Survey: Key Factors affecting Mobile App Development Time

The amalgamation of modern smart phones and apps has created a world where we live and manage our life around them. Apps have become the primary way we engage with each other. They are the digital boundary through which we function. The strategic placement of the apps in the market is critical not only from the user’s point of view but also for the publishers who exploit the apps to their full potential to derive future strategies and monetization gains. The mobile app domain sees an exciting future as you see the figures unfold below. The year 2015 showed us how the app ecosystem is the centre point of our lives.

In continuation to our series of quarterly updates about the Android and iOS landscape keeping you informed with the key developments and statistics of mobile apps for each quarter in 2015, we bring you 2015 in a nutshell offering highlights of the two OS.

MOBILE APP REVENUES

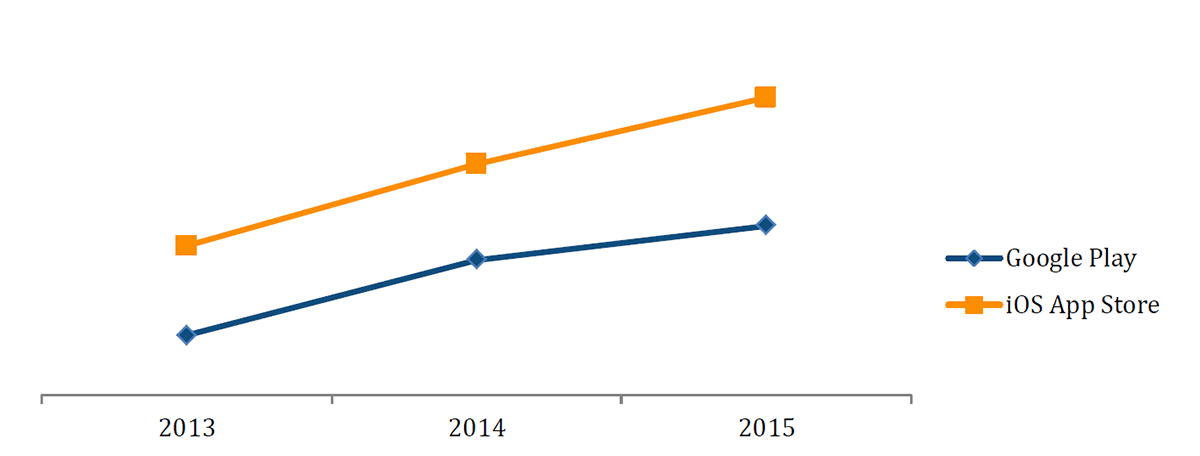

The year 2015 saw an increase in the annual revenue from US$ 35 Billion to US$ 41 Billion in comparison to 2014. This count to an approx. 17% increase in revenues from 2014 as compared to the 30% increase that the mobile app market saw while transitioning from 2013 to 2014.

In terms of annual revenue generated by the mobile apps, this year also Apple Store was way ahead of Google Play Store. Apple’s app store earnings through monetization of mobile apps are much higher than the Google play store. This year Apple App Store made more than 76% revenue than Google Play.

Fig.2 - Annual App Revenue

Over the past two years the app revenues have multiplied but iOS outpaced Google by maintaining a strong foothold as the leader of the app store revenue. The major reason behind the huge revenue growth for iOS is the provider’s rapid growth in United States, China and Japan. The revenue gap between the two app giants has been broadening, thus giving way to new revolution in the mobile app economy. Increased revenue drives monetization of other segments in the domain enabling new growth opportunities via mobile apps.

Fig.3 - Share of Mobile App Revenues by Channel

Mobile apps have become the official channel to drive content and services to consumers. This business is generally divided into three models: paid apps, in-app purchase and advertising. On having a look at the various channels that contribute towards these positive figures, nearly 90% of this revenue was generated because of paid apps and in-app purchases in 2015. Fig. 3 shows the different share of the various revenue channels that contribute to the overall revenue of the mobile app domain. The major contributor to the revenue pool has been the Paid Apps for years but has its share gradually reduced over the past two years from 76% on 2013 to 59.5% in 2015. During the same period, revenue share generated through app Advertising and In-App Purchasing has increased, principally for In-App Purchases which is 30% in 2015 in contrast to 22.5% in 2014.

Fig.4 depicts the revenue generated by In-App Purchases and Paid Apps in the past years. As mentioned above, the share of revenue contribution made through the means of Paid Apps has reduced speedily, still the figures show a growth in terms of revenue generated. It has increased proportionately year-on-year but not as much in comparison to the In-App Purchases. The mobile app trade commenced with the paid app system but was gradually overshadowed by the in-app purchase model introduction.

It is estimated that the Mobile App revenue will cross US$ 100 Billion mark by 2020, reaching US$ 50 Billion mark by the end of this year. It is also anticipated that like present times, iOS app store will remain the highest-growing store through 2020 and will double the revenue in comparison to 2015.

MOBILE APP DOWNLOADS

Fig.6 - Annual App Downloads

Google play out performed Apple App Store in terms of number of apps downloaded in 2015. Emerging geographies like India, Indonesia, Brazil, Mexico and Turkey have a large market of users who use smart phone for the first time and the affordability of Android devices adds to the advantage. Not to forget that Google is performing equally well in some of the iOS dominated developed markets like the United Kingdom and even surpassed annual downloads on the iOS App Store in 2015. The number of apps downloaded from the Google store each year has grown massively in the past few years whereas iOS App store download numbers fluctuate negligibly. Thus, it can be said that the continuous year on year growth in the number of app downloads is credited to Google Play. As device penetration is on a high in the emerging markets, and future is likely to be boosted with the app download number, Google Play Store will continue to enjoy the massive market share in the near future.

Similar to the trend in mobile app revenue, the number of mobile app downloads are expected to grow 2.5 times in the next five years reaching at 285 billion mobile app downloads. Google App Store is expected to remain at the top slot in terms of mobile downloads.

Based on the above figure, 2015 saw that free apps accounted for 93% of total app store downloads. The above forecast shows an interesting trend, where the share of free apps is constantly on a rise for the next five years. This does not mean that paid apps are going to vanish for the scene but it would be difficult and risky to neglect not developing the free version for your app. While free apps will see an increase of 25% more free app downloads by the end of this year, the figure would be only 6% for paid apps in comparison to 2015. By 2017, the free app download market is expected to have a share of 94.5% reaching to 96% by 2020. For the end user, price of the app is a determining factor when choosing to download an app – this fact is a cause of concern for those who rely completely on paid apps as monetization solutions.

TOP SLOT – CHINA vs. UNITED STATES

Fig.9 - Apple App Store Revenue

United States was the leader in terms of iOS app downloads up until 2014, but in 2015 China overtook United States and became the leader. The long fondness of Chinese population for large screen phones enabled Apple to enter the market after the launch of iPhone 6 and 6+. The high download growth is largely due to the adoption of new devices. High download growth is generally inter-connected with revenue growth. As China saw a boom in the number of iOS app download, so did the Apple revenue through mobile app downloads. Currently, China comes third in terms of global iOS revenue just after United States and Japan; surpassing Japan in few years.

GOOGLE & iOS PLAY POSITIONING – US & UK

United States and United Kingdom are iOS dominated markets, but have experienced a growth in the Android market in 2015. Any changes in these markets have huge impact on the total app market. In the US, share of Google play store downloads increased from 44% in 2014 to 56% in 2015. In UK also, the trend was almost similar where the share increased from 42% to 45% for Google play store downloads. The major reason for sudden increase in the share of Google downloads is attributed to game downloads.

EMERGING MARKETS – CLIMBING THE LADDER

Fig.12 - App Downloads

The majority of Google Play downloads came from the emerging markets with strong acts from countries like Vietnam where the Y-on-Y growth was six times in 2015 in comparison to 2014. India saw a growth of 50% in the year for iOS and Google stores downloads put together. Though not all emerging geographies had as strong year but overall each of the countries mentioned in Fig.9 saw a minimum of 20% growth in app downloads.

KEY FINDINGS

- Google Play remained the undisputed king in terms of the apps downloaded that was contributed by emerging markets like India, Indonesia, Brazil, Turkey and Mexico.

- Apple’s iOS Store was the highest revenue generator for the mobile app market seeing sudden growth in the Chinese market because of the launch of large screen phones.

- App store returns will grow over US$50 Billion in 2016, exceeding to US$100 Billion by 2020. The growing economies tilt towards apps and grown-up markets ability to confine more returns will drive this revenue growth.

- The global app download market will see a tremendous growth in the emerging markets in the coming years reaching a download figure of 285 billion by 2020.