ABSTRACT:

The global pharma industry has always been committed to driving change and improving patient health outcomes. The recent pandemic has no doubt pushed the industry’s boundaries beyond imagination. Governments worldwide have realized the importance of keeping the pharma industry economically healthy, and several reforms have been introduced to boost the industry's core vitals.

This research article titled "Pharma Industry-Trends, Challenges, Market Opportunities” attempts to find the current trends, key challenges, and future opportunities in the pharma industry. An online survey was carried by Goodfirms between 5th July 2022 to 15th July 2022. The survey queried selected participants (pharma industry experts, pharma companies, online pharmacies, pharma consumers, and pharma research companies) across the world on various aspects related to the industry.

The survey examines the current state of all pharma industry subsets, including the online pharmacy platforms, pharmacy applications, consumer medical equipment, OTCs, etc. The research also uncovers consumer perception and buying behavior pertaining to medicinal drugs and other pharmaceutical products.

Table of Contents:

IntroductionOverview of the Global Pharma Industry

Pharma Industry Trends

- Reshoring of Pharma Manufacturers

- Outsourcing API Manufacturing and Packaging to CDMOs

- Decentralized Clinical Trials Are Gaining Traction

- Moving Towards Value-based Care in the Pharma Sector

- Patient Empathy: Going Extra Mile to Collect Critical Patient Data

- Prioritizing Compliance and Risk Aversion

- Reviewing Units and Products for Environmental Concerns

- Rising Mergers and Acquisitions

- Development of Digital Technologies

Emerging Technological Trends in the Pharma Industry

- AI is Driving Massive Innovation

- Additive Manufacturing With 3D Printing Technology

- Wearable Technology in Clinical Trials

- Blockchain Technology

- Other Technology Trends

Consumer Trends in the Pharma Sector

- Local Pharma Shops are the Most Preferred Buying Venue for Medicines

- Online Pharmacies Are Set to Gain More Traction Despite Challenges

- Medicine ‘Brand’ is an Important Consideration Factor While Buying Medicines

- Pharma Pricing Structures Get Mixed Reaction from Respondents

- Generic Medicines are in Demand, But Consumers Need to Tread with Caution

- Online Medication Programs Fail to Gain Consumer Trust

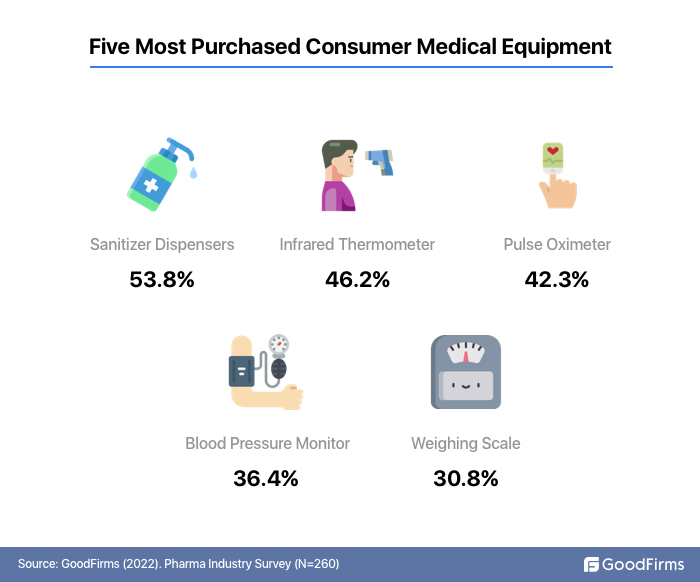

- Sanitizer Dispenser, Infrared Thermometer, and Oximeter are the Most Bought Consumer Medical Equipment

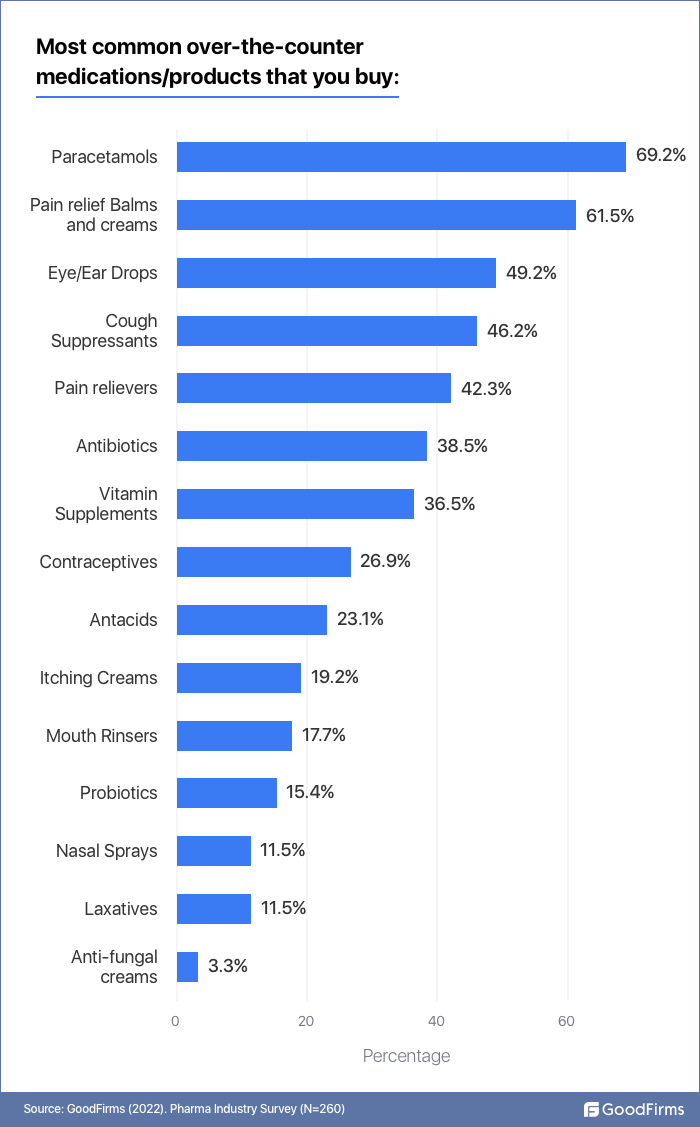

- Paracetamol is the Most Purchased Over-the-Counter Medicine

Challenges in the Pharma Industry

- Stringent Regulations

- Forced Cost-Containment Measures

- Catastrophic Cybersecurity Breaches

- Failure of Third Parties in Meeting Obligations

- Retaining Skilled Talent

- Off-label Usage by Patients

- Counterfeit Medications

- Consumer Trust

- Other Risks and Challenges

Introduction

When the world economy plummeted due to COVID 19, the pharma industry had dual responsibilities-(a) adapt to the situation and protect itself from the downfall and (b) save the world by creating an effective vaccine in the lowest possible time. The pharmaceutical industry had never faced such a dire need to develop a cure immediately. With a more cohesive vision to lead scientific breakthroughs, advancement in technology in general, along with the best of business practices, legal & regulatory factors, the pharma industry is breaking conventions, and trying its best towards progressive advancements. .

However, the industry still faces multiple short term and long term challenges related to supply chains, regulations, cost-containment pressures, high competition, huge research and development expenditures, delayed drug launches, product recalls, workforce attrition, and many more. To mitigate these challenges the industry continues to invest in smart factories, automation, and strategic digitalization. From building supply chain resilience to conducting patient-centric clinical trials, life science companies are adjusting to new norms and creating landscapes for the future. With a mostly positive outlook in the sector, the industry is set to scale new heights.

This research titled "Pharma Industry-Trends, Challenges, Market Opportunities” evaluates the key challenges and opportunities in the pharmaceutical industry. The survey also explores the current industry trends, consumer and technological trends, and overall state of the pharma sector. The research also reveals how latest developments in online pharmacies, and online medication programs are perceived by consumers.

Overview of the Global Pharma Industry

After the sharp rebound in 2021, the economic output of many countries improved further in 2022. Aided by fuelled strides in international trade, government stimulus packages, vaccination drives, and debt restructuring, the pharmaceutical industry managed to keep the revenue toplines intact. However, geopolitical disturbances like the Russia-Ukraine war stand as a threat to the industry. Rising fuel prices, inflationary pressures, and supply chain disruptions are aggravating the situation for the global pharmaceutical industry. The industry also faces challenges related to complex alliances, mergers, and acquisitions, licensing issues, intense competition, heavy regulatory surveillance, data privacy issues, and frequent technological changes. Still, due to the inherent strength and certain favorable factors akin to the industry, pharma is poised to grow and post encouraging results.

Sidelining the global headwinds, the sector valued at $1.4 trillion in 2021 (1) will continue to grow at a CAGR of 11.34% till 2028. (according to estimated projections).(2) The continuous requirements for vaccines, the aging population of the world, new diseases, and the launch of new medicines are some factors that will drive the growth.

Pharma Industry Trends

Reshoring of Pharma Manufacturers

The current geopolitical situations demand pharma companies rethink their global operating strategies to mitigate procurement and supply chain issues that are common today due to global tensions. The pandemic and the ongoing war have shaken the global supply chain ecosystems. Countries, particularly in the west, have learned that over-reliance for APIs (Active pharmaceutical ingredients) on China can be risky.

“The pandemic has starkly exposed the fragility of the global supply chain and over-reliance on China as a manufacturing location," says Karen Winterhalter, MD, Onyx Health.

In recent decades, China has emerged as a key supplier of certain pharmaceutical raw materials, and any geopolitical situation involving China can expose the dependent countries to supply chain vulnerabilities.

Therefore, a plea for reshoring the drug manufacturing facilities is gaining a voice in the US and the allied countries.(3) While it may take several years to completely onshoring manufacturing units, the native CDMOs (Contract Development and Manufacturing Organizations) can come to the rescue of mainstream pharma companies.

Outsourcing API Manufacturing and Packaging to CDMOs

The pharma industry is finding CDMOs as a viable alternative to in-house manufacturing. Amidst unprecedented challenges and fierce competition, CDMOs relieve pharma companies’ workload by handling drug manufacturing and packaging processes. From extraction, fermentation, and synthesis of active pharma ingredients to packaging and labeling of drug products, pharma businesses are outsourcing many manufacturing processes to CDMOs to bring cost-efficiency and ensure faster releases of new products.

The Pharmaceutical CDMO Market was valued at USD 183.62 billion in 2021. It is expected to reach USD 289.64 billion by 2027, registering a CAGR of 7.29% during the forecast period.(4)

CDMOs also bring niche expertise in manufacturing some specialty medicines. "The specialty pharma market is growing rapidly, owing to the aging population and the increasing prevalence of chronic diseases", says Laura Helke - Founder, WREI. CDMOs with expertise in a particular niche can help pharma companies develop specialty medicines.

Decentralized Clinical Trials Are Gaining Traction

Decentralized clinical trials (DCTs) refer to conducting medical trial activities at patients’/volunteers’ homes rather than at the clinical trial sites. This expedites the medical trial processes and makes the experience comfortable for volunteers and patients participating in the trials as ‘subjects.’

The COVID19 pandemic acted as a catalyst to boost the adoption of DCTs.(5) As gathering volunteers to the trial site could have been risky, many pharma companies conducted trial activities at volunteers’ homes. It also allows pharma companies to include a more diversified subject base and go beyond the limits of geographical boundaries.

“The pharma industry is focused on improving patient inclusion and diversity in clinical trials,” says Gail Trauco, the chief executive officer of The PharmaKon LLC.

A constellation of medical technologies and tools such as electronic consent, remote patient monitoring, electronic health records, etc., work together to shift clinical-trial activities from trial sites to the subjects’ homes. The DCT model allows trial subjects to share data via telemedicine, embedded clinical-grade sensors, wearables, etc. Physicians can monitor the subjects via video conference, and nurses may visit subjects at their homes if required.

Moving Towards Value-based Care in the Pharma Sector

As healthcare costs rise drastically, global pharma players are under pressure to focus on value and identify best practices to reduce the costs. The implementation of value-oriented care will steer pharma resources toward result-based medical products and uproot the low-impact high-priced medications. Value-based care aims to eliminate interventions that bring mediocre results and replace them with those having the highest impact.

"The shift to value-based care is forcing the companies to focus on delivering value rather than just selling drugs", says Leonard Keane, CTO, IBR.

However, there are concerns regarding value-based care. Getting paid based on outcomes seems a difficult approach in an already hyper-competitive environment. In such a scenario, pharma companies have to realign their operating models and think of products that secure superior outcomes for them. A product portfolio that brings superior results with different sets of patient populations can undermine the competition and achieve economic viability for the pharma companies.

Patient Empathy: Going Extra Mile to Collect Critical Patient Data

Pharma companies are collecting extensive data from the personal lives of suffering patients to get a better understanding of their experiences. With increased sales, usage, and acceptance of consumer-grade wearable devices, pharma companies are now better able to derive critical health data from the sample population. Pharma industry solution providers are partnering with platforms that use remote monitoring tech, sensor-equipped wearable devices, and AI/ML to capture data for clinical trials and pharma research.

For instance, ICON, the global drug solution provider, has been using the Intel® Pharma Analytics Platform for clinical trials since 2018.(6) High-quality data from embedded sensors and tools in wearables are helping transform the landscape of clinical trials by improving patient engagement, reducing time-to-market, and increasing trial success rates.

Prioritizing Compliance and Risk Aversion

Regulators and governments are now less tolerant of any loopholes in following the standard operating procedures SOPs), clinical guidelines, and safety measures. Pharma companies are now in no position to sideline compliance for commercial reasons. Technological vigilance from regulators requires pharma companies to focus on their risk and compliance policies and implement processes that prevent any deviation from SOPs. Pharma companies are now prioritizing patient safety, rigorously following safety guidance instructions received from USFDA and similar regulatory organizations.

Reviewing Units and Products for Environmental Concerns

Societal expectations from pharma companies regarding their environmental practices have increased after the pandemic. Any action from pharma companies perceived as detrimental to the environment can cause huge issues for pharma businesses. ESG matters are now critical judgment factors, and the inability to meet ESG goals can put pharma companies at strategic risks. This has led to a strategic review of all major manufacturing units for their environmental impact.

For instance, Boehringer Ingelheim switched to wind energy at its largest manufacturing site in the USA, in St. Joseph, Missouri.(7) Listerine by Johnson and Johnson introduced new bottles with 50% recycled plastic.(8)

Rising Mergers and Acquisitions

Pharma companies have a history of acquisitions and mergers to gain market share, increase product portfolios, reduce competition, enhance customer base, and strengthen research profile. The trend continues in 2022. As per Global Data, the pharma sector recorded 182 merger and acquisitions deals worth $30 billion in the second quarter of 2022, marking a 67% increase in deal value.(9).

“The increase in mergers and acquisitions is another key trend in the industry. Companies are consolidating to gain market share and to reduce costs”, says Leonard Keane, CTO of IBR.

- In June 2022, Bristol Bristol Myers Squibb announced the acquisition of the Oncology company Turning Point Therapeutics for $4.1 billion.(10)

- GlaxoSmithKline completed the acquisition of Sierra Oncology in June 2022 for an all-share deal of $1.9 billion.(11).

- AbbVie acquires Syndesi Therapeutics for $1000 million in March 2022 to strengthen its neuroscience portfolio.(12)

Development of Digital Technologies

Pharma 4.0 is all about the adoption of digital strategies in pharma manufacturing, drug distribution, clinical trials, and research and development. The industry is undergoing a period of significant change as it continues to integrate new technologies into its processes and systems. This constant integration is leading to changes in how drugs are developed and approved and how they are sold and marketed. In addition, continued technological advancements are helping to drive down the costs of developing new drugs. As a result, companies are investing more in developing new technologies that can help them accelerate drug development processes and reduce costs.

“Developments in digital technology to support and strengthen clinical trials is a key trend in the pharma sector in 2022”, says Steven Paul Nistico, Director of Dermatology, Laser Therapy Specialist at Heliotherapy Research Institute.

Let us analyze the pharma industry's key technological trends and digital innovations:

Emerging Technological Trends in the Pharma Industry

AI is Driving Massive Innovation

57.6% think AI can augment their medicine buying experience.

The world’s top pharma companies have either acquired or partnered with one or more AI development companies. Johnson and Johnson has partnered with Benevolent AI, Novartis with IBM Watson, MERCK with Atomwise, Pfizer with MIT, AstraZeneca with BERG, GlaxoSmithKline with Exscientia, Bristol-Myers Squibb with PathAI, etc.(13) These AI companies are providing technological leverage to pharma giants in phases such as drug discovery, identification, clinical trials, R&D, compliance monitoring, market optimization, analysis, filtering and sorting of large data volumes, etc.

The active adoption of artificial intelligence by pharma companies, large-scale collaborations, and strategic partnerships are complementing various operations across the sector. From creating expert systems to developing agile workflows, AI is helping pharma companies to build distinct capabilities. AI is also improving the buying experience with patient insights from patient data history analysis. More than half surveyees believed that artificial intelligence can improve their buying experience.

Additive Manufacturing With 3D Printing Technology

With additive manufacturing using 3D printers, pharma manufacturers can combine various drugs into one single pill by adding drug constituents in compartments or layers during the printing process. This is entirely different from the compression process that uses force to form tablets from powder form constituents. ‘Polypills’ manufactured with additive manufacturing tech have layered constituents in a single tablet that can replace multiple pills. Additive manufacturing can lower the number of medicines a patient has to ingest while retaining the benefits. Doctors can also control the drug release within the body via layered pills.

Additive manufacturing provides new opportunities for testing and scale-up of new drug candidates. 3D printing technologies are revolutionizing the pharma industry with the on-demand production of drugs with customized drug combinations and release characteristics that are unavailable in conventional manufacturing processes.(14)

“3D printing of medical devices enables printing of medical devices that matches a patient's anatomy", says James Coburn, senior research engineer”, USFDA.(15)

Wearable Technology in Clinical Trials

Pharma giants are manufacturing and integrating products, devices, and systems, such as medical sensors, smart watches, fitness trackers, etc., that can be used to improve medication processes and clinical trials. Wearable technology can track various factors, including blood pressure trends, sleep patterns, activity levels, and heart rate variability and provide real-time insights into the health status of the subjects.

Wearable technology provides a more convenient way for pharma professionals to collect and monitor data during clinical trials. The data can be used to manufacture better treatment plans and more effective medicines. By facilitating real-time analytics, wearable technology is a great support system for pharmacovigilance during clinical trials.(16)

Blockchain Technology

Blockchain is a distributed database that can be used in the pharma industry to record research data, supply chain information and clinical trial records. It's a shared, synchronized, replicated ledger that maintains an unchangeable history of all data. As blockchain is a completely decentralized entity, it is nearly impossible for hackers to alter data or tamper with records. Blockchain technology creates an unchangeable record of all transactions that are verified by network members and confirmed through cryptography. Blockchains have the potential to make clinical trial records more secure and tamper-proof.

Blockchain can also provide transparency and traceability for data associated with new drugs, under-experimentation drugs, and data filed for USFDA approvals. The biggest application of blockchain in the pharma industry is in the supply chains. With blockchain-based systems, even competitors can use a shared platform to trace their supplies during transition without revealing sensitive information to each other.

Other Technology Trends

- AR and VR are used at pharma manufacturing plants for error diagnostics, safety training, drug simulations, etc.

- Pharma companies are leveraging gamification technology to engage patients that are on medication. For instance, Sanofi came up with a digital game that reminds kids suffering from type II diabetes to regularly check their blood glucose levels.(17)

- IoT sensors can monitor patient conditions in real-time during clinical trials, monitor the temperature of their facilities, or track the number of samples that have been delivered to the right location. IoT also has the potential to transform pharma by making it easier to track and manage supply chains, reduce waste, and improve patient outcomes.

- Big data-powered analytics are assisting pharma companies in accelerating the drug discovery process, customizing medicines for targeted usage, improving procurement and supply chain operations, and increasing the efficacy of clinical trials.

Consumer Trends in the Pharma Sector

Local Pharma Shops are the Most Preferred Buying Venue for Medicines

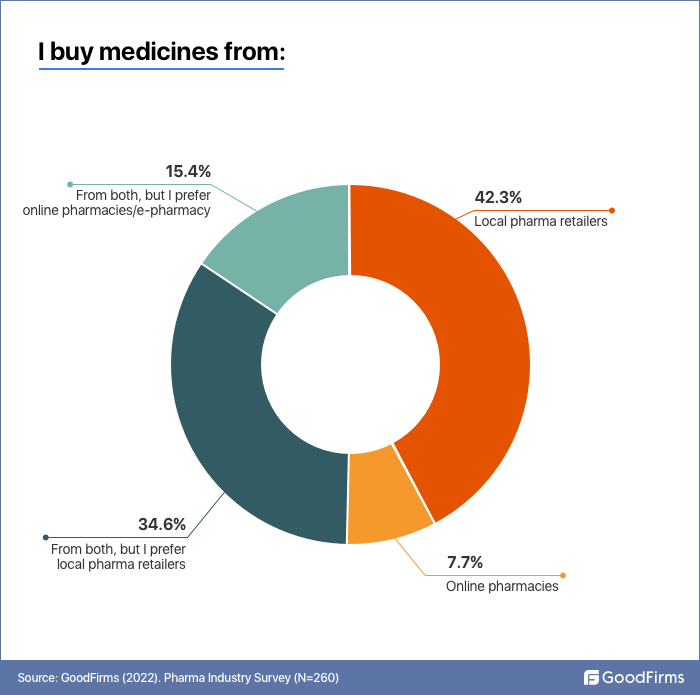

41.7% buy medicines from the local pharma retailers

Local pharmacies sell prescription drugs and also provide assistance to patients with respect to medication regimens. Retail pharmacists also inform patients about possible drug interactions. 41.7% of respondents reported buying medicines from local pharma retailers. This group exclusively buys medicines from local pharmacies only and does not use online pharmacies.

Retail pharmacists are also an important marketing source for pharma companies, and they play a crucial role in influencing the sales of pharmaceutical products. They can suggest generic substitutes for expensive brand names, can offer substitute medicine with the same composition, and provide discounts/coupons on certain OTCs.

33.3% buy medicines from both local and online pharmacies but stated that they prefer local pharma retailers

This group of hybrid pharma consumers buys from both local and online pharmacies. However, they asserted their preference for local pharma retailers.

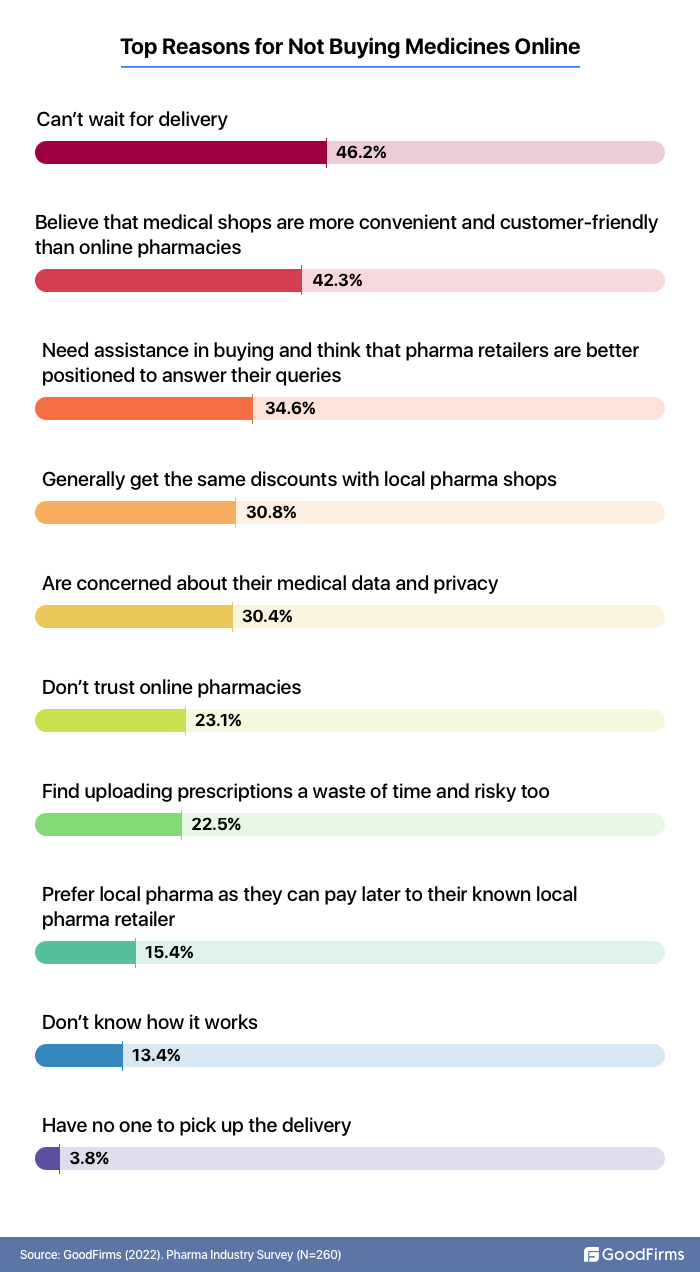

When asked about the reasons for not using online pharmacies, the surveyees reported different reasons mentioned in the table below:

46.1% state that they cannot wait for the delivery.

Waiting time for delivery turned out to be the biggest repellant for choosing online deliveries of pharmaceuticals products. People expect lightening deliveries when it comes to prescribed drugs as they want to start their treatment as soon as possible. Online deliveries may take somewhere between two hours to twenty four hours after the patient uploads the prescription and orders online. Therefore, many choose to quickly buy their medicines from local pharma retailers.

42.3% state that medical shops are more convenient and friendly than online pharmacies and 34.6% say that retail pharmacists are better positioned to answer their prescription related questions. Retail pharmacies also assist customers in choosing the best and cost-effective over-the-counter medications. 30.8% shoppers are worried about their medical data and privacy. Many also reported fear of online hacking attempts, credit card frauds, phishing, etc.

23.1% reported a distrust of online pharmacies.

Many rogue online pharmacy sites have duped customers or provided them with duplicate products, especially high-value vitamins and health supplements. This makes many wary of buying online. More than 10 online pharmacies have been issued warning letters from USFDA in the 2021-2022 period alone for involvement in illegal and potentially dangerous activities.(18)

While more prominent players in the online pharmacy space can meet FDA requirements, the rogue players are bringing negative connotations.(19)

Other reasons of not buying online include:

- 22.5% surveyees find uploading prescriptions a waste of time and risky too.

- 15.4% surveyees prefer local retailers as they can pay later to retail pharmacies

- 13.4% don’t know how online pharmacies work

- 3.8% expressed inability to buy medicines online as there is no one to pick up their deliveries.

Online Pharmacies Are Set to Gain More Traction Despite Challenges

As online pharmacies are improving their workflows and strategies and investing in technologies to serve their customers better, they are set to overcome the current challenges and perform well in upcoming times. The revenue topline of online pharmacies is expected to grow at a CAGR of 14.42% from 2022 and cross US$35 billion in sales volumes by 2026.(20) Consumers who buy online medications get substantial discounts on medications. However, online pharmacies charge delivery fees for online orders without a particular order size.

Medicine ‘Brand’ is an Important Consideration Factor While Buying Medicines

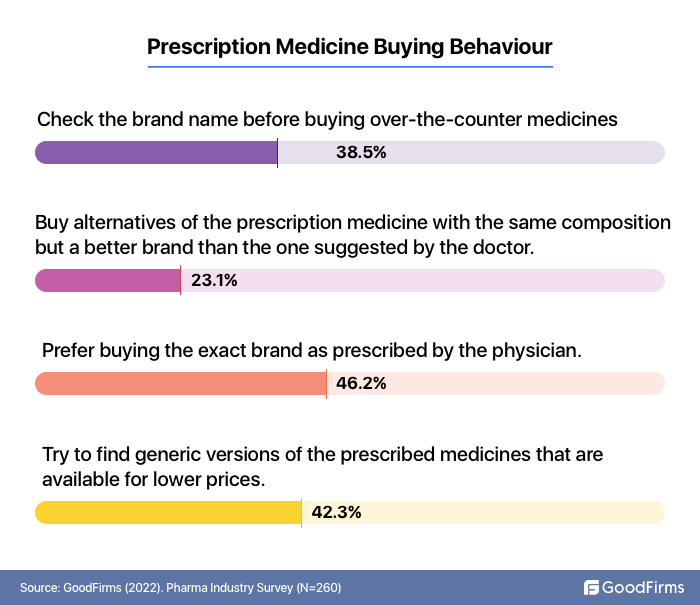

38.5% check brand names before buying over-the-counter medicines.

Over-the-counter medicines are the most common type of medication used by consumers. These medicines are available without a prescription and include a label showing the brand name and the active ingredient(s). When purchasing over-the-counter medicines, 38.5% of consumers stated that they check the brand name. Some brands have bigger marketing budgets, and therefore consumers are familiar with certain brands. Consumers may want to buy OTCs from reputed pharma brands.

23.1% buy alternatives for prescription medicines with the same composition but a better brand.

Today, there are websites and platforms that allow patients to compare drug prices of various brands, search for alternatives, research side effects, and also learn about drug reactions related to a particular medicine. The vast sources of information make it easy for patients to research alternatives to save money and buy options best suited for them. Sometimes, patients can even get better brands at lower prices than the one prescribed by a physician solely due to commission advantage.

46.2% would not like to deviate from or substitute the brand as prescribed by the physician and prefer the exact brand as prescribed.

Conservative consumers may want to stick with the brand as prescribed by the trusted physician and would not like to buy a substitute. To avoid health scares, most respondents buy the exact same brand as recommended by their doctor. Many also consult with a pharmacist before they purchase drugs online or from other sources. This is especially true in situations where surveyees have a known allergy or sensitivity to ingredients in one of the medications.

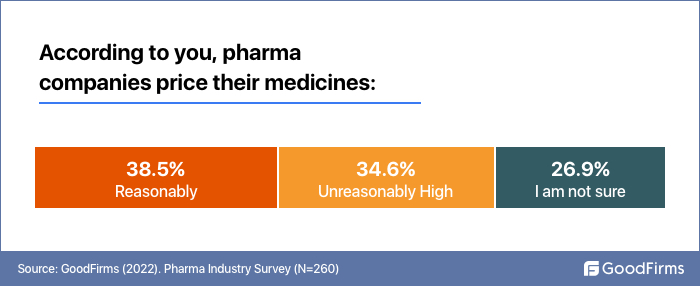

Pharma Pricing Structures Get Mixed Reaction from Respondents

In the pharmaceutical industry, companies have an obligation to price their products reasonably as Governments and regulators hold pharma businesses accountable for the cost of medicines that they supply. However, public perception regarding pharma’s pricing policies is a mixed one. While 38.5% of surveyees think pharma companies price medicines reasonably, 34.6% consider the prices to be unreasonably high. For instance, the $2.1 million price tag for a single dose of Novartis' gene therapy drug Zolgensma for spinal muscular atrophy has drawn criticism from many governments, and the drug continues to be scrutinized by media around the world.(21)

In the USA, healthcare acts such as 340B have helped many vulnerable communities to afford medicines amidst rising prescription drug costs.(22) 340 B provides financial help from the federal government to hospitals serving the financially weaker sections.

Generic Medicines are in Demand, But Consumers Need to Tread with Caution

42.3% try to find the generic versions of the prescribed medicines that are available for lower prices.

Globally, the prices of branded medicines are skyrocketing.(23) This prompts people to look out for generic versions of branded medicines. However, just like fast fashion, fast medicines (generic alternatives) may be poorly manufactured and devoid of quality.

“A large number of generic drug manufacturers in certain overseas countries are passing off substandard drugs as legitimate generics for profit. They are deliberately flouting FDA regulations and standards”, said Katherine Eban in her famous TED TALK: A dose of reality about generic drugs.(24)

A regimen of generic medicines may be cheaper than brand-name meds, but it's important to know the constituents well before purchasing generic ones. Some generic medicines are very similar in their effectiveness and safety to the brand-name drugs that they are designed to replace. However, there can be some differences between the two. Some generic medicines may have a different active ingredient than branded medicine. Even slight variations in their chemical composition can cause side effects.

Online Medication Programs Fail to Gain Consumer Trust

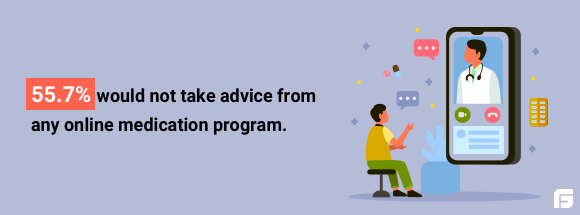

55.7% would not take advice from any online medication program

Online medication programs offer medical support, therapies, treatment plans, and more to patients via online means. The idea behind the online medication is to provide medical care to those who are unable to visit a doctor for reasons ranging from poor health that makes physical visits not feasible, and lack of accessibility to a healthcare center..

However, the majority of surveyees expressed disinterest in seeking advice from online medication programs. Respondents had varying reasons for not choosing online medication programs. 27.2% stated that they would take advice from an online medication program only if they are unable to visit a doctor physically. 11.7% of surveyees said they do not trust online medication programs.

Moving patient consultations to virtual realms changes the trust equations negatively.(25) Technological glitches and connection disruptions have also affected some surveyees who are now unwilling to go for online medication. Patient–clinician relationships get adversely affected due to a lack of physical proximity and connectedness while interacting via a digital interface.(26)

Sanitizer Dispenser, Infrared Thermometer, and Oximeter are the Most Bought Consumer Medical Equipment

The pandemic effect is clearly visible in the top purchased medical equipment category. Most of the products are directly related to covid-control mechanisms.

Paracetamol is the Most Purchased Over-the-Counter Medicine

Paracetamol, Pain relief balms, Eye/Ear Drops, Cough Suppressants, and PainKillers are the Five Most Purchased Over-the-Counter Medicines

Often patients reach pharmacists for minor ailments and mild symptoms for fever, cough, pain, acidity, etc. There is a category of drugs known as over-the-counter(OTC) medicines approved by regulatory authorities that can be legally sold by pharmacists. Paracetamol emerged as the most purchased OTC for self-medication needs with 69.2% surveyees confirming its purchase as one of the most commonly purchased OTCs by them. The other most commonly purchased OTCs stated by surveyees include pain relief balms, eye,ear drops, cough suppressants, pain killers, antibiotics, vitamin supplements, etc.

Challenges in the Pharma Industry

Stringent Regulations

The pharma sector, one of the highly regulated industries around the world, has complex equations when it comes to compliance and regulations. The companies in the pharma sector have to undergo stringent product safety reviews, clear sight visits by regulatory authorities such as USFDA, and maintain untampered records of clinical data for audit purposes.

"Increasing regulatory burden, compliance requirements, and growing scrutiny from NGOs/media on pricing are ongoing challenges faced by the pharmaceutical industry," says Andre Disselkamp, Cofounder of Finsurancy.

The industry can not even advertise, market, or promote products as publicly as other sectors do and has to depend on 'expert intermediaries' such as pharmacists, doctors, therapists, hospitals, etc., to influence product demand. In many countries, the prices of end products are government-controlled, and even purchasing active pharma ingredients requires regulatory approvals. Stringent regulations also slow down the pace of innovations, and any abrupt change is not possible in the industry.

Forced Cost-Containment Measures

Forcefully imposed industry-wise price reduction orders from governments or regulatory authorities can affect the margins of drug manufacturers. Government welfare programs that curtail the price of key medications or set unfavorable upper limits capping prices of drugs also hamper the bottom lines of pharma companies.

"Governments are introducing new regulations to try and control the cost of healthcare, and this is putting a strain on the pharma industry," says Laura Helke, Founder of WREI.

These risks are unpredicted and a major setback for any prior projection of revenue guidance. Moreover, any decision by the government to ban the export/import of drug APIs can also be challenging for pharma players. Local pharma companies can also come under pressure if governments decide to import low-cost generics from other countries.

Catastrophic Cybersecurity Breaches

Pharma companies are heavily dependent on IT systems for internal processes, daily operations, third-party contract collaborations, and critical data collection and preservation. However, pharma IT systems are susceptible to malicious intrusions, malware attacks, and security breaches. A data breach causing theft of clinical trial data or any other scientific pharma research can be catastrophic for pharma companies. Any cyber security attack that compromises trade secrets, patent formulations, or intellectual property can not only cause huge monetary losses to pharma companies but also put their future prospects at risk.

"The biggest challenge, which can go hand in hand with the newest trends in tech usage, is cyber threats that could damage data protection and confidentiality in the pharma sector," says Brandon Li, chief operating officer, Power, a platform for clinical trials information.

Failure of Third Parties in Meeting Obligations

Third-party contracts are critical for pharma companies. Various key functions, distribution activities, manufacturing operations, etc., are carried out in collaboration with third-party agreements. Any misappropriation, breaches, non-compliance, quality compromise, or loopholes on the part of the third-party companies can cost pharma companies dearly. Pharma companies may have to face supply chain issues, investor outrages, or regulatory penalties due to third-party failures in meeting their obligations. There have been many instances where product recalls, unit closures, rejection of under trial drugs, debarment, suspension of manufacturing units, etc., were attributed to third parties.

Retaining Skilled Talent

Pharma companies are investing heavily to attract, nurture and retain a highly-skilled workforce. Any failure to retain skilled workers and highly-qualified management teams, researchers, pharma specialists, etc., can negatively impact ongoing projects. The pandemic has accelerated the adoption of flexible working models and recruitments from a global pool of talent. However, the external supply is still limited due to changes in the job ecosystem post-pandemic.

"Production pressures have never seemed more challenging than in recent times. Raw material shortages, scarcity of vial packaging, and absence of skilled labor have forced producers to increase stock holding, extend production hours and hold increasing levels of stock to insulate against possible future supply chain woes", says Pablo Martinez-Moore, Commercial & Marketing Director at North Ridge Pumps Ltd., a company that supplies fluid handling solutions to various industries, including the pharma sector.

The increased production pressures make it challenging to keep employees happy.

Off-label Usage by Patients

Off-label usage of drugs refers to a situation when an U.S. Food and Drug Administration-approved medication is used for an unapproved condition.(27) For instance, a FDA-approved drug generally prescribed for a particular type of fungal infection is taken by a patient who is suffering from a different type of fungal infection. Now, this type of usage of an approved drug for a different medical condition can create more side effects or also can treat the patient. However, the final results are always unknown to pharma companies.

“Discovering off-label uses and abuse by customers is an extremely difficult task for big pharma. They don't have access to the actual users of their products”, says Deniece Moxy, Director of Product Marketing, Cortical.io.

Other off-label uses such as taking medication in more quantity than labeled approval or taking medicine intended to be taken as a whole in a powdered form or after dissolving in water. Collecting data for efficacies in off-label use is challenging for pharma companies.

Counterfeit Medications

Counterfeit versions of popular pharma brands illegally distributed via third-party networks are a threat not only to revenues but also to brand image. Manufactured at unregulated and uninspected facilities, the counterfeit versions do not meet testing standards and are potentially harmful for any medical use. With the online distribution of medicines, it is easier for unauthorized people to distribute and sell counterfeit drugs.

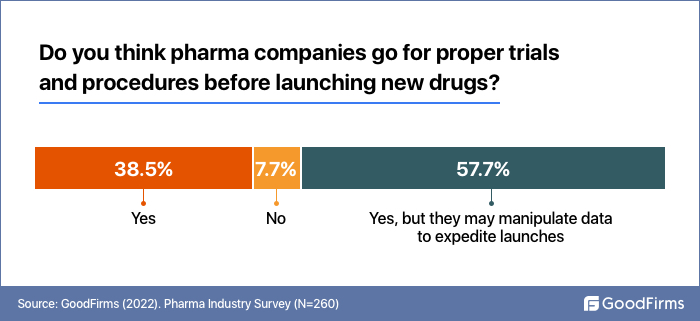

Consumer Trust

Despite multiple pharma companies launching vaccines in record time, the survey reveals that pharma companies still have to do a lot to gain complete consumer confidence. The expedited launch of vaccines may be seen cynically by many, and there were concerns regarding the efficacy and safety of these vaccines. Consumer trust on pharma companies' drug trial processes appeared to be at a very low level, with around 57.7% believing that pharma companies may manipulate data.

Other Risks and Challenges:

In addition to the above-discussed challenges, pharma businesses are susceptible to:

- financial and economic market conditions

- approval delays and rejections

- intellectual property thefts

- reputational challenges due to rumors

- interruptions in manufacturing due to adverse and unforeseen global or local situations,

- labor issues

- expensive product recalls

- intense competition

- legal suits

- taxation changes

- increase in prices of raw materials and APIs

Market Opportunities

The recent growth in the pharma sector is driven by increased demand for medications, as well as innovations in manufacturing. One major area of growth is the development of personalized medicine, covid treatment, and gene therapies. In addition, new drugs are being developed to treat different health conditions, including obesity and depression. New products that address unmet medical needs will also attract new customers. Additionally, strong economic growth worldwide will provide more opportunities for companies to expand their operations.

Key market opportunities in the pharma sector are:

Huge Scope in Prevention Healthcare

The core pharma companies need to invest thoughtfully in the new-age technologies such as cloud, automation, AI, blockchain, Wearables, IoT, AR/VR, data analytics, and more to combat the disruption caused by the rise of preventive healthcare startups. Preventive healthcare startups are coming up with tech innovations and solutions that reduce the need for drug consumption. Preventive healthcare innovations can put pharma into oblivion by crushing the demand for treatment pills. Pharma companies that keep innovating, adopt technologies and develop capabilities to outperform their peers will be highly successful in the long run. The laggards might lose the battle.

The seismic shift from treatment healthcare to prevention healthcare also presents a huge opportunity for pharma players, both incumbents and new entrants.

In collaboration with technology companies, the pharma companies can offer products and services focused on the prevention of diseases for the new-age health-conscious customers. In this context, pharma players can extend their therapeutic portfolio and include products that are preventive in nature, such as virtual healthcare services, medical advice, nutrition and wellness, physical activity tracking wearables, and more.

Precision Medicines To Cater to Diverse Populations

Precision medicine takes into account patient-to-patient variables such as genes, lifestyle, environment, physical traits, etc., to develop medications specifically designed for a particular group of patients. It is different from general pharmacy solutions that are targeted towards specific diseases but are not formulated keeping the different traits of patients in mind. Social variations-based health determinants can cause disparities in the effectiveness of medicines, and the same medicine can have varying effects on different patient groups.

The overall positive growth drivers for precision medicines bring a plethora of opportunities for pharma companies, especially the niche ones. As precision medicine trends scale further, there will be a need for smaller, high-quality manufacturing facilities. “In contrast to what is needed for the bulk production of pharmaceuticals, precision medicine calls for the utilization of smaller manufacturing facilities'', says Olive Grat, Marketing Director of Techiegarden.

Opportunities for Native Startups

There are also numerous opportunities for startups in this space, as well as for established companies looking to diversify their product offerings. The sector generally faces no obstacle in securing investments and has easy access to financing options for expansion, research, and development. The indigenous production of active pharmaceutical ingredients and shifting of manufacturing facilities of various multinational pharma companies offer a huge opportunity for pharma-based startups.

The potential synergy between established pharma companies and startups can fill the technology gap, and both can leverage their complementary strengths. For instance, Bit Bio, a UK-based pharma startup, is providing solutions in biomedical research to pharma companies.(28) uFraction, a German pharma startup, is catering to pharma companies with cell separation technology.(29)

Rising Chronic Diseases and Aging World Population

The number of people suffering from one or more chronic ailments is on the rise.(30)(31) Some of the other biggest trends in the industry include new medicines being developed for cancer and other diseases, as well as advancements in digital health technologies. In addition, there will be continued demand for generic drugs due to increasing restrictions on the use of certain expensive drugs by insurance companies.

Pharma is a large market that is constantly growing and evolving, which provides plenty of opportunities for companies that are willing to seize the moment. Dietary changes, sedentary lifestyles, and an increase in virus profiles with the emergence of new and deadly virus families are all going to drive up the need for pharma products. While the aging population may hit the US economy adversely(32), the pharmaceutical sector can benefit due to increased demand for at-home care products, generic medicines, OTCs, chronic ailment medication, etc.

Opportunities for Online Pharmacies

Online pharmacies are yet to realize their true potential, and there is a huge untapped market share available for online pharmacies to explore. Online pharmacies are still struggling to gain a strong foothold, but they can gain big if they focus on enhancing customer experience. Online pharmacies should ensure faster deliveries through the use of sophisticated Pharmacy software that automates and facilitates complete collaboration with the third-party suppliers, distributors, and delivery partners. Most online pharmacies onboard customers on the basis of huge discounts and free home deliveries but later stop these freebies. Most customers stop ordering once such freebies are not given anymore. So, rather than providing huge discounts that cannot be sustained, providing consistent and realistic discounts and free deliveries are prudent solutions for long-term customer retention.

Goodfirms’ research revealed that 23.1% of surveyees distrust online pharmacies. There are many who have queries related to their prescriptions and, therefore, rather than uploading the prescription online, choose to buy from local retail pharmacists who often help buyers in understanding their prescriptions. Retail pharmacists are also trusted entities, and therefore people are assured of their medication purchases. Online pharmacies must collaborate extensively with local doctors and pharmacists to verify prescriptions, suggest generic alternatives, and provide a free consultation to those who want to buy online. Such an arrangement will create more trust in online pharmacies.

Future of the Pharma Industry

The continuous developments in Industry 4.0 tech in pharma supporting augmented manufacturing, personalized medicine, localized 3D printing of treatments, and more will soon let the pharma industry envision a future where automation phases out all waste processes and shifts pharma manufacturing to lean production methods where humans are no longer intimately involved with production processes.(33)

Collaborations will be a Key to Survival

The pharma industry invests heavily in drug research and development and subsequent clinical trials. If the end-product brings sub-par revenues, then it can be disastrous for the balance sheets. Research collaborations are critical for driving better outcomes, survival, and scaling for pharma businesses. Collaborative partnerships between pharma players can create synergies that accelerate scaling, bolster innovations, and ramp up capabilities.

Now, these collaborations are not necessarily limited to internal members and can be extended to external industries. For example, pharma companies can partner with technology companies to aid their research data analysis or to optimize their core operational processes.

Pharmaceuticals no longer can stay competitive with standalone businesses only. They will have to generate revenues through aligned consumer products, complementary therapies, diagnostics labs, and data offerings.

Pandemic has drastically changed the social, economic, and demographic context in the pharma industry.

- The futuristic facilities will have to focus on customization rather than bulk production.

- Pharma companies will also have to recruit, train and retain researchers, manufacturing experts, supply chain managers, health economists, financial experts, risk management consultants, disease management specialists, etc.

- Pharma companies will need to focus on products with long-term sustainability and superior features that cannot be superseded by rival products.

Key Finding

- Owing to the current geopolitical situation, pharma companies are planning to reshore their manufacturing units to their home countries.

- Outsourcing specialty medicines to CDMOs is becoming a viable alternative to in-house manufacturing.

- Decentralized clinical trials (medical trial activities at patients’/volunteers’ homes) are gaining traction after the pandemic.

- Pharma companies are striving hard to collect patient data via wearable integrations to come up with better products.

- The pharma sector is prioritizing compliance and focusing on risk aversion processes.

- 41.7% buy medicines from local pharma retailers.

- 33.3% buy medicines from both local and online pharmacies but stated that they prefer local pharma retailers

- 42.3% believe that medical shops are more convenient and customer-friendly than online pharmacies

- 30.8 % are concerned about their medical data and privacy and therefore avoid buying medicines online.

- 23.1% distrust online pharmacies.

- 38.5% check the brand name before buying over-the-counter medicines.

- 23.1% buy alternatives of the prescription medicine with the same composition but a better brand than the one suggested by the doctor.

- 46.2% prefer buying the exact brand as prescribed by the physician.

- 42.3% try to find generic versions of the prescribed medicines that are available for lower prices.

- 55.7% would not take advice from any online medication program.

- Paracetamol is the most purchased over-the-counter medicine, followed by pain relief balms, eye/ear drops, cough suppressants, and painkillers.

- Sanitizer dispensers, Infrared thermometers, and oximeters are the most bought consumer medical equipment.

- 57.6% think AI can augment their medicine buying experience.

- Additive technology in manufacturing, blockchain for supply chains, wearable tech for data collection, IoT sensors, are among the top technology-driven innovations trending in the pharma sector.

- Stringent regulations, forced cost-containment measures, cybersecurity breaches, failure of third parties in meeting obligations, retaining skilled talent, etc. are among the top challenges in the pharma industry.

- In the post-pandemic world, collaborations will be the key to survival for pharma players.

- The pharmaceutical industry has seen significant growth over the past few decades and is expected to continue growing in the future.

Conclusion

Despite a slow pace of deal-making in the sector so far this year, activities in the pharma sector are set to pick up in 2022. Many big pharma firms now have adequate capital, especially those who have COVID treatment and therapies in their product portfolio. Biotech valuations that surged due to the pandemic have been consolidating and are now into stable territory. Most supply chains have returned to normal, barring those dependent on Ukraine and Russia. Pharma balance sheets are in the green zone.

Pharma companies have seen unprecedented scientific breakthroughs in the past two years. The industry is witnessing greater collaborations across the value chain, shift toward more data-driven methods, digital transformation including automation, and a shift from conventional approaches. A new standard has been set, and those who meet it will reap the greatest benefits.

We sincerely thank our Research Partners who participated in the survey.

References

- https://www.statista.com/statistics/263102/pharmaceutical-market-worldwide-revenue-since-2001/

- https://www.grandviewresearch.com/industry-analysis/pharmaceutical-manufacturing-market

- https://www.ey.com/en_us/life-sciences/reshoring-us-pharma-manufacturing

- https://www.mordorintelligence.com/industry-reports/pharmaceutical-contract-development-and-manufacturing-organization-cdmo-market

- https://www.mckinsey.com/industries/life-sciences/our-insights/no-place-like-home-stepping-up-the-decentralization-of-clinical-trials

- https://www.reuters.com/article/brief-icon-announces-deal-with-intel-all/brief-icon-announces-deal-with-intel-allowing-integration-of-the-intel-pharma-analytics-platform-for-clinical-trials-idINFWN1RU0XC

- https://www.boehringer-ingelheim.us/press-release/transition-renewable-energy-signals-broader-commitment-environmental-sustainability

- https://www.jnjconsumerhealth.com/innovation/making-our-packaging-more-sustainable

- https://www.globaldata.com/store/report/healthcare-industry-m-and-a-deals-by-theme-quarterly-analysis/

- https://news.bms.com/news/details/2022/Bristol-Myers-Squibb-to-Acquire-Turning-Point-Therapeutics-a-Leading-Precision-Oncology-Company/default.aspx

- https://www.gsk.com/en-gb/media/press-releases/gsk-completes-acquisition-of-sierra-oncology/

- https://news.abbvie.com/news/press-releases/abbvie-acquires-syndesi-therapeutics-strengthening-neuroscience-portfolio.htm

- https://www.lek.com/sites/default/files/insights/pdf-attachments/2060-AI-in-Life-Sciences.pdf

- https://pubmed.ncbi.nlm.nih.gov/33965461/

- https://www.fda.gov/consumers/consumer-updates/3rs-3d-printing-fdas-role

- https://www2.deloitte.com/us/en/pages/life-sciences-and-health-care/articles/impact-of-wearable-technology-in-pharmacovigilance.html

- https://www.researchgate.net/publication/273775749_Digital_Games_for_Type_1_and_Type_2_Diabetes_Underpinning_Theory_With_Three_Illustrative_Examples/link/553cf8750cf2c415bb0d3d47/download

- https://www.fda.gov/drugs/drug-supply-chain-integrity/internet-pharmacy-warning-letters

- https://www.forbes.com/sites/forbestechcouncil/2021/09/14/the-future-of-pharmaceutical-e-commerce/

- https://www.statista.com/outlook/dmo/digital-health/ehealth/online-pharmacy/worldwide

- https://fortune.com/2020/02/07/zolgensma-high-drug-prices/

- https://www.aha.org/fact-sheets/2020-01-28-fact-sheet-340b-drug-pricing-program

- https://jamanetwork.com/journals/jama/article-abstract/2792986

- https://www.ted.com/talks/katherine_eban_a_dose_of_reality_about_generic_drugs/

- https://hbr.org/2021/03/building-trust-into-telehealth

- https://www.thelancet.com/journals/landig/article/PIIS2589-7500(22)00100-5/fulltext

- https://www.ahrq.gov/patients-consumers/patient-involvement/off-label-drug-usage.html

- https://www.bit.bio/

- https://www.ufraction8.com/

- https://www.medicaldirector.com/news/clinical-practice/2021/03/the-rising-tide-of-chronic-disease

- https://www.cdc.gov/chronicdisease/center/index.htm

- https://www.reuters.com/world/us/aging-population-hit-us-economy-like-ton-bricks-us-commerce-secretary-2021-07-12/

- https://ispe.org/pharmaceutical-engineering/march-april-2021/industry-40-future-pharmaceutical-industry