Abstract:

The recent hype about the Non-fungible-tokens(NFTs) is apparent in the rising sales numbers of NFTs around the world. This research by Goodfirms analyzes the varied reasons that are causing the exceptional growth in the sales volume and transactions in the NFT marketplace. The study also details the top NFT marketplaces, most popular NFTs, recent NFT sales figures, key terminology associated with NFTs, and top features of the non-fungible tokens. The research further discourses the top challenges in the industry and evaluates if the NFT will end up like a bubble or will it sustain itself in the current business landscape?

Table of Contents:

Has NFT Become a Major Industry?

Evolution of NFTs: When and How did it Start?

Most Popular NFTs in 2021

Key Terminology Associated with NFTs

Top Features of NFTs

NFT vs. Cryptocurrency

What Has Led to the Recent Rush in NFTs?

Is the Current Surge in NFT Volumes Pointing Towards Another Bubble?

Will NFTs Evolve from a Fragmented Marketplace to a Unified One?

Challenges in NFTs: Environmental, Valuation, Legal and Security Concerns

Key Findings

Conclusion

Introduction

NFTs, or non-fungible tokens, an entity that is centered around collectibles, have been spurring rapidly. Stamps, coins, postcards, weapons are a few examples of what people collect in various formats as a passion. Today, in the digital world, the collectibles have also progressed with a specific market. NFT or a Non-Fungible Token is a unit cryptographically built and secured on a blockchain that allows people worldwide to collect and trade any digital asset - like music, art, domain name, ticket, game, real estate, tweets, etc., with undeniable ease, and generate promising revenue. The term non-fungible consists of digital collectibles that have a unique identity and are not interchangeable.

NFTs are unique identifiers of ownership of digital assets. Authenticity, Ownership data, and Uniqueness make NFTs valuable.

With an exponential surge in demand for digital goods, NFT holds a good grip on the blockchain market. The abbreviation NFT (non-fungible token) was announced as the word of the year(1) by Collins Dictionary, coining the rise of 11,000% in 2021. One might relate an NFT to a digital twin that has no twin in the physical world.(2).

This article details the NFTs as an evolving trend, reasons for the recent rush, discusses the most popular NFTs, challenges in the field, and future implications.

Has NFT Become A Major Industry?

The non-fungible tokens are the assets based on the blockchain and cryptocurrency that allow various artists to auction their artworks without relying on traditional methods. NFTs enable people to monetize their digital content. The sale proceedings from NFTs are making headlines, with many artists able to translate their work into millions of dollars. When Mike Winklemann sold his digital artwork Everyday: The first 5000 days for $69.3 million at Christie's NFT auction, it established NFTs as a major industry in the world.(3) NFTs are not just a passing fad but a budding and innovative industry based on blockchain technology.

The practical applications of NFTs are astonishing. For example, a business that has closed due to going bankrupt may still have a customer list that is valuable. The customer list is a non-fungible and intangible asset that can be valued. Such a list can be converted into an NFT and sold digitally. Wildlife NFTs can be sold to finance wildlife conservation programs.(4) NFTs can also be used to issue tickets validated by blockchains. Such tickets cannot be counterfeited and therefore, prevent frauds where customers buy invalidated and bogus tickets on fraud websites.(5)

Will It Evolve Or Be A Passing Craze?

The skepticism that surrounds NFTs stems from the fact that their concept is similar to that of cryptocurrencies, and therefore, the cynicism associated with cryptos gets attached with NFTs too. However, the investing world has already seen the way cryptocurrency has proved most people wrong. Similarly, the digital assets authenticated by blockchain are revolutionizing sports, arts, fashion, music, and the digital world.

Evolution of NFTs: When and How did it Start?

It was around 500 years ago when Leonardo Da Vinci created the famous painting Mona Lisa(6). The Louvre Museum in Paris has held all the rights to its exhibition for the past 224 years. Museums have always been a matter of great interest to a great many people who love art. However, trends kept changing over time. The emergence of digital platforms created a revolutionary change in the way people deal with art today.

In 2014 Kevin McCoy minted the first NFT known as Quantum. However, it was not minted on an ethereum platform. In 2017 Technically, NFTs got streamlined in 2018, when William Entriken, a technologist, hacker, and corporate development architect, created the ERC-721 protocol for the Ethereum blockchain. Before ERC-721, colored Bitcoin was intended to be a standard platform for NFTs. However, issues such as validation of tokens, case in point, and other challenges prevented colored Bitcoin from developing like an NFT platform. Developers involved in ERC-721 resolved issues that halted colored Bitcoin from being the standard platform for NFTs.

Since then, NFTs have seen a continuous increase in sale records. However, the real momentum came in 2021 when NFTs crossed all records and became a $22 billion industry. Data from DappRadar,(7), a firm that tracks sales, showed that trading in NFTs reached $22 billion in 2021, compared with just $100million in 2020.

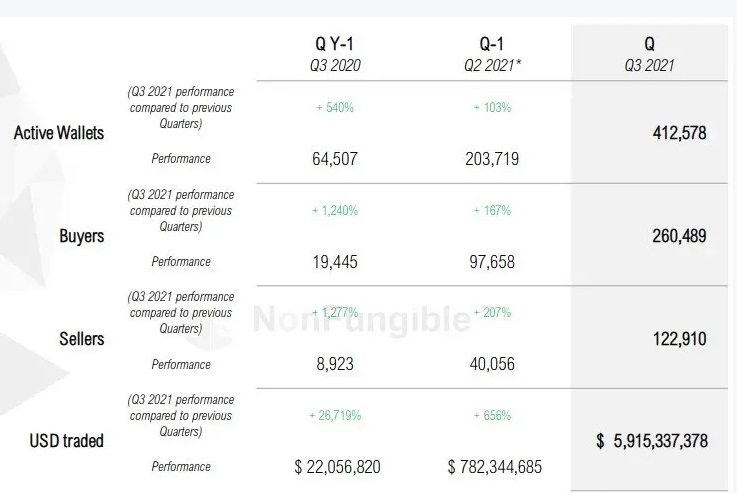

(Source: nonfungible.com)

Most Popular NFTs in 2021

NFT is on a great hike. NFTs belonging to Sports, Collectibles, Art, Games, Utility, Metaverse, and Real Estate are getting a lot of attention lately. Out of hundreds of NFTs showcased and auctioned in 2021, below is the list of the top 10 NFTs in 2021.

- Pak’s ‘The Merge’ — $91.8m

- Everydays: the First 5000 Days — $69.3m

- Beeple’s HUMAN ONE — $28.985m

- CryptoPunk #7523 — $11.75m

- CryptoPunk #3100 — $7.67m

- CryptoPunk #7804 — $7.6m

- Beeple’s Crossroad — $6.6m

- XCopy’s A Coin for the Ferryman — $6.034m

- Beeple’s Ocean Front — $6m

- CryptoPunk #5217 — $5.59m

NFTs are constantly making headlines. In March 2021, Jack Dorsey’s first Tweet - got sold for $2.9m.

Key Terminology Associated with NFTs

- Blockchain: As the name suggests, blockchain is the database that stores data in blocks arranged in chains. It collects electronic data in the form of digital files. It plays a vital role when it comes to bitcoin and cryptocurrencies.

- Cryptocurrency: It is the currency that operates based on digital assets. A decentralized authority manages all transactions rather than a centralized one. However, as per safety concerns, all the information is stored in an encrypted format.

- Bitcoin: Bitcoin is the money of the modern era. It is a type of cryptocurrency that existed in 2009 and could buy anything showcased in the digital universe.

- Ethereum: Ethereum is both a blockchain platform and one of the cryptocurrencies used by that platform. The abbreviation for ethereum is ETH or Ether.

- Tokenization: It encrypts sensitive data like a credit card, using secret codes embedded in the form of unique tokens.

- Smart Contract: It is an agreement between two parties in the form of computer code. They operate on blockchain and are available in the public domain yet remain secure.

- Cryptographic Asset: Cryptographic Assets are the transferable digital representation on the blockchain that can not be copied or duplicated.

- Collectibles: The unique items that hold more value than their initial cost because of their rarity are called collectibles, for example, trading cards and stamps.

- Fungible Assets: An interchangeable entity that can be traded with something else with equal value is called fungible. Likewise, fungible assets are items that a person can trade for something else on the blockchain.

Top Features of NFTs

The innate nature of NFTs and their features have made them a perfect platform to list, transact and save digital assets. NFTs are already creating breakthroughs in the art, lifestyle, and fashion space. The burgeoning NFT craze can be attributed to NFTs’ uniqueness, resale value, and permanence.

Some of the top features of NFTs are:

- NFTs can be traded but not interchanged.

- It is a type of intangible asset that gets its value from the demand and scarcity equations.

- They are tokenized assets that can be deciphered by blockchain’s identity verification method that uses mathematical formulas to validate NFT’s authenticity.

- NFTs provide immutable ownership rights to digital art collectibles and other digital assets such as images, videos, tweets, etc.

- The ability to assign unique product identity and authentication make NFTs a prominent solution for tackling the issue of duplication and counterfeiting of high-value assets and merchandise.

- NFTs can be passed onto the future generations, and over time, inheritors can enjoy the monetary appreciation in the value of NFTs.

- The NFT ecosystem provides content creators, artists, businesses, individuals, investors, etc., to come together on a unified platform.

- Smart contracts embedded in NFTs allow creators to earn through commission models or royal programs whenever an NFT is resold.

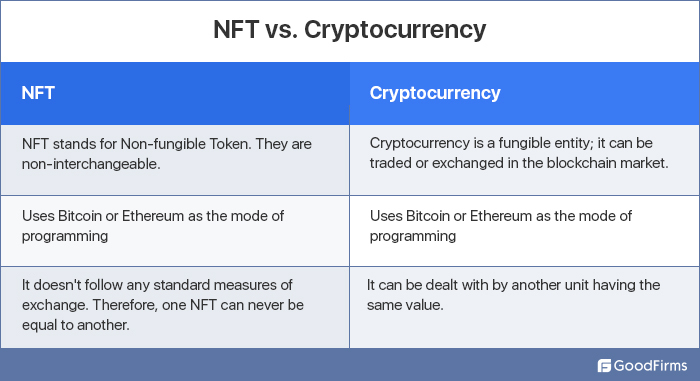

NFT vs. Cryptocurrency

What Has Led to the Recent Rush in NFTs?

NFT is the new normal in the blockchain industry. It has significantly impacted the global economic graph, especially on the digital front. The recent surge in NFTs is unprecedented. 59% of Americans believe NFTs will be the next big thing.(8) By October 2021, investors have poured in $26.9 billion into NFTs.(9)

The involvement of auction houses, exhibition companies, producers, and more doesn’t allow content creators and artists to reap the complete benefits of their creativity and intellectual properties. The evolving NFT market is changing these dynamics. NFT has impacted not just the digital art industry but other verticals, as well.

Reasons for the Recent Surge in NFTs:

Pandemic

Pandemic created financial troubles around the world. Reeling under the adverse effects of the pandemic, many turned to online venues of income, and NFTs that haven’t seen much traction since their existence in 2018 suddenly saw phenomenal growth. Using augmented reality, artists transformed their physical and digital works into NFTs.

Rise in Cryptocurrency

In November 2021, prices of cryptocurrencies such as Bitcoin, Ether, etc., surged at all times high. When cryptocurrencies surpassed $3 Trillion in market cap, the valuations of NFTs jumped as well. NFTs such as arts, music, in-games assets, and other digital assets are traded in cryptocurrencies, and therefore, the surge in cryptocurrencies had a positive effect on NFTs.

People's Fascination and Increased Awareness For NFTs

People are fascinated and driven towards NFT because they feel a unique connection to their artwork. It becomes crucial to own a piece of original art and prove it yours, where NFT helps. NFTs provide the right of ownership to people. Also, many are now gifting the digitally signed NFTs of their favorite artists to their friends and family members.(10) As the prices of NFTs are generally on the higher side, they prove to be a valuable and high-end gift.

Earlier people, even the digitally savvy ones, had little awareness of how NFTs work, what the platforms are, where they are bought and sold, and what constitutes NFTs. With increased awareness of NFTs among the millennials and GenZ, NFTs have been seeing voluminous growth recently.

Multiple Buying Platforms

Today, there are several NFT marketplaces in existence, and many sell items in a specific niche--OpenSea, Axie Marketplace, Cryptopunks, Raribles, Nifty Gateway, Mintable, etc.(11). These platforms also support the minting of non-fungible tokens, and many also provide users the facility to attach their crypto-wallets.

NFT marketplaces are of two types: Streamlined and Augmented: Streamlined NFTs offer a broad range of assets, a more generic approach, and varied sellers. For example, OpenSea, Rarible, etc., are streamlined NFT marketplace. Augmented NFTs offer specialized services and trading in a particular type of NFT. They charge a heavier fee on transactions. SuperRare, Sorare, etc., are augmented NFT marketplace.

Fundraising for GLAMs

Galleries, Libraries, archives, museums (GLAM) are generally dependent on government or institutional grants, ticket revenues, or exhibition sponsors for their survival and maintenance. Sometimes, the items in the museums are auctioned for raising large funds. However, NFTs offer GLAM to raise large funds without selling actual objects.(12) With NFTs, GLAMs can sell digital rights and digital copies of the physical objects in their collection. Museums now sell cryptographically signed copies and limited editions of the artwork as NFTs to raise funds. After the Pandemic, GLAMs were receiving fewer footfalls, and loss of revenue stood at 77% in the year 2020 as compared to 2019.(13) Amidst this, NFTs provided a ray of hope to GLAMs to cover their losses. This led to a surge in NFTs adoption during the crisis.

Gaming Potential

During the pandemic, many turned to alternative means of income and entertainment. As people lost their jobs, many turned to online games to earn more money. As NFTs are digital properties that can be used in gaming, they have become very popular. In NFT-based games, instead of earning points, badges, or virtual gold/silver coins, people earn NFTs. These NFTS can be traded to other gamers for cryptocurrencies. The cryptocurrency can then be withdrawn from your wallet into the local currency. The game developers earn by getting a percentage cut from the sale/purchase transaction happening between players.

Metaverse

Metaverse is a computer-generated virtual environment that lets users create their digital counterparts and interact with other users in a virtual universe.(14) NFTs are a valuable addition to metaverses as they can make the metaverse look more real. Participants or players in the metaverse can use digitally authenticated NFTs to make it more engaging and nearer to the truth. NFTs guarantee authenticity and verification of digital possessions used in the metaverse. As metaverse is based on blockchain technology, the verification of NFTs is not an issue.

NFTs’ potential function in the metaverse to verify the authenticity of digital possessions makes them attractive for the metaverse players too. It would be interesting to see how NFTs play out in the metaverse-created virtual environments.

Ease of Recording and Selling Digital Properties

Non-fungible tokens are becoming an increasingly popular mode of recording, trading, and documenting contracts, agreements, sale deeds of real estate, and more. Virtual real-estate NFTs are stored on the blockchain.

Return on Investment

Most popular NFTs are regularly traded on NFT marketplaces. Many NFTs are proving to be valuable investments providing a lucrative return on investment.

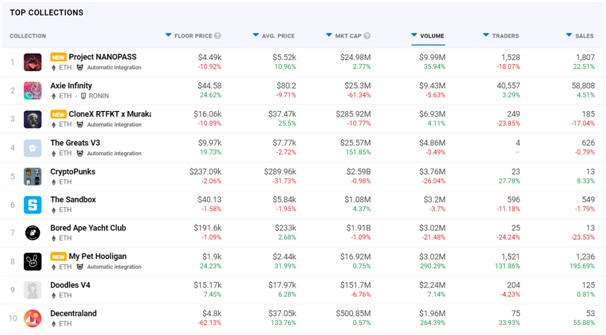

(Source: Dappradar)

Is the Current Surge in NFT Volumes Pointing Towards Another Bubble?

It is undoubtedly a revolutionary step to release assets like digital art on the blockchain for auction. Many investors are using NFTs as another form of hedging in the financial arena. NFTs offer another avenue of investment apart from real estate, gold, currencies, stocks, mutual funds, cryptos, etc. However, with a massive hike and extreme volatility in this vertical, it is evident to think of the worst-case scenario. What if the NFTs didn't last long?

One more factor that matters when it comes to gambling upon NFT is its value to the buyers. It highly depends on one's interest in the entity if it holds value in their eyes. NFTs are entirely different from shares or other financial instruments. It has no standard value chart or a periodic growth record. NFT is only worthy if it is in demand. Therefore, a market's fundamental, technical, and economic factors do not add significant value. In such scenarios, if buyer sentiment turns hostile, then what would happen to the assets sold for multi-million dollars? It is an essential concern floating in the blockchain market lately.

Secondly, although NFTs are at a super hike these days, they aren't much older. They do not have historical data to predict, analyze or validate their investment potential. Therefore, it becomes risky to count on their future value. Whether NFT will sustain in the blockchain market for a long time or not is a complex job to predict.

Till things clear out and NFTs evolve from the nascent stage to a fully-developed entity, any experimentation or investment in NFTs or a full-fledged roll-out in the NFT ecosystem should be limited with small collections and editions. Gauging the audience’s response with meticulous analysis is critical to mitigating the bubble concerns for NFTs.

Will NFTs Evolve from a Fragmented Marketplace to a Unified One?

Both traders and clients in the NFT market are busy brainstorming whether this wave will sustain in the future or burst like a mere bubble after reaching a certain peak? The hot concern is the confined scope of selling NFTs digitally. Making policies and norms for NFTs to be valued outside the virtual world could significantly change the current dilemma. Also, there is a debate whether NFT marketplaces will ever attain Amazon-like industry standards?

Whether a few platforms will emerge to be the market leaders in this category, or will the NFT industry continue to be dominated by multiple players? As NFTs are built on blockchain infrastructure that keeps transactional data in the public domain, it is difficult for a single platform to achieve monopoly.

Challenges in NFTs: Environmental, Valuation, Legal and Security Concerns

NFT is blooming in the world of blockchains and cryptocurrencies. With the hike in demand, it becomes predictable for the bar of challenges to rise significantly. Therefore, it is not that simple to deal in NFTs or the crypto-collectibles if someone is planning to invest. Experts and institutions did several pieces of research to identify the shortcomings of NFTs.

There are various grounds on which a community faces the consequences. Some of the high priority factors are as follows:

Environmental Concerns:

Blockchain’s immense requirements for energy consumption raises questions about the environmental damage caused by NFTs, especially due to the proof-of-work(PoW) issue. Proof-of-work is a mechanism that helps in keeping blockchain transactions safe. Widely used in crypto mining, the PoW setup requires miners to solve complex equations, mathematical puzzles to mine currencies and keep transactions secure without third-party interference. However, this system uses a huge amount of energy, and therefore, many environmentalists and activists have raised concerns regarding the sustainability of such concepts. As NFTs are also based on blockchain tech and require similar procedures to keep transactions secure, the energy usage concerns are serious.

On average, every special edition of NFT contributes a carbon footprint, equivalent to the petrol required to drive a car for 1000 km(15). The tunneling of cryptocurrencies leads to the higher consumption of fossil fuels. The energy consumed by bitcoin in 2016 was enough to serve enough power to a small country. The figures increased by 4-times in the year 2018. The people dealing in NFTs must take care of the environment, as well. NFT itself is a challenge to the environment.

Uncertainty of Value:

There are NFTs worth thousands and millions of dollars in the blockchain market, but there is a loophole too. The value of NFTs is uncertain and depends upon the interest of the owners and buyers. So, the question is, how valuable is an NFT, and how is the ascribed value determined? In a decentralized trading environment, the value is determined by the desire for an object. People's willingness for the collectibles and the perceived notion of scarcity drives the demand for NFTs.

Legal Issues:

NFTs are not legal tenders and face many regulatory challenges. Their existence depends on their ability to be exchanged for cryptocurrencies. Most of the developed countries do not have any Financial Act that provides a regulatory framework for dealing with NFTs. Their role as an economic function is unclear.

Cyber Security and Rights Violation:

As the blockchain market is entirely digital, the chances of online fraud and cyber attacks such as hacking, plagiarism, and bank scams increase exponentially. There are cases where scammers copied digital assets like artwork and tried to auction them on various NFT platforms. Another community of scammers includes those who launched fake NFT auction platforms using the phishing method.

A major cryptocurrency firm, Poly Network, faced a major hacking event in August 2021, when hackers made off with $600 million worth of tokens. Though, the hacker later returned most of the stolen tokens, more than $200 million is still inaccessible without a private key that the hacker is still withholding. Such attacks reveal the security flaws that are yet to be taken care of by platforms offering NFT buying and selling services.(16)

More contentious security challenges include the misrepresentation of ownership or relocation with 404 errors.(17) In the first case, an object bought as an NFT does not provide exclusivity in a meaningful sense. The NFTs can be viewed online by others also. Secondly, the NFTs online location is a domain address. If the domain address is shifted, NFTs will return a 404 error.

Key Findings

- NFTs are spearheading a new way of storing digital properties.

- Pandemic is one of the significant reasons why NFT is in so much demand.

- The cryptocurrency wave had a positive effect on NFTs.

- Digital art is trending out of a great many NFT assets.

- NFT despite being on-trend, may or may not turn out to be a bubble.

- NFTs are a valuable addition to metaverses.

- Along with several pros, there are cons to investing in NFT. Some include cyber security risks, legal concerns, drastic environmental impact, and uncertainty of value due to non-standardization.

- It is difficult for a single NFT platform to achieve monopoly as NFT data is in the public domain.

Conclusion

NFT, an industry that initially seemed to be lucrative only for tech-enthusiasts, crypto fans, and art enthusiasts, is now displaying potential for becoming a mainstream industry. What started as an obscure concept is today a mainstream discourse. With a myriad of functions and immense financial potential, NFTs have gained a center of attention along with cryptocurrencies.

Additionally, NFTs use a decentralized blockchain infrastructure that transforms controls from centralized entities to users (distributed network of people). In the future, we may have all physical assets with an NFT attached to them. It will be interesting to see how they direct the future of digital economies.

References:

- https://www.bbc.com/news/newsbeat-59401046

- https://blogs.gartner.com/andrew_white/2021/03/23/ideas-are-more-valuable-than-things/

- https://www.nytimes.com/2021/03/11/arts/design/nft-auction-christies-beeple.html

- https://www.researchgate.net/profile/Mac-Mofokeng/publication/327832753_Future_tourism_trends_Utilizing_non-fungible_tokens_to_aid_wildlife_conservation/links/5ba7af61a6fdccd3cb6d4de4/Future-tourism-trends-Utilizing-non-fungible-tokens-to-aid-wildlife-conservation.pdf

- https://www.fim-rc.de/Paperbibliothek/Veroeffentlicht/1045/wi-1045.pdf

- https://en.wikipedia.org/wiki/Mona_Lisa

- https://dappradar.com/

- https://piplsay.com/the-sudden-hype-around-nfts-what-do-people-think-about-it/

- https://go.chainalysis.com/nft-market-report.html

- https://www.cnbc.com/2021/12/15/millennials-gen-z-plan-to-spend-thousands-crypto-nfts-metaverse-land-as-holiday-gifts.html

- https://dappradar.com/nft/marketplaces

- https://www.mdpi.com/2076-3417/11/21/9931

- https://www.theartnewspaper.com/2021/03/30/visitor-figures-2020-top-100-art-museums-revealed-as-attendance-drops-by-77percent-worldwide

- https://arxiv.org/abs/2110.05352

- https://flash---art.com/2021/02/episode-v-towards-a-new-ecology-of-crypto-art/#

- https://www.cnbc.com/2021/08/23/poly-network-hacker-returns-remaining-cryptocurrency.htm

- https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3822743