Mamble

Digital product and marketing automation under one roof

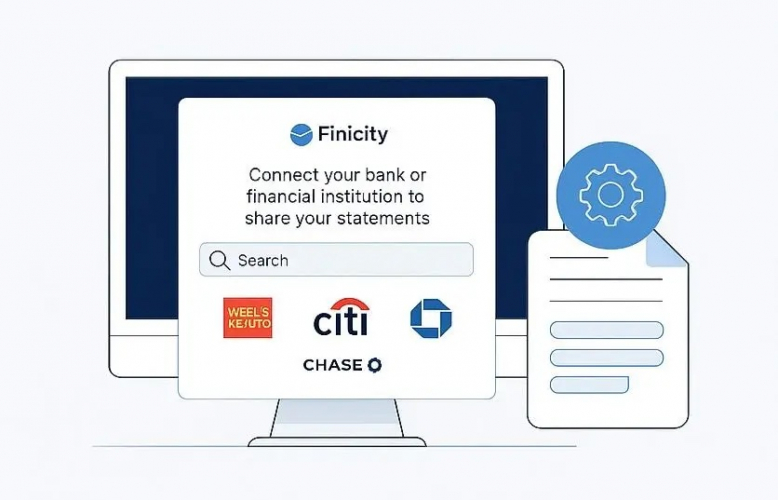

Mamble is a product development and marketing automation partner with over 15 years of experience in fintech, CRM systems, and lead generation.

We’ve built high-performance systems including:

-

Online loan application portals

-

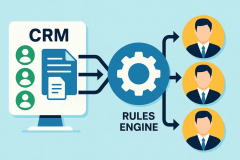

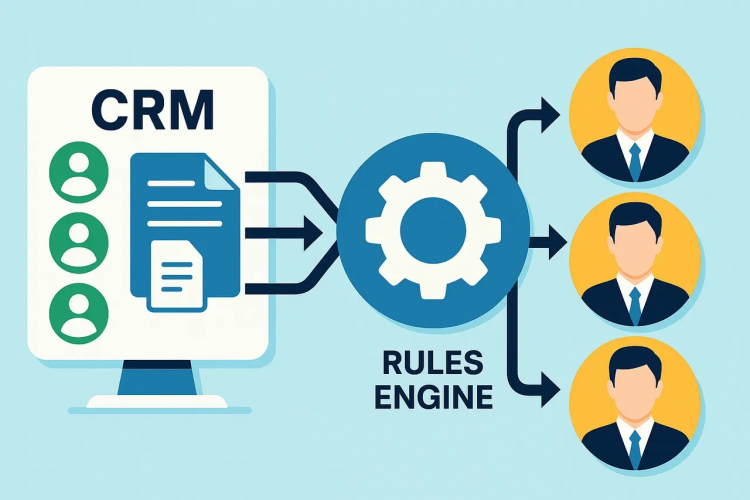

Dynamic lead distribution engines

-

Twilio-based call centers

-

Marketing attribution and A/B testing tools

Our projects power real-world operations — from US-based financial firms to growth-stage teams scaling across Europe.

As an ISO 9001-certified team, we combine software engineering precision with deep marketing insight to deliver solutions that automate workflows, reduce CPA, and support measurable growth.

We specialize in bridging the gap between product engineering and performance marketing — whether you need a custom CRM, internal ops tools, or growth-ready APIs.

Headquartered in Armenia, we serve clients across the US and Europe with timezone-aligned teams and a proven ability to deliver on complex, high-stakes projects.

Armenia

Armenia

Detailed Reviews of Mamble

Client Portfolio of Mamble

Project Industry

- Financial & Payments - 100.0%

Major Industry Focus

Project Cost

- $50001 to $100000 - 100.0%

Common Project Cost

Project Timeline

- Not Disclosed - 100.0%

Project Timeline

Clients: 3

- Freedom Financial Network

- dot818

- Freedom Debt Relief

Portfolios: 2