A good accounting practice can help businesses of any size to assess the performance, and plan future business strategically.This is prime for a family-owned business which often struggles to function cohesively. Apart from investing in the best accounting software for your family-owned business, it is also critical to know the intricate details of accounting, and gain alerts over potential financial gaps. Following the right accounting practices for your family business can help you mitigate malicious frauds, take preventive measures against low sales or other damages, and prevent bookkeeping errors that can lead to substantial financial losses.

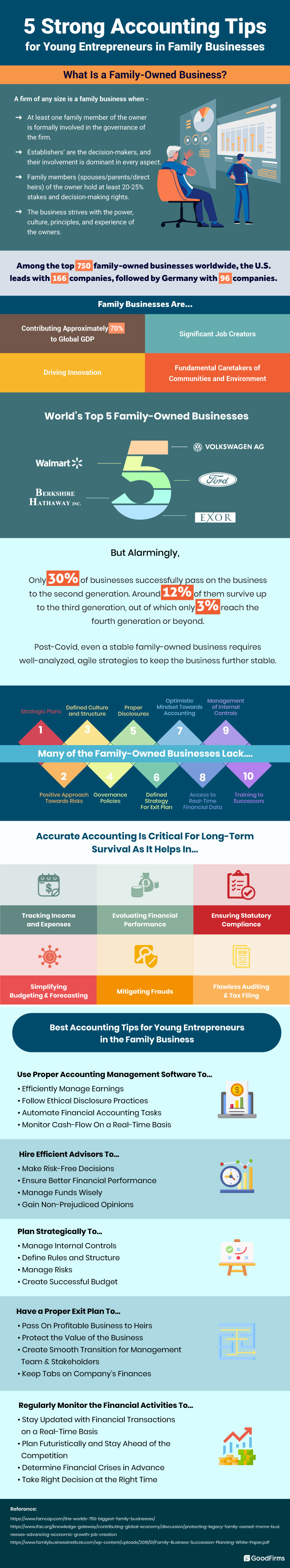

The following infographic is specifically designed for young entrepreneurs in the family businesses, helping them gain insights into 5 strong accounting tips.

Conclusion

Having a basic understanding of accounting, bookkeeping, and smart budget planning can help you run a profitable business. If you are looking for ways to deploy customizable and affordable accounting technology besides following the above accounting tips, consider going through the list of the top accounting software and choose the one that best suits your family business.