ABSTRACT:

Customer focus, technological exuberance, redesigning of business models, and increased regulations are all changing the insurance landscape like never before. With the economic recovery in foresight and expanded digital capabilities, the insurance industry is poised to accelerate its growth in 2022 and beyond. However, there are many challenges that the industry needs to mitigate amidst the rising inflation, geopolitical tensions, and era of interest rate uncertainty. Consumers are seeking innovative insurance products and their expectations are higher than ever before.

This research titled: 'Global Insurance Industry Outlook 2022: Megatrends and Key Challenges’ by Goodfirms analyzes all the current trends, customer perception, industry competition, evolving concepts, key challenges, regulations, and technological innovations in the insurance industry. An online survey was carried out between 25th April 2022 and 6th May 2022. A total of 490 responses were collected. The survey queried selected participants across the world on their insurance preferences, policy holdings, buying behavior, perception of the insurance industry and their processes, and top influences driving their insurance purchase decisions.

Table of Contents:

Introduction

Current Scenario in the Insurance Industry

Types of Insurance: Products-Wise

- Health Medical Insurance

- Life and Accident Insurance

- Vehicle Insurance

- Home Loan Insurance

- Business Insurance

- Term Insurance

- Credit Card/Debit Card Protection Insurance

- Property Insurance

- Cyber Insurance

- Liability Insurance

- Litigation Risk Insurance

- Microinsurance

- Reputation Risk Coverage Insurance

- Retirement and Annuity Insurance

- Mobile Device/Home Appliance Insurance

- Reinsurance

Mega Trends in the Insurance Sector

- #More People Prefer to Buy Insurance from Private Insurers than Public ones

- #Online Website/Mobile App of the Insurer is the Most Preferred Channel to Buy an Insurance Policy

- #Price is the Biggest Influencer in Insurance Buying Decisions

- #Overall, 57.9% do their own research, website analysis, and policy comparison before initiating a policy buy.

- #Personalized Products in Demand

- #Embedded Insurance: A Ubiquitous Product Channelizing Innovations

- #Open Insurance Gains Traction Around Global Markets

- #Peer-to-Peer Insurance: A New Frontier of Insurance Modernization

- #Growing Usage of Social Media to Advertise Insurance Products

- #Growing Plea for Net-Zero Emissions

Key Challenges and Major Barriers to Growth

- Disintermediation is a Major Risk for Core Insurance Companies

- The Industry is a Laggard in Customer Education

- Consumer Demand Lower Insurance Premiums but Higher Coverages

- Unavailability of Monthly Premium Paying Option

- Rising Inflation

- Economic Instability in the Pandemic Era

- Lack of Trust Between Insurers and the Clients

- Lengthy and Frustrating Claim Settlement Processes

- Abuse of Drugs and Health Care Insurance Claims

- Rising Investment Thresholds in Insurtech

- Faster Technology Adoption in Insurance World

- The insurance Industry is Revamping its Distribution Channels

- Insurers Provide Discounts on Use of Smart Devices and Safety Measures

- Focus on Customer Experience

- Better Risk Management With Technological Assistance

Technologies Empowering the Insurance World

- Telematics: Tech for Insurance Premium Adjustments

- Claim Assessment Technologies Expedite Claim-settlement and Ensure Accuracy

- Insurtech 2.0: Growing Usage of Tech that Enhances CX and Simplifies Processes

- AI and Robotic Process Automation

- Blockchain

- Metaverse

Regulations

Future of the Insurance Industry

KEY FINDINGS

CONCLUSION

References

Introduction

The global insurance industry is witnessing renewed growth and spurred business activity amidst heightened customer sentiments for insurance and aggressive investments from private players and intermediaries. With the economic recovery in foresight and expanded digital capabilities, the insurance industry is all poised to mitigate the financial impacts of the pandemic and accelerate its growth further in the year 2022 and beyond. However, the industry is facing challenges such as economic instability, adverse geopolitical situations, a rise in inflation, technological implementation issues, competition from intermediaries, etc.

Insurance providers globally have ramped up their technological infrastructure to reduce costs, increase flexibility, improve customer engagement, and mitigate challenges. Technologies such as AI, Blockchain, AR/VR, etc. that support the insurance industry are posing as game-changers.

This survey by Goodfirms titled:'Global Insurance Industry Outlook 2022: Megatrends and Key Challenges’ attempts to analyze the current trends, customer perception, industry competition, key challenges and industry barriers, success factors, and technological innovations in the insurance industry.

Current Scenario in the Insurance Industry:

If we go by the profit perspective, Insurance has not been a very lucrative industry. The margins, return on investments, and return on assets have been lower compared to other industry segments. The COVID-19 health crisis further dented the industry's growth prospects. The premium growth dropped to 1.2% in 2020 from an average of 4% between 2010 and 20.(1) COVID-related claim payouts amidst the catastrophic pandemic and higher attrition rates in the aftermath further broke the banks of many insurance companies, that now stand with a large number of outstanding losses. Even loss-free insurance companies are witnessing a huge drop in their overall brand valuation.(2)

With the pandemic still not completely over, the emergence of more transmissible COVID-19 variants and the uncertainty around the ability of vaccines to keep the pandemic under control suggest that the claim payouts will still remain on the higher side.

"With claim payouts on the rise, keeping up with claim reserves has been a challenge," says Taylor George, Independent Agent with The George Insurance Agency in Fishers.

However, with unprecedented fiscal stimulus, COVID-relief packages for industries, and direct benefits transfers to households, the insurance industry has witnessed a quick bounce back from the lows of 2020. The industry is showing some signs of growth in 2022; especially, the countries that have attained a larger rollout of vaccines are showing more growth.

However, there are concerns as the current growth in premium revenues comes mostly from price hikes and not due to increased policy volumes. Further, the environment of high-profile cybersecurity attacks, stringent underwriting standards, and increasing interest rates is capping the sector's profitability and pricing competitiveness. Core insurance businesses are also facing headwinds amidst the rise of the intermediaries (Insurtechs, Insurance aggregators, policy comparing websites, etc.).

The rise of Intermediaries

Insurance is witnessing a value shift towards the intermediaries and aggregators, who are now the new-age digital distribution channels. While the imminent partnerships with intermediaries have brought some revenue growth for the core insurance sector, there are multiple challenges. The intermediaries are asset-light as they are not responsible for providing coverages but enjoy commissions on selling policies through their web properties. Intermediaries also enjoy advertisement revenues from financial companies as well as monetary benefits for sponsored policies.

The core insurance segment is losing to the intermediaries, who are now preferred destinations for institutional investments as their revenues rise year on year.

The most disastrous outcome is that even when insurance companies are retaining the premium revenues, they are losing the client relationships to the intermediaries who now control the client relationships.

With billions of dollars of investments and huge marketing budgets, intermediaries and price comparing websites have leveled up their visibility and brand awareness. With convenience factors at powerplay, algorithmic support for policy recommendations, and next-level customer services, these new-age companies are becoming preferred channels to buy insurance products.

On the positive side, the insurance industry has also started investing heavily in technologies or partnering with insurtech to bring down operating costs. The sector is revamping its distribution channels, rethinking customer engagement strategies, and eliminating legacy systems to come at par with competitors and intermediaries. The ongoing health crisis has renewed the focus on health insurance products, and the industry has come up with several customized products that cover COVID-related medical complications. Health insurance has emerged as the most sought-after insurance product, with 78.9% of respondents in Goodfirms' survey agreeing to hold a healthcare policy.

Health insurance, Life Insurance, and Vehicle insurance are the top three insurance policy types that people hold. 78.9% of respondents agreed to hold a health insurance policy, 73.7% hold a life insurance policy, and 52.6% stated that they currently hold a vehicle insurance policy.

Insurance is financial protection against losses due to unforeseen circumstances. It covers both financial and non-financial losses. Health insurance pays for medical expenses, doctor visits, hospital stays, prescription drugs, life insurance covers life and also provides maturity benefits, and vehicle insurance pays for accident damages or theft.

Here, we will further highlight some of the top insurance products in detail:

Types of Insurance: Products-Wise

Health Medical Insurance

78.9% of surveyees in Goodfirms’ research stated to have a health insurance policy.

Health insurance coverage pays for medical expenses. Health insurance can take many forms, including employer-sponsored group plans, individual plans purchased through marketplaces, or government-run insurance programs. Employer-sponsored health insurance is offered by employers to their employees and their dependents. Medicaid is a government-run health insurance program that is available to low-income people who meet certain eligibility requirements.

Life and Accident Insurance

73.7% of surveyees hold a life and accident insurance policy.

Life and accident insurance policies are designed to protect consumers from financial loss in the event of death or injury. In general, life insurance provides a lump sum payment to survivors upon the insured party's death. On the other hand, Accident insurance provides coverage for medical expenses and lost wages in the event of an accident. The coverage included in accident insurance varies by policy but typically includes both short-term and long-term disability coverage.

Short-term disability coverage may be sufficient to cover a few months' worth of lost wages if the insured is injured, while long-term disability coverage can be more robust, covering multiple years' worth of wages. Accident insurance may also include some sort of mental health coverage for the trauma associated with an accident that leads to mental health issues like PTSD or depression.

Vehicle Insurance

52.6% of respondents have vehicle insurance.

Auto insurance (also known as motor insurance or vehicle insurance) protects against a range of potential losses, including liability for injuries and vehicle damage, theft, third-party damage, and medical bills. Auto liability insurance covers any costs associated with injuries you cause to other people or damage caused to their property. Collision coverage covers damage to the vehicle from a crash. Comprehensive coverage covers damage from things like storms and vandalism.

Beyond these three basic types of auto insurance coverages, there are a variety of optional coverages that may be worth considering, including towing and rental car reimbursement, roadside assistance, personal injury protection (PIP), and collision vehicle replacement.

Home Loan Insurance

21.1% of surveyees stated they have home loan insurance.

Home loan/Mortgage insurance is a type of insurance that protects lenders against loss in the event that a borrower is unable to make mortgage payments. The Insurer will reimburse the lender for any amounts they owe as a result of a borrower's default. A home loan insurance policy is typically taken out by the borrower to protect the lender in the case of default. This type of policy is required by most conventional lenders–banks, home finance companies, etc. but there are some that allow forgoing this requirement as the home loans already fall in the category of 'secured loans.'

Business Insurance

17.9% of businesses surveyed by Goodfirms have insured their businesses

Business insurance protects businesses against a variety of risks and provides coverage for property damage, losses, vendor liability, fraud, compensation, lawsuits, and employee injuries. Business Insurance includes a variety of different coverage options that can be tailored to a business's needs.

Term Insurance

11.2% of respondents hold a term insurance policy

Term insurance provides life coverage for a specified period of time. The benefits are derived in case of the death of the insured. Nominees get the lump sum amount for which the insured was covered. Term insurance is typically less expensive than other types of life insurance because it is designed to cover a life need and does not build up cash value over time. Term insurance can be used to cover expenses such as funeral costs, the cost of replacing lost income, and outstanding debts.

To qualify for term insurance, one must typically be in good health and meet the insurance company's minimum age requirements. Insured can renew your policy before it expires but may have to take another medical exam if their health has changed substantially since your last policy was issued.

Credit Card/Debit Card Protection Insurance

10.5% of Goodfirms’ research surveyees have credit/debit card protection insurance.

Credit card protection insurance reimburses for losses incurred due to any fraudulent activity on your credit/debit cards. It can also help to cover the cost of any losses if a customer's identity is stolen and used to open new accounts or make fraudulent purchases using the cards' credentials. In most cases, insurers will refund the money that was taken illegally and reimburse any additional expenses that were incurred due to the fraud, such as late fees or overdraft fees.

Property Insurance

5.3% surveyees hold a property insurance

Property insurance covers damage to buildings or other structures, including their contents. On-premises coverage is the most basic form of property insurance. It covers the building or structure itself, including the foundation, walls, floors, ceilings, mechanical equipment, plumbing, electrical fixtures, appliances, etc. Coverage typically also extends to nearby structures that may be damaged in any unforeseen event. In addition, coverage can extend to protect neighboring property in the event of fire or water damage during an emergency situation.

Property insurance is available on a wide range of buildings, including homes and apartments, commercial buildings and stores, offices and warehouses, schools and churches, industrial buildings and factories, farms and agricultural buildings, recreational properties such as campsites and cabins, vacant properties available for rent, and many more.

Cyber Insurance

5.1 % of businesses surveyed by Goodfirms hold cyber insurance policies.

Cyber insurance protects individuals, small businesses, large corporations, and managed service providers from losses due to cybercrimes. Cyber insurance is complicated and difficult to get, unlike other types of insurance. There are very few insurance companies that have expertise in dealing with cyber insurance needs as most of the reported losses are intangible: data, identities, losses due to disruption, etc. This makes it difficult to quantify.

Moreover, amidst the explosion of ransomware and frequent cyber attacks, cyber insurance companies are struggling to keep up their profits and therefore, making the product less attractive. However, with the rise of more small-scale businesses, celebrities, individuals, freelancers, etc., opting for cyber insurance policies, insurance companies operating in this field may get the required scale for profitable outcomes.

Other Popular Insurance Products:

Liability Insurance

Liability insurance protects people from being financially responsible for any damage or injury that they may cause to others due to negligence or error of judgment. For example, if a customer gets sick after eating at a restaurant, the owners and the management could be held liable for the medical expenses. Liability insurance protects the insured from these types of claims. This type of insurance can be particularly important for businesses that face an increased risk of liability claims from customers and employees. Liability insurance policies typically cover costs of potential lawsuits, legal fees, and damage settlement costs resulting from property destruction, bodily injury, etc.

Litigation Risk Insurance

Litigation risk insurance covers losses arising from adverse litigation judgment. Such insurances are mostly bought by companies seeking to acquire attractively valued target companies that have pending litigation against them. To avoid litigation hindering deals, adequate litigation protection coverage is sought. This type of insurance also covers corporations, businesses, and high-profile individuals who run a risk of any litigation against them due to their business nature.

Microinsurance

Microinsurance is a term that refers to insurance coverage for small, low-value risks such as medical costs, property damage, lost items, small-scale cyber attacks, etc. It is often tailored for people with low incomes or who live in areas with high levels of poverty. Microinsurance is often provided by non-profit insurance organizations or charities. These organizations can charge lower rates than traditional insurance companies because they do not have to make a profit.

Microinsurance has a number of benefits for low-income households. It provides a financial safety net in case of unexpected circumstances. While microinsurance is more commonly used by individuals than by companies, it can also be used by businesses to cover smaller losses.

Reputation Risk Coverage Insurance

Reputation risk coverage insurance is a type of business interruption insurance that protects businesses against loss of revenue and brand reputation resulting from negative public perception. Reputation risk coverage insurance protects against loss of reputation due to a data breach, cyberattack, crisis, or privacy violation. It is available as a standalone policy or in combination with cyber liability insurance. Obtaining comprehensive cyber liability protection is essential for organizations that collect and store sensitive data. Cyber liability insurance provides coverage for costs associated with cyber breaches, such as legal fees and expenses incurred in the event of a lawsuit.

Retirement and Annuity Insurance

Retirement and annuity insurance covers people who are retired and need to receive monthly payments from pensions or annuities. The premiums for this type of insurance vary depending on the type of plan opted for, the age at which the policy is purchased, and other factors. These policies can provide a lump sum amount upon retirement that can be used to cover costs like medical bills and housing expenses. A lump-sum payment can also be made to the beneficiary in the event of death.

An annuity is an investment product where an individual deposits money and is then paid a stream of income. Financial planning for retirement can include planning for retirement and annuity insurance. This type of insurance is designed to help protect people’s assets in the event that they are unable to work due to retirement or disability.

Mobile Device/Home Appliance Insurance

Mobile device and home appliance insurance covers a variety of losses and damage related to those devices and home appliances. These types of insurance cover any damage to your mobile device or home appliances, from water damage to theft. It can also provide coverage for loss or damage to a home appliance, such as a refrigerator, stove, or washing machine, due to malfunctions, Fire events, or other incidents.

Reinsurance

Reinsurance is also known as retrocession. It is an insurance type used to spread the risk of loss between multiple insurers. Insurance companies sell their risky policies to third-party insurers, called reinsurers. Reinsurance is particularly useful for companies that have high premiums or large payouts and want to hedge their investments. Reinsurance can help to keep premiums down and reduce the financial impact of claims on insurance companies.

Mega Trends in the Insurance Sector

#More People Prefer to Buy Insurance from Private Insurers than Public ones

36.8% of people prefer to buy insurance from private insurers, whereas only 21.1% said they prefer public ones. 42.1% said they buy from both.

Private insurance companies tend to provide better customer service than public ones. People are also turning to private insurers due to the long wait times they face when dealing with public ones. Public insurers generally have large workloads and, therefore, may not respond to customer requests in a timely manner. In addition, public insurers have complicated processes that make it difficult for consumers to get the coverage they need. So, by going with a private insurer, consumers have more control over their customer experience. People also prefer the more personalized and flexible services offered by private insurance firms that tailor their policies to the individual needs of their customers. All of these contribute to better satisfaction which leads to more repeat business and referrals for private insurers.

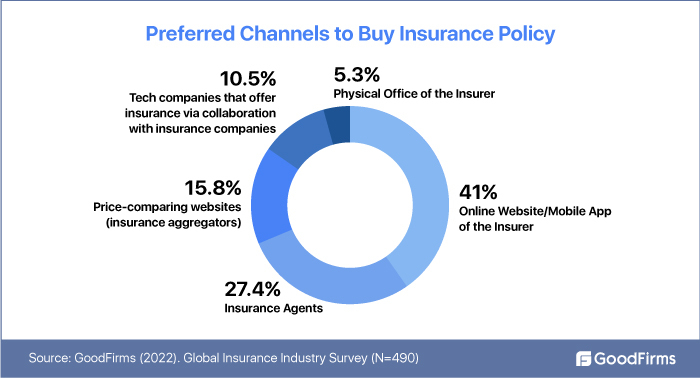

#Online Website/Mobile App of the Insurer is the Most Preferred Channel to Buy an Insurance Policy

41% surveyees mentioned the online website/mobile app of the Insurer as the most preferred channel to buy an insurance policy

A website or a mobile app is the first touchpoint for customers who are looking to buy insurance plans and policies. With online insurance websites and mobile apps, customers can quickly and easily find the information they need about different products and prices. They can also compare different insurance plans to find the best fit for their needs. Many customers also prefer to buy insurance online because it is more convenient than going to a brick-and-mortar location, and customers can shop around anytime, anywhere.

27.4% surveyees Prefer Buying Insurance from Agents

Insurance Agents represent insurance companies and offer different types of insurance policies. They have extensive knowledge of the existing products and are trained to advise people on what coverage is best for them. Insurance Agents help clients understand the nuances of different policies and offer suggestions on how to best protect themselves. Insurance agents are trained to spot red flags, have the knowledge and expertise to assess the risk factors, can walk clients through the available insurance options, and help them choose the right plan for their unique needs. In some cases, insurance agents also offer discounts and may pay the first premium installment for clients if they sign up through them.

Not only do these people prefer buying from insurance agents, but 36.8% of overall surveyees also stated that they buy insurance following advice from an insurance agent.

Investments in digital enhancements bring more prospects via digital channels. However, even AI-led platforms may lack robust personalized advice capabilities. This is where insurance agents empowered with digital tools can convert the traffic into paying clients with the addition of personal touch. Agents amplify the digital capabilities of insurance firms.

15.8% Surveyees Prefer Price-Comparing Websites (Insurance Aggregators) To Buy Insurance

An insurance aggregator is an online company with a platform that collects and compares prices from a number of insurance companies. They take the hassle out of looking for an insurance policy and provide a quick, easy way to find a competitive price.

Insurance aggregators have begun to emerge as a popular alternative to traditional insurance providers. Customers can compare various insurance plans from different providers before making a purchase. The main advantages of using an insurance aggregator include lower costs, greater choice and flexibility, and easy comparisons between different plans. Customers have to simply input some basic information (like age, location, and health history), and the aggregator will show them all of the available options. There is a growing reliance on these websites to make insurance comparisons. 63.2% of surveyees reported comparing insurance policies on price-comparison websites before buying insurance plans.

10.5% buy insurance from third-party big tech companies that offer insurance via collaboration with insurance companies

Big tech companies like Amazon, Google, Facebook, and Apple are offering insurance products based on collaboration via insurance companies. For instance, Amazon has partnered with Cigna to provide healthcare insurance(3), and with Acko insurance for auto insurance(4). Google has ventured with Swiss Re and Verily for healthcare insurance products(5). Apple has collaborated with Aetna and Humna to provide health insurance products(6).

Only 5.3% would want to visit the physical office of the Insurer to buy insurance products.

People are avoiding visits to the physical offices of insurers to buy insurance products. The widespread adoption of online venues of transactions is the reason behind lower footfalls in the physical premises of insurance offices.

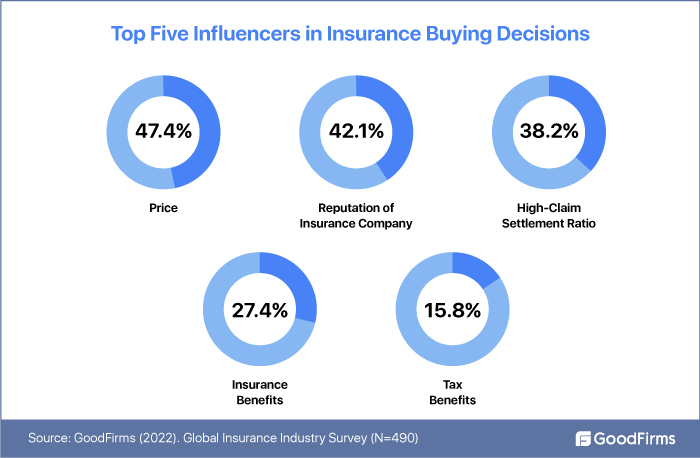

#Price is the Biggest Influencer in Insurance Buying Decisions

47.4% stated that Price is the topmost influencer affecting their insurance-buying decisions

Consumers are price-sensitive when it comes to making insurance-buying decisions. Affordability and price structure are critical for choosing policies. When the price of the insurance policy and coverage needs fall under the budget of customers, they are more likely to purchase the policy. Customers may also respond negatively to sudden and drastic changes in premium pricing. Lower-income consumers expect price subsidies, discounts, and attractively priced policies.

Premiums are paid either in a lump sum amount or in installments. While high-income customers may want to pay the lump sum amount to avail of discounts that are generally available with annual and lump-sum premium payments, low-income people may need monthly premium payment options.

For 42.1% of surveyees, the reputation of the insurance company is one of the most important considerations when buying an insurance policy.

Today consumers study the company's past track record, customer satisfaction quotient, reviews, information regarding the company's financial stability, claim handling practices, etc. online. By researching various companies and determining reputation factors, customers significantly reduce their chances of being scammed by an unscrupulous insurance company. The reputation of an insurance company is based on factors like customer care, claim settlement track record, and the quality of services offered.

Insurance companies should deploy mechanisms to accumulate positive reviews, ratings, and testimonials for satisfied customers.

38.2% consider a high claim settlement ratio before making an insurance purchase decision.

The term 'claim' refers to any time that a customer is seeking reimbursement for money lost due to a covered incident. A claim settlement ratio is calculated as the percentage of claims a company pays out from the claims that are received. In insurance, a high-claim settlement ratio means more claims were accepted, and fewer rejected. A high claim settlement ratio is important because it shows how well an insurer can handle claims on average. Insurers with a higher ratio tend to be more reliable and trustworthy. A low claim settlement ratio might indicate either poor customer service or a lack of concern by the Insurer when it comes to protecting its customer's interests.

How to calculate a claim-settlement ratio?

In order to calculate a ratio, you first need to know the number of claims made as well as the number of claims settled. The difference between these two figures is the number of claims that were declined or unpaid. After this, you can calculate the settlement ratio by dividing the number of claims paid by the total number of claims made. For example, if there were 100 claims made and 96 of them were settled, the settlement ratio would be 96%

15.8% Buy insurance Based on Tax-benefits offered by the Insurance Plan

Insurance is a tax-advantaged product and reduces taxable income. Premiums are typically considered non-taxable income for the policyholder, as are any returns from investments held in the policy’s cash value. Health insurance premiums can also be deducted as a medical expense on the taxpayer’s income tax return.

#Overall, 57.9% of respondents stated that they identify, evaluate, and select policies based on their own research analysis and online comparison of policies.

The advent of price comparing websites and the availability of abundant online resources for insurance product analysis make it easier for people to undertake a detailed research analysis before confirming their purchase.

Customers these days are getting used to analyzing the insurers' websites, studying product features, and comparing the policies before finalizing their choice. Price, quality, features, claim settlement ratios, tenure, riders, and policy provisions are top elements that people compare.

#Personalized Products in Demand

Personalization is not limited to offering tailored insurance products, offers, or deals but also assisting a prospect in navigating, evaluating, and anticipating their insurance needs and risks. It is a journey that an insurer takes along with the client while deploying strategies and technologies that will help the client in extracting full benefits from their insurance coverages. From personalized product bundles to communication and quotes, insurers are delighting their customers with fully-tailored solutions that enhance their experience.

“Customers now prefer 'all-in-one' insurance lifestyle products. Imagine all your insurance policies like car, house, and life insurance personalized to your lifestyle." says Nick Schrader, Insurance agent, Texas General Insurance.

#Embedded Insurance: A Ubiquitous Product Channelizing Innovations

Businesses are collaborating with insurance companies to embed protection covers in their consumer products and services. Using digital distribution channels and tie-ups with businesses, insurance companies are able to integrate insurance products into customers’ buying journeys with third parties. Embedded insurance is an area that shows the growing trend of globalization of fintech.(7)

Embedded insurance products are smartly woven and integrated into customer products and services. For example, if you were to purchase a new home, the seller may offer an embedded home insurance policy as part of the mortgage process. While booking train/plane tickets, the aggregator may offer you travel insurance in partnership with a travel insurance provider, or you may be given theft/damage insurance for a newly purchased mobile device.

#Open Insurance Gains Traction Around Global Markets

Open insurance ecosystems work by sharing insurance data across the insurance industry via APIs. Such ecosystems give access to consumer insurance data across various organizations and allow interoperability. Open insurance is the extension of open banking practices around the world. Insurance companies, insurtech firms, payment wallets, startups, banks, non-banking financial institutions, and even tech companies come together to provide personalized insurance services by sharing data and expertise. Open insurance ecosystems are regulation-driven in many countries. The UK, the USA, India, Singapore, China, Mexico, and Malaysia have made significant developments in open insurance architecture.

"As they integrate data from multiple sources, the Application Programming Interfaces (APIs) will enable the creation of insights-driven offerings. More accurate risk assessments, customized premiums, and value on a long-term basis will result in improved customer experience and brand loyalty, as well as fewer false claims", says Dan Close, Founder, and CEO of We Buy Houses in Kentucky.

#Peer-to-Peer Insurance: A New Frontier of Insurance Modernization

Facilitated through the use of a peer-to-peer platform, this type of insurance connects individuals who are willing to share risks to purchase insurance coverages. By pooling risk, this type of structure allows individuals to purchase insurance coverage at a lower cost than they would be able to otherwise.

Reflecting the sharing economy paradigm, P2P insurance leverages the latest technological advances in social networking to mutual fund mechanisms and creates new types of insurance companies.(8)

- Lower costs and increased efficiency

- Peer-to-peer insurance companies are decentralized and community-based.

- Insurance premiums are paid in exchange for access to a pool of potential claims payouts in the event of an accident or emergency.

- Offers lower premiums than traditional insurance policies

- Ideal for individuals who are looking for more affordable coverage options and who are comfortable with self-insuring

#Growing Usage of Social Media to Advertise Insurance Products

Consumers are increasingly using social media to research products and brands before making a purchase decision. Insurance companies are using social media to reach customers, promote their brands, share information, solve customer issues, and answer questions.

Insurers advertise and share information about the types of insurance they provide, their rates, and other information on their social media accounts. Insurance companies also conduct survey campaigns on social media networks to gain valuable insights into consumer wants and needs.

In addition, social media is a great way to reach younger generations, who are often more likely to use social media than older generations. Social media is also a great way to reach customers who speak different languages or who may not have access to other forms of communication. It also allows businesses to reach existing customers in a way that is more personal and relatable than ever before. By using social media, insurance companies stay connected with their customers by providing them with timely information on the company’s latest news and promotions.

#Growing Plea for Net-Zero Emissions

Record-breaking weather extremes, rising global warming worries, climate change challenges, and catastrophic events across the world add urgency to the race to net-zero emissions in the insurance industry. The Net-Zero Insurance Alliance (NZIA) formed under the aegis of the United Nations, is an alliance of top global insurance companies who have committed to bringing revolutionary transitions in their portfolios and bringing emissions caused by their industry to net-zero emissions levels. Initially formed with eight members in the Venice G20 summit, the alliance today has 20 members.(9)

Eight founding members:

- AXA (NZIA Chair),

- Allianz,

- Aviva,

- Generali,

- Munich Re,

- SCOR,

- Swiss Re

- Zurich Insurance Group.

The alliance is working towards ESG goals and striving to decarbonize the industry.

ESG Movement in Insurance:

Environmental impacts from insurance include the emissions associated with vehicle and personnel travel, water use, materials use, and waste generation. Social impacts from insurance include the impact on communities from changes in insurance rates and coverage as well as the effect of human migration patterns as a result of displacement from natural disasters. Governance impacts from insurance include the ways in which governments interact with insurers to regulate premiums and coverage requirements. The ESG movement calls for insurance companies to take responsibility for their environmental, social, and governance impacts to ensure that they are doing their part in creating a sustainable future.

Key Challenges and Major Barriers to Growth

Disintermediation is a Major Risk for Core Insurance Companies

Many core insurance companies are facing stiff competition from insurtech companies and original equipment manufacturers who have started selling their own insurance products to their primary customers. "Risk is continued disintermediation, whether it be self-driving cars, companies like Tesla selling their own insurance, capital markets providing alternative risk management, etc.," says Ian Gutterman, CEO of Informed Insurance.

The Industry is a Laggard in Customer Education

Financial education regarding insurance products is critical for customer-centric organizations. However, insurance products are still perceived to be complicated compared to other financial instruments. Complicated wordings and lengthy documents deter customers from reading the policy documents thoroughly. Almost 42.1% of policyholders asserted their confusion regarding what their insurance covers.

Helping customers navigate through the intricacies of their policy coverages can help insurance companies build a more loyal customer base. If using insurance jargon is demanded due to the nature of the industry and its processes, insurance companies can publish-secondary materials and articles explaining their policy contents in an easy-to-understand way.

Consumer Demand Lower Insurance Premiums but Higher Coverages

Insurance companies are facing insufficient premiums to coverage challenges. The collected premiums are lower than the expected coverages. "People who work from home are asking for lower rates on their car insurance because they are on the road less than before", says Shawn Laib, an insurance expert with Clearsurance.

Unavailability of Monthly Premium Paying Option

31.6% of respondents asserted that the unavailability of a monthly premium option is a deterrent in buying policies.

Mostly, insurers stick to annual payment options to ensure high retention and prevent shifts to other policy providers. However, the monthly installment premium option helps increase insurance penetration when affordability is a major issue. Rising premiums amidst a cash crunch can prevent many from buying insurance policies at lump-sum amounts, and therefore, a monthly payment option becomes crucial to ensure persistence.

Rising Inflation

High-interest rate environments increase premium requirements when already the disposal income is at an all-time low due to inflation.

War-induced commodity price increases and broadening price pressures have led to 2022 inflation projections of 5.7 percent in advanced economies and 8.7 percent in emerging market and developing economies—1.8 and 2.8 percentage points higher than projected last January.(10)

Considering the current inflation numbers, the persistence of high-interest rate environments in the foreseeable future cannot be ruled out.

Economic Instability in the Pandemic Era

The pandemic created more pain in the vulnerable parts of the world, and governments with limited resources were unable to combat it. The effects of financial instability and hardships in society are still visible even when the world is striving hard to recuperate from the disaster.

The pandemic caused widespread economic instability and has been a deterrent for the insurance industry. It has also put the industry's bottom lines under tremendous stress as more claims were filed, especially the healthcare ones.

While the current scenario is changing in favor of the industry's long-term sustainability as people's perception regarding insurance has changed and more people are buying insurance products, in the short term, the industry will struggle to cover the losses borne during the pandemic.

Lack of Trust Between Insurers and the Clients

The lack of trust stems primarily from the lack of transparency and reports of many insurance companies failing to settle the claims or rejecting them. As a result of this, insurers and their clients have difficulty building long-term relationships.

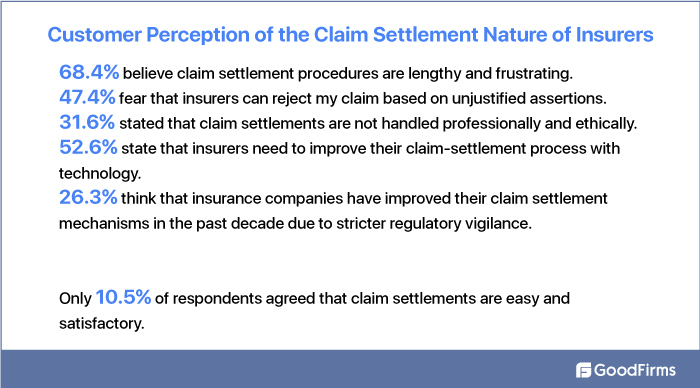

Goodfirms survey revealed customers' perception about the claim settlement process, and the results hint toward the lack of consumer confidence in the claim settlement process of insurers.

Lengthy and Frustrating Claim Settlement Processes

Claim settlement is a complex task with multiple variables in consideration. There are technical challenges, stressful moments with the customers, fraud claims to deal with, and underwriting issues. While the industry is getting rid of slower legacy systems and deploying digital capabilities to expedite claim processing and bring more accuracy to the process, customers still have a negative perception of claim settlement processes.

68.4% of policyholders surveyed by Goodfirms stated that claim settlement processes are lengthy and frustrating.

Abuse of Drugs and Health Care Insurance Claims

The opioid epidemic has already had a significant impact on the insurance industry. When used as prescribed, opioids such as Fentanyl can be effective painkillers for short-term use. But misusing opioids can cause serious health problems, including addiction, overdose, and even death. Health insurance providers are concerned about the increasing rate of opioid abuse. Opioids can be addictive and can lead to physical and mental health problems, including depression and chronic pain. As opioid abuse has become more common, more people have been seeking treatment and coverage for opioid abuse treatment. This has led to significantly higher costs for insurers.

“There is a growing risk of overdose by fentanyl, and this risk is outpacing insurers' responses to it,” says Jimmy McMillan, Founder of Heart Life Insurance.

The opioid epidemic is having significant financial implications for health insurers, as people with opioid addiction often have higher rates of emergency room visits and hospitalizations than other people. Moreover, health insurers also have to deal with high costs for prescription opioids themselves.(11) Health insurers are concerned about all these issues and are looking for ways to address them. One way they can do this is by providing support and counseling services to patients who are taking opioids and who may be at risk of becoming addicted.

Key Success Factors

Rising Investment Thresholds in Insurtech

Insurtech is a technology-driven industry that helps insurance companies to manage their policies, claims, and other processes. Because of its high potential, large amounts of funding are being invested in this space. "Hundreds of millions of dollars are being poured into the end goal of how we can implement technology and specifically AI, to replace an archaic system of assessing risk", says Michael E. Gray, Jr., Owner and Founder, KeyPersonInsurance.

However, only companies with strong fundamentals and proven track records have a chance of securing funding. Insurtech startups that can meet the rising investment thresholds will be able to secure funding for their businesses and grow more quickly.

Faster Technology Adoption in Insurance World

In today's increasingly complex insurance environment, it is more important than ever for insurers to have the right data and technology in place to optimize processes and create a competitive advantage. By leveraging the latest technologies, insurers automate manual processes and make better risk-management decisions while also improving customer experience and brand reputation.

With technologies such as AI, ML, blockchain, big data, cloud computing, and predictive analytics, insurers now collect and analyze vast amounts of data related to all aspects of their business - from premiums, claims, and customer behavior to weather patterns and traffic accidents. This helps them make better decisions about pricing, coverage levels, and risk assessment. AI is also used to automate routine tasks - such as processing paperwork - freeing up employees' time to focus on more important tasks.

The Insurance Industry is Revamping its Distribution Channels.

The traditional agent-led distribution channel has dominated the insurance industry for decades. The paradigms are changing now, with major insurance giants focussing on digital distribution channels with AI capabilities to offer hyper-personalized insurance services. Third-party distribution channels such as comparison websites, Robo advisors, P2P insurance, etc., have emerged.(12) Insurance companies are also partnering with intermediaries who sell insurance as an ancillary product to their primary product or service. For instance, automakers selling vehicle insurance, loan providers selling loan-coverage insurance, transport companies/cab aggregators selling accident insurance, etc.

As the new-age digital distribution channels, such as comparison websites, intermediaries, etc., are getting more engagement from potential insurance customers, it becomes imperative for insurers to sophisticate their digital and agent-led channels to stay ahead of other competitors. A healthy collaboration with intermediaries and embedding insurance products on partner websites/platforms will be a prudent solution to bridge the distribution gap.

Insurers Provide Discounts on Use of Smart Devices and Safety Measures

Homeowners that have home security systems, fire sprinklers, smoke detectors, leak detection systems, pool safety, etc., installed in their homes can get discounts on their liability and term insurance premiums.

- Sharing data from health wearables that track sleep patterns, heart rates, calories, body temperature, etc., to insurance companies can get discounts on premiums.

- Residential buildings and industrial structures with devices that detect fire outbreaks, water leaks, gas leakages, etc.

- Implementing in-car devices that track driving behavior, predict malfunction, weather conditions, traffic and road conditions, etc.

- AR/VR to demonstrate insurance products and better manage customer communication

- Drones for claim assessment and on-site surveys

Focus on Customer Experience

The structural overhaul is evident in the insurance industry, which is now prioritizing customer experience and deploying smarter tools to meet client expectations. Seamless communications, multi-channel interactions, and hybrid experiences have become the top CX initiatives undertaken by insurance companies. The data revolution has already allowed insurers to personalize purchases, recommendations, and renewals. From internal profiling of customers to suggest them the best policies to exceptional claim assistance, insurers are taking their customer service equations to the next level.

For instance, travel insurance companies are using IoT to monitor the travel experiences of their customers and also send real-time alerts of safety through predictive analytics. AI coupled with augmented reality can highlight a potential risk to vehicles across a risky geographical area, and insured travelers who receive such timely alerts will value the level of engagement, care, and proactiveness shown by their Insurers.

More focus is on providing comprehensive choices to customers, the convenience of purchase, and the speed of insurance delivery.

Better Risk Management With Technological Assistance

Risk management is a process of identifying and analyzing potential hazards, assessing the likelihood of their occurrence, and devising strategies to minimize their impact should they materialize. It is an essential component of any comprehensive insurance strategy, as it allows insurers to identify, quantify, and mitigate the risks associated with insuring a given client or portfolio of clients. AI-powered predictive analytics provide insurance companies capabilities to reduce risk exposures.

Technologies Empowering the Insurance World

Telematics: Tech for Insurance Premium Adjustments

Telematics car insurances track insured people's driving behavior via devices fitted in the vehicle, such as Diagnostic plugin devices, Bluetooth beacons, Analytics software, Motion sensors, etc. The usage-based insurance provides discounts on premiums for safe driving. Telematics enables insurance companies to create tailored plans based on driving behavior, reward safe drivers with premium discounts, and increase premiums for risky ones.

Telematics is a game-changer for cab aggregator companies that can not only get insurance coverage but also track driver behavior in real-time with shared analytics and ensure passenger safety. Telematics, along with artificial intelligence and augmented reality, can be extremely useful for risk mitigation. Recently, Telematics has gotten a significant boost with Tesla's insurance points that calculate premiums by tracking real-time driving behavior and rewards for higher safety scores.(13)

Claim Assessment Technologies Expedite Claim-settlement and Ensure Accuracy

Insurance companies have started using drones, satellite images, machine learning, and AI together for large-scale damage assessment involving land areas, farms, real estate, cruises, etc. Manual claim payout decision-making can take a long time and significant work hours for claim assessment and processing in incidents such as a large-scale fire in a remotely located resort or villa or damage to crops in agrarian land covering thousands of acres.

Matt L. Schmidt, the diabetes life insurance advisor for Diabetes Life Insurance Solutions, says-”Now, consumers can be approved for $3 million of coverage in a matter of minutes. Life insurance AI can pull MVR data, prescription history, Medical Information Bureau activity, etc, and can determine an applicant's eligibility immediately. The days of waiting 4-6 weeks for an underwriting decision are over for most people who are applying for coverage.”

Insurtech 2.0: Growing Usage of Tech that Enhances CX and Simplifies Processes

Agents, insurance brokers, and insurers now use CRM tools to get a 360-degree view of customer demographics, chatbots for resolving queries, and marketing automation for hyper-personalized policy suggestions. From mining data for predictive analytics to post-sales support, technology is equipping agents with tools that streamline work, engage customers, and increase agent efficiency.

Insurtech 2.0, a next-generation technological innovation in the insurance industry, is a leap over the first phase of insurtech that focused on distribution and product development and adopted a need-based approach. Insurtech 2.0 marks leading innovations in customer experiences through AI, blockchain, and ML.

InsurTech Partnerships are Inevitable for Traditional Players

Traditional insurers will be compelled to either invest in technology or form partnerships with InsurTech firms as a result of this rapid expansion, says Robert Zeglinski, Managing Editor & Researcher, BreakingMuscle. As demand for new and more innovative products and services is catching up with the new generation of insurance seekers, the collaboration between traditional insurers and InsurTech firms becomes a necessity to improve CX.

AI and Robotic Process Automation

Underwriting: Underwriting is another area where fintech companies are implementing artificial intelligence to reduce the lengthy manual reviews, applications, and examinations to hassle-free and click-of-the-button processes.

Risk Assessment: AI is set to replace the archaic models of insurance risk assessment with sophisticated auto models that not only shorten the risk assessment process but also are highly accurate.

Blockchain

Blockchain technology is one of the biggest disruptors in the insurance industry. This can be used to automate many different processes, including claims processing. With the help of blockchain technology, insurers can process claims faster and more accurately while significantly reducing the risk of fraudulent claims. “Combined with AI, blockchain technology can offer additional tools that can reinvent and reinvigorate the insurance industry", says Meredith Kokos, Head of Marketing for Guaranteed Rate Insurance. By increasing efficiency and transparency, blockchain can help to reduce costs and improve customer experience.

Blockchain has a wide range of applications in the insurance industry:

- Insurers can use blockchain to store data such as claims, premiums, and policy details on a decentralized network.

- Blockchain enables the creation of “smart contracts” that automatically execute when certain conditions are met.

- Blockchain reduces fraud by decentralizing data, expedites claims processing by enabling trusted third-party verification, and improves transparency by providing secure data access to all parties. “Blockchain allows for more secure claims. There are multiple claims and frauds that happen in the insurance industry. With the use of blockchain technology, that can be mitigated”, says Anthony Martin, CEO of Choice Mutual.

- Blockchain is also being used for KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance.

- It can also be used for identity verification and claims processing. It can improve efficiency, reduce costs, and improve customer experience.

Metaverse

The Metaverse is a virtual reality ecosystem that allows users to create and monetize their digital realities. By creating a digital avatar, users can interact with other avatars in a virtual world, much like the real world. Insurance companies can use the Metaverse to conduct remote interviews with customers who have filed insurance claims, onboard new customers, etc. This can help insurance companies to reduce their operating costs, increase the speed of claim processing, and build trust with customers by providing them with a better customer experience.

Regulations

A highly scrutinized industry, the insurance industry is governed by global capital standards. Though national and regional regulations dominate the industry, the frameworks are almost similar across the globe. As international financial markets are interconnected with each other, addressing systemic risks requires the industry to work amidst stringent regulatory frameworks that are designed to protect the insurers, insured, and other connected financial institutions.

Top Regulatory Bodies globally:

- Prudential Regulatory Authority(PRA), the UK

- The National Association of Insurance Commissioners (NAIC), the USA

- Insurance Regulatory and Development Authority IRDA, India

- German Federal Insurance Authority, Germany

- Banking and Insurance Regulatory Commission - CBIRC

- The Financial Services Agency (FSA), Japan

- Insurance Bureau of Canada, Canada

- The Central Bank of the Russian Federation (the CBR), Russia

The insurance industry is regulated by these statutory bodies, mostly established under the administrative acts of the countries. From Licensing to controlling and standardizing policy products, these regulatory bodies preserve the standards required for the industry and prevent unfair trade practices.

Future of the Insurance Industry

The uncertainty overhaul caused by the pandemic, recent geopolitical events, inflationary regimes, etc., have made people more conscious of their and their families' future well-being.

47.9% of surveyees are planning to buy more insurance policies to protect themselves from uncertainties, revealed the Goodfirms survey. This will bring more opportunities for the insurance industry in the near future.

Insurance plays an important role in financial planning, providing peace of mind and financial protection for individuals, businesses, and property owners. Since it is a relatively mature industry, it is unlikely to undergo any dramatic changes in the short term. However, the successful implementation of emerging technologies can bring drastic changes in the insurance world. For instance, as self-driving technology continues to develop, it’s likely that car insurance rates will become more affordable as fewer accidents occur and fewer people need coverage.

We may see more capital-raising initiatives, particularly in the cyber insurance stream. The viability of cyber insurance depends on the ability of insurers and clients to generate additional capital assets that can address cyber catastrophes that hit multiple companies simultaneously. The large-scale events infect multiple clients at the same time, and therefore, covering them all together can be challenging for insurers.

The future may also see more involvement of large tech companies in the insurance industry and enhancements in the open ecosystems. "So many companies like Amazon, Google, and Facebook have so much personal data that I actually think we may see these companies start partnering with insurance companies to exchange the data they store," says Mike Brown, Director of Communications at Breeze, an insurtech company simplifying the disability and critical illness insurance transactions.

Certain provisions/clauses in insurance policies waive coverage for particular types of risks or events for which a claim is sought. Insurers refuse to cover such specific risks, and they are known as insurance exclusions or riders. For example, Health Insurance doesn't extend to weight-loss medication, or Hearing aids are not covered by health insurance. Epidemics and pandemics are excluded from travel insurance. General maintenance or damage caused by normal wear and tear are excluded from home insurance. Damage to commercial business property due to riots, war, or military actions is not covered.

There are more specific exclusions, such as accidental insurance claims that can be denied for driving a bike with a higher cc engine than specified in the policy document. Apart from exclusions, policies are also designed to provide lower insurance coverages for people with a history of high blood pressure, diabetes, chronic illness, etc. Such issues also increase insurance rates and premiums.

Many countries have come up with stronger legislation and guidelines for insurers to protect the rights of the LGBTs –(lesbian, gay, bisexual, or transgendered). However, there are still a few insurance companies that do not have a clear policy for LGBTs.

Extensive riders, demonic exclusions, and ambiguous policy provisions repel many insurance buyers.

The insurance industry's future depends on how they strive to be more inclusive and construe policy provisions in favor of policyholders at the time of claims.

Overall, the outlook for the global insurance industry is mostly positive, with an expected above-average growth of 3.3% in 2022 and 3.1% in 2023.(14)

KEY FINDINGS

- More people prefer to buy insurance from private insurers than public ones.

- The online website/mobile app of the insurer is the most preferred channel to buy an insurance policy.

- Price is the biggest influencer in insurance buying decisions. Other influencers are the high-claim settlement ratio, the reputation of the company, insurance, and tax benefits.

- There is a growing usage of social media to advertise insurance products.

- Insurance marketers are turning to social media to advertise insurance products.

- 57.9% do their own research, website analysis, and policy comparison before initiating a policy buy.

- Personalized policy products are in huge demand.

- Rather than marketing insurance products, futuristic insurers will prioritize embedding insurance products into the daily activities of customers.

- Consumers are demanding lower insurance premiums but higher coverages.

- Disintermediation is a major risk for core insurance companies who are losing their client relationships.

- Unavailability of monthly premium paying options is a deterrent for buying insurance and halts higher insurance penetration.

- Rising inflation, economic instability, lack of trust between insurers and clients, and growing drug abuse are challenges that the insurance industry currently faces.

- Common consumer perception about claim settlement processes is that the claim settlement processes are lengthy and frustrating.

- Rising investment thresholds in insurtech, faster technology adoption in the insurance world, and revamped distribution channels are top success factors for the insurance industry.

- Customers get discounts if they share data obtained from the use of smart devices and safety measures with their insurers.

- Insurance companies are focussing on customer experience more than ever before.

- Telematics is revolutionizing the insurance premium adjustments in the auto insurance category.

- Claim assessment technologies powered expedite claim settlement and ensure accuracy.

- Insurtech 2.0 is dominating the current technological arena in the insurance sector with growing usage of tech that enhances customer experience and simplifies processes.

- Embedded insurance, peer-to-peer insurance, and open insurance ecosystems are trending themes in the insurance sector.

- Blockchain brings efficiency and transparency to insurance transactions.

- Metaverse is poised to bring dramatic effects on the insurance landscape.

- The outlook for the global insurance industry is positive.

CONCLUSION

While challenges remain due to lingering pandemic concerns, the industry is poised to grow substantially from the current levels. The alignment of emerging technologies with current processes and proactive management decisions can help insurance companies to achieve exceptional growth in their revenues, profitability, and customer base.

Consumer-focused insurance businesses will have to ascertain the precise needs of their customers and integrate technology to unleash improved business models and deliver personalized solutions. The insurance industry can utilize tools such as insurance agency software to streamline operations and increase productivity.

We sincerely thank our Research Partners who participated in the Goodfirms Global Insurance survey 2022.

References:

- https://www.mckinsey.com/industries/financial-services/our-insights/global-insurance-pools-statistics-and-trends-an-overview-of-life-p-and-c-and-health-insurance

- https://brandfinance.com/press-releases/worlds-top-insurance-brands-lose-nearly-30-billion-in-brand-value

- https://www.cnbc.com/2018/03/08/amazon-entry-into-health-care-narrows-with-cigna-express-scripts-deal.html

- https://www.businessinsider.in/business/startups/news/amazon-and-flipkarts-binny-bansal-backed-acko-raises-255-million/articleshow/87326012.cms

- https://www.reuters.com/article/us-alphabet-verily/alphabets-verily-targets-employer-health-insurance-with-swiss-re-partnership-idUSKBN25L1Q9

- https://www.cnbc.com/2019/01/28/apple-aetna-team-up-on-attain-health-tracking-app.html

- https://www.forbes.com/sites/alexlazarow/2021/10/12/embedded-insurance--where-are-we-now/

- https://content.naic.org/cipr-topics/peer-peer-p2p-insurance

- https://www.unepfi.org/net-zero-insurance/

- https://www.imf.org/en/Publications/WEO/Issues/2022/04/19/world-economic-outlook-april-2022

- https://www.cbo.gov/system/files/2022-01/57050-Rx-Spending.pdf

- https://www.mdpi.com/2227-9091/9/8/143/pdf

- https://www.tesla.com/support/insurance/real-time-insurance

- https://www.swissre.com/dam/jcr:f0561771-6248-4cab-a21e-57adf78ce378/swiss-re-institute-sigma-5-2021-en.pdf