Who is Alexforbes?

Alexforbes is a diversified financial services company founded in 1935, offering a broad range of employee benefit solutions, retirement, healthcare, and sustainability consulting, as well as investment and wealth management services.

Over the years, Accedia has worked closely with Alexforbes across multiple platforms and services, combining efforts to drive digital transformation, support regulatory compliance, and enhance operational performance. Accedia has contributed to many projects, integrating Engineering Managers, Software Development and QA Consultants, UI/UX Designers, and more.

The Two Pot System: A Major Change in Retirement Savings

In September 2024, South Africa introduced the Two Pot Retirement System, restructuring how retirement savings are managed. Instead of locking all funds until retirement, contributions are now divided into two parts: one-third goes into a savings pot, which can be withdrawn once per year, while the remaining two-thirds go into a retirement pot, which stays locked until retirement. For financial institutions like Alexforbes, implementing the Two Pot regulation meant adapting a vast network of interconnected systems to track contributions, enforce withdrawal rules, and ensure compliance. Many of these systems—spanning both customer-facing platforms and internal processes—required modifications, with Accedia playing a role in supporting some key updates.

Preparing Alexforbes for the Two Pot System

As part of this large-scale transition, Accedia collaborated closely with Alexforbes to ensure the successful alignment of their platforms with the new regulatory requirements. Among these platforms were the core system for managing pensions, investments, and insurance policies, and the core financial services management hub.

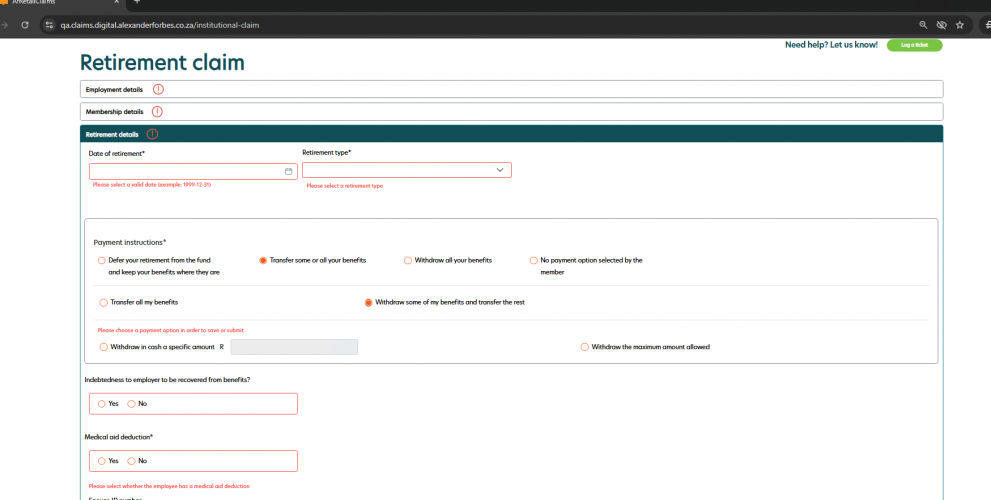

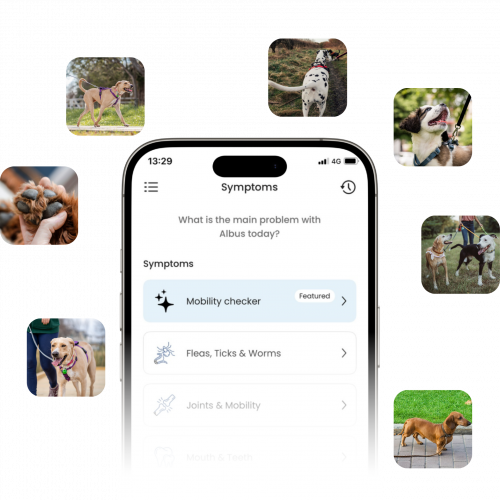

The first one needed updates so customers could easily see how their funds were divided across the savings, retirement, and vested pots, while backend changes ensured that withdrawal rules were properly enforced and data remained consistent across interconnected systems. At the same time, the centralized hub for extensive financial resources and services had to be adapted to handle real-time updates to retirement savings while maintaining compliance and ease of use. Beyond these platforms, numerous other systems across Alexforbes also required adjustments. Accedia was involved in optimizations to the company’s primary mobile application, the retirement fund management platform, and several shared services used across the company. Given the scale of the project, close coordination between teams was essential to ensure a frictionless regulatory rollout.

Challenges During the Regulatory Transformation

- Coordinating Across Multiple Teams and Systems

With so many interconnected applications and stakeholders involved, ensuring consistency in financial data processing was a significant challenge. Multiple teams involving both Alexforbes and Accedia developers worked side by side, each with their own roadmaps and priorities, yet all updates needed to align with the overarching regulatory requirements. Collaboration across teams was critical to ensure that no discrepancies arose in the processing of retirement contributions and withdrawals.

- Adapting to Changing Regulatory Timelines

The South African Reserve Bank adjusted the implementation deadlines several times, prompting development teams to revise their plans on short notice. This meant compliance requirements were evolving even as development was underway. To stay aligned, close collaboration between compliance specialists, business analysts, and technology teams was essential.

- Managing a Complex, High-Stakes Deployment

The final deployment of the Two Pot system was a highly coordinated effort led by Alexforbes involving dozens of teams across both organizations. With numerous interdependent systems, the rollout required months of meticulous planning to ensure each update was implemented in the correct sequence. Multiple dress rehearsals were conducted to refine the process, identify potential issues, and minimize risks before the final implementation.

Each team followed a precisely planned schedule to deploy, validate, and integrate their changes while carefully managing dependencies across platforms. Extensive crossfunctional alignment was critical to ensuring a successful transition, with contingency plans in place for any unexpected issues. Following deployment, Accedia also participated in the post-launch hyper-care phase, monitoring system performance and resolving any arising issues. This period was critical in stabilizing the updates, diagnosing unexpected system behaviors, and optimizing functionality.

Business Impact

Implementing the Two Pot system marked a major milestone for Alexforbes, ensuring full compliance with one of the most impactful legislative changes in South Africa’s retirement landscape. The successful rollout reinforced the company’s reputation as a trusted financial partner, agile in responding to shifts in policy across the African markets it serves.

Technology

The technical solution employed a robust stack, utilizing Microsoft .NET for the back end and Angular for the front end to ensure a dynamic and responsive user interface. SQL Server databases were hosted on Azure, providing the scalability, security, and reliability needed for enterprise-grade financial systems.