ABSTRACT:

The world is witnessing a drive toward cashless payments while lowering the reliance on cash. The payment trajectories have changed with the rise of fintech companies, declining cash usage, adoption of real-time payments, migration from physical stores to online commerce, and the sophistication of banking applications. The integration of new technologies such as Near-Field Communication (NFCs), Unified Payment Interfaces (UPIs), Stablecoins, etc., has led to a revolution in cashless and contactless payments. Customer perception towards cashless payments has changed owing to the pandemic and, at the same time, compelled financial regulators to create policies in favor of the cashless stream.

There are also equal worries regarding the financial inclusion of the underbanked and the economically weaker sections in the cashless regimes. Infrastructure development for the cashless world, cyber threats, and other challenges need to be addressed too. This research survey titled "Cashless Payments - Benefits, Challenges, Trends, and Opportunities" attempts to find the reasons behind the rise of cashless payments, and identify the ongoing trends in the cashless payment world. Goodfirms' online survey was carried out between 11th March 2022 and 25th March 2022. A total of 350 responses were collected. The survey queried selected participants and financial experts across the world on their payment habits and preferred payment methods, and other driving factors that influence their payment choices. The research also uncovers and analyzes the benefits, challenges, and future scope of the cashless payment regime. The research brings out invaluable insights into how the payment culture has changed forever after the pandemic, and cashless settlements are witnessing unprecedented traction.

Table of Contents:

IntroductionCurrent Trends in Cashless Payments Across the World

- #1 Consumers Prefer Cashless Transactions

- #2 Digital Wallet Payments Are Rising

- #3 For High-Value Transactions - Credit Cards Still Stands as the Favorite Payment Option

- #4 Increase in the Usage of Cashless Payments After the Pandemic

- #5 Cryptocurrency is Now a Part of Public Consciousness

- #6 Demand for Mobile Point-of-Sale Systems is Growing

- #7 Biometrics Authenticated Payments Will Become Increasingly Popular in 2022 and Beyond

- #8 P2P Payments Are Accelerating the Growth of a Cashless Society

- #9 Central Bank Digital Currency(CBDC) Could be the Next Disruptor in the Cashless Payment World

- #10 Regional Payment Giants are Power Playing Along with International Payment Systems

Key Challenges Today and Opportunities for the Future in Cashless Payments

Challenges

- Technical and Financial Challenges

- Addressing Loss of Transaction Revenues

- Extreme Volatility in Virtual Currency

- Unhealthy Consumer Behaviors

- Fears of Government Totalitarianism and Expropriation

- Cyber-Criminals Can Crumble Down the Whole Financial System

- Consumer Surveillance and Privacy Issues

The Future of Cashless Payments:

Key Findings

Conclusion

References

Introduction

The world is heading toward a cashless payment regime, and somewhere in the future, physical money is likely to become obsolete. Managing physical cash is cumbersome not only for consumers and the general public but also for financial institutions and governments. Printing money bills, keeping cash safe in vaults, transportation in armored vans, and sorting and storing them cost rich countries about 0.5% of their GDPs.(1) But the cost isn’t the only reason that persuades countries to move towards a cashless regime. There is the demand side too. The current demand from consumers for faster, cheaper, and real-time modes of payments is higher than ever before. The advent of new-age payment service providers and innovative approaches by fintech companies have further provided the required momentum to shift towards a cashless future.

Digital wallets, internet banking, mobile payments, and contactless card payments are replacing the cash payment mode. Another incentive for governments to push for a cashless economy is easy monitoring for tax evasion and financial fraud. However, not all are yet ready for the transition. Personal perceptions about the speed of payment, accessibility, ease of use, trust factors, privacy issues, etc., determine the probability to shift to a cashless regime. Socioeconomic factors such as financial viability, inclusion, budget, bank accounts, financial awareness, and infrastructural access to cashless methods control if an individual can adapt to the cashless payment world or not.

This survey titled- "Cashless Payments - Benefits, Challenges, Trends and Opportunities" by Goodfirms attempts to uncover the reasons behind the steep rise in cashless payments, current trends in the cashless payment world, and key opportunities and major challenges going forward with the cashless regime.

Current Trends in Cashless Payments Across the World

With cashless transactions growing steadily, along with the availability of digital currencies, this survey conducted by Goodfirms attempts to reveal the top trends governing the payment world in 2022.

Let us have a look at the most significant trends exposed by the latest survey.

#1 Consumers Prefer Cashless Transactions

The global trends are pointing toward consumers' preference for a cashless regime. Overall, 65.7% of respondents in GoodFirm’s cashless payment survey stated that they prefer cashless transactions. The preference for cashless payments can be attributed to many reasons:

- Cashless payment transactions save valuable time in multiple instances. Online payment for booking tickets, buying from ecommerce space, etc., spares people from unnecessary travel and saves time.

- It also removes scenarios where anyone denies receiving payment as all transactions settled with cashless options, are recorded digitally..

- It also removes the risks associated with losing paper receipts/bills as invoices and payment receipts in cashless settlements can be retrieved anytime later with a few clicks.

- People also prefer the cashless way to pay because it solves issues of hygiene with contactless payment modes and minimum contact pay.

- Cashless payment also eliminates personal security risks of carrying and handling cash.

71.4% Prefer Cashless Transactions For The Convenience of Not Having To Carry And Protect Cash

With the widespread penetration of smartphones, services, and products such as buses, air, train tickets, movie tickets, and ecommerce products are mostly bought via cashless payments. It eliminates the need of having to carry cash around. Also, cashless payments bring the convenience of real-time settlement, automatic electronic records, no-location restraint, multiple modes of payment, and easy tracking of payment status.

#2 Digital Wallet Payments Are Rising

The rise of digital wallets resonates with millennials' desperateness for easing payment processes. With automated receipt generation and storage, multi-biller capabilities, multi-currency payment modes, direct integration with bank accounts, and lightning-fast payment abilities with QR code scanning or one-tap payments, digital wallets are proving to be more than a match for the physical cash payment method or even contactless cards.

One of the biggest trends that we are now seeing is the rise of digital wallets, as they are starting to compete with contactless cards, with many consumers now firmly transitioning towards mobile payments, says Kathleen Ahmmed, co-founder at USCarJunker.

When it comes to digital wallets, there is no dearth of alternatives. Goodfirms queried surveyees about the digital wallets they use and Google Pay emerged to be the most used digital wallet by consumers.

Google Pay is the Most Used Digital Wallet Worldwide

- Google Wallet (51.4%) is the most used digital wallet worldwide, followed by Paypal(31.4%) and Paytm(28.6%).

- Only 5.7% of surveyees reported that they don’t use any digital wallets.

Digital wallets facilitate faster, easier online checkout and payments at physical stores for users. When businesses implement digital wallets such as Gpay, Paypal, Paytm, Apple Pay, Amazon Pay, Samsung Pay, etc., within their app or website, buyers can check out or pay with just a few clicks.

One can note that all the top digital wallets have been created by technology companies and not banks or financial institutions. While banking incumbents are still struggling to completely give up legacy systems, tech companies have been way ahead in their approach. Capitalizing on the user demand for faster and seamless payment processing, fintech companies have created a far superior and hyper-personalized payment experience for their customers.

What sets the fintech giants apart from traditional financial services such as banks and cards is the way in which fintech companies monetize their customer data by partnering with other companies. Banks and card companies have been reserved about venturing into merchant partnerships with third parties due to their stringent regulations and conservative nature. On the contrary, fintech companies have been extremely successful in monetizing their customer data by sharing the same with third-party product and service providers.

42.9% Frequently pay via Digital Wallets for Low-value Transactions

Goodfirms' research reveals that 42.9% of global consumers are paying via digital wallets for online transactions, in-store purchases, subscriptions payments, monthly bills payments, etc. Digital wallets integrate with bank accounts or store credit/debit cards to make payments. One reason why digital wallets are gaining prominence for low-value payments is that most credit cards and debits cards have an attached convenience fee. The convenience fee is a burden on both the merchant and the buyer. Digital wallets spare both from these charges.

We've all unintentionally tried to pay at a small local company that doesn't accept cards. Or a minimum purchase amount is enforced. This is due to credit card merchants' interchange fees. The fees often take 2–4% of a transaction, causing a business to lose money on minor purchases., says Johnathan Merry, Founder of Moneytransfers.com

Convenience is another reason why digital wallets are preferred over cards or cash for low-value transactions. Customers don’t need to carry a card or cash physically. Also, it solves the ‘unavailability of change’ issue. 31.4% of surveyees stated that they prefer cashless methods such as digital wallets to pay as it eliminates issues such as unavailability of cash.

Moreover, digital wallet companies (often backed by cash-rich tech giants) are offering more lucrative rewards, cashback, partner offers, etc., than card issuers.

#3 For High-Value Transactions - Credit Cards Still Stands as the Favorite Payment Option

60% of Shoppers Use Credit cards/Debit cards for High-Value Transactions at Physical Stores

Credit cards/Debit cards offer rewards/points for purchases at physical stores. Credit card users get more benefits if they are milestone users. The rewards given back to milestone users are substantial. Buyers looking for payment in the EMI mode go for credit cards. Digital wallets require the money to be debited directly from the connected bank account or from the wallet itself. Such transactions cannot be converted into EMIs unless your digital wallet allows you to pay from a credit card or has a partner credit card company that converts purchases into EMIs.

Credit card purchases for high-value transactions strengthen the user’s credit history and creates a space for easy loans in the future too. Digital wallet payments can be used for buying preference analysis, but still, these purchases are not reported to credit bureaus and do not affect the credit score. Therefore, more people choose credit/debit cards for high-value transactions at stores.

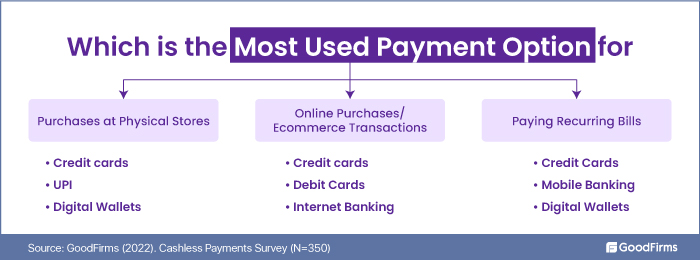

Other than credit cards, users in some countries reported paying via digital wallets and UPI(Unified Payment Interface).

40% of Shoppers Use Credit Cards to Pay for Ecommerce Purchases

Credit cards claimed the top spot for paying for ecommerce transactions. There are a plethora of reasons for this preference.

- Consumers get reward points for paying via credit cards

- Options for no-cost EMIs are mostly available with credit cards only

- Most credit cards offer price, purchase, warranty, and fraud protections on online purchases

- In the case of disputed transactions, the money is not debited from users' bank accounts as it would be in the case of other payment modes.

- Even in the case of online fraud, the extent is limited to credit cards’ limit (which many set to a lower end), and not all money from bank accounts can be withdrawn by cybercriminals as would be in the case of debit cards or internet banking.

Other than credit cards, users reported paying via Debit cards and internet banking as their second and third options to pay for ecommerce purchases.

25.7% Pay for Recurring Bills via Credit Cards

Credit cards emerged as a preferred payment option for paying recurring bills. Automatic debits without worrying about keeping a sufficient balance in the account to pay for bills is a major reason why credit cards are preferred over other modes of payment for monthly bills. Credits cards are closely followed by mobile banking and internet banking as other modes of payment for recurring bills.

#4 Increase in the Usage of Cashless Payments After the Pandemic

60% of Surveyees Reported an Increase in the Usage of Cashless Payments After the Pandemic

The pandemic didn’t give rise to new payment methods but boosted the already existing contactless and digital payment modes(2) and slowed down the momentum in cash payments. People's buying behavior shifted towards online venues amidst the pandemic and in the post-peak pandemic era(3) creating a spur in the need for cashless payment options. The rise of cashless payments compelled regulatory bodies to restructure and reframe the existing rules for cashless and contactless payment processes. Taking steps to encourage cashless and contactless payments in the wake of the pandemic, financial regulatory bodies around the world increased the limit for such transactions. In countries such as Belarus and Mauritius, the contactless transaction limit was increased to 400%. Canada and India allowed an increase of 150% in contactless payments.(4)

#5 Cryptocurrency is Now a Part of Public Consciousness

60% of respondents are familiar with payments using virtual/cryptocurrencies such as Bitcoin, Ethereum, Litecoin, etc.

The speculations and forecasts about physical cash getting replaced by other forms of currencies stem from the world's search for more convenient, secure, and independent alternatives to cash. Cryptocurrency is one such alternative. The rise of cryptocurrencies stimulates the transition of finance towards a decentralized regime even when it poses serious financial stability risks. Cryptocurrencies' very existence is a deviation from the age-old belief that people have a deep-rooted trust in government-backed currencies.

However, the challenge is that all taxpayers in the world are taxed in government-backed sovereign currencies. National debts, and foreign exchanges; all involve transactions in sovereign currencies, and therefore, accepting cryptocurrency that is stateless, highly volatile, and unregulated can be risky for the stability of economies.

Until we have a stable currency that can be trusted, it will be difficult to have any type of wide adoption by consumers and businesses. It will be interesting to see how the USA and other governments ultimately decide to regulate crypto because the most powerful thing a country can do is control the monetary supply, and no government will give that up without a fight, says Cristopher Carillo, Cofounder of Allied Payments.

In March 2022, US president Joe Biden signed an executive order directing federal reserves to examine if the central bank should create its own digital currency in the wake of the extreme popularity of cryptocurrencies and geopolitical fears that sanctioned countries might use cryptocurrencies to evade sanctions.(5) On 18th April 2022, Nirmala Sitaraman, the Finance minister of India speaking at the 2022 IMF Spring Virtual Meet called upon the world to create a global framework to regulate cryptocurrencies.(6)

Because the blockchain is controlled by no single bank, government, or financial firm, no one may impose fees for transactions that take place on the network. This lowers the entrance barrier, says Jonathan Merry, Director at Bankless Times.

#6 Demand for Mobile Point-of-Sale Systems is Growing

Forced to stand in the checkout queue leads to customer stress and frustrations. The appetite for faster checkouts is driving the mobile POS revolution. Mobile POS eliminates the restriction to carrying out the billing process from the traditional billing counters only. Sales staff equipped with mPoS devices can accept payments from anywhere in the store and save customers' time. Businesses can completely get rid of billing counters and utilize the space in a more profitable way using Mobile POS. Also, businesses can stretch their physical locations and accept payments at exhibits, sales events, concerts, and trade fairs via the mobile point of sales.

mPOS also integrates with new-age technologies such as beacons, ID tagging, etc., to deliver a real-time personalized shopping experience to store visitors. Also, it allows the users to update the prices and inventory information from any remote location, offering high-end convenience and reliability.(7)

#7 Biometrics Authenticated Payments Will Become Increasingly Popular in 2022 and Beyond

Biometrically authenticated payments verify a person's biological and anatomical traits such as fingerprints, iris, facial geometry, biorhythm, voice patterns, veins, etc. Modern consumers are already familiar with the concept from its usage in mobile phone unlocking.

Biometric payment cards come with sensors that image fingerprints for identification just before the card is put into the payment terminal such as ATM or POS. If the fingerprint matches the stored database, the payment is authenticated. The biometrics payment system mitigates the risks associated with stolen cards and PIN theft. It also spares consumers from remembering PINs or following the hectic procedures to retrieve forgotten PINs.

#8 P2P Payments Are Accelerating the Growth of a Cashless Society

P2P payments are accelerating the growth of a cashless society. The ease of opening a P2P account is the biggest catalyst behind the meteoric rise of P2P financial institutions. The market penetration achieved by P2P service providers is unprecedented. Real-time P2P payments are fast emerging alternatives to traditional payments as the incumbents are offering competitive and compelling payment solutions.

The P2P networks have figured out a way to penetrate these markets in ways that traditional banks could never. “This massive user base of the P2P networks also creates a unique opportunity to disrupt traditional payment card systems with new technologies and platforms as legacy payment platforms try to compete”, says Cristopher Carillo, co-founder of Allied Payments.

P2P enables faster settlements for freelancers and small businesses.

"Cashless economies can benefit gig workers and small and medium enterprises in the future," says Amanda Sullivan, Research Analyst at CreditDonkey.

The adoption of the P2P payment system was highest during the pandemic period, and during the post-peak pandemic period, P2P payment growth showed signs of saturation. However, the growth saturation is more visible among millennials who are already a part of the P2P ecosystem. There is a major growth opportunity in P2P as the tech-savvy generation Z 'ages' and achieves financial independence. With the attainment of purchasing power in the near future, GenZ offers P2P payment providers a huge opportunity for growth.(8)

#9 Central Bank Digital Currency(CBDC) Could be the Next Disruptor in the Cashless Payment World

Bahamas central bank introduced Sand Dollar, the world's first central bank digital currency(CBDC), in 2020.(9) Its progression is being closely watched and analyzed by major economies around the world, and now other major central banks around the world are considering foraying into the same payment technology.(10)

Cryptocurrencies and other private digital coins pose a constant threat to the financial authority and intermediation powers of central banks in the payment ecosystem. It is imperative for central banks to launch their own digital currency and retain the control of monetary policies.

A timely launch of digital currencies by central banks can counter the progress already made in private cryptos. Cryptocurrencies are moving slowly amidst saturation, regulatory hurdles, and inclusion issues. “However because the technology is understood by relatively few people, there is some resistance, so its adoption will be slower compared to other forms of electronic payment," Evan Albert, co-founder of Seamless Chex.

CBDCs, a form of virtual currency issued and backed up by the central banks, is set to revolutionize cross-border payments settlement and bring more credibility to virtual currencies. CBDCs can change the nature of cross-border payment transactions from the current high-value and low-volume transactions to low-value and high-volume exchanges.

The proliferation of cryptocurrencies, such as Ethereum, Dogecoin, Bitcoin, and many more, have been a catalyst for central banks' inclination to create their own digital coins. CBDCs can function as legal tender in digital economies and streamline real-time payment systems.

#10 Regional Payment Giants are Power Playing Along with International Payment Systems

Payment infrastructure is now a strategic part of financial policies by Governments. Elo in Brazil, UPI in India, Troy in Turkey, etc., are examples of how domestic payment systems are dominating the payment landscape in some countries. These payment systems have reduced transaction costs and time and are fostering the growth of inclusive economies with mass penetration.

Key Challenges Today and Opportunities for the Future in Cashless Payments

Cashless transactions bring extreme convenience over cash when it comes to payments. The ability to pay online from anywhere, pay with multiple options (Cards, UPI, Wallets, Internet Banking, Mobile banking, etc.), and freedom from carrying cash are top reasons that persuade people to adapt to the cashless regime. Other trends such as buy now and pay later in installments are emerging and creating a buzz for digital payments. Particularly Generation X and baby boomers are using the BNPL features, such as one that is pioneered by Amazon with its flagship Amazon Pay Later.

The fears of cybercrimes or privacy often get sidelined when compared with the benefits that cashless payments offer. However, while the opportunities and benefits are lucrative, the challenges are also real. Let us dive into the detailed analysis of top challenges and opportunities in cashless payments:

Challenges

Technical and Financial Challenges:

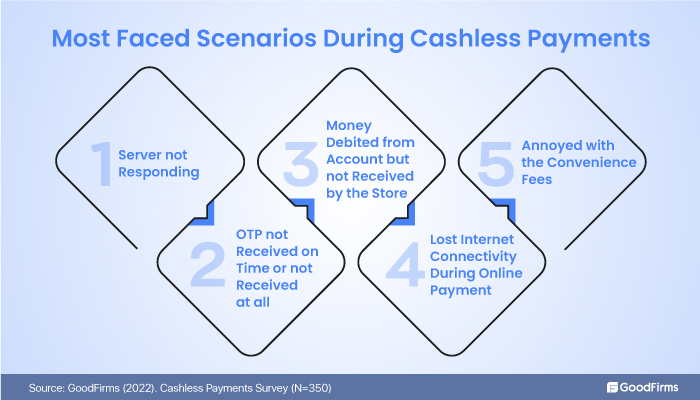

From low-bandwidth internet causing online transactions to fail to server failures at payment gateways, online payment transactions can be interrupted due to multiple reasons. Goodfirms queried surveyees about the most faced scenarios while carrying out cashless payment transactions. The top faced challenges during cashless payments, as stated by most surveyees, are:

- Technical disturbances such as server not responding (57.1%)

- OTP not received on time (54.3%)

- money debited but not received by the store (37.1%)

- Lost internet connection during the ongoing transactions (37.1%)

- Annoyance due to convenience fees at payment gateways (31.4%)

Apart from the above issues, respondents also reported instances of forgetting PINs or putting the wrong ones, getting stuck due to a very tedious and lengthy payment process, and credit/debit cards showing invalid at the time of payment. However, the recent developments in 5G and cloud computing are set to remove the above hurdles and enable lightning-fast payment transactions.

Addressing Loss of Transaction Revenues:

Swipe fees and merchant service charges for the 'party to party' payments have been a considerable revenue stream for incumbents such as banks and mainstream financial institutions. However, the advent of new-age fintech firms that offer zero-charge P2P transfers has adverse ramifications for the traditional banking industry. As the world makes a transition to a cashless regime, those dependent on existing service charge revenues will need to address the loss of transaction revenues for survival. "Banks and payment companies must rethink their go-to-market strategies and payment mix now that these fees are in jeopardy," says Matthew Dailly, Managing Director at Tiger Financial.

Extreme Volatility in Virtual Currency

Crypto assets have projected more volatility than any other financial asset. Extreme enthusiasm and utmost fears mark the trading patterns in cryptocurrencies. Secondly, exaggerated value propositions, speculative trading, lesser liquidity, and low penetration of institutional investors such as banks, investment firms, etc., are reasons behind the heightened volatility in crypto-based assets. One more reason why cryptos are more volatile than other financial instruments that trade on exchanges is that there is no 'çircuit breaker' to stop the fluctuation as there is with equities or ETFs. Moreover, in case of extreme volatility, stock exchanges halt trading and implement a 'cool off period.'(11)

"Most cryptocurrencies are still too volatile to serve as reliable means of exchange for day-to-day transactions," says Carter Seuthe, CEO of Credit Summit Consolidation.

Unhealthy Consumer Behaviors

Cash is visible, and therefore when people spend money on unhealthy foods, hedonic items, etc. they display more restraint when paying in cash. On the contrary, cashless payments eliminate the immediate negative arousal associated with decision-making and therefore don’t prevent risky consumption patterns.(12) If cashless payments induce unhealthy and irresponsible consumption behavior, then the unintended consequences will hamper the growth of cashless economic environments. “Intangible money may lead to an increase in debt from overspending," says Evan Albert, co-founder of Seamless Chex.

Fears of Government Totalitarianism and Expropriation

The defenders of cash economies argue that ill-intentioned governments or central banks, under the pressure of international lenders, can easily go for expropriation and usurp the digital cash of citizens whenever they want. This is something not easy when physical cash is involved. Total cashlessness gives central banks full control over monetary policies. For example, if central banks introduce negative interest rates on deposits, people will refrain from keeping their money in banks and would prefer to keep it in the cash form. If cash is completely abolished, central banks can push interest rates into the negative territory if required for economic control.

Cyber-Criminals Can Crumble Down the Whole Financial System

State-sponsored cyberattacks, hacker groups, terrorist groups targeting financial institutions, and other independent cybercriminals pose a constant threat to global financial stability. Data corruption, payment system disruption, fraudulent transactions, credential theft, etc., are ways through which cyber criminals attack the integrity of financial systems. Pandemic fueled a digital revolution in financial systems and expedited the financial inclusion process, especially in the third-world economies. However, it also led to a surge in destructive cyberattacks. A single hacker stole the data of 100 million customers of the financial giant Capital One in 2019.(13) Highly sophisticated cyber attackers have the potential to take down the whole financial systems of banks, central reserves, etc. Physical cash is safe from hackers and cybercrooks. Cash doesn't need a password that can be hacked, and therefore many believe it is safe.

Consumer Surveillance and Privacy Issues:

Cashless payment systems record transactional data that can be used for consumer surveillance in both positive and negative ways. On the one hand, data analytics and marketing technologies can analyze the transactions to come up with better products and personalized offers for consumers; on the other hand, third parties can misuse the data for unauthorized surveillance and cybercrimes.(14) Cash facilitates secrecy and privacy, whereas payment cards and digital wallets expose the financial data of consumers. Private companies may also use data in a manner that may be vicious.

Are We Prepared For the Financial Inclusion of the Underbanked in the Cashless Society?

The pandemic reinforcements and subsequent shifts toward cashless payment methods caused a dramatic reduction in the availability of cash currencies. Still, a large population around the world hasn't adopted the cashless regime. Poor, elderly, and people in remote areas of the world are still acclimatizing to digital payment methods. Any unthought haste by governments and corporates to shift to a cashless economy can render such a vulnerable class financially excluded.

Opportunities:

For Businesses:

- Safer Channel for Upselling by Financial Services and Partners: Until the cashless payments originated, credit was the way to onboard customers and offered a range of financial services based on the credit payment history. This has changed with the cashless payment regime. Digital payments provide financial services with real-time data on consumers' buying habits, purchase patterns, financial behavior, top spending areas, etc. Such data can be a safer alternative for upselling rather than the 'credit' method. I believe very strongly that for countries like the United States we could and should move to a digital currency and get rid of currency, Joseph Stiglitz, Nobel Prize-winning economist.(15)

- Cashless payment methods accelerate cross-border, cross-currency, and real-time B2B payments.(16)

- Cashless payments ensure business continuity in disruptions such as the pandemic.

- Distributed ledger technologies in collaboration with AI and cloud computing enable high-speed and unhindered payment transactions.

For Consumers

- Cashless payments put consumers in total control of payments: With advanced cashless payment architecture, banks, businesses, and regulators are taking consumers toward a frictionless buying world where buyers pay without logins, without putting their hands in their pockets for cash, without opening wallets, or not even having to touch their smartphones for opening digital wallets. Soon, even the current cashless payment methods, such as cards, digital wallets, UPIs, etc., will become outdated. Facial recognition-powered convenience stores, payment deduction via number plate scanning at toll roads, subscription payments to services and products, sensor-based automated orders, wristband swipes(for example, Disney), etc., are a few instances where users pay without doing anything.

- Real-time payments may not be possible with cash if the payer and payee are at different locations. However, with cashless options, users can pay irrespective of location restrictions.

- Cashless payments alleviate feats of infection: Infection fears are a direct stimulus driving consumers toward cashless payment systems.

- 37.1% of respondents to Goodfirms' survey stated that digital payments are valid proof of payment in case of loss of receipt and, therefore, a preferable mode of payment over cash.

- More personal safety from armed robbery and direct assault for snatching cash.

- No need to line up in front of ATMs or stand in bank queues for cash withdrawal.

- Cashless payments help consumers in tracking their spending and keep electronic records of all expenses.

For Governments and Central Banks

- Increase in Government Tax Revenues: Cash is the most preferred payment method in the shadow economy. Unorganized businesses thriving in the shadow economy seldom report revenues and income to avoid tax compliance.(17) Cashless economies can bring these businesses under scrutiny and be liable for tax compliance and increase governments’ direct income. Cashless payments can combat the ill effects of shadow economies and also assist in strengthening monetary policies in the era of zero-bound interest rates.

- Preventing Money Laundering and Criminal Funding: Cash is also used for nefarious activities such as terror-funding, smuggling, money laundering, etc. The anonymity of cash is exploited by criminals to carry out illegal activities. Cashless regimes can be better positioned to prevent such illicit activities. However, criminals may turn to cryptocurrencies as an alternative to cash, and therefore, more regulations will be required for virtual currencies.

- Transitioning to a cashless society also eliminates counterfeit currency issues.

- Central banks are able to retain their monetary authority, influence, and control.

- CBDCs can ensure hassle-free and uninterrupted global payments in an era of global tensions and mounting protectionism.

For Environment

Cashless Societies are Environment-Friendly: The cash is printed using natural resources, and it needs to be replaced after certain years due to the wear and tear of currency notes. However, digital cash only consumes electricity, and with developments in sustainable energy sources, it has minimal impact on the environment.

The Future of Cashless Payments:

Cashless payments are getting ingrained in most economies globally. Global cashless payment volumes are set to increase by more than 80% from 2020 to 2025.(18) National Payments Corporation in India (NCPI), which operates the Unified Payments Interface (UPI), reported a whopping 5.04 billion transactions, which translates to more than 117 billion dollars in the month of March 2022 alone.(19)

82.9% of Respondents Believe that Fully Cashless Transaction is the Future of Payments

Sweden is all set to meet its ambitious goal to go fully cashless by 2023. Finland has projected the same by 2029. Other countries such as the UK, Norway, Netherlands, Canada, China, Australia, South Korea, and many more are on the path to reducing their dependence on cash.(20)

Digital experiences delivered by new-age companies like Amazon, Uber, Airbnb, Fitbit, etc., have set consumer expectations very high in all fields. Payment service providers that fail to imbibe the latest tech and don't deliver above the class customer experiences will lose to peers that do it.

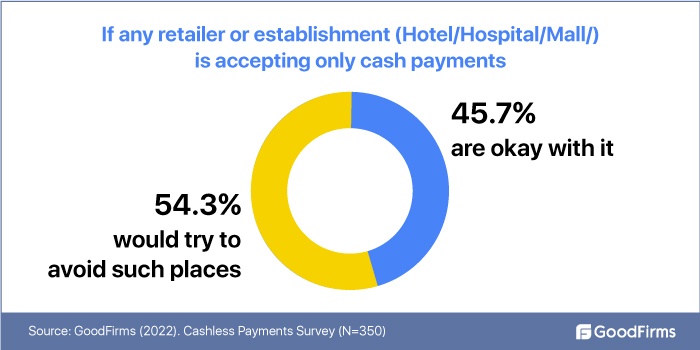

The same applies to businesses too. Businesses that fail to provide cashless payment options to their customers will most likely be avoided by customers. 54.3% in Goodfirms’ survey said they would avoid places (retailers or establishments such as hotels, hospitals, malls) that accept only cash payments.

The global payment ecosystems are on the verge of massive transformation. The world will see an inevitable collaboration between new entrants in the payment world, such as fintech companies, and incumbents, such as banking organizations and regulators, to create new payment methods. New entrants bring sophisticated tech with them, while incumbents provide the experience and regulatory backing needed to roll out disruptive payment regimes. Are we moving to a time to cash out? Wait and watch for our findings on this in the future days to come.

Key Findings:

- 71.4% prefer cashless transactions for the convenience of not having to carry and protecting cash

- Digital wallet payments are rising, and Google Pay is the most used digital wallet worldwide

- 42.9% frequently pay via digital wallets for low-value transactions

- Credit cards are the favorite mode of payment for online purchases, physical store purchases, and paying recurring bills

- 60% of respondents reported an increase in the usage of cashless payments after the pandemic

- Cryptocurrency is now a part of public consciousness, with 60% of surveyees reporting familiarity with virtual currencies such as Bitcoin, Ethereum, etc.

- Demand for the mobile point-of-sale systems is growing

- Biometrics authenticated payments will become increasingly popular

- P2P payments support freelancing operations and small businesses

- Central Bank Digital Currency (CBDCs) is set to become the next disruptor in the cashless payment world

- Regional payment giants are power playing along with international payment systems

- Extreme volatility in virtual currencies, fears of government totalitarianism and expropriation, and cyber-attacks are some of the top deterrents for cashless economies.

- Financial inclusion of the underbanked and the vulnerable class is critical before the world heads for a completely cashless regime.

- Cashless economies are beneficial for all stakeholders, including consumers, businesses, governments, financial institutions, regulatory authorities, society, and the environment.

- Cashless economies are better positioned to control terror financing, corruption, money laundering, tax evasion, and bribery

- 82.9% of respondents believe that fully cashless is the future of payments

Conclusion

Cashless payments form the epicenter of transformation in financial services. The fintech revolution and regulatory transitions are improving customer experiences in the payment sector. Digital disruptors are striving to make payments more ubiquitous, process-free, and automated—for instance, the synergy of wearable tech and biometrics to create digital identity-based payment mechanisms.

It would also be interesting to see how banks and card providers play amidst the payment revolution. It is imperative for them to reimagine the current services and unleash a frictionless payment process to prevent customer defection to the fintech companies. The comprehensive strategy of building the cashless regime should include hiring an adequate workforce by financial institutions, strengthening the financial sector's cybersecurity capacities, expanding digital payment channels, and safeguarding gains in financial inclusion. The priority of financial authorities should be to build a resilient cashless system that can withstand any targeted attack on financial data, algorithms, encrypted vaults, etc.

We sincerely thank our Research Partners who participated in the survey.

References:

- https://www.economist.com/leaders/2019/08/01/rich-countries-must-start-planning-for-a-cashless-future

- https://www.bis.org/statistics/payment_stats/commentary2112.pdf

- https://www.goodfirms.co/resources/buying-behavior-post-peak-covid-era

- https://www.nfcw.com/2020/03/26/366173/table-contactless-payment-transaction-limit-increases-around-the-world/

- https://www.cnbc.com/2022/03/09/biden-orders-cryptocurrency-study-as-traders-await-new-regulations-legislation.html

- https://meetings.imf.org/en/2022/Spring/Schedule/2022/04/18/imf-money-at-a-crossroad

- https://www.goodfirms.co/blog/why-is-integrated-smart-pos-system-essential-for-modern-retail-businesses

- https://assets.mwcbarcelona.com/Los-Angeles/InsiderIntelligence_USMobileP2PPaymentsForecast_2021.pdf

- https://www.bloomberg.com/news/articles/2021-05-20/the-bahamas-central-banker-explains-why-its-sand-dollar-led-the-way

- https://www.federalreserve.gov/publications/files/money-and-payments-20220120.pdf

- https://www.bloomberg.com/graphics/2021-bitcoin-volitility/

- https://www.journals.uchicago.edu/doi/pdf/10.1086/710251

- https://www.nytimes.com/2019/07/29/business/capital-one-data-breach-hacked.html

- https://journals.sagepub.com/doi/pdf/10.1177/2053951720907632

- https://www.project-syndicate.org/commentary/digital-payments-bitcoin-stablecoins-central-banks-by-raghuram-rajan-2021-03

- https://www.pwc.com/gx/en/industries/financial-services/publications/financial-services-in-2025/payments-in-2025.html

- https://www.nbp.pl/publikacje/materialy_i_studia/337_en.pdf

- https://www.pwc.com/gx/en/financial-services/fs-2025/pwc-future-of-payments.pdf

- https://economictimes.indiatimes.com/tech/tech-bytes/in-a-first-upi-transactions-hit-five-billion-a-month-in-march/articleshow/90557520.cms

- https://www.paymentscardsandmobile.com/cashless-countries-which-are-the-forefront-of-the-cashless-revolution/

upstackstudio.com

odysseynewmedia.com

octosglobal.com

walletfactory.com

optimum.net

saedx.com

suzakuproductions.com

webbingstone.com

netvor.co

ATROMG8.com

comcast.net

ukad-group.com

tigerfinancial.co.uk

Seamlesschex.com

marketplacefairness.org

financejar.com

alliedpay.com

vpncheck.org

Barbend.com

Banklesstimes.com

suzakuproductions.com