The loan servicing market is witnessing increased growth due to advancing technologies like IoT, AI, automation, and blockchain. Additionally, the expanding lending ecosystem and the development of scalable solutions to manage loan services are interestingly simplifying loan origination and disbursement, improving workflow efficiency and customer satisfaction.

Advanced loan servicing software solutions help in maintaining the creditworthiness of the borrowers.

This article is aimed at helping you to familiarize with the processes of loan servicing in this digital era, and also with some of the top-rated free and open source loan servicing software solutions.

Loan Servicing Software

Finances affect one’s credibility a lot. They will help you build up credit if you successfully make payments. They will hurt your credit rating if you pay late or default on loans. Effective loan serving helps in administering diverse aspects of your mortgages to streamline the timely payment of finances and save you from penalties and over-debts. Recognized loan servicing agencies take the assistance of the advanced loan servicing software solutions to service your loan administration job from the time loan proceedings are dispersed until the loan is paid off.

Nowadays, banks, mortgage organizations, and financial institutions are hiring services from third-party organizations or agencies for loan servicing.

Automation of loan servicing has changed the paradigm in the lending industry. A loan servicing company, servicing firm or a mortgage bank uses advanced automated loan servicing software solutions to collect interest, principal, and escrow payments from their borrowers.

What are the key features of loan servicing software?

It is always advantageous if your loan servicing software offers affordable and comprehensive solutions with a wide range of features. It should necessarily be capable of handling numerous types of loans in addition to being a user-friendly program. Have a look at the listed key elements that come with the loan servicing software;

- Compatible with different versions of Mac and Windows operating systems.

- Free, open-source, or cost-competitive software.

- Secure transfer of existing loans from other servicing systems.

- Able to import one to thousands of loans.

- Exceptional reporting ability.

- Accepts foreign currencies having decimal formats.

- Particular reporter module to develop management reports, invoices, graphics, letters, etc.

- Easy upgrading of files with each version change.

- Investor account tracking.

- Escrow tracking and payment processing.

- Auto-tracking of insurance and tax due dates.

- Unlimited network users.

- Free technical support via Toll-Free phone line.

- Capable of handling multiple separate lenders.

- Print loan coupons and delinquent reminder notices.

- Print amortization schedules with annual total amounts.

- Track loans as active, delinquent, paid in full, etc.

- Password secured system with specific rights to access certain functions.

Loan Servicing Challenges with Traditional Methods

In a recent research conducted with the loan servicing managers and executives, specific problems and challenges related to the field were discovered and they are as follows;

- The cost of loan servicing dramatically rises due to regulatory compliance instituted after every market fluctuation or any emergency arises such as the great recession impacted years ago.

- Misapplication of loan payments or late fees charged due to alerts received in advance due to manual loan servicing processes.

- Your loan is in default or delinquent and you get charged for default-related services due to unknown or inapplicable reasons.

- Violation of the state and federal laws for debt collection when the loan is in default category and the loan servicer has to take over debt collection responsibilities (with some exceptions).

- Borrowers are not informed through a formal notice of the transfer of servicing rights for their loans.

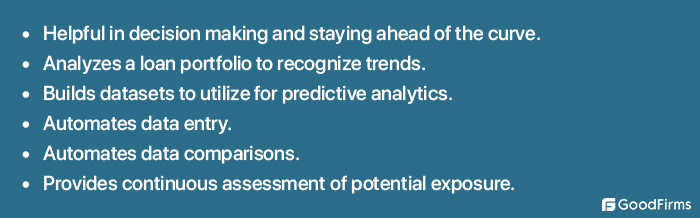

Benefits of AI-backed loan servicing software?

The field of loan servicing is rapidly rising with modern technologies. For example, Wells Fargo, PNC Financial Services, Bank of America, JPMorgan Chase, Ocwen Financial Corporation are some of the established names in the loan servicing industry. They use advanced software systems that can perform Robotic Process Automation (RPA). In the lending environment, RPA has helped many of the lenders and loan servicing agencies to face the industrial challenges. These measures are as follows that actually help them with cutting costs and improving profitability.

Why is there a need for Loan Servicing Software ?

There are distinct advantages of using automated loan processing or servicing software systems. The latest ones are made available based on cloud or web-based technologies. Free and open source loan servicing software solutions bring you some other privileges. They are the automated systems that can be quickly configured, easy-to-implement, and provide a superior customer experience. They help in eliminating paper documents and improve accuracy in decision-making.

Automated loan servicing allows the servicers to evaluate and identify applications that meet the lending criteria quickly.

Seven Crucial Points Supporting the Importance of Loan Servicing System

- Manage credits given by the lending company.

- Track loans based on their different types and access loan servicing information including payment history, escrow and tax information and history, investor reports, and borrower payments.

- Provide a different level of interest methods.

- Handles delinquency and loss mitigation supporting bankruptcy, foreclosure, REO, charge-off, and credit bureau reporting.

- Monitor payment dates with generating month-end summary reports, cut-off reports, investor reports, and year-end reports.

- Calculate and apply late fees to accounts either manually or automatically.

- Support borrower self-service like auto-tracking their loan’s performance.

Loan servicing software is important and can boost your business due to the efficiencies it provides. It is also important to know that not all loan servicing systems are created equally, so you need to choose the best that can fit your organization's needs. Hence you need to make a viable selection based on your specific requirements.

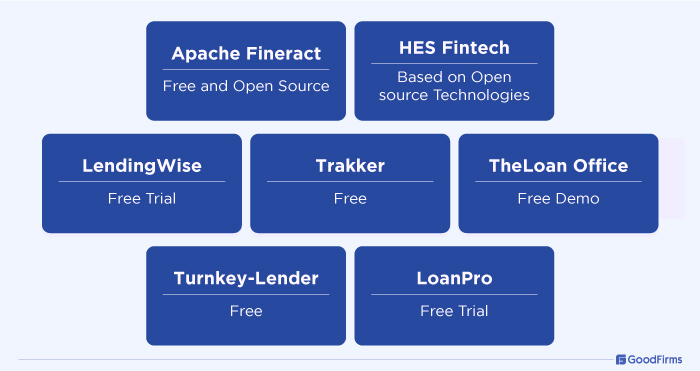

If you are looking for a budget-friendly option, you can consider the below-mentioned list of top-rated free and open source loan servicing software solutions

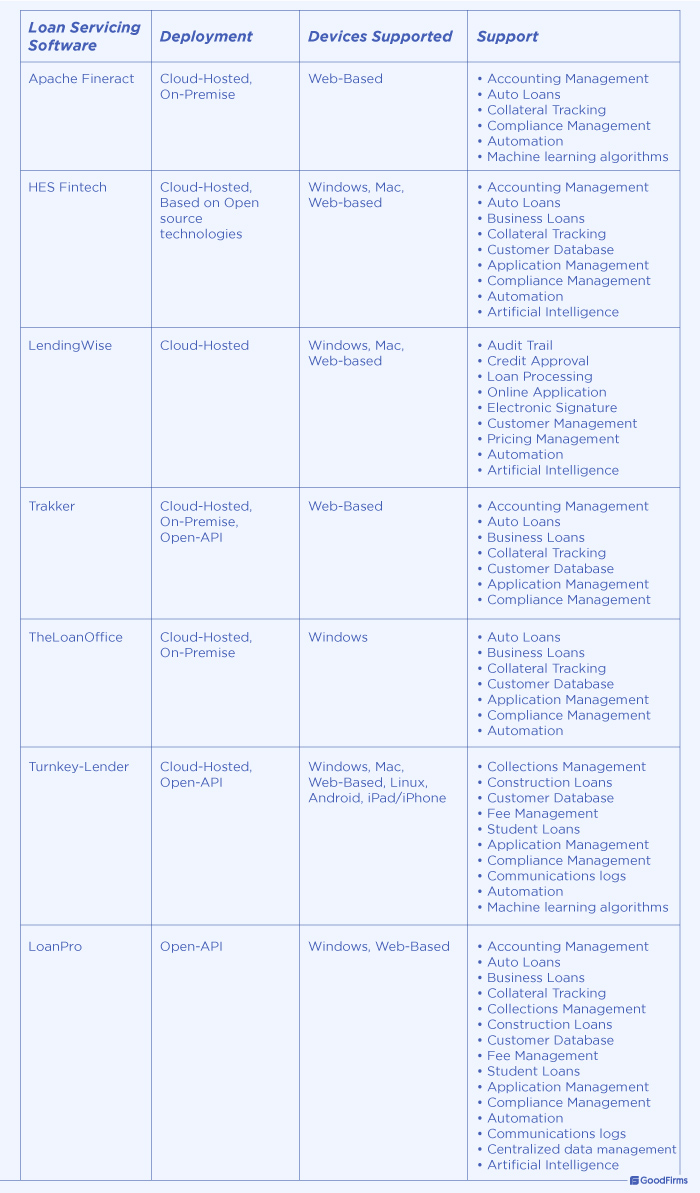

There is a chart given below to help you to understand the distinct features of these software programs.

Now, let us discuss all of these software solutions in detail.

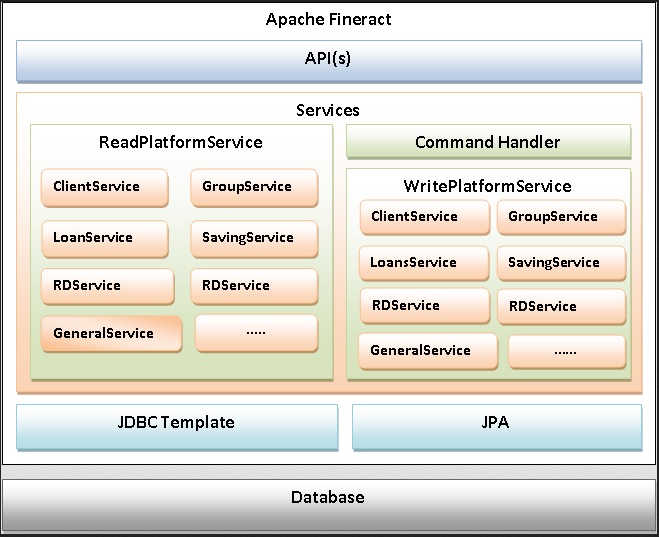

1. Apache Fineract – (Free and Open Source)

Apache Fineract is a popular open source program for digital financial services and offers an exceptional loan servicing facility with amazing on-premise or cloud-based software programs. It works on all devices with flexible product configuration and comes with the most trusted stable version Fineract 1.x. It is a robust, scalable, and powerful solution to streamline loan servicing tasks.

(Source: Apache Fineract)

Highlights:

- Fineract 1.x is a responsive platform with open APIs.

- It is easy to develop front-end applications separately and then connect to Fineract1.x.

- The software can be installed on any deployment platform like Windows, Linux, Mac OS server, and mobile devices.

- The system requirements include Java 1.8 or higher, MySQL 5.5 or MySQL 5.6, and Apache ActiveMQ.

- The software is licensed as per Apache License, Version 2.0 that is compatible with version 3 of the GPL.

- Current and past standing instructions processing

- Ability to reschedule payments to next repayment date

- Configurable payment allocation

- Database passwords decryption via CLI

- Client data management

- Loan and savings portfolio management

- Integrated real time accounting

- Social and financial reporting

- Flexible product configuration

- KYC documentation support

2. HES Online Lending Software – (Based on Open Source Technologies)

HES Online Lending Software is one of the finest innovations in the field of online lending and loan servicing. The company offers exceptional commercial loan management and servicing features for SME lending. The software comes with cross-device functionality and all-time online/offline access. Although the software is neither free nor open source, the platform is based on open source technologies, which means that the users do not have to pay extra license fees.

(Source: HES Online Lending)

Highlights:

- HES software is based on open source technologies.

- The software empowers financial institutions and banks with the agility of maturity and customization of the HES Core Engine.

- The scalable modular architecture of the software enables accurate and qualitative automated loan servicing.

- GDPR compliance and AI-powered credit scoring tools add additional functionalities to the software.

- Adjustable level of automation

- Fast calculation engine

- Day-to-day calculations

- Automated credit disbursement

- Integration with BI/Reporting tools, accounting systems, collateral registry tools, etc.

- Dynamic amortization schedules with initial interest, fees, and commissions

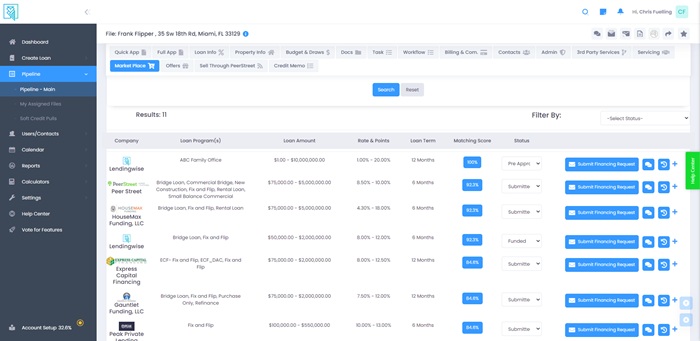

3. LendingWise (Free Trial)

LendingWise is the best loan origination tool and customer relationship management platform. As a prominent loan servicing software, LendingWise incredibly fits the needs of private lenders and commercial brokers. This digital loan management system is also used for construction, flix, flip, bridge, CRE, SBA, and more. LendingWise allows organizations to scale up their business process and enhance borrower engagement. The CRM further helps to improve loan conversions.

The software is customizable for any loan product. You can also compare the best offers from different lenders and investors by visiting a single online marketplace. The tool even provides third-party integrations and a loan payment tracking facility.

The cloud-based software provides a 15-day free trial period with a starting price of $134 per month, paid quarterly.

(Source: LendingWise)

Features

- LendingWise provides a user-friendly interface with customized workflows, seamless loan servicing, and paperless origination.

- This best loan servicing software quickly integrates with the website and other web app forms to collect the critical data.

- This software offers the benefit of real-time team collaboration, enabling you to keep everyone updated and in the same loop.

- The best-in-class tool is aligned with Amazon Web Services (AWS) providing robust security and infrastructure.

- LendingWise also offers additional features such as email marketing, lead tagging, document library with the digital signature facility, and much more.

- The software can also seamlessly sync with other popular tools and applications.

- Custom Pricing Engine

- Borrower & Broker Portals

- Automated Rules Engine to create tasks, send email, webhooks, etc.

- Customizable pipeline and workflow steps

- Broker network management

- Automated payments with powerful ACH APIs

- Fractional investor model to fund loans or sell fractions of the loan

- Detailed payment ledger

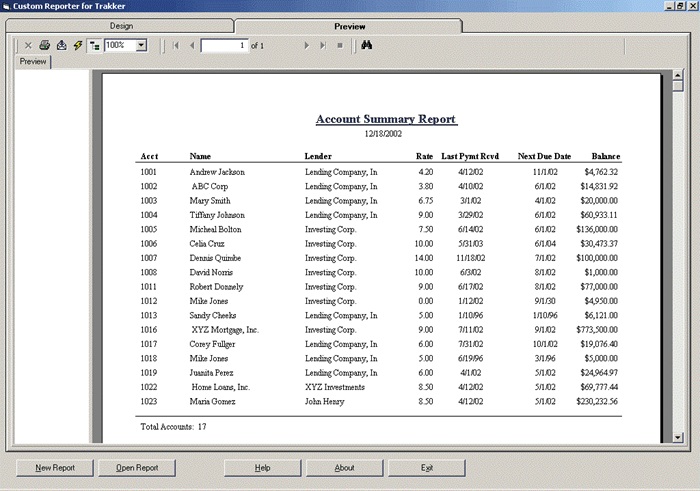

4. Trakker - (Free)

Trakker is a multi-financial services company that offers valuable loan servicing software features to its clients. The company is headquartered in Florida, and its loan servicing solutions are well-recognized all across the globe. Loan servicing software Version 2.4 is the latest free software tool offered by the company which is a Windows-based program that can easily run on the Mac, Unix, Linux and Windows based operating systems.

(Source: Trakker)

Highlights:

- User-friendly programs supported in an actual Windows 32bit environment.

- Able to import thousands of loan portfolios.

- Unlimited network users are allowed to use the software at once.

- The software is capable of handling more than 9000 separate lenders.

- Track loans as active, delinquent, paid in full, etc.

- Develop and print custom reports for individual payments and annual totals.

- Agency reporting for FNMA and GNMA

- Expanded Variable Interest Rate Function

- XML standards for new loan import

- ASP borrower page capability

- Credit bureau processing

- Data file backup

5. TheLoanOffice – (Free Demo)

TheLoanOffice is a reputed name in the field of loan servicing, and provides an affordable and reliable loan servicing software program to its customers worldwide. It is a web-based software program that is meant to help small businesses in the financial arena. TheLoanOffice software works on all Microsoft Windows Desktop Operating Systems like Windows 10 Pro (32-bit and 64-bit), Windows 8 Pro (32-bit and 64-bit) and Windows 7 Professional (32-bit and 64-bit). The software facilitates users to use the loan servicing templates for simplifying data entry and ensuring consistency in managing loan records.

(Source: TheLoanOffice)

Highlights:

- The software facilitates the secure processing of reversals, write-downs, NSFs, and payoffs.

- Easy tracking of loan charges and advances, and documentation of detailed recording of payments.

- Enhanced reporting and forecasting abilities

- Automated loan servicing functions

- Regular audits to meet local and federal regulations

- Real time credit card and EFT payment processing

- Full escrow accounting & administration

- Track delinquencies & generate late notices

- Print borrower statements, amortization schedules, coupon books and mailing labels

- Integration with QuickBooks

6. TurnkeyLender – (Free)

TurnkeyLender offers intelligent lending software with out-of-the-box functionalities. It is a GDPR compliant software system that facilitates automation for efficiency, speed and accuracy. A free version of the platform is provided by the vendor to determine its effectiveness with respect to the client business needs. This software is powered by AI to efficiently automate and handle every aspect of loan management effortlessly with better cost effectiveness. The TurnkeyLender software automatically tracks all interaction between the lender and the borrower, including customer service query and payment history.

(Source: Turnkey-Lender)

Highlights:

- Communication is facilitated through text, SMS, and/or email for payment reminders and account alerts.

- The software automatically updates the credit bureau data of the borrower.

- It is available in both cloud-based and on-premise deployment options.

- Ability to automatically generate schedules based on loan terms

- Comes with a dedicated, intuitive borrower portal and app

- Automated, in-depth advanced reporting

- Due date reminders

- Live tracking of loan performance

- Smooth AML and KYC compliance process

- Supports integration with 75+ business tools

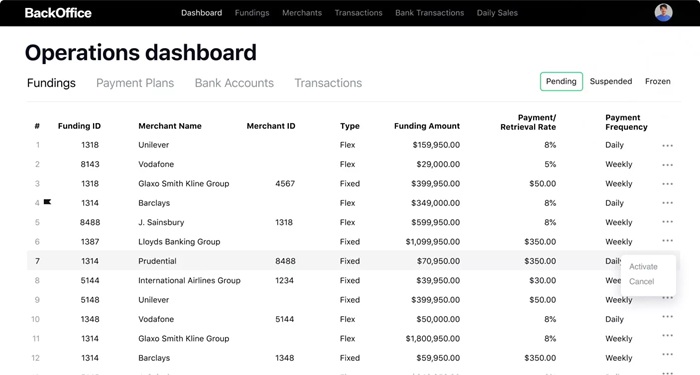

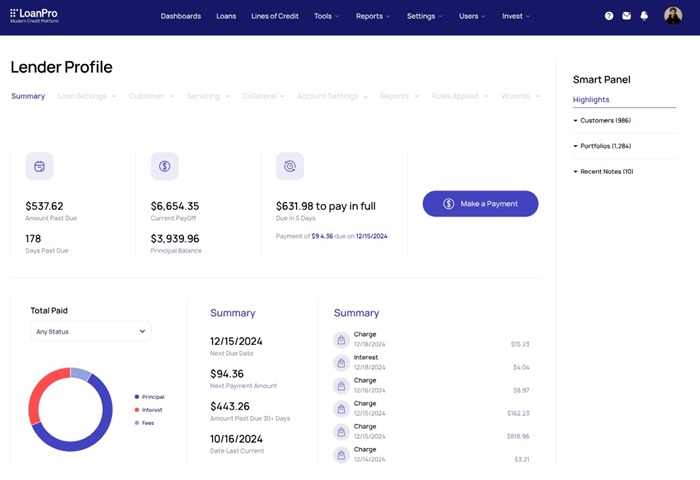

7. LoanPro – (Free Trial)

LoanPro, formerly AutoPal is another well accepted system that is capable of offering exceptional loan servicing software. It is cloud-based software that can run on any system supported by a secure Internet connection, and it is based on the proprietary license.

(Source: LoanPro)

Highlights:

- The AutoPal software offers 100% accurate payoff calculation.

- Custom payment schedules can be set according to the user’s preferences and following the payment cycle.

- Real-time transaction view for up-to-date transactions for scheduled, paid, and forecasted payments.

- The SMS text messaging, email, and automated phone campaigns are facilitated to support the customers.

- Configurable, rule-based automation

- Comprehensive reporting to automate all regulatory, investor, and internal reporting requirements.

- Self-service options for loans

- Role-based access

- Ability to send personalized notices, disclosures, and marketing materials

- Comprehensive loan recasting

- Configurable end-to-end platform

If you are already using one from the software solutions listed above, you can freely share your reviews here. However, if you are looking for premium loan servicing software with value-added features and capabilities, take a look at the following lists;

Popular Loan Servicing Software

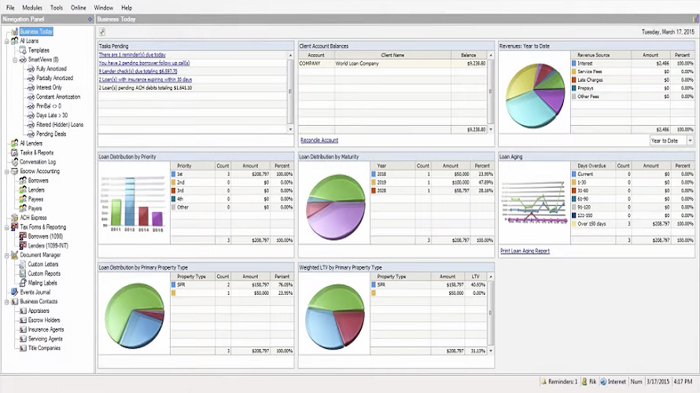

The Mortgage Office

Since 1978, The Mortgage Office, a product of Applied Business Software has been serving world class loan servicing solutions to lenders from all over the globe. Owing to the powerful automation and loan servicing features, financial teams can streamline loan origination processes, efficiently manage transactions, and rapidly close more loans without much hassle and effort. Not only this, but lenders can also simplify loan processing, expand loan servicing capacities, effectively handle large portfolios, and manage different types of loans. One of the most unique features of this loan processing software is SmartViews that allows businesses to use filters and customizations to create tailored dashboards to display the loan they need to see. Apart from this, reminder scheduling, teaser rates, payment distribution, automated emails, payment processing, document imaging, etc., are a few notable features. Seamless integration with loan origination software, QuickBooks, Microsoft Office, etc., is available to streamline loan-related operations.

LOAN SERVICING SOFT

Another popular software that made it to the list of advanced loan servicing software solutions is LOAN SERVICING SOFT. This next-generation software is a great fit for lending firms of all types and sizes owing to its robust investor support, servicing fees, trust accounting, Metro 2 credit reporting, lockbox, task management, and many more features. Apart from these, LOAN SERVICING SOFT is also a reliable choice for automated billing, fully automated servicing, ACH electronic payments, easy account setup, automated accounting, custom reporting, and various other functions. It also comes with an in-built CRM for functions like batch reporting, mail merge, email and letter writing, etc. Through this robust loan servicing software, private money and alternative lenders can fully control their operations, streamline loan procedures, and achieve higher accuracy, ensuring risk and error free finances.

Moneylender Professional

Trusted by over 1600 lenders, Moneylender Professional is a top-notch loan servicing software to manage and service different types of loans in various industries. Through a user-friendly interface, lenders can automate almost every calculation, track payment status, generate statements, service their papers, maintain user accounts, and do much more. Colleges, universities, private investors, in-house financiers, investment firms, banks, credit unions, etc., can benefit from this loan servicing tool. It comes with tons of advanced features to quickly perform tasks like sending 1098 forms to borrowers, Metro2 files generation, integration with existing business systems, contract template creation, seller financing, over/under payment management, automated account numbering, loan reminder scheduling, statement customization, etc. The software comes with a 30-day money back guarantee, and is available to purchase at a starting fee of $489.00 per license. The basic features can also be run as a free demo unless it is purchased.

Nortridge

Since 1981, Nortridge has been helping financial and lending organizations from different industries manage, originate, service, and close their loans effortlessly. It is widely used by online lenders, captive lenders, branch-based lenders, and marketplace lenders to set up recurring payments, accept credit cards, accept MoneyGram payments, accept Western Union payments, etc. Businesses can create tailored loan products using features like loan type creation, custom accrual, interest rates set up, flexible payment period, automatic late fees, and many others. A borrower portal is also provided by Nortridge, through which borrowers can make payments, check their balance, and pull statements on their own.

Industry-wise List of Top Loan Servicing Software

Loan Servicing Software for the Banking Industry

Loan servicing software is of great help for the banking industry as they can use loan servicing tools to efficiently handle loan lifecycle management, create seamless workflows, enhance customer services, and streamline borrowers’ experience. A loan servicing software can also simplify loan processing tasks, allowing banks to efficiently handle large volumes of data. Following are a few leading loan servicing options for the banking industry;

Shaw Systems

Shaw Systems released its commercial loan servicing software in 1969 aimed at automating complex loan processes and helping banks navigate the dynamic credit landscape. Banks looking to effectively manage every aspect of the loan servicing lifecycle can benefit from this software. Customer centric account management, automated communication campaigns, integrated payment tools, real-time alerts, user-defined screens, risk automation, workflow automation, securitization, queue assignments, etc., are a few notable features of this state-of-the-art software.

Able

Trusted by over 15 Tier 1 and Tier 2 banks, Able is a comprehensive loan servicing software that banks, MFIs, and alternative lenders can use to enhance customer service, improve credit portfolios, and deliver superior banking experiences. By implementing this easy-to-use, and affordable loan servicing solution, banks can ensure high-quality loan servicing and collection, enhance performance, significantly reduce financial errors, automate borrower data updates, set up payment reminders, calculate installment and interest payments, etc. Apart from these, it also allows banks to leverage AI and ML into loan servicing, serve omnichannel customer outreach, cross-border selling, and automate repetitive workflows. Additionally, features like system monitoring, AWS Cloud and Kubernetes configurations, security checklists, centralized storages for logs, audit database, alert notifications configurations, etc., ensure top-level security and privacy of financial data.

Peach

Another prominent loan servicing software for the banking industry is Peach, a specially designed suite of tools to help banks achieve better efficiency, launch new lending products, and enhance productivity without much hassle, errors, and risks. Automated communication, smart case matching, intelligent collection campaigns, a borrower portal, self-service repayment, payment scheduling, payment plan customization, etc., are a few features to optimize loan servicing for better results. Apart from these features, a CRM specifically designed for banks and lenders is also offered by this software to efficiently manage payments, reimburse loans, update credit limits, manage advances, set interest rates, waive fees, and execute many more tasks. Additionally, it also features native first-party collection tools to automate collection specific tasks.

Loan Servicing Software for Mortgage Brokers

Mortgage brokers often face challenges in tracking loans and their status in real-time, loan servicing solutions can be of utmost help. Through loan servicing software, mortgage brokers can automate repayments, effectively manage loan applications, manage borrower queries, adhere to local regulations, and centralize communication, without any delay and errors involved. Some of the popular loan servicing options for mortgage brokers are as follows;

MSP

Among the list of best-in-class loan servicing solutions for mortgage brokers, MSP takes a leading place. Mortgage brokers of all types and sizes can make smarter decisions, drive innovations, lower operational costs, and efficiently address regulatory requirements through this mortgage loan servicing software. Features like automated lien release, centralized claim processing, delinquent payment collection, credit bureau management, self-service, foreclosure, automated invoicing, ICE servicing agents, lien alerts, servicing order functions, standardized digital document storage, etc., are useful in helping mortgage brokers perform their functions seamlessly.

Dara

Dara is a unified loan servicing software to help mortgage brokers manage mortgage loans, build customer relationships, prioritize compliance, optimize costs, and do much more seamlessly. It comes integrated with AI capabilities for data extraction, document classification, enhanced auditing, advance reconciliation, automating claim filing, real-time predictive insights, deploying Gen AI-based chatbots, etc. Apart from these, other popular features of Dara include workflow automation, collateral management, exception queue, document management, robust analytics, compliance assessments, and loss mitigation.

Mortgage Servicer

Another leading loan servicing software for mortgage brokers is Mortgage Servicer. Mortgage brokers can benefit from advanced automation capabilities to automate various loan servicing functions like payment processing, custodial accounting, escrow administration, investor reporting, report writing, etc., through a user-friendly interface. In addition to these, features like flexible payment processing, escrow administration, year-end reporting, collections control, digital statements view, servicing transfer, customized correspondence, maintenance history, custom data retrieval, etc., are there to streamline the execution of mortgage tasks.

Loan Servicing Software for the Private Lenders

The loan servicing software solutions are becoming a must for the private lenders in automating the entire loan lifecycle, scaling their business, and increasing overall efficiency. Not only these, but a private lending loan servicing software can also assess borrower creditworthiness, generate statements, send payment reminders, etc., making the lending easier and flexible than earlier. Some of the best loan servicing software for private lenders selected by Goodfirms are as follows;

Vergent

Trusted by over 20,000 users, Vergent is a comprehensive loan servicing software for the private lenders. Through this complete loan management software, private lenders of all types and sizes can create custom loan models, automate communications, customize configurations, and manage the entire loan lifecycle. A centralized module to view data, built-in customer portal, automated marketing funnels, ancillary products, loan restructuring, user-friendly dashboards, and built-in compliance are the top features. Besides these, advanced AI capabilities for customizable workflows, fully automated accounting reports generation, data export, and more features are there to eliminate errors and inefficiencies in loan servicing. The software is also available to use in Spanish language and can be integrated with over 80 business tools for consistent data flow.

Mortgage Automator

Since 2013, Mortgage Automator has helped private lenders to relieve and unburden staff from tedious workloads of loan servicing. It is widely used by private lenders to track loan ledgers, automate collection processes, manage payments, generate payment tracking reports, etc., without further investments. Post-dated checks, custom extension conditions, automated warnings, credit card payments, automated distribution, auto interest adjustment calculation, custom NSF fees, payout statements, per-diem calculations, payment schedule changes, exportable dashboards, external payment tracking, etc., are among the key features that private lenders can benefit from.

Loan Servicing Software for Student Lending

The education industry currently is struggling with a wide range of student lending issues such as increasing loan default rates, CFPB scrutiny over lending practices, facilitating paperless loan disbursement, etc. To eliminate and control these issues, student loan servicing software could be a reliable choice that comes with exquisite features and benefits to elevate student lending processes in educational institutions. Following are some of the best loan servicing tools for student lending;

Bryt

Since 2016, Bryt has been one of the best student loan servicing solutions to streamline manual and complex loan-related tasks. It comes with an automated lending engine to serve hassle free and personalized lending experiences to students. Features like automated loan workflow, contact relationship management, omnichannel experience, advanced loan tracking, built-in reporting and documentation, prepopulated loan notices, loan payment wizard, regular payment schedule, built-in interest accrual, automated late fee calculation, etc., ensure timely loan servicing without any inconvenience to students. The pricing plans for the business version of this software start from $59/month per user with additional charges for addons and modules.

Scratch

Scratch is a scalable loan servicing software that educational institutes and student lenders use for enhanced visibility, delivering enhanced repayment experience, and gaining better control in student loan servicing. The software comes with a user-friendly borrower portal that allows borrowers to track their loans, set up autopay, view statements, see real-time data, and manage loan progress. Personalized support, daily portfolio insights, variable interest rates, flexible accommodation policies, real-time loan updates, compliance, delinquency management, skip tracing, credit bureau reporting, and SCRA monitoring are some great features to help student borrowers manage and pay back their loans seamlessly.

Loan Servicing Software for Consumer Lending

In the consumer lending industry, the need to quickly approve and service loans is higher than ever. In such a scenario, loan servicing solutions are among the most efficient choices that consumer lending businesses can use to efficiently execute their functions. These performance driven solutions allow consumer lenders to gain real-time data on loan performances, automate interest calculations, generate accurate reports, track changes in regulatory requirements, assess loan information, simplify repayments, etc. Here is a reliable loan servicing software for consumer lending;

FUNDINGO

Since 2013, Fundingo has been helping consumer lenders reduce financial risks, optimize errors, bring better cost effectiveness, allowing them to lend better. Through this software, users can rapidly generate and customize statements in a few clicks, monitor repayment trends, automatically calculate disbursements, track performance metrics, etc. It offers next level automation, reporting, and security capabilities with enhanced efficiency and control. The tool is reliable for consumer lending firms struggling with deal management inefficiency as it comes with a comprehensive tracking system, automated alerts, pricing options based on previous deal performance, and many more features to optimize agreements and renew terms, ensuring an increase in renewals.

Conclusion

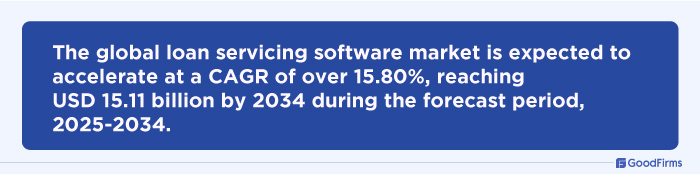

The loan servicing software market is likely to grow at a CAGR of 15.80% in the near future owing to the increasing demand for efficient loan servicing software. AI and machine learning technologies are making lending and processing much easier for lenders. Integrated loan servicing software systems with Big Data analytics is equally contributing to enhance the services to maximize collections and supports the borrowers to reduce delinquencies.