Almost every small business attempts financial planning soon after determining its vision and objectives. An ideal financial plan should include fixed and variable expenses, assets and liabilities, sales projections, and a comprehensive risk management plan. It ultimately helps founders and higher management set clear expectations for cash flow, allocate a smart budget, identify unnecessary or over-inflated costs, mitigate the risks, have smooth fundraising and a growth map.

Accounting plays an essential role in this ongoing financial planning process. It helps businesses maintain three key financial statements - the income statement (profit and loss), balance sheet (clear financial position on a particular date), and cash flow statement (cash generated and spent during a specific period of time). However, entrepreneurs often struggle to understand the importance of maintaining all the documents or figuring out the best financial strategy, in general.

Goodfirms surveyed 424 business owners worldwide to know how they manage financial processes, the costly mistakes, the challenges they face, and the strategies SMEs must implement to ensure financial stability and growth.

How Do Small Businesses Manage Their Finances?

With the growth of a business, its financial requirements grow too. As a result, owners cannot keep track of finances, which they might be doing by themselves in the earlier stages. They have a tough time deciding whether they should employ an in-house team or go for outsourcing. Then, entrepreneurs can also consider software solutions for accounting, budgeting, payroll, cash flow analysis, billing and invoicing, expense tracking, inventory management, etc., which makes various tasks more manageable.

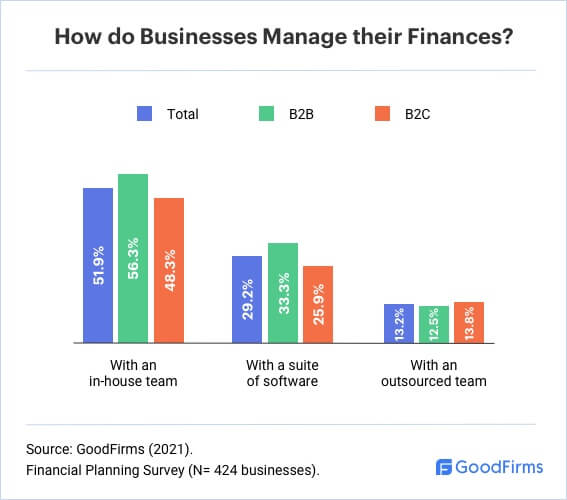

SMEs must understand the differences, benefits, and drawbacks of all these options to make the appropriate choice. Goodfirms survey reveals that 51.9% of business owners prefer to have in-house finance teams.

With an in-house team of financial professionals

- Owners have more say over the way their employees work.

- All finances are handled on-premises, making it convenient for owners to refer to financial documents whenever they want.

- Businesses have to spend more on infrastructure, resources, talent acquisition and onboarding, training costs.

- There will be more errors, and time and money will be wasted, if owners or employees do not have enough expertise and experience in complex financial processes.

With outsourced financial services

- Owners can work with the best financial experts worldwide and access the most exclusive information and technology.

- Top management can focus on the core aspects of the business.

- An excellent outsourcing partner can help identify cost-saving opportunities without compromising on the quality of work or efficiency.

- Communication gaps depending upon the time zones.

- There might be a difference in norms and work culture.

Who Are Involved With Managing Finances in Small Businesses?

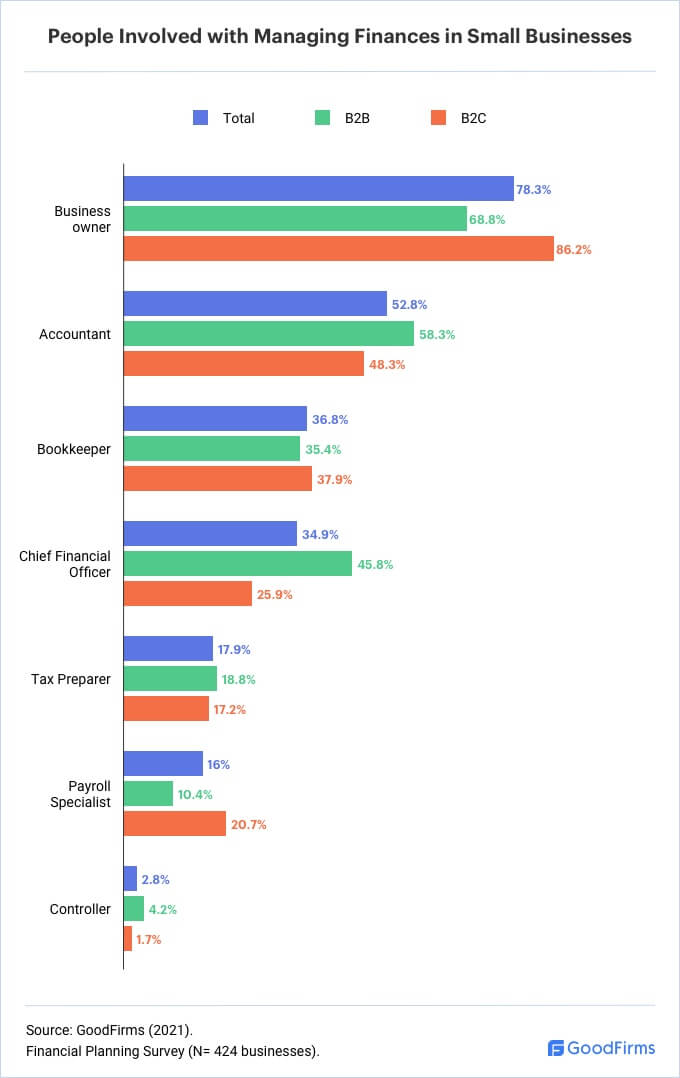

From accountants to bookkeepers, payroll experts to tax preparers, various people are associated with financial processes. Then, there's a controller too, who's higher in the hierarchy, and is responsible for multiple tasks, such as overseeing accounting operations, producing financial reports, formulating company budgets, etc. A controller generally reports to a company's CFO (chief financial officer).

Interestingly, 78.3% of the surveyed founders are actively involved with managing finances! Not every business necessarily needs a huge finance team. What generally happens is - the owner may hire one or two financial experts to handle accounting, bookkeeping, payroll, tax filing as per the business requirements. Or they may outsource, as mentioned earlier.

Goodfirms survey reveals that small businesses consider accounting and bookkeeping as the more essential tasks. 52.8% of the surveyed organizations have accountants, followed by 36.8%, who have bookkeepers. Also, 45.8% of B2B appoints Chief Financial Officer. In contrast, only 25.9% of B2C has a CFO.

"Most business owners do their best to preserve cash in the early days. However, not having a solid team of professionals can hurt the company when it can least afford it. Having a proactive CPA, attorney, and financial advisor can help the owner avoid mistakes that will come back and hurt the company. Business owners who want to avoid this problem need to ask for referrals and shop around for the best advisors they can find," says CFP, Dr. Guy Baker from BMI Consulting.

What Financial Goals do Small Businesses Have?

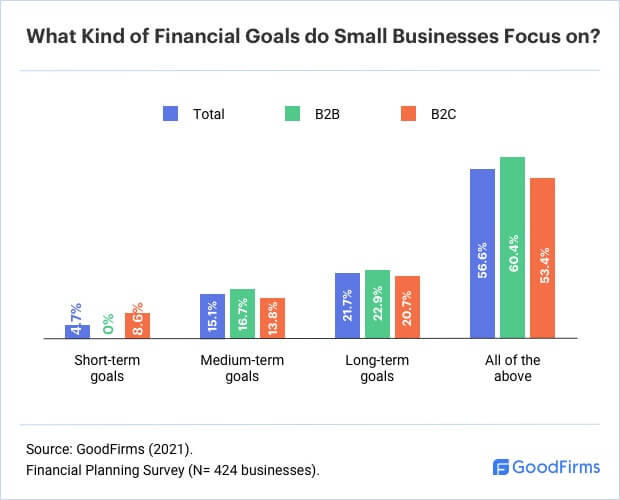

Financial planning is the process that involves deciding the goals businesses aspire to reach and estimating the resources, the amount of money, and the time needed to achieve every goal. As the name suggests, long-term planning focuses on the goals that take more time to get fulfilled. However, short-term and middle-term planning is inherently essential to accomplish those goals.

Goodfirms research confirms that 56.6% of the businesses focus on finding an adaptable middle ground between these three attitudes.

Short-term Financial Planning

Short-term goals are created to solve immediate problems and develop strategies that can lead to results, usually within one year. These goals should be adaptable to changing circumstances. Examples of some short-term goals are -

- Business will bring in at least, say, 1 million dollars over a fiscal year

- Doubling advertising budget every other month for the next eight months

- Reducing overhead expenses by 20 percent in 9 months

Middle-term Financial Planning

Mid-term financial goals can neither be achieved right away nor take too many years to accomplish. Examples of some common mid-term goals are -

- Keeping 25 percent of money aside for expansion or capital reserve

- Reducing production cost by 35% in 4 years

- Completely automate financial processes in 5 years

Long-term Financial Planning

Businesses need to create a ten or twelve-year plan to see that their mission is realized.

- Increase profit margin by 10 percent in 7 years

- Keeping net working capital ratio in check throughout the journey

- Setting aside a contingency fund amounting to 10 percent of monthly expenses

- Updating a business's equipments and infrastructure in 8 years

What are the Main Financial Challenges For Small Businesses?

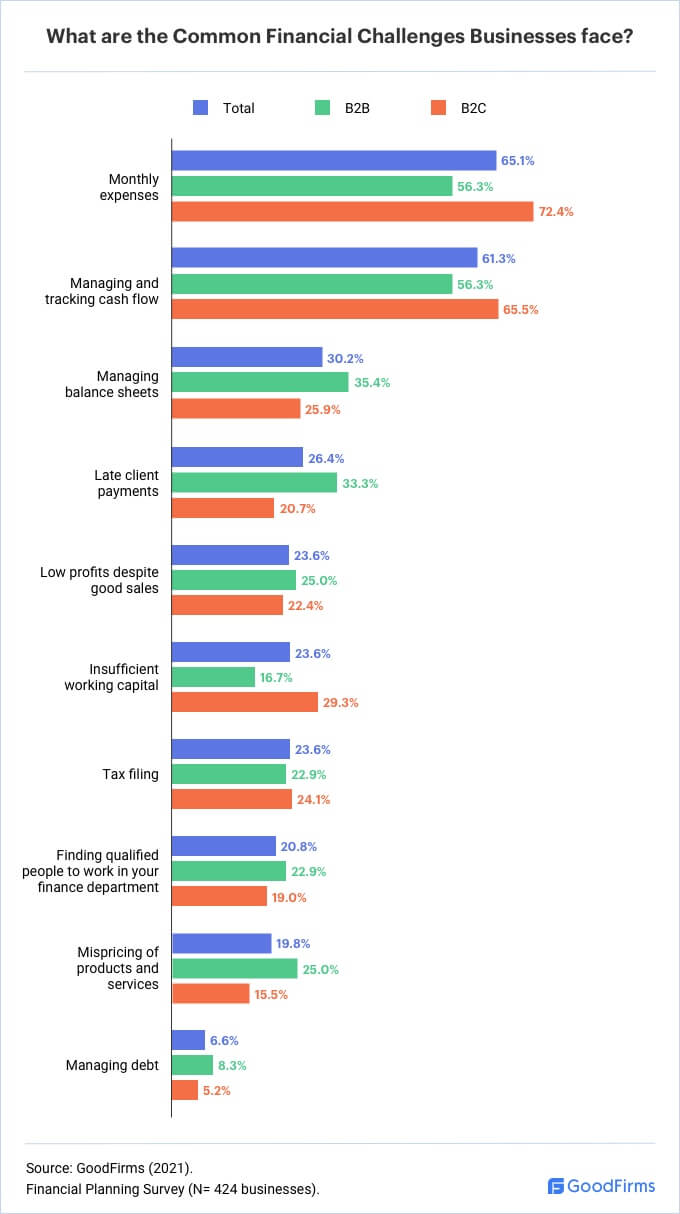

Small businesses face innumerable obstacles every day, from challenges to hiring the right employees to maintain product relevance. And on top of all that are financial challenges, which tend to be the largest, most complicated, and essential to solving for keeping a business running. Enterprises need to manage the debt, file the taxes, find qualified financial experts, deal with late client payments and insufficient working capital, and many more.

However, 65.1% of the surveyed business owners consider monthly expenses as the biggest hardships to solve.

Monthly expenses -

Some common spendings that every business has to go through every month are rent/lease/mortgage payments, payroll, insurance, loan installments, office amenities, marketing and advertising, among many others. Companies often struggle to have enough cash reserves after they are done with spending on these basic expenses.

Managing and tracking cash flow -

When a business's expenses surpass the cash, it experiences a cash flow problem. The situation becomes critical when the balance is not maintained between sales expectations and projected costs for longer. However, the expenses of a company in its early stages of growth are naturally more than its revenue. The reason is, they are still trying to figure out sales and marketing, contractor relationships, admin costs, and validate R&D.

7 Common Financial Mistakes Small Businesses Make

Every small business inadvertently makes mistakes that let the owner lose their hard-earned money. Some common ones are underestimating the timing of projects, overestimating future revenues, underpricing products or services, not monitoring cash flows, etc. Given below are the main financial mistakes that can turn out to be major hazards for SMEs.

1) Using Personal Accounts

"Enterprises using personal accounts for business-related transactions unknowingly make a huge mistake," says Craig Campbell, CEO of Auto Parts Guideline.

He adds, "Firstly, the legal consequences of using business funds for personal use are severe and can lead to jail time in extreme cases. Secondly, there are separate tax regulations for business and personal funds.

Mixing both can cause confusion when the end of the year rolls around, and you have to figure out your taxes. Combining these two accounts will also overlap what you earn and spend with what your business generates and expends. This will cloud the bigger picture of the financial health of your business."

2) Unnecessary Spending

"Very often people invest in fancy logos, upscale offices or multiple subscription services. When it comes to SAAS products for business, it can be tricky, because for example, you need to use a service and have to subscribe, but then forget to cancel your subscription. It happens all the time," says Regina Sadykova, General Partner at Interstellar Digital.

3) Creating Wrong Business Entity

"In their haste to get up and going, new business owners may decide to postpone forming a legal entity. Or they start a limited liability corporation on the spur of the moment because a buddy advised them to," says Dan Shepherd, Owner of Veicomm Communications.

He adds, "However, selecting the incorrect company entity, or failing to establish one at all, can have major long-term repercussions. If you operate as a general partnership, for example, you may be astonished to learn that you are personally liable for all of the company's debts, including those you never committed to. Because you are taxed at both the corporate and personal levels if you form a corporation, you may wind up paying higher taxes."

4) Not Reading Loan Agreements Thoroughly

"When it comes to dealing with a small business's finances, most owners make the error of failing to read the fine print on loan paperwork. Often, entrepreneurs rely on loans to get started, they hastily sign loan agreements, believing that they are only a formality," says Collen Clark, Lawyer and Founder of Schmidt & Clark.

He adds, "What they don't know is that loan agreements, like any other contract you'll sign, must be thoroughly read, comprehended, and evaluated. This is due to the fact that once signed by both parties, the contract becomes enforceable, which means you may be punished for breaches and requested to pay penalties if you fail to comply with some of its conditions."

5) Not Tracking Burn Rate

The burn rate is generally the cash spent per month. For instance, if a company spends $50,000 per month, it has a burn rate of $50,000.

"A huge trend I've noticed with a few startups that I have worked with was that they didn't track their burn rate! Finding out that you only have enough cash in the bank to sustain 1 more month can and will cripple you. They come up with an idea that sounds great but haven't conducted market research in order to ascertain what market share they need to capture in order to stay on target and unfortunately lack the capacity to get there only to stretch themselves too thin," says Conner Goldberg, Managing Director of Ascension Cloud Solutions.

6) Not Monitoring Your Business Credit Score

"A business credit score is a figure that's unrelated to your personal credit score and recounts the story of your company's debt history. Many of the elements that influence that figure — your payment history, your debt usage ratio, and the length of your credit history – are within your control," says SEO Consultant Daniel Foley.

He adds, "This statistic becomes increasingly essential as your company grows. It will not only assist you in the future with things like obtaining business finance, but it will also serve as a public record. If another company is considering granting you trade credit and your company's credit score is low, they may refuse to do so or offer you less advantageous conditions."

7) Lack Of Broader Perspective

"The biggest mistake I see other small business owners making is being too focused on one perspective of their finances. For example some business owners will always be shopping for deals from their suppliers, they will spend extra during sales or to buy in bulk so they can increase their margins. But by doing this they ignore their actual sell-through. It's great to save 10% on a product but if you're going to sit on it for 2 years, that money could have gone towards something else," says Edwin Ivanauskas, Owner of Last Looks FX & Beauty Supply.

Financial Planning Tips For Small Businesses

The financial management of a small business determines whether a company will climb the ladder of success or fall flat at the first hurdle. Here are the tips by financial experts that will help SMEs ascend to the next level of success during good times while surviving in bad times.

1) Plan Your Taxes Aptly

Every entrepreneur must understand the basic provisions of the tax code to take advantage of all possible opportunities for tax savings and deductions. Conducting formal tax planning sessions in the middle of each tax year gives them time to apply all the strategies to the current year and get a jump on the following year.

"Start saving for business income tax, sales tax, and property tax early and often. That way, you have enough money saved to pay your bills when they are due rather than scrambling at the last minute," says Dr. Austin Dowse, CEO of Aimvein.

He adds, "Since these taxes are based on a percentage of your business' revenue, I'd recommend that you save 3 months of revenue in reserve every year as a cushion against any unexpected dips in revenue. In addition, if you are using an accrual method for accounting, you may want to take everyday expenses out of revenues when you receive them and put them into a separate account."

Conner Goldberg works with a CPA to work out strategies to leverage various grants and tax relief packages for the clients they consult with.

He says, "Here in Australia, we have grants that promote software R&D as well as other grants allowing for free allowances for certain cloud computing platforms which are essential for my business day to day operations. If you're thinking about trying out a new piece of software, reach out to a sales consultant and ask for a demo/free trial. Most of them would be happy to try to convince you to stay with them above the competition."

2) Separate Expenses Into Simple Buckets

Separating cash into different 'buckets' for particular purposes allows entrepreneurs to see how much goes toward each goal.

"The best advice I can give is to separate out all your expenses into simple buckets. Let's assume your business makes usually $100 gross revenue per order. Simply slice and dice each cost that goes into providing that order to the customer," says Sam Mendelsohn, COO of Sozy.

He adds, "In the case of eCommerce, it might look something like this

Gross Sale = $100

Shipping Income +$4

Discount -$12

Returns -$9

Fulfillment -$10.5

Shipping Cost -$16

Advertising -$32.5

Operations -$17.5

Profit - $6.5

Each month evaluate each bucket or category and set a percentage goal of what each area should cost your business. Do your best to continually decrease your variable costs or increase your income, so your expenses become a smaller percentage of your overall revenue. Always plan to have some level of profit, and always plan for the worst-case scenario so if you ever have a bad month, you will be able to handle costs being elevated for a few months without getting you in trouble."

3) Keep Your Books Updated

By having books in good order, entrepreneurs get to know how much money is coming into and going out of their business. This helps them improve financial analysis & management, keep the stress of receiving an audit at a minimum, and not miss out on potential tax deductions.

"There are many cloud accounting softwares that integrate with apps that track receipts so that a lot of the work can be done with automation. Take a look at your up-to-date financials on a regular basis so you can get a sense of your baseline. Perhaps advertising is usually 10% of revenues and all of a sudden you notice it has skyrocketed. Or you notice that your accounts payable is really high and you forgot to pay a bill. The data is the source of truth," says Sara Feldstein, CPA, CA at Barumba Play Inc.

She adds, "Even if you cannot afford a bookkeeper or accountant on a regular basis, it is still worth paying one to set up your books from the get-go. They can create the account names, set-up the tax rates and connect the technology for you to make it as easy as possible to maintain yourself. If the books are set up wrong, then the data is useless and it would be a mistake to rely on that data for decision making."

Jacob Wedderburn-Day, CEO of Stasher, advises having a monthly process of going through books. He says, "We use Xero, but we also keep an Excel budget of our predicted income and expenses. Every month, we tally up both in Excel, see how we performed against budget, look ahead to the next few months. We routinely tweak our model and budget based on past performance, to see what's realistic. You don't get points for how accurate your annual budget was at the start of the year - it's much more important to regularly course correct."

4) Structure Your Partnership Agreements Well

A Partnership Agreement is a document that legally binds two or more individuals who come together to form a business. It covers the name of the partnership, personal details, business activities, capital contribution, profit distribution, and other details.

"Open an online joint account, draw up a spending and saving plan with your partner. Also, complete all financial tasks together, including splitting expenses and income. Manage the books together, you will at least be speaking the same language!" says Eric Powers, Founder of Big Game Pro Shop.

He adds, "For peace of mind, work on structuring your business legally to protect both partners from liability and/or legal disputes down the line. If one person owns more equity in their company than the other person, you might want to put some time into browsing freelancing sites for a side income that can provide supplemental cash flow without jeopardizing any shared responsibilities in your team's main endeavor!"

5) Keep Your Financial Plan Dynamic

A dynamic plan can be adjusted and refined whenever a business is either underperforming or outperforming. A business strategy must quickly respond to changing circumstances based on sound judgment and principles.

"Make the plan dynamic and consistently play around with it! As with life, our businesses evolve for many reasons, so we need to be able to pull different levers and see what that means for our business and lifestyle goals," says Jillian Plank, CPA & small business financial strategist at Spring Accounting.

She adds, "For example, you should be able to play with your offer's pricing or the number of clients you have and see how that directly impacts your take-home pay. Action steps become so much more tangible when you can see that a 5% increase in price can add $20,000 to your bottom line over the course of a year - without doing any additional work!"

6) Keep Your Credit Score Healthy

Business credit scores mostly range from 0 to 100; the higher the score, the better. A business that pays bills on time, stays out of legal trouble, and doesn't incur too much debt, will have a good credit score.

"As your company grows, you might want to buy more commercial property, obtain more insurance policies, and take out more loans to help with all of your business operations. Securing approval for any of these deals and mergers can be difficult if your company has poor credit," says Scott Keever, CEO/Founder of Scott Keever SEO.

He says, "To keep good credit, pay off all of your debt funding as soon as possible. Allowing a balance on your company credit cards to accumulate for more than a few weeks, for example, is not a good idea. Don't get loans with interest rates you can't afford. Only look for funding that you will be able to return quickly."

7) Diversify Business Portfolio

Rather than depending on core business alone to generate revenue, it is a good strategy to diversify through new ventures, mergers, or acquisitions.

"Plan out your finances such that you always have a backup plan. In other words, never put all of your eggs in one basket. If A doesn't work or stops working at some point, B will hop in and keep you afloat, and so on," says Adam Garcia, Finance and investing expert at The Stock Dork.

Giving an example, Adm says, "Peter is starting a humble affiliate marketing business - a typical B2C (business-to-consumer) enterprise. So he will manage different websites, increase their online exposure, and earn whenever a site visitor buys anything through Peter's links.

However, Peter knows that around half of all small businesses are doomed to fail within the first five years. So, he decides to also allocate a portion of his funds for plan B - an affiliate marketing agency, which is B2B (business-to-business). Respectively, both of these approaches stand a 50% chance each to fail. When combined, however, the likelihood of failure is much smaller, averaging at 25%."

8) Keep Your Exit Plan Ready

Entrepreneurs must integrate an exit strategy into their businesses' vision and goals. Dominic Trupiano, CIMA at Artesys, recommends starting an exit plan early on.

He says, "Will this business be transferred to family, employees, or sold at retirement? Forming a plan early on will help you attract and retain good employees long term. There are many steps to efficiently extract maximum value for the business while also allowing it to thrive.

For example, if the business owner plans to transfer to the next generation but isn't sure their children will want the business. In that case, a series of trusts can offer maximum flexibility to pass on the business later. Many employees may be reluctant to take the risk of ownership unless they are part of the decision-making process. So, if you are planning for an employee buyout, you need to involve the employees from the beginning to create trust. This can be done through an employee trust, direct ownership/ESOP."

Conclusion

Every small business needs financial management to assess the business environment, goals, resources requirements and highlight any risks they might face. Also, a financial plan prepares enterprises for pitching to investors, receiving funding, and achieving long-term success.

The majority of founders take an active interest in financial planning nowadays. They particularly pay more attention to accounting and bookkeeping. However, it can be tough and complicated to understand various finance terminologies, excelling at sales forecasts, profit-loss statements, cash flow management, tax savings. Fortunately, you have better options out there, like using various financial software or outsourcing the services to experts. Incorporate the above-mentioned financial tips into your business planning and enjoy revenue growth with minimum operational costs.

About The Financial Planning Survey

Goodfirms surveyed 424 business owners to know the common mistakes in handling finance and the tips for financial planning for small businesses.

We sincerely thank our Research Partners, consisting of B2B (45.3%) and B2C (54.7%), for giving us insights into the strategies to keep businesses afloat financially.

A mix of senior-level executives and business process managers took part in this survey. These included CEOs (25.5%), Founders (20.8%), Co-Founders (11.3%), Owners (11.3%), Financial Experts (15.1%), and other executives (16.0%).

These respondents belonged to various sizes of companies - 97.2% of small businesses (1-249 employees) and 1.9% of medium businesses (250 to 499), 0.9% of large businesses.

* For any queries, drop an email to [email protected]

- Aim Workout

- Aimvein

- Alpha Efficiency

- Aquinas Consulting

- Artesys

- Ascension Cloud Solutions

- Auto Parts Guideline

- Barumba Play Inc.

- Bettini Financial Solutions

- BidFortune

- Big Game Pro Shop

- BMI Consulting

- Brenton Way

- Cameron Miller

- CFO On Call

- Chicago Landscaping Services

- Clara Finds

- Clooms

- ClothingRIC

- Coach Foundation

- CocoDoc

- CocoFax

- Constant Delights

- Créatif

- Credit Donkey

- Daniel Foley SEO

- Diggity Marketing

- Dundas Life

- Electrician Apprentice HQ

- Empire Crafter.

- Enventys Partners

- ExitGuide

- Flooring Masters

- FnX Media

- Forex to Stocks

- FormsPal

- FreeAdvice

- Front Signs

- Funeral Funds of America

- Geeka

- Goldie Agency Inc.

- GSD Lovers

- Harmony Home Buyers

- Hernorm

- Home Garden HQ

- Home Grounds

- HomeWorkingClub

- Improovy

- Incorporation Insight

- Instrumental Global

- Interstellar Digital

- InVideo

- Izba

- KeaBabies

- Kevinmrc

- Klint Marketing

- Last Looks FX

- Life Managed

- Live Lingua

- Lowes Financial Academy

- Ministry of Hemp

- Money Rules

- My Consulting Offer

- My Enamel Pins

- My Macro Memoir

- myPOS

- Norsemen

- NumLooker

- Online Alarm Clock

- PeopleFinder Free

- Perfect Steel Solutions

- Petsolino

- Polish Perfect

- Powerful Generator

- Primetime Pokemon

- R3SET

- ReturnGO

- RRP Jewellers

- Sapochnick Lawfirm

- Schmidt & Clark

- Scott Keever SEO

- Sensual Fashion Boutique

- Skill Success

- Small Business Tax Savings Podcast

- Sozy

- Spring Accounting

- Spyic

- Stasher

- Stock Hitter

- Surf Financial Brokers

- The Bookkeeper

- The Cash lab

- The Stock Dork

- TimeShatter

- ToolsGaloreHQ

- Veicomm Communications

- Velvet Jobs

- VIBE Agency

- VinPit

- vpnAlert

- Westland Auto Sales

- What's Dog

- Yael Consulting

Table of contents

- How Do Small Businesses Manage Their Finances?

- Who Are Involved With Managing Finances in Small Businesses?

- What Financial Goals do Small Businesses Have?

- What are the Main Financial Challenges For Small Businesses?

- 7 Common Financial Mistakes Small Businesses Make

- Financial Planning Tips For Small Businesses

- Conclusion

- About The Financial Planning Survey