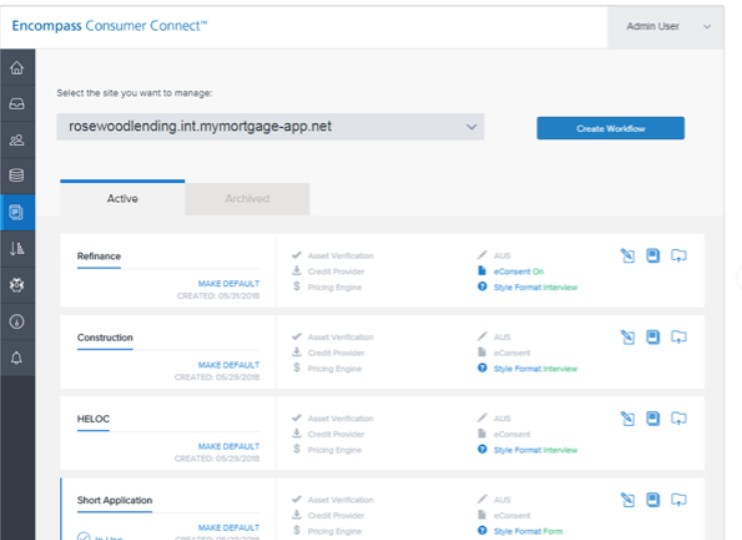

#5 Encompass

Encompass is one of the best loan origination software in the market, offering a free demo as well. The Loan Origination business solution promises to optimize loan origination and support functions so that the users can save their precious time in the process - translating to an increased ROI. Furthermore, the entire ecosystem is URLA-ready, making it one of the first loan origination software solutions. Third-party integrations are undoubtedly important, and Encompass delivers - integrating a Loan Product Advisor by Freddie Mac and Fannie Mae’s Day 1 Certainty programs. Encompass is a Loan origination system software encoded with AI-driven decision-making rule sets while offering industry-grade security.

Source - Encompass

The best features of Encompass are as follows:

- Compliance management

- Document management

- Loan processing

- Native integration

- Online application

- Rapid implementation

- Simplified configuration

- Configurable task-based workflows with powerful automation

- Ability to audit multiple loans simultaneously

- Automatic database schema updates synced with changes

- Pre-built report templates in Tableau, Power BI and Qlik

#6 HES Fintech

HES Fintech’s loan origination software promises to help users make credit decisions in two minutes, with its vast improvements in AI and ML decision models and third-party integrations for the same. The loan origination system also comes equipped with product lending technologies such as merchant cash advances, asset-based financing, and secured or unsecured loans. The loan management system helps efficiently onboard clients, stores all necessary documents, and ensures the highest standard data security. It is available for a 3 month trial.

The loan origination business software allows for easy import and export of data and customizable solution sets for business decisions. The loan origination solution promises a 2.5x faster loan processing, 90% percent lower human error possibilities, and a 3.5x accuracy in business decisions.

Source - HES Fintech

The best features of HES Fintech are as follows:

- Audit trail

- Compliance management

- Customer management

- Document management

- Loan processing

- Native integration supporting over 100 APIs

- Online application

- Rapid implementation

- AI-based credit scoring

- Granular data access

- Supports landing page creation with a built-in loan calculator

- Borrower profile to track outstanding balance, personal information, and the state of the request

#7 CloudBankIN

CloudbankIN is a loan origination software offering a free trial to prospective clients. The online loan origination software offers integrations to cross-selling platforms for customer-specific marketing, besides the more standard functions such as workflow orientation, authorization overrides, and application-based reminders. The loan origination system also provides custom-rule based engines to determine creditworthiness through credit bureau application integration, e-KYC platform, and a mobile application for easy access to data. It also lets users keep track of the client's financial health, and adjust for loan funds accordingly. The software also comes with an interest rate management system and enhanced data security.

Source - CloudBankIN

The best features of CloudBankIN are as follows:

- Audit trail

- Compliance management

- Customer management

- Electronic signature

- Document management

- Loan processing

- Native integration

- Online application

- Seamless client onboarding with automated processes

- Assess customers’ credit scores with credit bureau integrations

- SMS analysis to analyze clients’ messages

- In-built credit rule and quick decisioning engine with configurable parameters

- Ability to analyze bank statements

The loan origination software market is replete with a bouquet of attractive options delivering all the necessary functions. Besides the free and open source loan origination software, there are several premium solutions that come with advanced features leveraging latest technologies like AI, automation, etc. The following section will discuss a few most popular loan origination software solutions identified by Goodfirms.

Most Popular Loan Origination Software

ARIVE

With over 20k users, ARIVE is an integrated Loan Origination System (LOS) to streamline the loan processes from anywhere without any friction. This mortgage origination system features pre-approvals, products pricing, integrated settlement fees, lender integration, income analysis, digital documents, forms & disclosures, quarterly mortgage reports, etc. Contract processors, mortgage brokers, banks, independent loan originators, etc., can use this user-friendly software to centralize their processing workflows, define contract processing fees, and digitally submit loans. Apart from these, ARIVE also comes with a secure client portal that leverages workflow rules to collect loan applications and other required documents for enhanced results and efficiency. API integration using Zapier is also supported to automate complex workflows. Users can avail this software for a 7-day free trial after which, under the broker plan the core originator seat starts from $49.99/user per month, billed annually.

Fiserv Lending

Since 1986, Fiserv has been helping businesses effectively fulfill their financial needs at lower costs, but with higher efficiency. Its loan origination software is among the most popular ones for improving the consistency and cost-effectiveness of loan origination functions. Among other features, the most notable is a database of over 18000 data sources that helps businesses improve customer relationships, reduce risk or exposure to unsafe loans, and grasp more growth opportunities to rapidly process loans. The ability of customers to pay via digital payments, and flexible client-centric components make Fiserv meet all business demands effectively. This business loan origination system helps users open loan accounts hasslefree while ensuring document free processing.

Lending Pad

Lending Pad is another top-notch loan origination software endorsed by leading associations. The software improves lending decisions, provides a seamless user experience, and elevates operational performance without incurring any financial losses. Since 2015, this web-based, end-to-end innovative LOS is preferred by lenders, banks, brokers, credit unions, etc., to centralize and automate complex mortgage lending functions. Real-time notifications, multi-user processing, task segmentation, multiple role definitions, centralized source system, cross-departmental collaboration, insightful management, multi-user edit, etc., are major features to seamlessly perform loan origination tasks. Users can access this easy-to-install loan origination tool from anywhere.

Industry-Wise List Of Top Loan Origination Software

Loan Origination Software for Mortgage Brokers

Mortgage brokers often encounter issues associated with creditworthiness evaluation, document collection, staying in compliance with the regulations, etc., when loan applications are in huge numbers. However, these challenges can be prevented to a huge extent if a reliable loan origination software system is implemented by the mortgage brokers. Such a solution can simplify document verification, streamline credit checks, automate complex tasks, improve client relationships, and perform many more functions while reducing errors in handling high volumes of applications. Here are the top loan origination software for mortgage brokers, extensively selected by Goodfirms as follows;

MeridianLink

Since 1998, MeridianLink has been helping mortgage brokers and lenders quickly process loans, scale their business, and streamline their mortgage lending process. Business rules engine, PriceMyLoan, compliance, e-documents, etc., are popular features that Mortgage brokers of all sizes can benefit from. Mortgage brokers looking to hasten their loan processing, origination, and closure processes can rely on this loan origination solution to achieve better results. The tool also comes with notable features including single sign-on, smart cross-sell, flexible account opening, data analytics, etc., that are crucial to consistently drive productivity, and business growth.

Floify

Among the top custom-tailored loan origination software for mortgage brokers, Floify is a prominent name to automate loan processing, origination, closure, and other relevant functions. The inbuilt features and capabilities of software can lead to an 84% increase in overall efficiency, making it the best among the competitors. Document management, automated disclosure, customizable workflows, mortgage reports, etc., are some leading features of this loan origination system. Integration with other tools, such as BytePro, LendingPad, Encompass, MeridianLink, Surefire CRM, TotalExpert, etc., is available for the smooth functioning of the business. The premium plans of Floify start from $74/month, billed annually.

The Mortgage Office

Trusted by thousands of businesses worldwide, The Mortgage Office is a premium loan origination software to maximize efficiency of loan origination and processing functions. Since 1978, it is a reliable choice for mortgage brokers to quickly originate loans, perform audit checks, close loans faster, and ensure compliance with industry regulations. Advanced portals, RESPA compliance, loan document generation, custom workflows, loan pipeline optimization, and forecasting are the leading features of The Mortgage Office. Seamless integration with tools like QuickBooks and Microsoft Office Products helps in streamlining data transfer, reducing manual data entry, and enhancing productivity.

Loan Origination Software for the Banking Industry

For banks, it is vital to comply with regulatory and internal requirements while reviewing, approving, disbursing, and closing loans. Therefore, a loan origination tool with relevant features and functionalities is essential to make the overall loan processing faster, reduce risks and errors, fine tune loan offerings, manage documents, facilitate credits, etc., effortlessly. The loan origination software for banks can also automate tedious tasks, enable faster decisions, simplify audits, and offer enhanced visibility and insights into the borrower behavior. Following are the top LOS systems for the banking industry;

NewgenONE

With over 520 customers in 74+ countries, NewgenONE is an AI-powered loan origination software to simplify lending and loan origination-related processes. For banks, features like queue-based workflow, dashboards and reports, loan cycle time monitoring, activity monitoring, configurations, automated audit log, loan approvals, customer portal, auto-decisioning, etc., are beneficial in quickly approving and disbursing loans. This ISO & CMMI certified loan origination tool supports credit cards, personal loans, direct auto lines, secured loans, overdraft line of credit, commercial loans, and many more, making it a unified loan origination solution for banking loans.

Finastra Originate

In the list of top loan origination systems for banks, Finastra holds a special mention owing to its deep expertise in financial systems and lending solutions. It offers powerful personalization, while labeling, and customization features that allows banks to tailor it as per their needs. End-to-end customer process, automated financial workflows, instant approvals, self-service, online disclosures, compliance reporter, loan documentation, etc., are notable features to quickly originate and approve banking loans for both consumers and businesses. Its robust omnichannel experience, cloud-based architecture, and easy onboarding features help banks easily unlock their full potential when originating different types of loans, mortgages, and deposits.

SPARK

Since its inception in 2008, SPARK has been assisting banks and other financial organizations in simplifying the loan origination process with a keen focus on a people-first approach. For banks, the tool can help in digitally managing documents, monitoring eligibility in real-time, making informed decisions, digitizing workflows, automating letters of interest generation, etc., to ensure rapid lending and origination. A few popular features that banks can benefit from include SBA eligibility calculator, adaptive checklists, applicant dashboard, lending team creation, configurable notifications, loan activity history tracking, risk rating, etc. This SaaS-based lending platform is available for a 30-day free trial.

Loan Origination Software for the Education Industry

Education costs are rapidly increasing, making it difficult for students to learn without financial worries. In such a scenario, a loan origination software system is of utmost importance for educational institutions in serving flexible payment options, making the overall process of lending student loans more easier. Through a LOS, educational institutes can efficiently manage documentations, check student eligibility, offer tailored financing options, ensure compliance, and make education more accessible. Some of the major loan origination software are as follows;

Nortridge

Among the top educational loan origination solutions, Nortridge is a top-notch software that educational institutions can leverage to manage the entire loan lifecycle and portfolio in an efficient manner. It allows schools, colleges, and universities track loan-related data, set up default interest rates, defer payment schedules, offer interest-only payments, import documents, pull credit data from multiple bureaus, set up disclosures, etc., in easy steps. Features such as advanced customizations, workflow and rule configuration, direct database access, API support, auto-decisioning, document generation, and various other functionalities designed to make the overall process seamless and smooth. Integration with bankruptcy processing, DocuSign, and other solutions is also supported for consistent data delivery, processing, and analysis.

Compassway

Another educational loan origination solution is Compassway, a leading low-code automation platform to simplify student financing, easily make payments, and minimize new debt lines from a user-friendly interface. Features like custom repayment plans, enhanced digital student onboarding, address verification, approval, document verification, credit assessments, workflow automation, automated applicant data analysis, custom parameters, manual review escalation, etc., are there to improve the overall student financing experience. Customizable scorecards, risk optimization, and credit decision engine functionalities are also supported to enhance organizational efficiency. The software comes with a 15-day free trial.

Loan Origination Software for the Retail Industry

In the retail industry, a loan origination software system can efficiently handle retail loan origination tasks from pre-qualification process to loan funding. For retail businesses, LOS systems are required to adhere with compliances, save operational costs, and streamline loan related functions. It allows retailers to perform quick credit assessments, approve loans, automate repetitive processes, serve flexible financing options, and reduce default risks when lending loans. Leading loan origination software for the retail industry are as follows;

TIMVERO

Among the top loan origination software for the retail industry, TIMVERO is an AI-powered solution that retailers use to drive increased operational efficiency, personalize user experience, and ensure seamless interoperability. A few popular features of TIMVERO LOS include advanced data ingestion, embedded financing, AI analytics, document management, loan processing, report generation, digital onboarding, cash flow engine, customizable loan architecture, etc. By using this software, retailers can ensure 12 times faster decision-making, bringing better profitability, efficiency, and productivity to their lending operations.

VeriLoan

VeriLoan is another popular retail-based loan origination solution to efficiently manage the entire loan origination process from a unified solution. Retail businesses can rely on this omni-product and omni-channel platform to simplify KYC, calculate eligibility, complete policy checks, and perform AML and blacklist checks. Self-service origination, advanced risk mitigation decisioning, loan portal, OCR and PDF upload, mobile-based origination, configurable loan engine, application scoring and document management are some widely used features that retailers of all sizes can benefit from. Apart from these, it can integrate with rule engine software, i.e., InRule to automate monotonous functions associated with loan origination, processing, and servicing.

Valeyo

With over 20+ years of experience, Valeyo has been a market-leading solution to simplify borrowing and loan origination tasks. Through this web-based system, retailers can leverage features like configurable workflows, customer management support, credit processing, form automation, auto-adjudication, reporting, etc. Apart from these, risk mitigation, auto decision engine, indirect lending, credit insurance integration, etc., are some more notable features that make it unique from others. Integration with leading banking systems, credit insurance providers, credit bureau, indirect lending channels, etc., is also available to streamline the data processing and transfer.

Conclusion

A loan origination software is of utmost importance for businesses when nearly half of all banking tasks, including loan origination, are manual. And with the surge in AI and ML capabilities, especially within loan origination systems, the productivity gains are expected to reach at unprecedented levels. Furthermore, the Loan origination software market will grow to be worth closer to $4.37 billion by 2030, growing at a CAGR of 11.9 percent.

All these statistics point to the importance of loan origination software captures in the minds of prospective users of the software. These impervious gains make loan origination software a must-have for lending businesses of all sizes and shapes.