Ogemen Solutions

Banking Consulting Services That Drive Real Operational Results

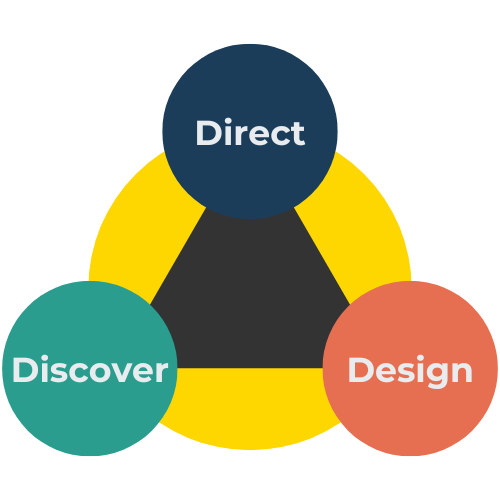

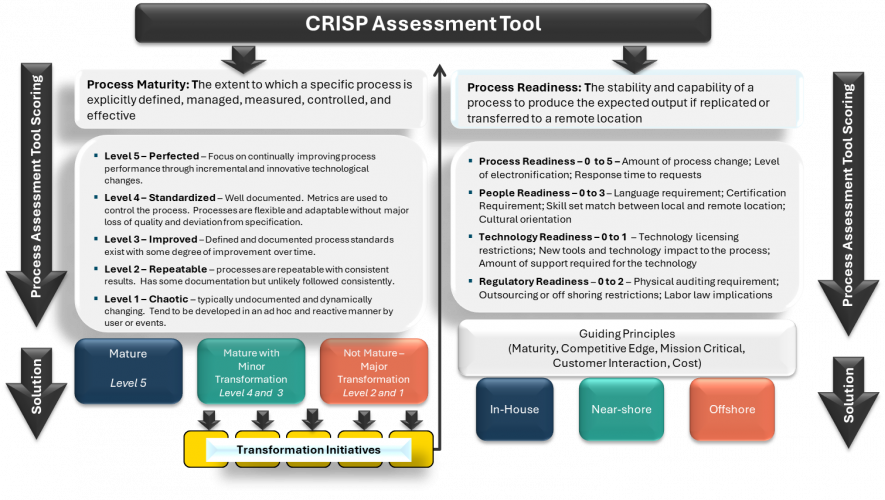

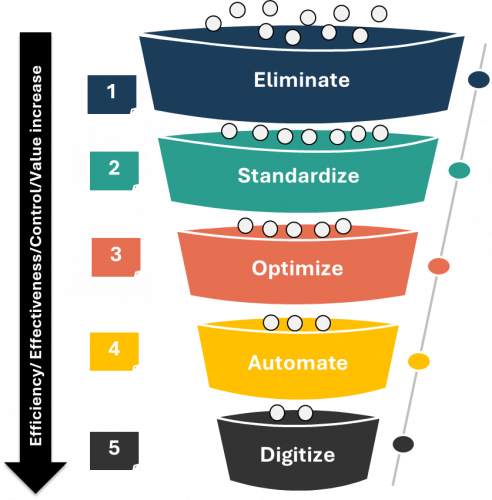

Ogemen Solutions is a specialized consulting firm that helps banks optimize operations, reduce cost-to-income ratios, and accelerate transformation. We deliver structured, outcome-driven solutions through our flagship offerings, such as Process Transformation as a Service (PTaaS), Rapid Results Workshops, AI & Automation Strategy Sprints, and Fractional COO/CTrO roles.

Our clients typically include small banks, community banks, and credit unions with under $25B in assets that lack dedicated transformation teams but still face cost pressure, regulatory complexity, and digital disruption.

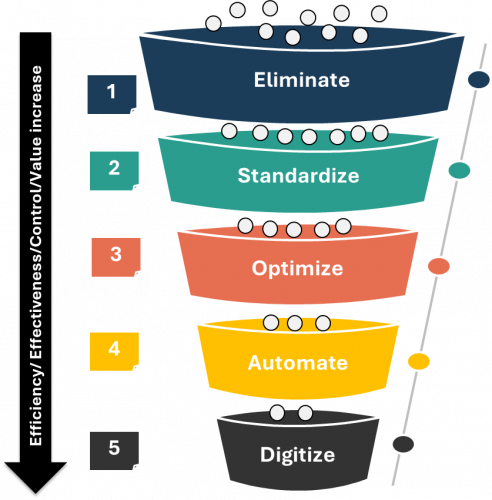

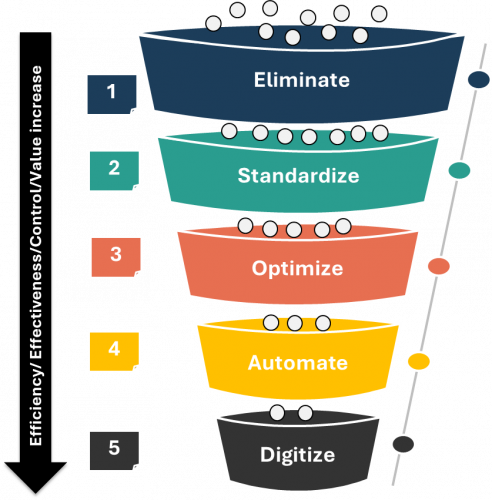

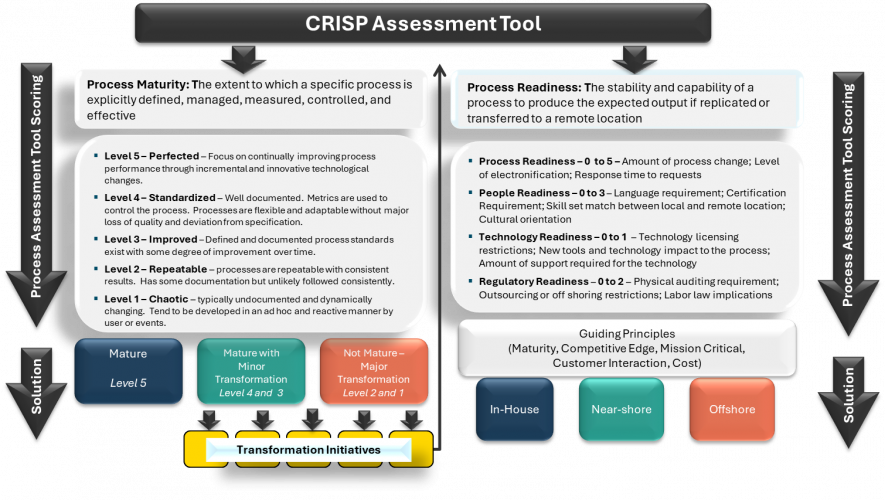

What makes us different? We productize transformation. Our PTaaS model delivers tangible outcomes in 40 hours per month, including current state assessments, process mapping, opportunity identification, future state design, business cases, and implementation roadmaps — all delivered on a monthly subscription.

With a strong focus on banking ops, compliance-heavy environments, and frontline-to-C-suite alignment, we bring deep expertise and structured methodologies to every engagement. From streamlining lending processes to redesigning back-office workflows and identifying automation use cases, we help banks stay competitive without bloated consulting retainers.

Ogemen is led by Balaji Sampathkumar, a certified AI strategist and Lean Six Sigma Black Belt with two decades of transformation experience in the Banking and Financial Services industry. We serve clients across the U.S., offering flexible delivery models without compromising on quality, impact, or context.

United States

United States

Detailed Reviews of Ogemen Solutions

Client Portfolio of Ogemen Solutions

Project Industry

- Financial & Payments - 100.0%

Major Industry Focus

Project Cost

- $0 to $10000 - 100.0%

Common Project Cost

Project Timeline

- 1 to 25 Weeks - 100.0%

Project Timeline

Clients: 3

- Regional Bank in USA

- Mortgage Lender in USA

- Digital Bank in Australia

Portfolios: 3