ABSTRACT:

The Covid-19 pandemic triggered digital adoption to a greater extent. Mobile money picked up drastically across many parts of the world. People who never had a bank account started using digital banking, storing money, and making payments through mobile phones. Banks started offering a complete range of financial services, from deposits to transfers, credits, and payments, right through applications. Tech-driven banking solutions like mobile banking have enabled several underdeveloped countries to leap ahead. Convenience, privacy, feasibility, and experience are some of the top reasons for the rapid adoption of mobile banking facilities.

Mobile banking apps have reduced contact points and have become a single point of interface for all banking service needs. However, concerns regarding the safety of funds and financial data restrict many banking customers - from using mobile banking apps.

This research titled: 'Mobile Banking Apps - Market, Scope, and the Future' identifies and analyzes the market dynamics, scope, and opportunities in mobile banking apps. Goodfirms conducted an online survey between 15th Sept 2022 and 21st Sept 2022. A total of 860 responses were collected. The survey queried selected banking app users across the world on their banking app usage, experience and challenges. The survey uncovers technologies and factors that will assist the future growth of mobile banking apps. The research also explores a few current factors that contribute to the increasing use of mobile banking apps. The research aims to help banking partners in getting valuable insights to scale their business further and attain a more profitable regime. The survey insights will also help in improving the experience for banking customers.

Table of Contents:

Introduction

Global Mobile Banking Market

Survey and Data Analysis

- Customers Prefer Private Banks

- Mobile Banking is the Preferred Choice of Users Over Net Banking

- Mobile Banking Apps Usage Behavior

- Satisfaction Levels of Mobile Banking App Users

Top Features Accessed and Utilized in Mobile Banking Apps

- Account/Check Related Information

- Mobile Fund Transfers

- Online Bill Payments

- Card Control Services

- Make Bill Payments for Utilities, Online Products, and Services

- Self-service Options

- Other Commonly Used Features

Most Preferred Functions in Mobile Banking Apps

Challenges in Mobile Banking Apps

Future Opportunities And Scope for Mobile Banking Applications

Technologies That Will Revolutionize the Mobile Banking Apps

Focus on User Preferences Will Open Numerous Opportunities

Key Findings

Conclusion

References

Introduction

The use of digital technology is making life easier. The banking industry’s initiative towards fulfilling the demand for digital banking services came into effect with their move toward mobile banking. This facility allows users to access the bank’s app via smartphone and do banking at their convenience from their phone. The Covid-19 pandemic undoubtedly accelerated the adoption of digital banking, and the journey will likely evolve in the coming days. Digitally in touch with the banks allows customers to know when the balance is low or when and what type of transactions are made, in real-time, and to conduct all transactions through the app without personally visiting the bank. Such a facility gives complete control over the financial position of the users from anywhere.

However, frauds, server issues, and hacking are the top challenges experienced by users when using mobile banking apps. The banking sector is deploying advanced technologies and striving to find more strategic options to mitigate these challenges.

This research survey titled: 'Mobile Banking Apps - Market, Scope, and the Future’ aims to deliver reliable statistics about the current state of mobile banking apps. The survey reveals critical insights regarding the market, scope, and future opportunities in the mobile banking apps segment. The research also outlines the popular features, required functionalities, and significant challenges associated with mobile banking apps.

Global Mobile Banking Market

Technologies are developing with time, leading to new changes in almost every domain. One such domain is the mobile banking apps market which is also going through a transformative phase. An increase in the use of smartphones, changes in user preferences, and evolving technologies like AI, IoT, Blockchain, etc., can bring unprecedented changes to the mobile banking apps sector. However, ongoing global tensions associated with the Ukraine-Russia war and the China-Taiwan crisis may impact this growth.

The mobile apps market is expected to reach US$430.90 bn by the end of 2022 year.(1) The growing reliance on mobile is pushing humans into a new technological era in which people spend more on mobile apps. People use mobile apps for different purposes, and finance management is one of the crucial segments of the mobile app market.

North America is the Biggest Mobile Banking Application Market

The mobile banking market was worth $692.5 Million in 2021 and is expected to grow steadily at a CAGR of 11.9% till 2028.(2) North America is a leading mobile banking apps market and commanded 42.9% market share in 2021. Various factors contribute to this domination, such as emerging new fintech technologies, increasing investment in mobile banking apps, customized service offerings, etc.

The Best Banking Mobile Applications (As of 2022)

Bank of America and JP Morgan Chase are leading banks if we consider the number of mobile banking customers.(3)(4)

Bank of America: Bank of America is one of the few banks that focus on their application for delivering a more personalized digital experience to their customers. With BoA mobile app, millions of their customers can have safe, easy, and convenient access to the following features:

- BoA provides an integrated view of financial information, including savings, credit cards, private bank accounts, investment accounts, etc.

- It also provides an extended AI-driven virtual assistant for portfolio performance, investment balances, trading, holdings, etc.

- It comes with in-app trading for accessing and executing market trades.

- BoA also offers a consolidated view of rewards and offers.

- A broad set of capabilities, including bill pay, funds transfer, budgeting, shopping, etc.

JP Morgan Chase: With a multi-pronged mobile strategy, JP Morgan Chase delivers an exceptional mobile banking experience to its users. The bank has successfully managed to continue the momentum growth in its customer base by providing various key services through its sophisticated mobile banking app. JP Morgan has been continuously focusing on improving the mobile banking experience through regular investments in data analytics, artificial intelligence, and its mobile banking platform. Key features include:

- 24/7 Access to account information, investments, deposits, credits, etc.

- Protection with multi-layer security protocols

- Customized reports regarding portfolio

- Transfer money, pay virtually, manage bills, personalize profile, track spending, etc.

- Access tax documents from within the app

Survey and Data Analysis

Goodfirms surveyed 860 banking mobile app users to gain an understanding of their perception, user experience, issues, and preferences. The survey revealed key insights regarding the mobile banking space globally.

Let us analyze the survey findings in detail:

Customers Prefer Private Banks

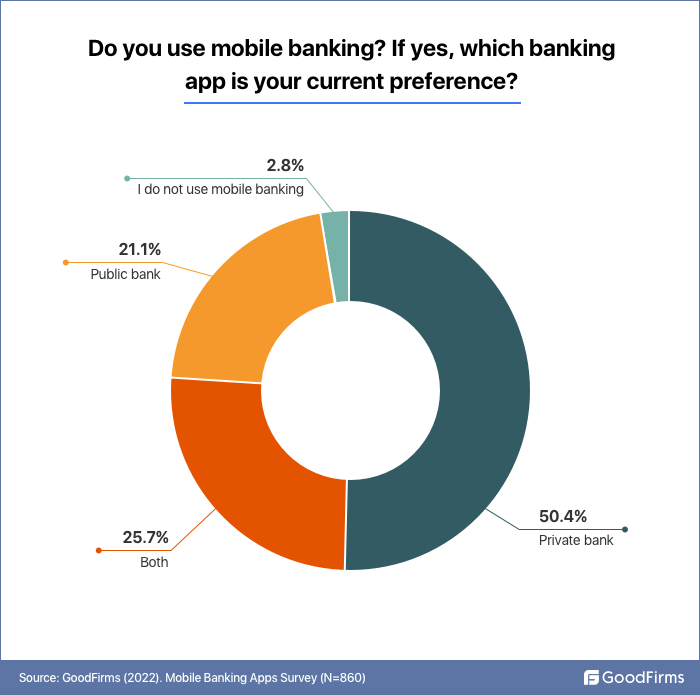

50.4% respondents use private banks’ mobile applications for their financial needs

50.4% of respondents prefer apps of private banks for their banking requirements instead of public banks. These respondents belong to the age group 25-39. Most of these respondents use private banks’ mobile apps to deposit checks quickly, initiate wire transfers, and use mobile banking features. People also consider the services of private banks as effective and efficient, whereas public banks are perceived to be slow in processes and poor in their digital services. Private banks like JPMorgan Chase, UBS, Credit Suisse, HSBC, etc., dominate the mobile banking apps market, mainly in the European and Latin American regions.

Reasons for choosing private banking apps are as follows:

- Ability to create disposable virtual cards from the Mobile Application.

- Ability to dispute Credit card transactions directly from the Mobile app.

- Ability to view Recurring bills, subscriptions, and memberships in the mobile banking app.

- AI chatbot support within their mobile banking app

- Fully digital account opening

25.7% respondents use both public and private banking applications

People from multiple age groups (18-24, 25-39, and 40-59) use both types of banks. These respondents generally use public banks to store their savings, whereas private banks meet their everyday financial needs.

21.1% respondents prefer public banking applications

21.1% surveyees prefer public banking applications instead of private ones, as some public banks give exceptional customer experience to users through mobile apps. In addition, money in public banks is also considered secure, due to which people often open accounts in them and use their applications when needed. Most public banks in the present time also offer digital services, including mobile applications. The majority of the respondents who use public banks belong to 40-59, who tend to have savings for their future and retirement.

2.8% surveyees do not use banking applications

Only a tiny percentage of surveyees are not interested in mobile banking applications. There is a dire need for banks to target such customers to raise their market share and customer base. There are various reasons for not using mobile banking applications in the present age, such as network connectivity issues, lack of awareness, security and fraud issues, etc.

Mobile Banking is the Preferred Choice of Users Over Net Banking

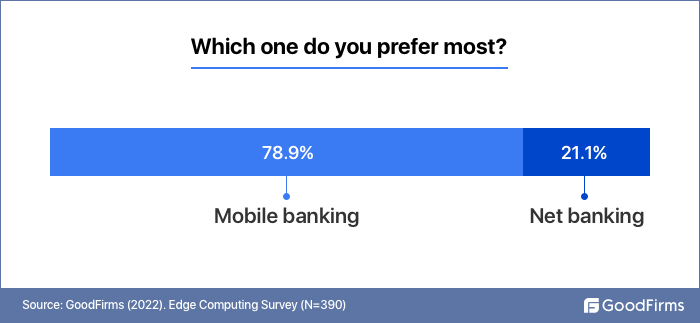

78.9% prefer mobile banking apps instead of using other net banking methods

This indicates that most people prefer mobile banking over other financial platforms. The main reason behind these huge preferences is the users' satisfaction and convenience that mobile banking apps offer. Banks with no mobile banking apps need to invest highly in applications to attract more customers and widen the scope of mobile banking applications.

The universal presence of mobile devices is allowing banking to be more tedious than it was ever. The rapidly increasing number of mobile users is also fueling the growth of mobile banking apps. As per the Goodfirms survey, only 1.1% use mobile banking apps once a month; the rest surveyees use their banking apps regularly, i.e., either daily, weekly, or every other day.

Mobile Banking Apps Usage Behavior

36.8% respondents use their banking app once a day, and 24.4% surveyees use their banking app twice a day

People who use their banking apps daily tend to execute multiple daily functions. They perform functions mainly to check their balances and transfer funds. These respondents mainly belong to the age group 18-24 and 25-39, who do not prefer to carry cash; instead, they make payments through their mobiles.

27.8% prefer to open their banking apps every week

These respondents tend to open their banking every week, mainly to pay their bills and online shopping products. These people mainly belong to the age group 25-39, who do not have much time to open their banking apps daily as they are mainly corporates and business persons who look out for settlements and reconciliation at the end of the week.

10.1% surveyees prefer opening their banking apps every second day

These respondents are from all age groups, but the majority belongs to younger generations who usually go out with friends and relatives for various purposes such as dining, party, etc.

Satisfaction Levels of Mobile Banking App Users

52.8% are delighted with the services provided by banking applications

This huge satisfaction level among banking app users directly states the impact mobile banking apps have on people's lives. These respondents perform almost all financial functions from their mobile banking apps, including bill payments, funds transfers, checking bank statements, drafting checks, etc. Most of these people are from age groups 40-59 whose banking issues are resolved without visiting the banks. A small number of these respondents also include people from age groups 25-39 who are using basic functionalities of the apps.

30.6% are neutral about their banking apps, whereas 13.9% are slightly satisfied with their banking apps

These customers mainly belong to the age groups 25-39 and 18-24 who look out for extra functionalities and benefits from their banks. These respondents mainly desire one-click payments, rewards points, discounts, etc. Banks should target these customers and take their feedback more often to add more customers.

2.7% are not at all satisfied with their mobile banking apps

These people are among the most demanding customers. Such customers can only be handled with a proper strategy, including taking feedback, serving new deals, loaning on low rates, etc. The main concern behind the dissatisfaction among these customers is the security and safety challenges associated with the theft and hacking of financial information. Previous experiences or untoward incidents are also reasons for the discontent.

Top Features Accessed and Utilized in Mobile Banking Apps

Account/Check Related Information

75.3% surveyees use mobile banking apps for viewing accounts/check related information

This is a fundamental feature of any mobile bank application. From tracking transactions to checking balances, mobile banking apps allow users to access different types of information as per their needs. People also check pending transactions, transaction date and time, account statements, etc., through their mobile banking app. Some users also check their banking apps' loan and credit card statuses to prevent skipping their EMI.

Mobile Fund Transfers

61.6% respondents prefer to transfer funds via mobile banking apps

Fund transfer is also a crucial feature of mobile banking apps. Fund transfer through banking apps is more seamless and convenient than other methods as, with few details, users can quickly transfer the funds to other accounts irrespective of the banks. Several bank applications provide fund transfer methods, including A2A, B2B, P2P transfer, etc.

Online Bill Payments

44.4% prefer online bill payments through their banking application

Bill payments through checks or physically visiting the stores are things of the past. In addition, offline bill payments are also inconvenient, time-consuming, and costly. With the rise of online bill payment systems, consumers are now paying their bills while sitting at home with their devices.

Moreover, app users can also set up automatic bill payments for recurring bills. In addition, people can also set reminders for upcoming bill due dates to ensure timely payment.

Card Control Services

30.6% surveyees use the ‘card control services’ feature in the banking apps

These services come in handy when users' credit/debit cards get lost or stolen. Card control services are mainly used for activation, deactivation, and restricting international transactions. Users can also set up card-specific alerts to acquire complete control over their debit and credit cards. Card control services also allow fraud protection and spending control to ensure the security of cards.

Make Bill Payments for Utilities, Online Products, and Services

Bill Payment for Utilities and services stands as the top factor in using a mobile banking app for 25% of the surveyees.

In the present technological era, mobile banking apps are used to pay for almost all services. Banking apps always come in handy whether online shopping or paying water and gas bills. Mobile banking apps offer quick services that allow faster checkouts and bill payments. In addition, some banking apps also provide reward points in return for making payments for utilities and online services.

Self-service Options

11.1% surveyees indicated self-service as the top factor in using a mobile banking app

Self-service options play a significant role in automatically eliminating customers' basic issues. It also offers convenience as many tasks are executed with the app's help instead of calling or texting the bank officials. Self-service options are helpful for tasks such as stopping payments, reordering checks, ordering personalized debit/credit cards, updating profile information, wealth management, etc.

Other Commonly Used Features

8.3% surveyees liked the account and fraud alert on their banking app

Almost all banking apps support account and fraud alerts allowing users to determine their bank accounts' health status. Users are using various types of alerts, such as low balance, direct deposit, unusual login, large purchases, large ATM withdrawals, etc., to ensure the safety of their account information. The users also set up alerts regarding credit and debit transactions to keep track of their expenses. Alerts are very much needed in present times for quick updates and notifications.

7.3% respondents mostly use ATM and bank locator feature

ATM and bank locator is another super essential feature that the banks use for displaying the locations of their ATMs and branches within the app itself. Many customers demand this feature to locate their nearest ATM and bank branches. Geofencing and beacon technology are being used for this feature to share the nearest ATM location with users within the app.

5.6% surveyees liked the touch and face id feature of their mobile banking app

Biometric security is crucial in the present technological era for ensuring the safety of financial data and money.

By using touch or face identification, application users can prevent their apps from unauthorized access. Banks are also giving biometric features in their applications to prevent identity theft, skimming, account hijacking, etc. This functionality was designed to secure sensitive financial information while complying with financial rules and regulations.

The ongoing trends in the mobile banking apps market favor simplification and convenience, with features such as fingerprint login and touch ID becoming increasingly common. There is also a trend toward incorporating more financial management features into mobile banking apps, such as budgeting tools and spending trackers, says Marcus Astin, COO, Pala leather.

3.7% respondents access coupons and deals to get discounts from banking applications

Some banking apps also provide in-app coupons and deals to avail discounts while shopping. These coupons and deals give huge benefits and discounts in various categories such as F&B, electronics, electrical, home accessories, etc. Some banking apps even allow reward points for specific activities like traveling, dining, etc., that are useful in shopping.

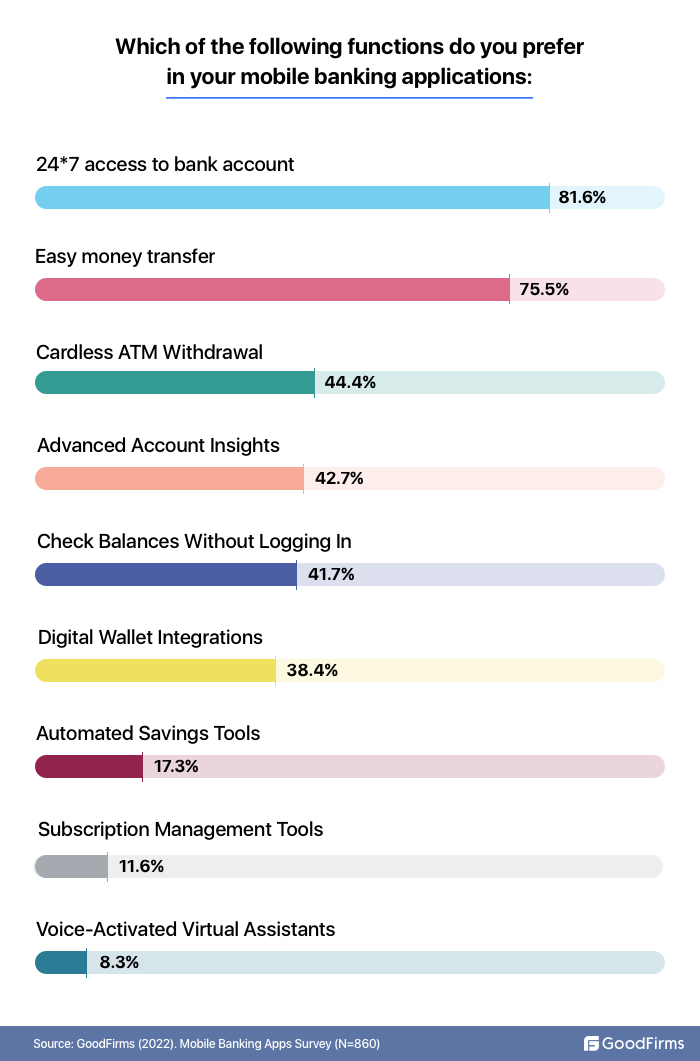

Most Preferred Functions in Mobile Banking Apps

24*7 Access to Bank Account

24*7 access stands as the most preferred function of the mobile banking app for nearly 81.6% surveyees

Most mobile banking apps offer 24*7 access to bank accounts for different purposes; however, there is a dire need to focus on the quality of services instead of saying 24*7 service availability. More and more respondents want to access their bank whenever they need. They do not want to wait for bank branches to open when they need banking assistance during any emergency. Mobile banking apps solve this problem through which customers can avail of their banking services at any time from anywhere. People do not desire to go out much in these challenging times, and banking app gives them this convenience.

Easy Money Transfers

75.5% respondents prefer easy money transfers through their banking app

This is one of the most convenient reasons why people prefer banking apps. Mobile banking apps allow users to quickly transfer their money to other people within seconds without worrying about cash. They send money to any person or business through their mobile application with just some taps.

Cardless ATM Withdrawal

44.4% prefer cardless ATM withdrawal by using their bank application

In the 21st century, humans are considered very busy as they do not wait. Instead, they need everything quickly. In addition, the use of contactless payments is also rapidly increasing among people. Such people prefer cardless ATM withdrawal, which reduces the contact points for withdrawing cash from ATMs. Just by opening their banking app, customers can withdraw their cash without the hassle. This function is helpful in cases when people do not carry their cards.

“Since the advent of the dread of a pandemic, which caught everyone by surprise, contactless transactions have been the standard everywhere. Numerous firms currently provide QR code technology that can be used to conduct touchless transactions. Its subsequent natural adoption is exemplified by touchless ATM transactions in the banking industry. This is accomplished using the bank's mobile application. This strategy makes withdrawals faster and more secure and minimizes the likelihood of card skimming and other fraudulent activity by a significant margin”, says Steve Elliott, Franchise Owner, Restoration1.

Advanced Account Insights

Advanced Account Insights delivered by the Mobile Banking Apps Stand as the Most Appealing Function for Nearly 42.7% of the Surveyees

Most banking apps offer only essential account insights associated with a bank account, credit/debit cards, bill payments, etc. Nowadays, people use banking apps not just for checking balances and paying bills; instead, they also desire to gain deep insights into their financial decisions and investments. They also desire to link their external accounts with their banking apps to gain insights about spending in a single place.

Balance Check

41.7% respondents stated that they want to check their balance without logging in

This feature was not available earlier in the banking apps, but now a few banks like Citi Mobile, Discover bank, Bank of the West, etc., are giving this feature in which users can check their account balance with just a tap. However, they need to initially log into their account so the app can easily display the balance. In addition, other essential features, such as credit card summary, account statements, etc., can be seen too using the mobile banking app.

Digital Wallet Integration

38.4% Indicated digital wallet integrations as the top-most function in their banking apps

Various payment applications or digital wallets are available on the internet for different purposes, such as Paypal, Razorpay, etc. Currently, most banking apps do not provide digital wallet integrations, but they are one of the most desired functionalities in banking apps. As per Goodfirms' survey, digital wallet integrations allow customers to refill their wallets directly from the app instead of specifically opening the wallet app for funds refilling.

Automated Saving Tools

17.3% indicated automated savings tools as the best function in their banking apps

People use their money for various things, irrespective of whether they are necessities or wants. However, they also want to save money for future or unpredicted needs. Customers expect their banks to help them save money for the future. Third-party apps like Plum provide automatic savings tools to customers, but people won't trust these easily. Automated savings tools can also improve customer satisfaction if given in banking apps.

Subscription Management Tools

11.6% want to have subscription management tools in their applications

Nowadays, people who use online banking apps also subscribe to other services associated with entertainment, shopping, groceries, etc. Due to this, they want to manage their subscriptions from their banking app. Customers strongly desire subscription tools in their banking apps to track information such as subscription charges, subscription period, starting date, etc.

Virtual Assistants

8.3% want to use voice-activated virtual assistants in their mobile app

By leveraging technologies like AI, ML, Big data, etc., banks can provide voice-activated virtual assistants to customers from their applications. These virtual assistants are useful in resolving the banking queries of customers by talking to them. Erica by Bank of America is a voice-activated virtual assistant capable of alerting customers regarding duplicate charges, subscription renewals, bill reminders, etc., from the app itself.(5)

“In the future, voice banking will offer a favored user experience. While Erica, a virtual assistant, assists a number of users, voice assistants are revolutionizing the creation of banking and finance apps. The new trend may enable the app to transmit voice alarms in the event of fraud, double billing, or a spike in subscription fees. They can assist with paying bills as well. The consumer insights, interaction, and conversions will rise with further app optimization that includes a vocal user interface for sound-driven search”, says Matthew Dailly, Managing Director, Tiger Financial.

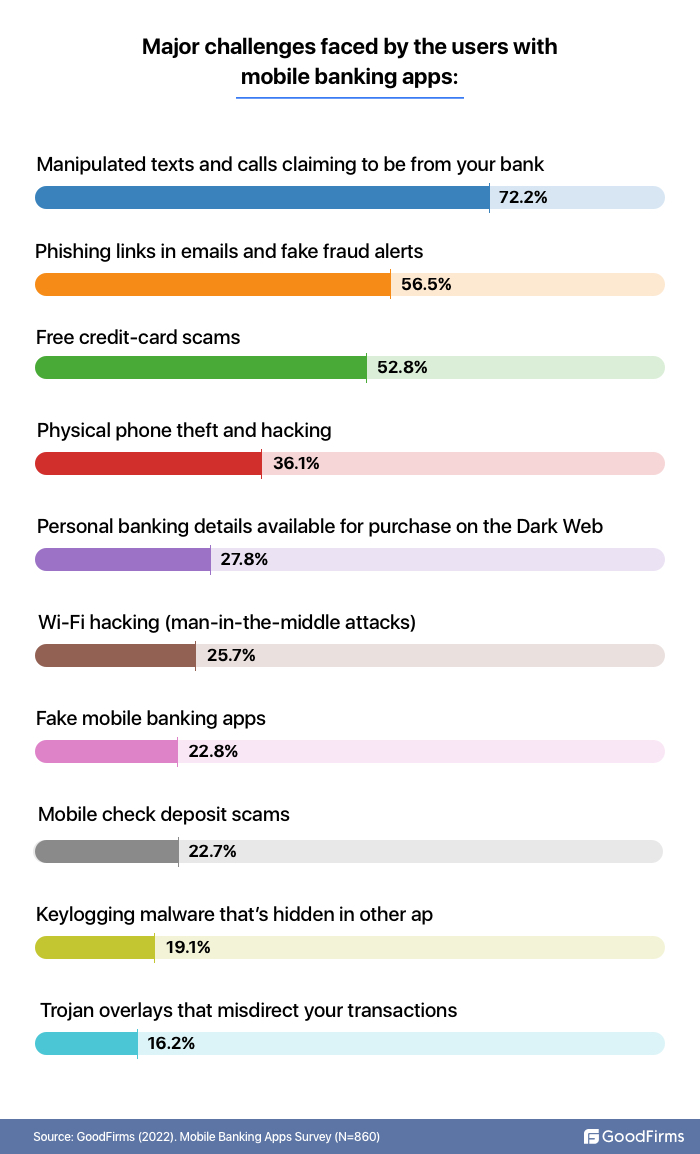

Challenges in Mobile Banking Apps

Mobile banking apps are rapidly increasing as they provide several benefits to users, like fund transfers, bill payments, applying for loans, account opening, etc. There is a vast scope for mobile banking applications if user expectations are fulfilled along with a good experience. There is a dire need for improvements in mobile banking apps to stay ahead with unprecedented speed.

Here are some of the challenges experienced that developers, users, and banks should address to achieve sustainability:

#Challenges for End-Users

Customers of the banks are end users when using mobile banking apps. They encounter many issues that deteriorate their experience and satisfaction levels. Some of the commonly encountered end-user challenges as per our survey are as follows:

Manipulated Links/Texts/Calls are Some Most Commonly Encountered Challenges

People consider banking apps as convenient and fast to use, but at the same time, they are also concerned about their account and money security. People have encountered a range of challenges when it comes to mobile banking apps.

72.2% of respondents agreed that they receive manipulated texts and calls claiming to be from their bank. In addition, 56.5% surveyees received phishing links in emails and fake fraud alerts in their device notifications which often leads to money theft. 52.8% of respondents also stated that they have encountered free credit card scams.

Banks have access to the credit and income history of their customers. When people have to use their financial information for purposes such as loans, credit cards, etc., they usually give their bank information to third parties so that the financial information can be caught automatically instead of manually entering data.

This often leads to data leaks as not every third-party organization makes money as per its ethical code. Instead, they sell the data to other people for financial gain. The buyers then usually call, text, or email the users and try to access their bank accounts in the name of suspicious transactions, new services, account issues, etc. The data buyers even use spoof phone numbers and mail addresses to look like official agents from Banks.

When this data makes it to the black market, scammers connect with the users to acquire their OTPs or passwords for money transactions. Banks should spread fraud awareness among their customers to prevent such security challenges.

Phone Loss/Hacking is Another Major Challenge for Mobile Banking App Users

36.1% of surveyees fear phone theft and hacking

Currently, the mobile is the most used device for banking needs. Even passwords and OTPs also come on mobile numbers to make a transaction. Many people store their financial credentials and information on their mobile devices, and others can illegally access this data after theft or hacking.

"The lack of encryption on mobile banking service providers' servers poses the greatest security risk. A skilled hacker will have no trouble stealing users' banking details. There is no encryption on bank-sent messages, either. Because of this, the data will be easily intercepted as it travels through the mobile operator's network. For example, if your phone is lost or stolen, the information contained in your messages could be read and used by a thief", says Joe Troyer, CEO of Review Grower.

So, if the mobile gets stolen or hacked, the financial data of the mobile user is exposed to other persons. In such cases, sometimes, the user data is available for sale on online platforms, including websites, social media platforms, etc. It is essential for banking app users to set up automatic erase in their devices to initiate when the phone is lost or stolen.

Fake Banking Apps and Check Deposit Scams are Rapidly Increasing

22.8% surveyees encountered issues with fake mobile banking apps, and 22.7% with check deposit scams

When scammers cannot access the banking applications of users, they usually try to trick people into installing a new fraud app. These apps look entirely similar to the official bank applications but do not function like one. When users insert their credentials into the app, they send these credentials to scammers that are used for logging into real banking apps. In 2020, more than 65,000 cases of fake banking apps were reported to the FBI, which were available in major app stores.(6)

Fake check deposit scams are among the oldest bank scams, and with mobile banking apps, they are the easiest to cash. Scammers usually send a check to bank users posing as an employer, buyers, or sellers. When the check is cleared after depositing it, the scammers ask for a refund of money. Federal Trade Commission (FTC) states that the deposited checks look like real ones and are difficult to distinguish even by the bank employees. FTC has also listed ways to prevent mobile check deposit scams on its website.

Network Challenges

Network coverage failure is another issue that is impacting the user experience. Network challenges can arise due to various conditions, such as improper hardware installation, weather conditions, software issues, etc. In addition, network challenges also occur when the application infrastructure is extensive in terms of content, graphics size, etc.

#Challenges for Developers

Meeting Security Standards

It is one of the core challenges for developers working on banking apps. Banking apps usually connect with different financial institutions and services to process financial information, creating multiple opportunities for hackers to steal the data to sell it illegally. Cases of data breaches are increasing year on year basis. Developers are already aware of security challenges that can compromise the data but still lack in eliminating all potential data threats.

As per Goodfirms' survey, 27.8% respondents encounter challenges associated with the availability of their financial data on dark web portals. In addition, wifi hacking is a gruesome challenge for 25.7% of respondents, which can be avoided by using secure wifi.

“Using a secure wi-fi account when conducting business via mobile app is another way to lessen the likelihood of a security breach. If you need to check your business account balance or make a transfer and you are at a large event or conference, connecting to the public wi-fi increases the risk of these actions being intercepted”, says Jake Cowans, Founder, Companyscouts.

Malware cyber attacks are prevalent in the present times, with over a million cases and types. 19.1% surveyees also experienced keylogging malware that's hidden in other apps. Scammers not only target financial applications but also tend to hide keylogging tools in the code of other applications under the tag of optimizers, utilities, entertainment, etc. These tools can record all user information on their devices, including messages, contacts, passwords, etc. Keylogging malware can enter your device even through a public QR code.

16.2% reported challenges associated with trojan overlays that misdirect the transactions

Some malware types can record what users type on their mobile devices, whereas others can intercept your communications and replace them with their information. A code hidden in the applications, such as a virus or trojan, can compromise the devices.

These trojans or viruses can perform illegal transactions on a device, making them look like normal transactions, but in reality, users' devices are exposed to scammers. For example, a malware named Sharkbot was discovered by cyber experts that can initiate money transfers and access personal information, credentials, current balance, etc., from the victim's device, bypassing the multi-factor authentication mechanisms.(7)

Mobile Application Developers must look upon such challenges to provide the best services to the customers. For example, developers can build functionalities that will block the transactions in case of any suspicious activity, like different locations for logging in to applications and withdrawing money through ATMs. They can also optimize the number of touchpoints through which hackers can steal the data. Developers can even install stringent firewalls in the bank applications to meet security challenges.

Attractive UI/UX

Good quality-based UI/UX design is the utmost necessity for customers. When the UI/UX of an application is not appropriate, it often leads to a bad experience and low satisfaction levels. It is not an easy task to create exceptional UI/UX designs that can meet the expectations of all mobile banking customers. Creating designs for everyone is challenging as some prefer simple UI/UX, whereas others prefer advanced styles, including CSS and animations.

Developers should conduct proper research before working on UI/UX so that they can consider the preferences of everyone in the UI/UX development.

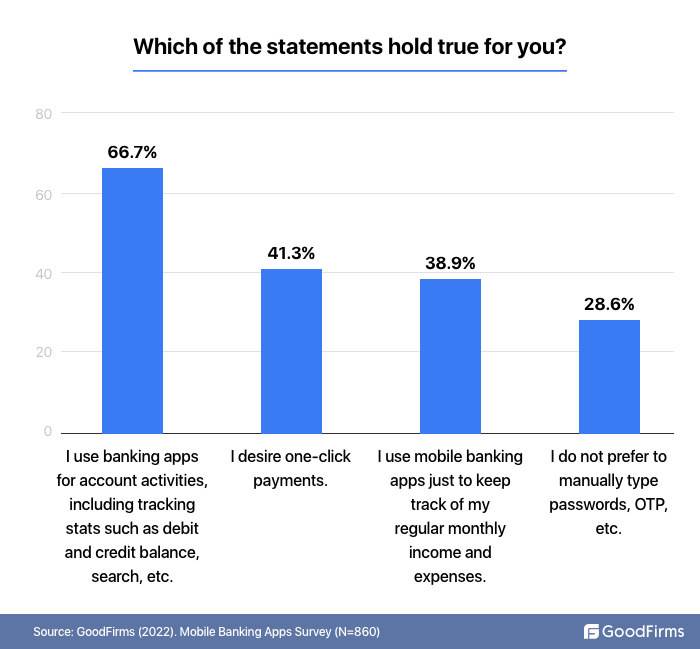

Choosing the Right Features

Features play a significant role in deciding whether a bank is feasible or not for financial services. Suppose essential features are unavailable in the bank's mobile application; in that case, the absence of certain features can impact customer satisfaction levels as they have to visit physical branches. If valuable features are not provided to the users, then even the most secure and high-performance-based applications are useless.

66.7% use banking apps for account activities, including tracking stats such as debit, credit balance, etc.

The banking app developers need to ensure that these essential functions, like debit and credit balance, etc., are working correctly without any issues and bugs. These functions are primarily used by customers, and therefore, developers need to focus on these functionalities intensively.

41.3% of people prefer one-click payments, and 28.6% do not prefer manually typing passwords, OTP, etc.

People in the 21st-century desire one-click payments through their apps without any need to manually enter OTPs, passwords, etc. Through this, they try to save time.

38.9% use mobile banking apps just to keep track of regular monthly income and expenses

People usually spend their money on different purposes, and it becomes hard for them to keep track of their expenses. Therefore, they expect their mobile application to show them their expanses about how much they save, spend and get.

Developers must conduct studies to determine the required features in the application. Popular features like checking account-related information, fund transfers, online bill payments, ATM & bank locator, etc., are a must in the present times.

#Challenges for Banks

Achieving Regulatory Compliances

The financial industry needs to ensure a vast number of regulatory compliances from the governments or local authorities to function within the legal parameters. They have to follow a considerable number of laws, requirements, and processes to prevent any operational challenges. These financial regulations and laws vary with the nature of the apps or banks. For example, for American users, Electronic Fund Transfer Act (EFTA) covers card transactions, and it is essential to have required permission from the federal government.(8)

Financial organizations must also comply with the Payment Card Industry Data Security Standard (PCI DSS) for card transactions. Organizations must comply with the New Payment Services Directive (PSD2) for European users.

“After security, the top most hurdle that you may face is getting compliance. This is because it is a more confusing and time-consuming task, says, BillyParker, Managing Director, Gift Delivery.

Banks must ensure that such laws are complied with to prevent any penalty from the authorities.

Keeping up With the Shifting Banking Habits of Customers

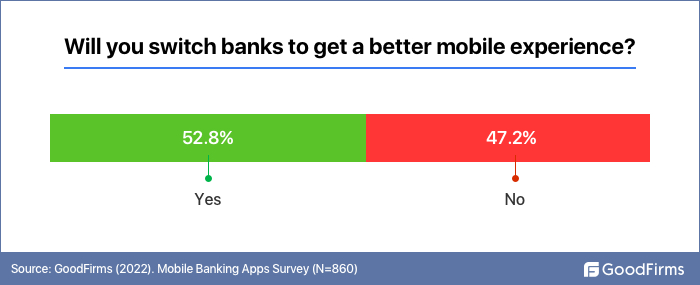

This is one of the major concerns for banks. 52.8% of respondents are willing to switch banks for a better mobile banking experience. If banks are not keeping up with the latest trends and shifting bank habits of customers, then it can lead to dissatisfaction among them, and they may switch their banks. Banks must stay aware of the latest technological developments, security issues, trends, etc., to effectively serve their customers. This is also essential to stay ahead of the competitors in the market.

Protecting user data and ensuring user convenience

With banking apps come the inherent security concerns associated with data privacy and protection. Currently, banking app users are susceptible to cyber attacks on their bank information and data. A bank's responsibility is to protect its customers' sensitive financial data from being hacked or stolen. Banks should ensure that they provide suitable security measures so that illegal access to user data without permission can be prevented.

As per Goodfirms' survey, 77.8% of mobile bank app users are very concerned that someone will illegally use their personal bank account information. Apart from this, respondents are also very concerned about the following issues:

- Someone will use their login credentials

- Someone will transfer funds from their account

- Someone will write fraudulent checks off their account

- Someone will steal their identity

Future Opportunities And Scope for Mobile Banking Applications

Mobile banking apps and their users are growing in number. In the US only, mobile bank application users are expected to reach 217 million by 2025.(9) Similar growth is expected in other regions, such as Europe, the Middle East, and Asia. In addition, consumer preferences, the latest technologies, new players, etc., will also contribute to the growth of mobile banking applications.

“Huge prospects lie in store for the future in this market. As more individuals become interested in using mobile banking apps rather than going into banks directly, there is still a significant amount of space for growth in this industry”, says Klara Dumancic, Marketing Specialist, Investors Club.

Various factors will drive this immense growth in the mobile banking apps market. These factors include new technologies, the satisfaction level of users, new and changed features, etc., which are discussed below.

Technologies That Will Revolutionize the Mobile Banking Apps

Internet of Things

IoT is an emerging technology for mobile banking applications that can influence the banking segment in several ways. Smart ATMs developed through IoT can reduce the queue at the ATMs, and users can use their app for withdrawing instead of physically using the cards. IoT also gave rise to 24*7 working chatbots that offer personalized experiences to users. It can also provide wealth management insights to users that alert them when approaching financial instability.

Artificial Intelligence and Machine Learning

Artificial intelligence and machine learning are boons for mobile banking apps as they execute various tasks automatically without human assistance. AI and ML are under development processes in the mobile banking apps segment. AI and ML are shaping new mobile banking application functionalities to enhance customer experience and satisfaction.(10) Some well-known AI applications in mobile banking apps include Chatbots, Self-service options, Robo advisors, Automated loan offers, etc.

“Artificial intelligence is here to stay. It is transforming the future of mobile banking. Most of the IT leaders of financial institutions claim that it is critical to implement AI-based solutions in the banking industry. Implementing AI solutions is increasing revenue, offering better adjustments to the client profile, and reducing costs. Also, the usage of AI support technology has significantly improved customer experience”, says Eric Jones, CEO, Couturecandy.

Big Data

The risks of digital fraud and scams are also increasing with the rise of new technologies. Big data can assist banks and developers in reducing vulnerabilities upto some extent. By using big data, organizations can improve their risk assessment to safeguard their customer's identity along with the optimum utilization of resources.(11) Through Big data, banks can collect the critical financial data of their customers, such as financial statements, banking history, loan records, etc. Then this data can be used to improve the services and prevent scams.

Big data is leading to unprecedented upgrades in the customer relationship management of the mobile banking sector, which will also be seen in the future.(12)

Cloud Computing

This is another interesting digital technology that can eliminate the need for hardware and physical infrastructure to improve the speed and flexibility of mobile banking processes. In addition, cloud computing allows system recovery, fault tolerance, and data protection for banking apps. When planning cloud initiatives in mobile banking, banks need to choose suitable service delivery models for better operational flexibility and cost savings.(13)

Blockchain

Blockchain technology came into the limelight after the success of the crypto market. It is rapidly becoming a disruptive force in the mobile banking segment that can do wonders for banks and their customers. Blockchain technology can eliminate third parties, which helps reduce costs and improve banks' profits.(14) In addition, it offers high transaction speed with advanced security features that prevent hacking or stealing money.

“The presence of diverse third parties frequently causes delays in the processes. In the end, this causes dissatisfaction among consumers and increases economic uncertainty. Right now, blockchain is the only available technology that gets to the bottom of this issue and solves it there”, says Emily Hutton, Chief Product and Technology Officer, Image Restoration Center.

Focus on User Preferences Will Open Numerous Opportunities

Customer preferences are dynamic and keep changing with time. According to Goodfirms’ survey, banking app customers desire 24*7 access to bank accounts, easy money transfer, cardless ATM withdrawal, and advanced account insights. These are the top preferred features that people want to see in their banking applications. Focus on these features can open multiple new opportunities for banks to gain new customers and a higher competitive edge.

In addition, other features such as balance checks without logging in, automated savings tools, digital wallet integrations, subscription management tools, etc., are also hugely demanded by customers. Demand for these features is expected to grow over the next few years, which should be banks' focus area.

Key Findings

- Private banks are more popular among customers in comparison to public banks.

- Customers prefer mobile banking apps over net banking.

- 36.8% of respondents use their banking app once a day, and 24.4% use it twice daily.

- Banking apps' top three functions are account/check-related information, mobile fund transfers, and online bill payments.

- Self-service options, fraud alerts, and ATM locators are also popular among mobile banking app users.

- 72.2% of respondents agreed that they receive manipulated texts and calls claiming to be from their bank.

- Network and security challenges are commonly encountered challenges for customers.

- As per Goodfirms' survey, 27.8% of respondents encounter challenges associated with accessing their financial data on dark web portals.

- 66.7% use banking apps for account activities, including tracking stats such as debit and credit balance, search, etc.

- 77.8% are concerned that someone will illegally use their personal bank account information.

- 52.8% are satisfied with the services provided by mobile banking applications.

- IoT, AI, and Big data are revolutionary technologies for banking applications.

- 81.6% of surveyees prefer 24*7 access to their bank account through their banking apps.

- 41.3% of people prefer one-click payments, and 28.6% do not prefer manually typing passwords, OTP, etc.

- Consumers also desire automated savings tools, subscription management tools, and digital wallet integrations in their mobile apps.

Conclusion

Nowadays, a major section of banking customers is using mobile banking applications on their mobile devices. As people are willing to spend more, they continue to depend on their banking apps for nearly every task, whether online shopping, tracking expenses, or paying bills. In addition, technologies like artificial intelligence, IoT, Blockchain, etc., enable developers to add new features to banking apps to enhance the customer experience. However, with increasing cybercrimes, it is crucial for banks and developers to address the challenges associated with security, network, server efficiency, etc., to make customers feel secure as well as acquire more market share.

Fulfilling customer expectations in this digital age can bring numerous opportunities for banking apps. Customers desire a quick and hassle-free experience from their banking apps which should be the main focus of every bank.

We sincerely thank our Research Partners who participated in the survey.

Survey Participants' Demographics

The data is sourced from a survey of the selected group of 860 mobile banking app users worldwide.

The survey participants belonged to the below demographics:

Age Group:

- 18-24 (31.7%)

- 25-39 (42.5%)

- 40-59 (18.1.%)

- 60+ (7.7%)

Gender:

- Female: 31.8%

- Male: 68.2.%

References

- https://www.statista.com/outlook/dmo/app/worldwide#:~:text=Total%20revenue%20in%20the%20App,US%24204.90bn%20in%202022.

- https://www.vantagemarketresearch.com/industry-report/mobile-banking-market-1521

- https://newsroom.bankofamerica.com/content/newsroom/press-releases/2022/02/digital-engagement-soars-at-bank-of-america-to-more-than-10-bill.html

- www.statista.com/topics/2614/mobile-banking/#dossierKeyfigures

- https://promotions.bankofamerica.com/digitalbanking/mobilebanking/erica

- https://www.ic3.gov/Media/Y2020/PSA200610

- https://www.cleafy.com/cleafy-labs/sharkbot-a-new-generation-of-android-trojan-is-targeting-banks-in-europe

- https://www.federalreserve.gov/boarddocs/caletters/2008/0807/08-07_attachment.pdf

- https://www.statista.com/statistics/1285962/digital-banking-users-usa/#:~:text=The%20number%20of%20digital%20banking,almost%20217%20million%20by%202025.

- https://www.researchgate.net/publication/346323685_Machine_Learning_and_Artificial_Intelligence_in_Banking

- https://www.researchgate.net/publication/357152903_Big_Data_Applications_the_Banking_Sector_A_Bibliometric_Analysis_Approach

- http://borneostudies.org/papers/banking.pdf

- https://www.researchgate.net/publication/266078602_I-BANKING_AN_APPLICATION_OF_CLOUD_COMPUTING

- https://www.researchgate.net/publication/327230927_Applications_of_Blockchain_Technology_in_Banking_Finance