Economic uncertainties continue even though people are navigating towards recovery and financial stability in this post-pandemic era. Currently, loan servicing companies are experiencing specific challenges due to the high volume of loan modifications and servicing requests. In this scenario, managing all the loan servicing operations manually can be prone to errors leading to financial risks.

To mitigate these risks and overcome the challenges arising due to market conditions and compliance issues, the loan servicing companies need to implement clear risk and control mechanisms which can be done with the help of the right loan servicing system in place.

Risk management in Loan servicing is challenging in the current situation, and to understand this subject in-depth, let's go through the complete information about what exactly loan servicing is, the risks associated with loans and the mechanism that needs to be followed for secure loan servicing.

What is Loan Servicing?

Loan servicing refers to the administrative process that includes all the tasks starting from approval to the final payment of loans. It includes collecting payments, maintaining records of payments and balances, managing taxes, insurance, and escrow funds, taking measures against fraud, and following up on any kind of delinquency. Loan servicing companies manage all these tasks on behalf of lenders and ensure that the loans are repaid accurately and within a specific time frame.

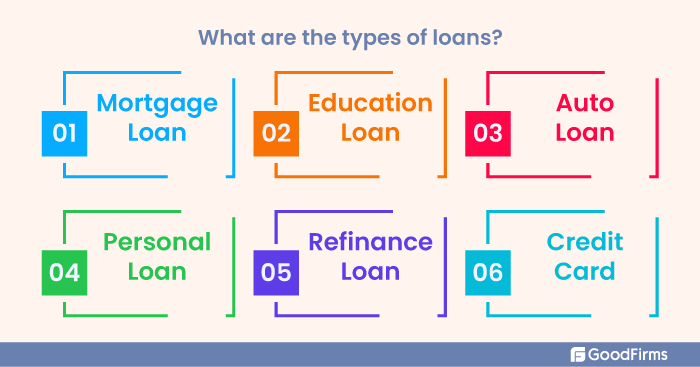

Traditionally, the loan servicing tasks were performed by the lenders. But, this situation shifted in the 70s and 80s when banks and financial institutions realized that record keeping and paperwork required in loan servicing is turning out to be unproductive for them. This gave birth to the loan servicing industry. The loan servicing companies oversees the administrative tasks for different types of loans like -

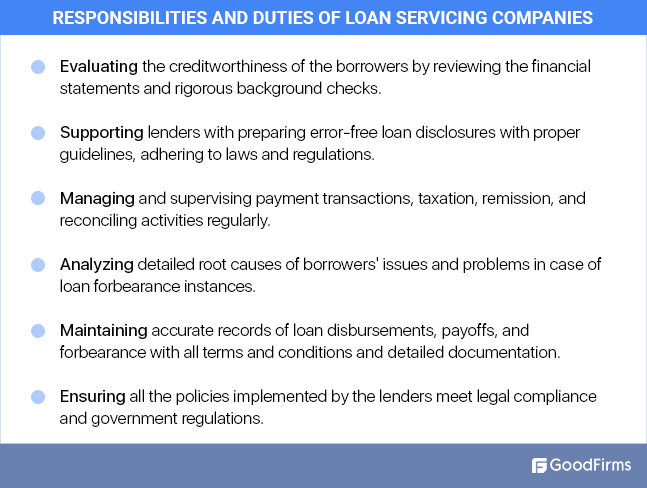

People usually mistake the loan servicing companies for the lenders. The lenders include banks and financial institutions that lend money to the borrowers. In contrast, loan servicing companies play an important role in supporting the lenders with all the tasks relating to managing the loan processing and repayments. Ensuring that the borrowers get their monthly statements and pay their installments on time is the core responsibility of the loan servicing companies. To make things a bit easier for you to understand, the following section will detail a few key responsibilities and duties of loan servicing companies.

While accomplishing these responsibilities and duties, the loan servicing companies face many risks associated with loans and need to overcome several challenges to provide a seamless experience to both lenders and borrowers. Let's look at those risks associated with loans and challenges usually loan servicing companies face with the solution of how to overcome them.

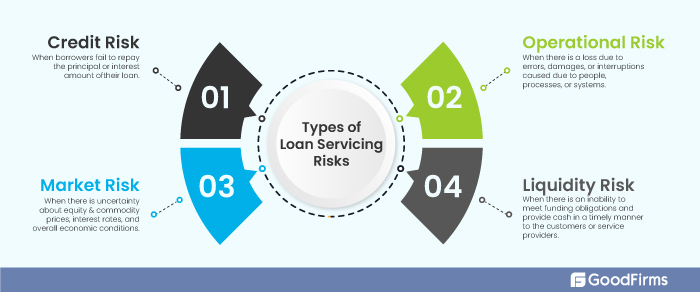

What are the Risks Associated with Loans?

Loan Servicing Challenges

Lack of Risk Awareness

When the borrowers fail to make required payments, that becomes a credit risk for the lender and impacts loan servicing companies through a lot of investigation and paperwork. You never know when loan forbearance introduced by the government in the CARES Act heads towards delinquency or default. In that case, a lack of funds recovery can adversely impact the reputation of loan servicing companies and their growth and profitability.

Retaining Customers

Loan servicing companies work towards bridging the gap between lenders and borrowers. Lenders and borrowers can go for the same loan servicing companies provided if they have had a satisfactory experience in the past. In this competitive business environment, every loan servicer needs to understand that lenders and borrowers are open to many options and thus, retaining them becomes a big challenge.

Operational Inefficiencies

Increased loan originations require handling more data and simultaneously ensuring compliance with industry standards and regulations. Especially now, when borrowers are coming out of forbearance and deferral status, loan servicers need to manage several disparate data points to deliver flawless services. The operational inefficiencies in loan servicing can give rise to dissatisfaction among lenders and buyers, adversely impacting the overall business finance and reputation.

So, What is the Control Mechanism?

The only solution that can help loan servicing companies to overcome these challenges is using the best loan servicing software. The loan servicing software provides a complete picture of credit risks, allowing you to take measures in advance and save your loan servicing business from incurring heavy losses. Moreover, it helps achieve operational efficiencies and enables delivering exceptional services to lenders and borrowers. Thus, the use of loan servicing software has the power to drive lenders and loan servicing companies to sustain and grow their business in this highly competitive financial market.

To elaborate further on this subject, let's now look at complete details about loan servicing software and how it can help loan servicing companies mitigate risks, improve their operational efficiencies, and enhance client relationships.

What Is Loan Servicing Software?

Loan servicing software is an application that automates the entire loan lifecycle starting from its origination to its final payoff and reporting. Usually, loan servicing companies use this software to streamline their operations and automate their processes, ultimately helping them to save time and money. But, the lenders who service their loans on their own can also use the loan servicing application as it allows them to automate their monotonous tasks to focus on their core business. Moreover, loan servicing software also helps lenders and loan servicing companies ensure that they follow a systematic approach toward regulatory compliance and manage customer service operations without any flaws.

After going through complete information about the loan servicing software, it is evident that it enables lenders to follow a systematic approach that can mitigate all the credit and repayment risks. Besides using the right technology, it is also significant for the loan servicing companies to follow fair and responsible servicing practices.

Loan servicing companies need to ensure that their customers get high-quality services and also they simultaneously follow specific regulations to stay compliant with the industry standards. For that purpose loan servicing companies implement effective control mechanisms that help them mitigate compliance and operational risks.

Below mentioned are preventive and detective controls which are integral to follow fair loan servicing procedures.

Preventive Loan Servicing Controls

- Detailed procedures and policies to be designed and circulated properly within the internal staff members.

- Job-specific training should be provided to the employees enabling them to follow regulatory requirements, policies, and procedure strictly.

- Ensuring that new loan products follow required compliance during their development and before they are launched.

- Testing the loan schemes before they go live to ensure high-level user acceptance.

- A properly documented change management process needs to be designed which includes the details about new regulations and enforcement actions.

Detective Loan Servicing Controls

- Analyzing ongoing trends, and reviewing quality assurance on a regular basis to ensure timely identification of errors.

- Monitoring the processes and efforts to ensure that the loan servicing processes being followed are flawless and add value to lenders and borrowers both.

- Internal audit to be conducted to ensure that the compliance management of the lender is effective and robust.

- Gathering customer feedback and taking appropriate action on customer complaints to ensure client satisfaction and harmony within the organization.

Following these preventive and detective control mechanisms in loan servicing are significant to ensure that they are not discrete towards any group or community. Moreover, following approved policies and clearly stated procedures are important to stay compliant with the regulations posed by the government and keep the loan servicing business running smoothly and ethically. Thus, proper documentation, monitoring, approval, and reporting should be in place to mitigate any kind of loan servicing risk and implement successful strategies.

Now, we know what are the risks to loan servicing and which control mechanisms to be used to mitigate those risks. But, the question remains - why a clear risk and control mechanism is essential for loan servicing. Let’s have a look at some reasons why following a clear risk and control mechanism follows for loan servicing companies as given below.

Top 5 Reasons a Clear Risk and Control Mechanism Matters for Loan Servicing Companies

#1 Reduces Uncertainty

An adequately designed risk management strategy includes the details of the potential events that can adversely impact loan servicing companies. Sometimes, it is impossible to predict all the uncertainties within a company. Still, effective risk management and control measures can help determine the majority of instances that are going wrong and prepare a plan to reduce their negative effect on the loan servicing business.

#2 Saves Time and Efforts

An incomplete picture of risk is the most significant risk for loan servicing companies. Having detailed records about the borrowers and their payments enables loan servicers to save time and effort in detecting the forbearances and delinquencies. With a robust risk management system in place, a loan servicing company can determine the defaulters in advance without spending too much time and putting in manual efforts, ultimately leading to quick resolutions.

#3 Enhances Communication

Strong communication is crucial to the success of any type and size of business. When it comes to loan servicing companies, proper risk management enables the lenders and borrowers to work effectively as it enables communicating crucial information on time. It becomes problematic if the lender is unaware of the borrower's weak financial position and setting wrong expectations. Risk management using loan servicing software promotes centralized communication and transparency.

#4 Improves Reputation

Reputational issues can arise for a loan servicing business if there are too many delays and defaults in loan repayment. This can cause businesses to face negative reviews from their clients. A risk department in a loan servicing company can help decrease the likelihood of this fallout. A clear risk and control mechanism enables loan servicing businesses to lower the impact of reputational loss and prevent negative consequences of the same.

#5 Allows Smart Decision Making

Decision-making can become very difficult if access to the correct information is not available on time. The risk department keeps all the information and plans readily available before negative instances occur, allowing organizations to make smarter decisions to prevent financial loss and other damages. The implemented risk and control mechanisms can also recommend several remedial alternatives, which can be a great source of guidance for loan servicing companies to make the right decisions.

Thus, you know now how important it is for loan servicing companies to implement robust risk management strategies. However, in many situations, limitations in risk assessment don't provide the required insights to identify risks and take appropriate actions to mitigate them. This is where loan servicing software comes into the highlight. Let's look at how loan servicing software can help implement successful risk management strategies.

How Can Loan Servicing Software Help in Implementing Clear Risk and Control Mechanism?

Comprehensive Risk Assessment

While many loan servicing companies, during their manual risk evaluation process, are able to determine vulnerabilities, risk areas, and the impact of an unforeseeable event on their business. But, a loan servicing software that automates the process of risk assessment has the potential to analyze the root cause of the risk and accordingly provide suggestions relating to the strategy that is required to be implemented to mitigate the risk. Moreover, this automation in risk assessment also helps loan servicing companies to determine the risk before time and which actions can prevent it from saving the business from financial and reputational loss.

Implementing Risk-Focusing Practices

There are many operational risks that loan servicing companies face, which are directly related to human errors. Besides analyzing the risks, it is also essential to implement practices that prevent risks before they arise and negatively impact the organization's profitability. The loan servicing software enables companies to follow a systematic approach to managing and accessing data, minimizing the chances of misguiding the lenders and borrowers. Precisely, a loan servicing software can keep the information updated, enabling the users to have secure access to the latest information, thus minimizing the risks relating to borrowers missing the payment dates, unauthorized access to the data, and many more that are likely to create huge problems for the business.

Developing Risk Mitigation Programs

Besides risk assessment and following risk-focused practice, consistently developing risk mitigation is integral to your loan servicing company's continued safety. A loan servicing software can help prioritize risks and, based on that, create programs that help reduce the impact of the priority risks that can disrupt the entire organization's operations. Also, it enables validating management actions towards mitigating risks and finally tracking and reporting the progress of risk programs implemented.

Precisely, risk management is an ongoing process, and loan servicing software allows the implementation of robust risk mitigation programs at every step of the loan servicing lifecycle. Moreover, the rising requirements of the loan servicing companies and other financial institutions like banks to comply with several regulations have boosted the demand for loan servicing software.

Conclusion

As per a recent report - Global Loan Servicing Software was valued at USD 2,151.08 million in 2020, which is expected to rise upto USD 4,812.08 million in 2028, accounting for a Compound Annual Growth Rate (CAGR) of 12.9% during this period.

Thus, with this growth a consistent risk management and control mechanism is critical. A loan servicing software reduces the chances of uncontrolled risks slipping through the gaps by providing sophisticated analytical and reporting capabilities. This can keep you informed about the areas of vulnerability and easily comprehend and take the required action to safeguard your loan servicing business from losses occurring due to delinquencies, forbearance, prepayments, market conditions, and other governance & compliance issues.

Are you looking for comprehensive solutions that can help you implement a clear risk and control mechanism in lending and loan servicing? If yes, go through this complete list of the best loan orgination software and loan servicing software to find the one that best suits your business needs.