Claims Carbon Institute is a forward-thinking organisation transforming the insurance sector with a sophisticated SaaS platform. Their tool enables insurers to analyse and manage claims-related carbon emissions, fostering a move towards sustainable, net-zero insurance practices. With user-friendly integration and multidimensional insights, Claims Carbon is setting new standards for eco-conscious decision-making in insurance.

CRAFTING A FUTURE OF SUSTAINABLE INSURANCE TOGETHER WITH CLAIMS CARBON

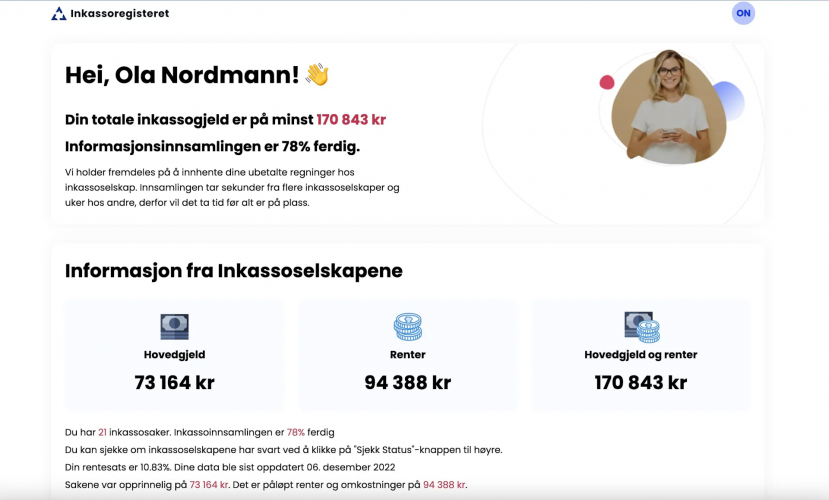

Insured vehicle and property repairs account for a whole 1% of global carbon emissions. So, when Claims Carbon teamed up with us, it was with a clear and ambitious goal: to shrink this footprint in the insurance world. Together, we've turned complicated data into decisions that don't just count – they care for our planet. In this project, our role became more than a technological partner supporting Claims Carbon's eco-driven mission; KOIA is now a proud investor. This commitment reflects our dedication to environmental stewardship, starting with the transformative step of decarbonising the insurance industry.

THE BUSINESS CHALLENGE

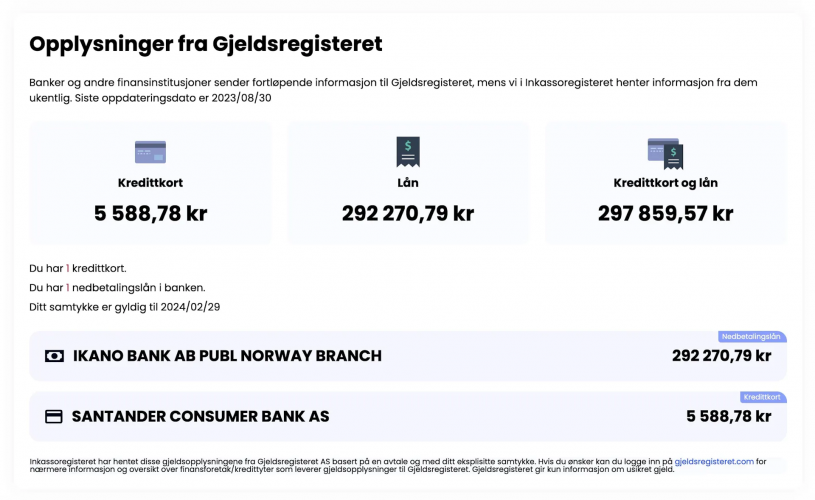

Claims Carbon faced a unique challenge, distinct from the norm. While many in the industry focus on direct emissions like office energy use or travel, Claims Carbon dared to delve deeper. Their goal? To untangle the complex web of emissions resulting not just from their own activities, but from the insurance decisions they influence, encompassing various risk types and their actual carbon footprint.

How does one even begin to measure this maze of emissions? It's not straightforward, as data might cover anything from an entire car to its smallest components. And consider the curveballs: what if a car's parts are sourced differently, or emission estimates change? This is where KOIA stepped in, partnering with Claims Carbon. Our mission was to create a data model that would be adaptable and nuanced enough to handle emissions data at any level of detail – whether zooming out to the big picture or zeroing in on the minutiae.

SOLUTION

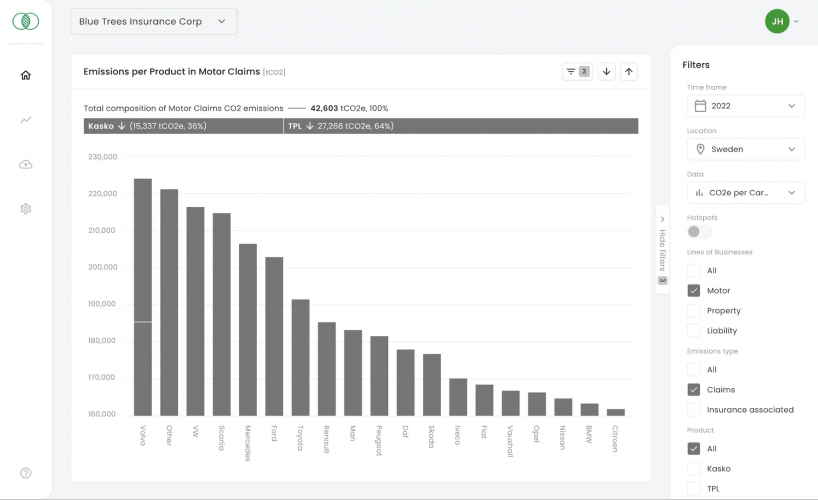

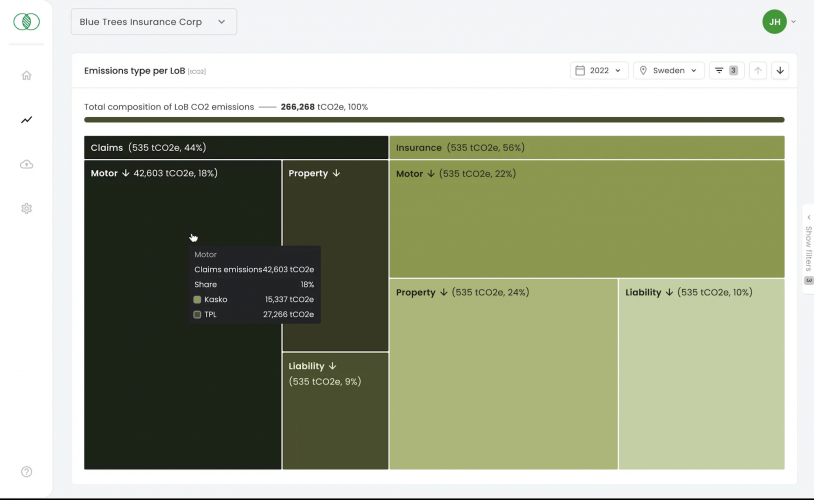

We spearheaded the tech side of things, crafting an application that not only securely handles a ton of data but also prepares calculations and reports based on the algorithms provided by the client. Tailored to meet Claims Carbon's core goals, our solutions included:

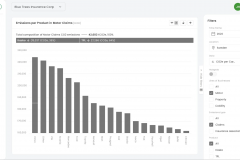

- Scalable infrastructure: We built a system robust enough to handle data rows by the hundreds of thousands, scaling up seamlessly as needed.

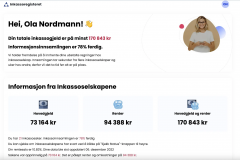

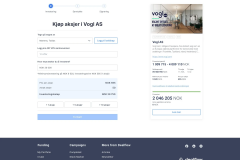

- Intuitive interface: We created a design that made inputting data into the system a walk in the park, ensuring users can provide extensive information without effort.

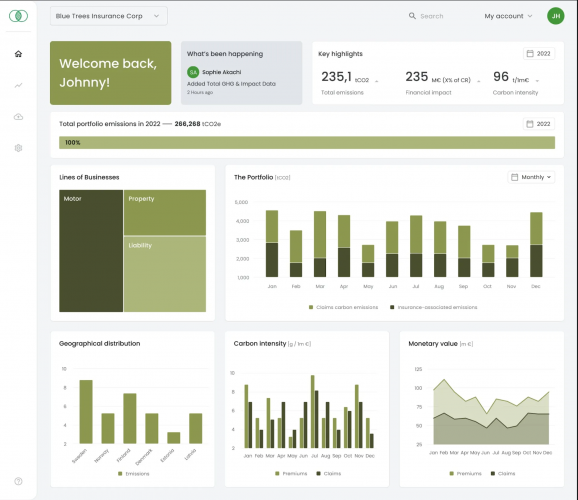

- Clear data presentation: We created automated reports with crisp, clear graphs and tables so users get the lowdown without the information overload.

- Optimised cloud environment: Our focus was on creating a cloud environment that is reliable and efficient. This means time and cost savings for Claims Carbon, ensuring smooth, hassle-free operation.

- High standard codebase: Precision in coding is crucial. We meticulously crafted our code to ensure accuracy and reliability, understanding that even the smallest error could have significant implications.

- Security and Data Privacy: When dealing with sensitive data, especially in the insurance sector, robust security and privacy measures are essential. We prioritised these aspects to safeguard the information entrusted to us.

PROCESS

Embarking on the Claims Carbon project, KOIA began with a deep dive into their existing algorithms and data models. Our goal was clear: to build a cloud-based solution that adapts and scales effortlessly, making data handling a smooth process, both at the front-end and back-end. Here's how we brought this vision to life:

- Started by thoroughly understanding Claims Carbon's algorithms and data models to align our approach.

- Developed an automatically scalable cloud application, ensuring robust handling of extensive datasets.

- Ensured the back-end was equipped to analyze data effectively, turning numbers into meaningful reports.

KEY ACHIEVEMENTS

KOIA's partnership with Claims Carbon has led to a series of focused achievements, each playing a crucial role in advancing sustainable practices in insurance:

- Built from scratch a custom application precisely fitting Claims Carbon's needs.

- Engineered a cloud platform with the capacity to manage large data volumes, which is essential for the platform's scalability.

- Developed analytical tools capable of handling Big Data, making information both accessible and actionable for front-end and back-end processes.

- Formed key partnerships with major Nordic insurance companies, broadening the scope of the carbon offset initiative.

- Upheld strict standards in code quality and data privacy, vital for maintaining integrity in the industry.

This ongoing project is more than just a technical innovation for us; it's about meaningful collaboration and a commitment to environmental change.

Poland

Poland