Fin X

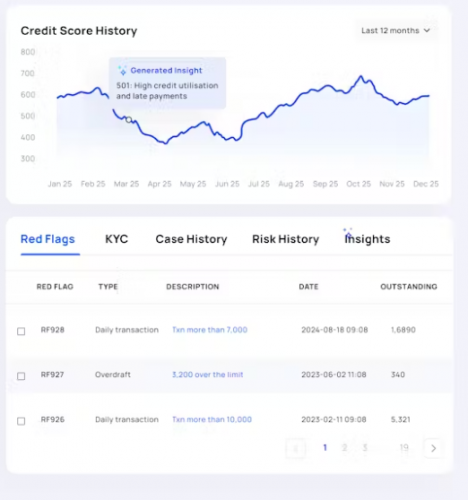

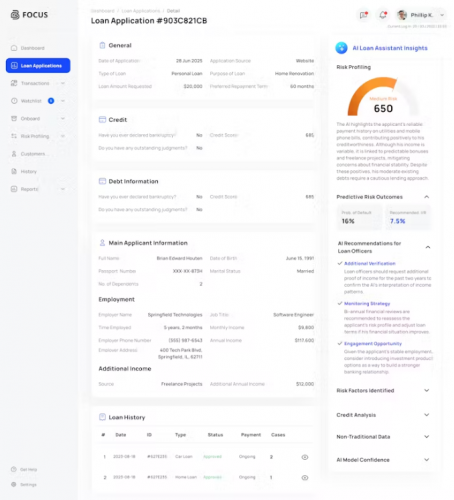

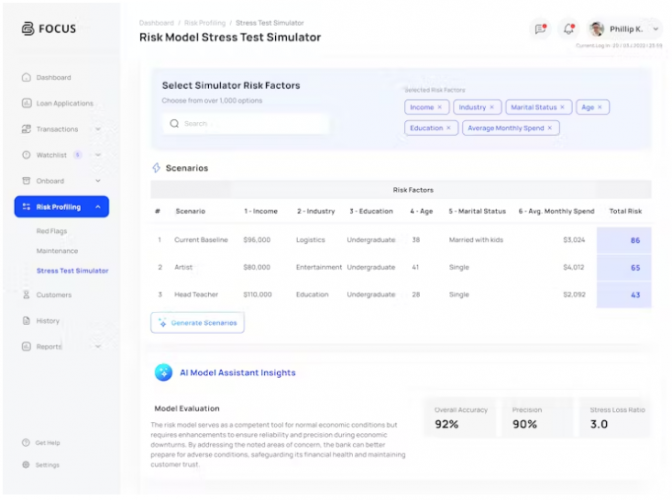

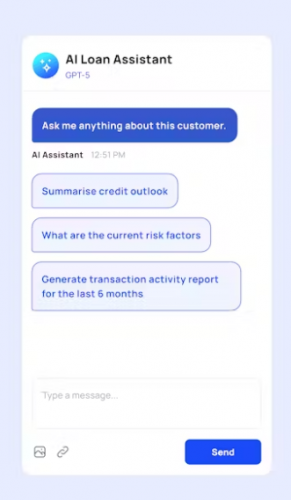

Build AI-driven financial products

Fin X is a pioneering entity in financial digital transformation, providing bespoke solutions and consulting services to banks and asset firms. We are Asia's largest innovation lab and AI product incubator for financial businesses. Trusted by leading financial institutions worldwide, Fin X AI builds AI-driven financial products to provide a competitive edge to our clients.

Our main offerings include:

- Custom financial software development

- AI consulting

- System integration services

By partnering with us, your business can significantly benefit with:

- Automate 90% of middle and back office tasks, reduce costs by 80%

- Resolve incidents faster with 74% less downtime and 27% more productive financial teams.

- Better customer experiences with 60 x SLA improvements and 50% CSAT improvement.

Schedule a call and you will be amazed by how Fin X can help you leverage AI to achieve your goals and increase ROI.

Contact Us:

- Website: https://www.finx.ai/

- Linkedin: https://www.linkedin.com/company/finx-ai/

- Email: [email protected]

Singapore

Singapore

Detailed Reviews of Fin X

Client Portfolio of Fin X

Project Industry

- Financial & Payments - 100.0%

Major Industry Focus

Project Cost

- Not Disclosed - 100.0%

Common Project Cost

Project Timeline

- 1 to 25 Weeks - 100.0%

Project Timeline

Clients: 8

- Sembcorp Industries

- Temasek

- DBS

- BlackRock

- Goldman Sachs

- Aspire

- TymeBank

- Julius Baer Group

Portfolios: 3