Block360

Blockchain Research, Development & Consultancy

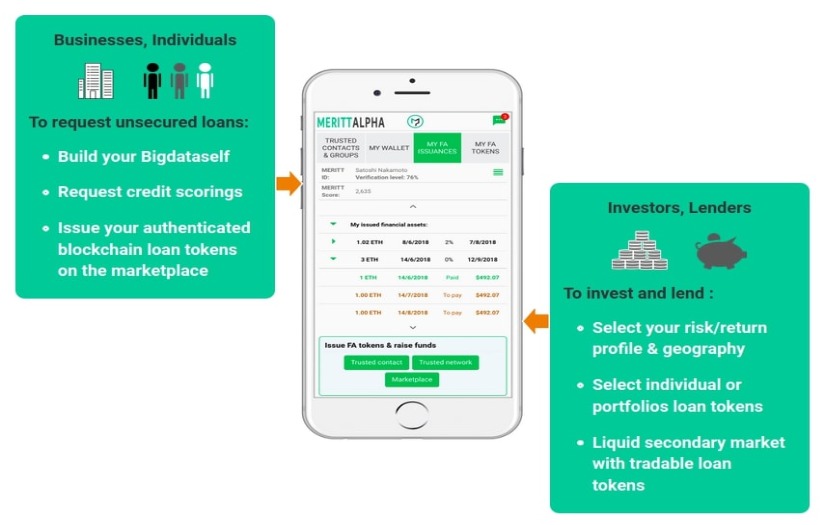

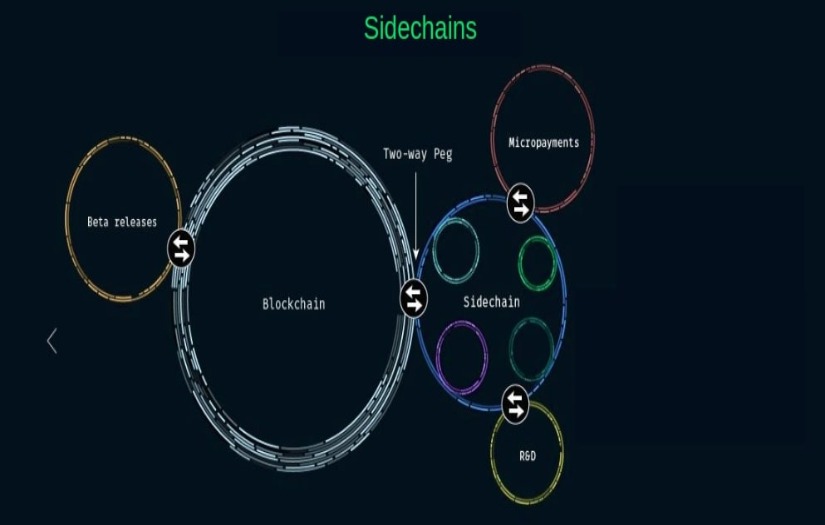

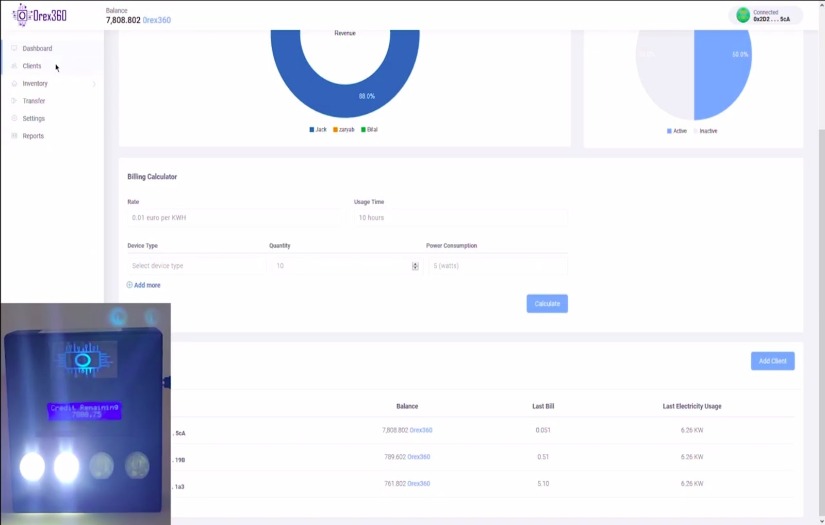

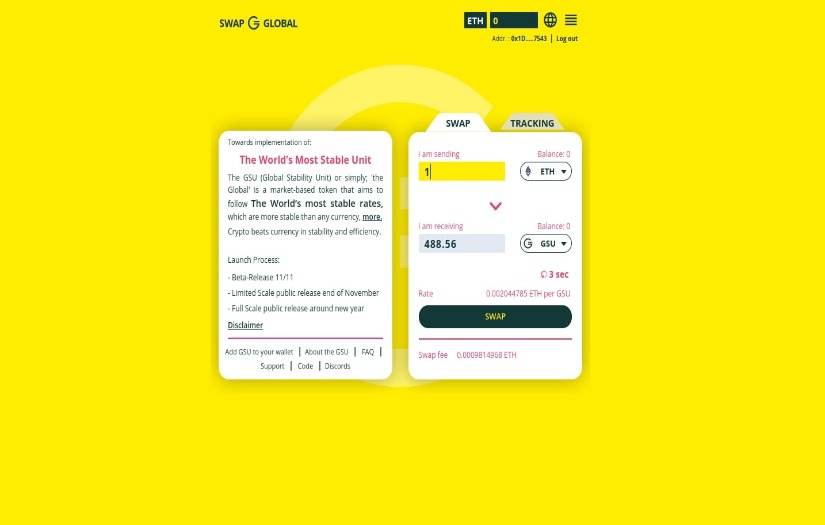

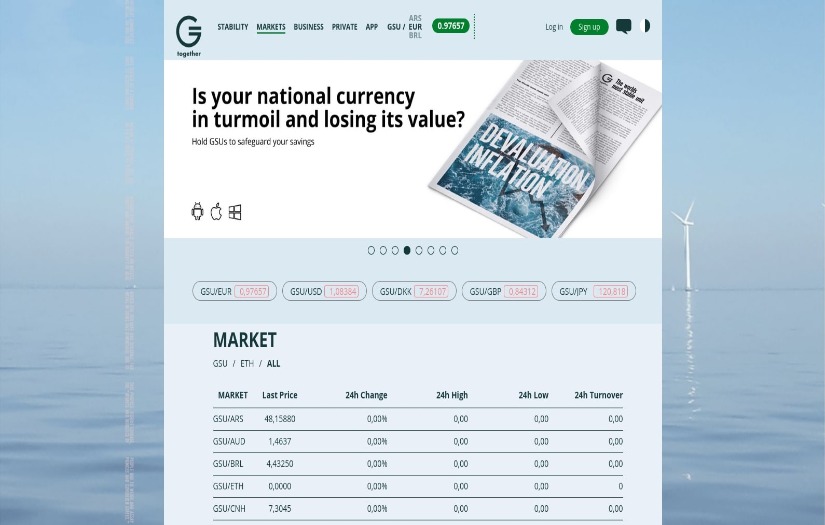

Block360 is a software development company using peer to peer technology innovations to build disruptive solutions. We have serviced various startups from Europe and the UK to build products like P2P Payments, M2M payments, P2P Lending, Digital assets trading and Digital twin. We work with clients from concept phase by understanding their needs, assessing economic and technical feasibility of their business case, planning release increments to allow them validate their assumptions early reducing the risk of product failure.

Germany

Germany

Edith-Stein-Weg 24 ,

Munich,

Bavaria

80935

4915254230594

$25 - $49/hr

10 - 49

2017

Detailed Reviews of Block360

Client Portfolio of Block360

Project Industry

- Startups - 42.9%

- Financial & Payments - 57.1%

Major Industry Focus

Financial & Payments

Project Cost

- $0 to $10000 - 42.9%

- $10001 to $50000 - 42.9%

- $50001 to $100000 - 14.3%

Common Project Cost

$0 to $10000

Project Timeline

- 1 to 25 Weeks - 85.7%

- 26 to 50 Weeks - 14.3%

Project Timeline

1 to 25 Weeks

Portfolios: 7