Innotech Viet Nam Corporation

Reliable Mobile App Development

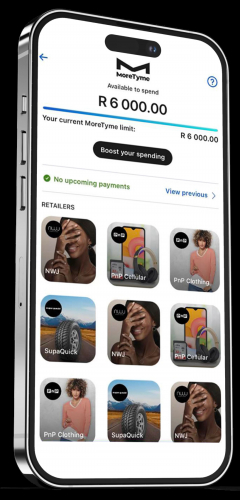

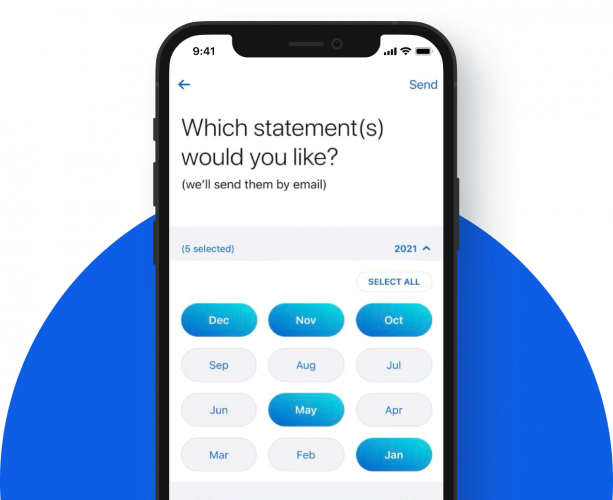

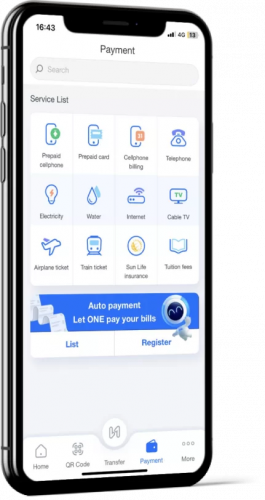

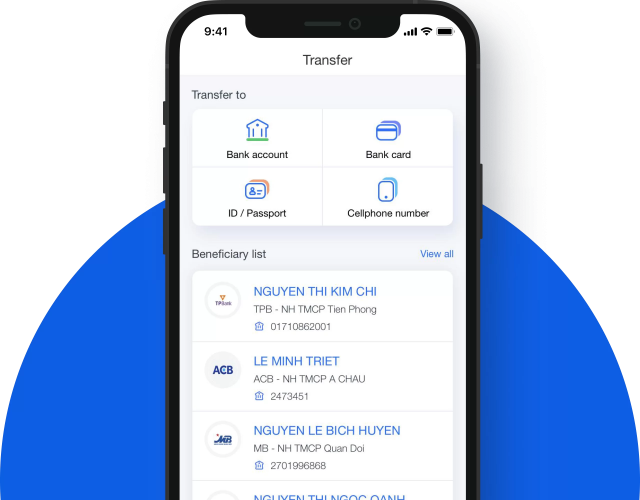

Innotech Vietnam Corporation is a software outsourcing company focusing on high quality services to provide large scale software services for Banks and Financial institutions. Innotech serves multiple clients all over the world, especially in Vietnam, Japan, America, Australia, Singapore. 200+ projects have been completed.

Vietnam

Vietnam

33 Ba Vi Street, Ward 4, Tan Binh District,

Ho Chi Minh City,

Thanh Pho Ho Chi Minh

700000

+842839991895

< $25/hr

50 - 249

2014

Service Focus

Industry Focus

- Banking - 40%

- Financial & Payments - 30%

- Manufacturing - 10%

- E-commerce - 10%

- Insurance - 10%

Client Focus

60% Small Business

30% Medium Business

10% Large Business

Detailed Reviews of Innotech Viet Nam Corporation

Client Portfolio of Innotech Viet Nam Corporation

Project Industry

- Financial & Payments - 100.0%

Major Industry Focus

Financial & Payments

Project Cost

- $100001 to $500000 - 66.7%

- $500000+ - 33.3%

Common Project Cost

$100001 to $500000

Project Timeline

- 51 to 100 Weeks - 100.0%

Project Timeline

51 to 100 Weeks

Portfolios: 3