Reportz

All-in-one reporting tool for digital marketers

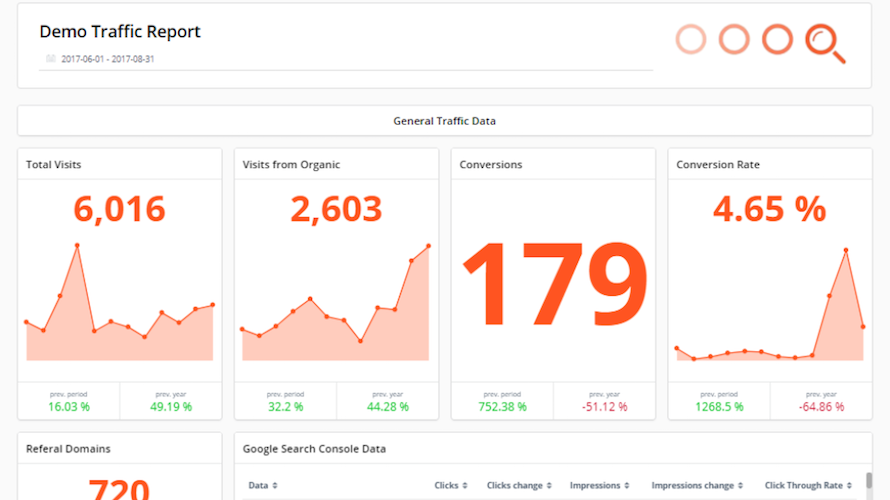

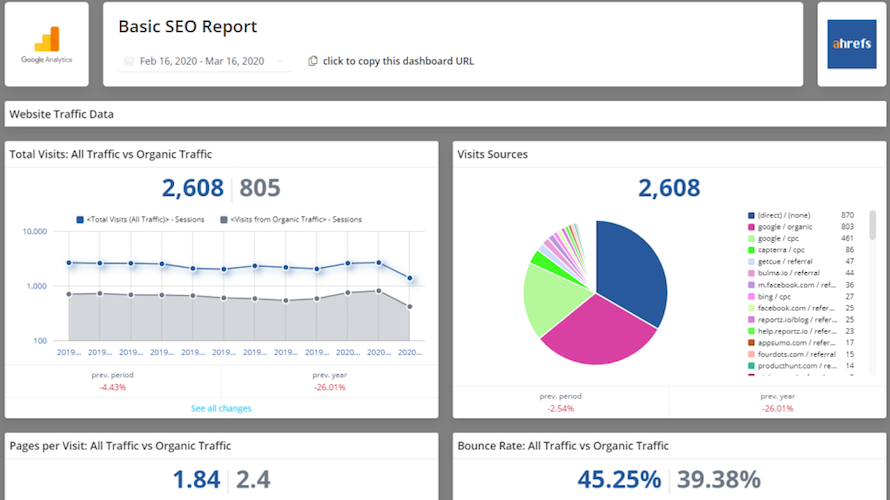

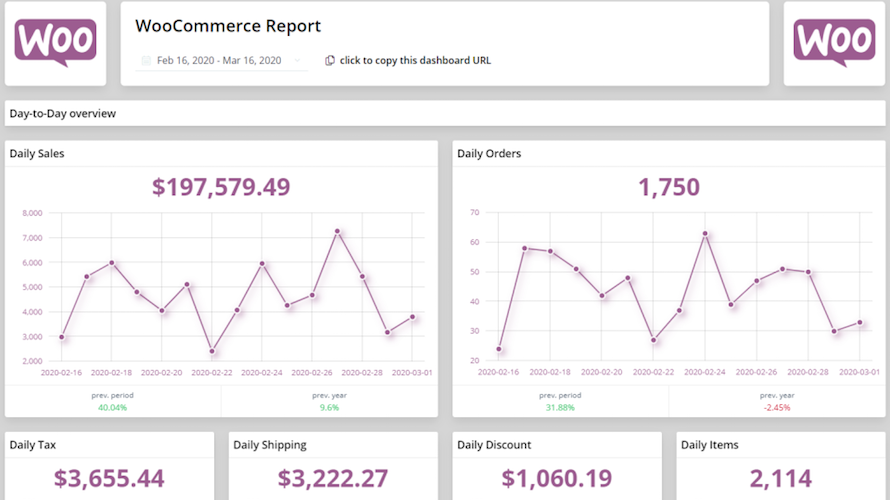

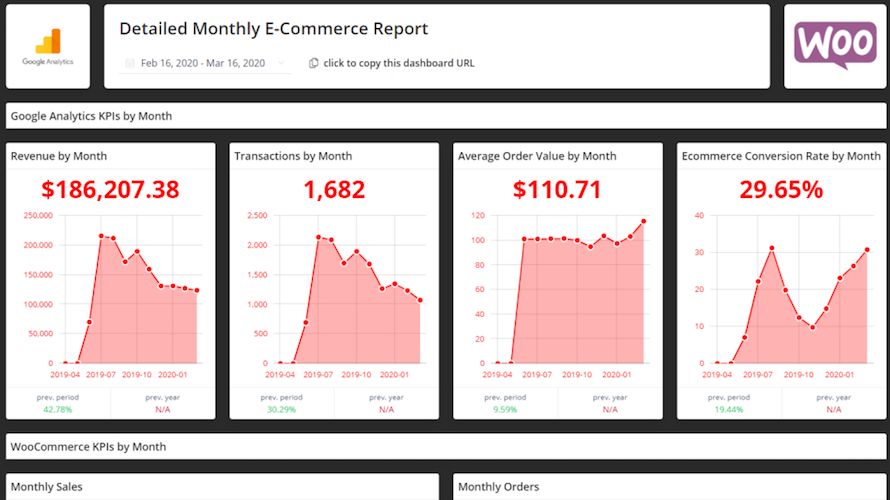

Reportz is an intuitive, white-label, client-reporting and data tracking tool created for marketers by marketers with the purpose of reducing the stressful and time-consuming client reporting process to mere minutes and clicks. Reportz users can make automated, real-time, informative, metrics-packed reports in the form of fully customizable dashboards and widgets. Set the KPIs once and let our tool do all the menial reporting work for you.

Licensing & Deployment

-

Cloud Hosted

-

Web-based

Support

-

Chat

Knowledge Base

-

Help Guides

-

Video Guides

-

Blogs

-

On-Site Training

Media

Reportz Core Features

Focus of Reporting Feature

- Automated Reports

- Customizable Dashboard

- Data Source Connectors

- Drag & Drop

- Marketing Reports

- Report Export

- Sales Reports

Reportz Pricing

Pricing Type

-

Flat Rate

Free Version

-

No

Free Trial

-

15 Days Trial

Payment Frequency

-

Monthly Payment

-

Annual Subscription

Plans & Packages

Standard

$9.98 Per Month