ABSTRACT:

A typical entrepreneurial mindset starts with the proper planning of finance. Financial planning lets businesses control the money flow and make the right business decisions. With the many benefits that financial planning offers to a business, it also stands as an integral part of a business plan. It is a crucial document for investors and banks who will potentially provide funds for the development of the business. Businesses must consider building a financial plan with utmost precision to reap maximum benefits. The financial planning process can be complex if not done properly. Following certain procedures and best practices can assist small businesses in curating a perfect financial plan.

Goodfirms’ research titled: ‘Financial Planning: Top Tips from Business Experts’ collates the top tips from business experts for a robust financial plan. Amidst the constantly changing business landscape, this study aims to provide unique insights into the realm of financial planning and its key aspects. The research also tries to analyze the basic components of a financial plan and the benefits financial planning offers for a business.

Table of Contents:

Introduction

An Overview of Financial Planning

Major Components of a Financial Plan

- Accounting Integration

- Budgeting and Forecasting

- Cash Management

- Consolidation/Roll up

- Expenditure Tracking

- Financial Reporting

- Investment Management

- Revenue Recognition

- Risk Management

- Tax Management

Benefits of Financial Planning

Challenges in Financial Planning

Top Financial Planning Tips From the Successful Business Experts

- Aim for Clear Business Goals

- Cash Flow Analysis is Necessary

- Maintain Liquidity

- Discover Fund-Raising Options

- Taxes Should be a Priority

- Follow a Strict Budget

- Assess the Need for a Financial Advisor

- Risk Management

- Manage Paperwork

- Have a Retirement Plan

Behavioral Finance and Financial Planning

Collaborative Financial Planning

Key Findings

Conclusion

References

Introduction

Finance refers to any monetary transaction and measurement. Alternatively, finance is the science of money handling and capital management. With all the importance of financial management, financial planning becomes crucial for any organization’s smooth functioning. Financial planning becomes a requirement for every small business as soon as they are clear with their goals and objectives. A financial plan gives an overview of the current financials of the business and future growth projections. It is, therefore, necessary for a business to have an efficient financial plan. Having a financial plan can help businesses set realistic expectations about the cash flow while considering the assets and liabilities of the business.

The research ‘Financial Planning: Top Tips from Business Experts’ aims to analyze all critical elements of a financial plan, its objectives, benefits, and challenges. The study also attempts to give some useful tips for small businesses to curate a good financial plan for their businesses.

An Overview of Financial Planning

A well-planned finance allows businesses of any size to construct or reorient themselves toward long-term growth. A long-term-focused business always surpasses short-term planners. A financially planned business easily gets valuable quantitative signals of the company's position, cash flows, whether it can sustain market conditions, and how attuned it is to unforeseen circumstances. A financial plan can act as a tool to encourage investors to take an interest in a business. It can also act as a financial warning system.

65% of people with a written financial plan feel financially more stable.(1)

“I would like to advise other business owners to prioritize financial planning like they prioritize any other business operation. Even if financial planning doesn't guarantee success, it makes sure that your business doesn't go towards failure.”, says Rhett Stubbendeck, CEO of LeverageRx

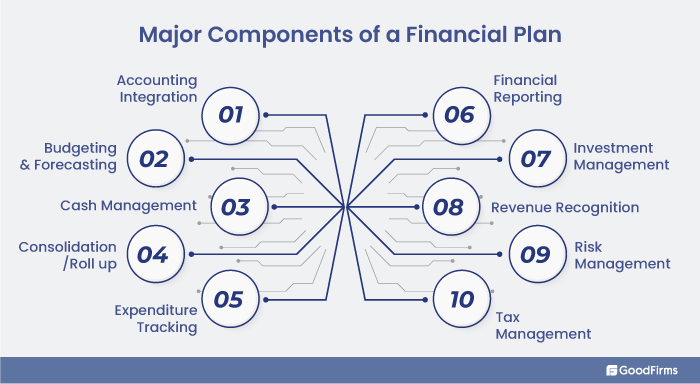

Major Components of a Financial Plan

Irrespective of a business's stage, the financial plan must have all its components in place. These components remain equally important for a business starting from scratch and a business planning an expansion. The following components are included in a Financial plan.

Accounting Integration

Accounting integration is a system that keeps all the major accounting functions in one place. The system integrates cost accounting and financial accounting functions together.

An integrated accounting system helps business to eliminate the need for separate books for accounting. An integrated system reduces the efforts of the organization to reconcile two sets of accounts periodically. It avoids data duplication and reduces the chances of confusion created with two sets of accounting data.(2)

Budgeting and Forecasting

Budgeting and forecasting are the tools used by an organization to determine the path of its growth.

Budgeting is the process of outlining the plan that the organization will implement to achieve its goals for a certain time period, typically a year. A budget includes the estimation of revenues, expenses, potential cash flow, and debt reduction.

Forecasting is used to estimate a company’s future revenue generation and other income outcomes while examining historical data. A financial forecast helps businesses in the budgeting process and makes changes in the inventory and production levels to keep the processes running smoothly.(3)

Sales Forecast: Sales forecasting is the process of predicting a company's sales over a certain time period in the future. An appropriate sales forecast is a critical report that can help organizations accurately plan their strategies. A sales forecast is an important tool that will help organizations manage inventory and cash flow. A positive forecast can help businesses plan for additional workforce and inventory required for the business's smooth functioning. However, if the forecast is not in favor of the business, companies can plan to tackle future challenging situations by implementing preventive measures.

A few factors that can affect a sales forecast are

- The economy and industry type

- Changes in the rules and regulations

- Introduction of a new product or service

- Marketing efforts of the company

Cash Management

Cash management is crucial to businesses. It plays an important role in maintaining a company’s financial stability. It is the process of collecting and managing cash flow.

Cash management, also known as treasury management, is mostly strategized by corporate treasurers and chief financial officers. The cash flow statement is the central component of cash management.(4)

Cash Flow Statement: Cash is the lifeblood of any business. It is necessary for a business to be informed about how much cash comes in and goes out and where the cash goes. A cash flow statement does exactly the same for a business.

A cash flow statement is a crucial component of a financial plan. It keeps track of the cash coming from operating activities, investors, and other financial activities. It also helps business owners with the outgoing cash through the expenses paid.

Surplus cash in a business is an indicator of healthy business as it assures that business can pay its debts if any. A cash flow statement helps business owners make informed decisions regarding regulating their cash flow, maintaining optimum cash balance, keeping a check on spending, and focusing on cash generation.

Consolidation/Roll up

Roll up is the merger strategy that enables the consolidation of small businesses of the same industry to form one organization that is in a better position to achieve scale economies. The consolidation strategy works better with highly fragmented markets.

The aim of such acquisitions is to realize substantial cost savings and increase the revenue of the organization. A consolidated company can increase its profits by being to cutting costs on operations and expanding its geographic reach.(5)

Expenditure Tracking

Having a track of the expenses of a business is of immense help to the owners. Expenditure tracking is about reporting and monitoring the expenses of the business throughout the month.

Expenditure tracking is an essential element to keep a business running efficiently. Keeping track of the company’s expenses helps a business check over the expenses in many ways. Expenditure tracking gives an idea about the areas where the expenditure is excess and helps in cost-cutting decisions wherever possible. It also assists the business in sticking to the budget and makes the decision-makers aware of the company's spending habits. (6)

Financial Reporting

The process of producing financial statements is called Financial reporting, which can assist in disclosing an organization’s status to stakeholders, investors, creditors, and regulatory agencies.(7)

Financial statements are written records representing the organization's business activities and financial performance. Financial statements are important for financial planning and help raise company funds.

Profit and Loss Statement: A profit and loss statement or P and L statement is a financial statement that helps to understand the profit earned or loss incurred by a business over a certain period of time. It is a primary financial document that lists the income of the business after subtracting taxes and expenditures.

A profit and loss statement is usually generated quarterly or annually. It includes the business’ revenue, cost of goods or cost of sales, and the taxes levied on the business.

The deductions in a P and L statement also include the business's operating costs.

A profit and loss statement helps businesses analyze their net income, which is crucial in decision-making for future growth.

Balance Sheet: A balance sheet is a fundamental statement in financial planning and can also be referred to as a statement of net worth or financial position. The basic equation that a balance sheet works on is Assets = Liabilities + Equity

A balance sheet states a company’s assets, liabilities, and shareholders' equity with respect to a specific period of time. It is generally created every quarter or half-year.

Assets: Assets comprise what a business owns. The assets section of a balance sheet mentions what a business owns of value and can be broken down into cash. The assets are typically mentioned in terms of liquidity. Assets can be broadly classified as Current assets and Long-term assets.

Current assets are the assets that can be converted into cash within a period of one year or less than a year, while long-term assets are the assets that take more time to get converted into cash.

Liabilities: Liabilities are what a business owes. It can be anything running from payments that are pending towards suppliers or debts to be repaid. Liabilities are further classified into Current liabilities and Long-term liabilities.

Current liabilities include the liabilities that are to be paid in the near future, like rent, taxes, payroll, and interest payments. Long-term liabilities include long-term payments, deferred income taxes, and pension funds.

Owners or Shareholders Equity: Owners’ equity or Shareholders’ equity is the value that would be returned to the company’s shareholders when all the assets are liquidated, and liabilities are paid off.

It is the representation of the company’s total assets after subtracting the company’s total liabilities, which is essential for determining some important financial ratios.

Financial Ratio Analysis: Financial ratio analysis is the process of comparative analysis of financial statements. Financial ratio analysis is employed to check a company's financial health and profitability.(8)

The ratio analysis process involves comparing a business's past and current financial statements. Ratio analysis can also be executed by comparing the financial statements of one organization to another in the same sector.

In some cases, the comparison can also be done with the industry average figures.

Ratio Analysis can be classified as follows:

- Liquidity Ratios: Liquidity ratios assist in finding the ability of a company to pay off its short-term debts.

- Solvency Ratios: The solvency ratios are used to determine the feasibility of a company for the long term.

- Activity Ratio: Activity ratios or efficiency ratios determine how efficiently the company uses the assets it owns. The improvement in activity ratios is an indication of the efficient generation of revenue and profit.

- Profitability Ratio: The ratios that can help in measuring the profit an organization can generate through its operations are profitability ratios. A company's performance can be conveyed through the improvement in the profitability ratios.

Investment Management

The handling of financial assets and other investments, along with their buying and selling, is termed Investment Management.

Management of assets includes banking, budgeting, tax duties, and services. It also associates with planning long-term and short-term strategies for acquiring and disposing of all of the portfolio holdings.(9)

Prioritizing investment management can help organizations in investing their resources with the utmost care, considering the availability of cash flow and liquidity for the business.

Revenue Recognition

Revenue is what all businesses are run for. Revenue recognition is an accounting concept that determines specific conditions when revenue can be recognized and it can be accounted for.

Typically, revenues are recognized when they are realized and earned and not just when the cash is received. Revenue recognition is mostly done when a critical event occurs and the amount earned is measurable for the organization.(10)

Risk Management

Risk management is the process that constitutes identifying, assessing, and controlling financial, strategic, and security risks to the capital of an organization.

Some unforeseen circumstances can arise due to a variety of sources ranging from changing market conditions to natural calamities. An organization must be readily prepared to tackle any such events and minimize the risk to the business.

Risk management is about trying to control the outcomes of potential threats in the future by implementing preventive measures. It also involves proactive responses to situations rather than reactive responses.(11)

Exit Plan: An exit strategy is defined as a contingency plan to liquidate or dispose of a business or a financial asset once it achieves a predefined objective or to mitigate some failure.

As a measure to limit the losses of a non-performing business, an exit plan may be executed. An exit plan can also be strategized in case of achievement of predetermined profit objectives. Reasons like legal complexities, liability lawsuits, or simply a divorce can all require executing an exit plan.

Businesses must consider an exit plan for every positive and negative contingency, irrespective of the type of business or investments.

Tax Management

Tax management is defined as the management of finances in order to pay taxes. It deals with all the processes that involve taxation, like filing the returns on time, deducting at the source, and getting the accounts audited.

Tax management aims to optimize taxes payments by avoiding penalties and managing interests and prosecution. Effective tax management is characterized by reducing the burden of taxes on the business. (12)

Benefits of Financial Planning

Financial planning is a process that starts with deeply set-out goals keeping the business value intact. Such planning has to be done not when the money is there but much before so that it gives businesses the freedom to stay without worrying about the future. Unfortunately, several businesses fail to start their financial planning unless they see a disaster. Having a proper financial plan can offer business-critical benefits that can help a business grow remarkably.

An efficient financial plan is a key to achieving the long-term financial goals of an organization. Goodfirms’ survey Turning a Loss into Strategic Gain reveals that 66.8% of organizations face financial risks in their businesses.(13) A financial plan ensures that the business is well-prepared for any unforeseen circumstances.

Helps Set and Achieve Company Goals

According to Carlos Barros, Director of Marketing at Epos Now, “Financial planning is all about creating a plan and setting achievable goals to help you reach your financial goals.”

While financial planning may seem to be complex if the goals are complex, businesses must understand that strategic financial planning is the key to achieving all their goals.(14) A financial plan is a good tool for having clear goals set for an organization as a financial plan is created keeping in mind the current financial budget and certain projections of the business and can therefore help in setting realistic goals. A financial plan can help a business set realistic goals and stick to them. A proper budget allocation includes budgeting not just for action but even for control.

Enables Businesses to Manage Cash Flow Efficiently

No business works the same all year round. There are some times of the year when a business performs extremely well, while others when the business does not even touch the break-even point.

Nearly 61% of small businesses around the world struggle to maintain a healthy cash flow.(15) A shortage of cash may be troublesome for businesses. It is, therefore, necessary for businesses to maintain cash flow in all circumstances. A financial plan is an important factor that helps maintain a healthy cash flow.

A cash flow statement is an integral part of a financial plan. Along with the other components of a financial plan, it can be a great aid for decision-makers to predict cash shortages and employ measures before any crisis. A financial plan accurately identifies the amount of cash required from time to time and can help businesses prepare for any shortages.

Guides Organizations for Better Investments

Investments take up a major share of the assets owned by a business. A company's investment decisions are usually considered capital budgeting, which enables the organization to invest the available funds efficiently for the long term. A firm’s investment decisions include expansion, acquisitions, and so on.(16) A financial plan can guide businesses to allocate resources for better investing. A well-developed financial plan also helps business owners to keep track of the yield from the investments made.

Better investments can help organizations ensure a smooth cash flow and make the business sustainable in rough times. Investment decisions of an organization influence the long-term growth of the firm and involve a commitment of a large number of funds. The financial statements provide an idea of the financial position of a firm and its ability to invest. It also helps in deciding where the company can invest and for what time period based on the forecasts and future requirements of the business.

Assists in Proper Budgeting

Having enough cash flow is just not enough for the smooth functioning of a business. Allocating the available cash is also important.

A well-informed and thought-out budget helps make decision-making a lot more easy and more efficient. Having an idea about where the funds of the business are going and setting optimal budgets for every department depending on their relevance helps determine where reductions can be made on spending. A financial plan does exactly that for a business.

The knowledge of available assets and the requirements of the business helps financial teams allocate resources accordingly. Proper budgeting requires profit and loss and cash flow statements that are an integral part of a financial plan.(17)

Raising Funds for the Business Gets Easier

Regardless of the size and type of the business, all require financial support at some point. A new startup requires funds to begin its operations. Sometimes, even a well-established business requires funds to meet its financial needs.

Financial statements are the documents that are relied upon to make investment decisions to forecast a company’s performance.(18) A well-structured financial plan that has appropriate financial statements eases investment-related decision-making for investors or banks.

Even while approaching investors to raise capital for a startup business, a financial plan is the most crucial document that investors trust. A financial plan makes one understand the sustainability of a business.

Facilitates Mitigating Risks

Running a small business involves several risks. A finance team is responsible for making the business ready to face all the ups and downs.

A well-designed and thoughtful financial plan includes strategies to set aside funds to tackle any risks that could arise. Appropriate strategies enable businesses to respond to risk and make the business more capable of surviving the competition. Also, a crisis like the pandemic has forced business owners to think of multiple uncertainties and create plans meticulously considering crisis management. Wisely planned financial strategies can position businesses to easily sail through VUCA - volatility, uncertainty, complexity, and ambiguity.

A financial plan is a good way to consider the changes in the market and risks or crises that can impact the functioning of a business. Organizations with robust financial plans are better positioned to tackle such risks and reduce any negative impacts on their processes.(19)

Assists Businesses in Measuring their Financial Performance

A financial plan involves various aspects and keeps various details together. A financial plan is designed to have financial metrics and all the financial ratios in place.

Financial planning provides a clear idea of the funds available to the company and determines the profit and loss of the organization. These key performance indicators are a great aid in measuring the performance of a business.(20)

Comparing the projections made in the financial plan to the actual results will help determine the areas that need improvement. It will assist in keeping a check on whether the goals are achieved or not.

Challenges in Financial Planning

With all the benefits that financial planning offers, there are a few obstacles to creating an effective financial plan. According to a report by the Chamber of Commerce, half of the owners of small businesses that failed in the US pointed out that the reason for closing the business was inadequate funds coming in. Poor planning was the second biggest reason to force business owners shut their businesses.(21)

Following are some of the challenges that businesses come across when curating a financial plan for their organization.

Unforeseen Costs

No matter how well a financial plan is made, what can make a plan fail are some unforeseen expenses due to unexpected events that arise in the way of a business.

These unexpected costs can sometimes make a business go cashless. Financial planning done with utmost care can also be vandalized by unexpected costs at times. These costs can be anything ranging from accidents to natural calamities.

The lack of a contingency plan is another reason that can hamper the effectiveness of financial planning. When a financial plan lacks a risk-mitigation plan, companies can lose track of the goals that were once achievable(22)

Revising the Financial Plan Regularly

Financial plans are usually designed for certain periods. However, these plans require revisiting and making changes to them regularly.

Businesses face ups and downs because of various factors. Changing market conditions and hyper-dynamic business environments may force decision-makers to change their long-term goals. Moreover, uneven cash flow or unexpected expenses are one of the reasons that hamper the future plans of organizations. All these factors and their results must reflect in the financial plans.

The ever-changing taxation rules and their impact on financial forecasts are also factors that need to be considered and reviewed when required.(23)

It is a challenge for the finance teams and management to frequently make changes to the financial plan to capture all the insights.

Negligence in Necessary Reporting

Small businesses often work with smaller teams. With too many roles to be carried out with a small team, reporting some financial transactions can be missed out on. Reporting transactions on the basis of some retrieved data can cause confusion and lack of information. Filling up tax forms requires the most accurate transaction reporting.

Missing out on accurate reporting of transactions can lead to impacting financial statements and, at times hampering the business's cash flow. Negligence in reporting and missing to report critical financial data can cost businesses time and money.(24)

Untimely Payments

The fixed payments that a business owes are expected to be paid on time. Small businesses get affected by the resulting costs when these bill payments get delayed.

Late payments in B2B transactions result in adverse effects on the business's cash flow, making it difficult to forecast accurately.(25)

Payments past due result in late fees or penalties that burden the firms. Late payments to suppliers also mean hampering business relations.

Apart from the above challenges, there are various other scenarios that may compel companies to take steps that drastically deviate from their initially designed financial plans. Therefore, it is always advisable to include scenario planning techniques while creating full-proof and more resilient financial plans. Scenario planning’s main goal is financial resilience in times of multi-faceted vulnerabilities, reveals Goodfirms’ survey on Scenario Planning.(26)

Top Financial Planning Tips From the Successful Business Experts

Financial planning is very important for a business, but it is even more important to do it correctly. Startups or small businesses should focus on having a great financial plan to carry on their business functions effectively.

Goodfirms queried business experts and global companies regarding their best practices in financial planning. This research collates the top tips for financial planning and experiences as shared by business experts and top executives. Following are some tips to consider while creating an effective financial plan for small businesses.

Aim for Clear Business Goals

Goal setting is an important part of the process of financial planning. It is imperative that businesses have goals set over all horizons of time. Setting clear short, mid and long-term goals can help in proper financial planning.

Clear business goals are a must to estimate expenses. Outlining clear goals helps provide direction to the organization's financial plan.

Working towards goals will help decision-makers decide on cost-cutting or investment decisions that are necessary for attaining those goals. It is better to have short-term goals along with long-term goals. Working on short-term goals adds up to the efforts to achieve long-term goals.

One more thing that small business owners must stick to is distinguishing between personal and business goals. Although achieving business goals is a way to achieve personal goals, business owners must be very clear about their personal and business goals. Personal goals should not create any hindrance to the achievement of business goals.

Cash Flow Analysis is Necessary

Cash flow is the representation of the cash equivalents a company owns over a set time period. A positive cash flow analysis indicates sustainable business growth. Cash flow determines the incoming and outgoing cash in a business.

A healthy cash flow ensures meeting with necessary day-to-day transactions like payroll or procuring raw materials. Cash-flow analysis assists in planning for future investments.

A proper cash flow analysis is recommended to assess the amount of cash coming in and going out and also the origin and destination of the cash. A cash flow analysis will help business owners and finance teams assess the cash on hand and predict any cash shortage in the future. It can offer to be an efficient aid to plan the finances keeping in mind any future risks.

Maintain Liquidity

Assets are not all that a business requires to survive. Focusing on liquidity is also crucial for businesses to carry out their transactions. Liquidity is the measure of how fast can assets of a company be converted into cash to meet some short-term obligations.

“If the last two years have taught us anything, it's that small businesses and startups should always ensure that they have enough liquidity to survive a catastrophically bad quarter,” says Ilan Mann, Postalgia Inc.

Enough liquidity ensures buffer cash on hand to cope with any short-term monetary requirements. Often being illiquid can force short businesses to shut down their businesses.

Enough liquidity is a way to boost the cash flow of the company in emergency situations. Financial plans should therefore have provisions that keep adequate liquidity available during the business cycle.

Discover Fund-Raising Options

Almost all business processes, from getting a startup into the market to increasing sales incur certain expenses. It is always necessary for businesses to have funds on hand to meet all the requirements.

Small business owners generally tend to use up all their money from their pocket or bootstrap to keep their venture going. However, these solutions may result in being insufficient for the business. It is necessary for businesses to explore all the fundraising alternatives they can have.

Having limited sources of investments for a business can be prone to several risks and put business owners in a tough spot. With diversified options for fundraising, businesses are good to go.(27) Financial plans should clearly underline all fundraising sources that businesses can access if required.

Taxes Should be a Priority

Taxes are a crucial aspect of the finances of any organization. Small business owners often unknowingly neglect the expenses incurred by taxes when curating a financial plan.

“Be sure to set aside money for taxes – both federal and state. This will ensure that you don’t get caught off guard come tax season.” says Mfon Abel Ekene, Editor at MakeMoney.ng

Not considering taxes from the beginning can surprise business owners with the requirement of funds to pay off the taxes. Also, the delay caused in paying off taxes may result in extra fees, which may create complications and result in disturbed financial planning.

“Paying taxes first: What you can do to pay your taxes as most taxes have a late fee and for the state will affect the finances of the business,” says Derrick Hathaway, Sales Director VEM Medical

Financial plans with clear tax provisions can help businesses achieve necessary compliance and save them from hefty penalties.

Follow a Strict Budget

Budgeting is a strong tool to keep a check on the expenses of a business. It is a way to assign a certain limit of money that can be spent on a particular activity.

Having a strict budget for all the operations keeps the expenses in check. It also forces employees to report expenses correctly and without delays.(28)

Accurate reporting of expenses is a valuable strategy for business owners that assists in the creation of financial statements that are crucial for an effective financial plan.

“Be mindful that budgeting is key to financial planning and success, budgeting and tracking your money allows you to see where money is being used and if changes to the plan are needed, ” says Samantha Hawrylack, Co-founder and CEO of SJ Digital Solutions.

Along with having a strict budget in finances, it is important to stick to it so that the business always has enough cash.

Assess the Need for a Financial Advisor

Small businesses often tend to opt for cost-cutting whenever and wherever they can. It is often seen that the owners try to perform multiple roles. However, managing taxes and investments can get complicated and critical at times. Assessing the need for help from a financial advisor or consultant is always a great idea. In 2022, 35 percent of Americans worked with a financial advisor.(29) The importance of financial consultants is more for businesses.

“Plenty of resources are available for small businesses and startups, so don't be afraid to ask for help if you're unsure how to manage your finances. Seeking the advice of a financial planner or another professional can also give you peace of mind that you're on the right track,” says Matt Wilson, Co-founder and Content Writer of Lift Your Game.

Seeking help when required can enhance business owners' confidence and reduce the risks that can harm a business. Advice from professionals can bring to light the complications that may arise in the future.

Risk Management

Risk management is essentially important when financial planning is concerned. Considering certain unexpected events and requirements of emergency funds for a business is the best thing one can think of while preparing a financial plan.

“My definition of an emergency fund is a sum of money kept aside for use in times of need. The peace of mind that comes from knowing you're prepared for a major, unexpected bill can go a long way toward alleviating financial stress,” says Josh Pelletier, Chief Marketing Officer, BarBend.

Availability of rainy day funds is a must and should be a priority of decision-makers. While setting a budget for the organization, emergency funds must always be considered. Along with rainy day funds, businesses must have insurance policies and other mitigating plans in place. Also, key person insurance forms an important part of the risk management strategy for a business.

Kelley Van Booxmer, Co-founder and CEO of Motion Invest says, “As an expert, I would estimate that the majority of organizations have at least one individual whose contributions to the company's operations are indispensable and difficult to replace. Consider safeguarding yourself and others with Key Person Insurance, as a loss or damage to key individuals might have far-reaching repercussions on the business's viability.”

A financial plan which is short of consideration of risks can be disastrous. It is always wise to consider such risk mitigation while curating a financial plan.

Manage Paperwork

For creating an efficient financial plan, paperwork is important as well. Reporting taxes appropriately requires proper and punctual documentation. It is necessary for organizations to keep perfect records with exact figures.

Missing out on important records may result in incorrect reporting and can be problematic for the taxation process. Also, loss of documentation can result in a delay in the process which may cost some extra fees for the business.

Have a Retirement Plan

This tip essentially concerns the business owner more than the business itself. Small business owners often end up investing all their money in the business and consider it their only retirement plan. However, it is necessary to have an amount of money set aside for their business.

“Combining succession planning and retirement planning can help you experience a financially secure retirement, regardless of whether you intend to sell the business or pass it on,” says Jason Farr, President & Owner of Aviara Pavers INC.

Having a succession plan is also a good idea to safeguard the future of the business. An exit plan and a succession plan form a vital part of the financial plan and can aid in proper investments and savings to be effective for a secured future of the company.

Behavioral Finance and Financial Planning

Behavioral finance is a relatively new concept that deals with the role of psychology in finance. Behavioral finance is based on psychological theories promoting stock market deviation.

Financial planning often seems overwhelming and intimidating when done without professional guidance. Behavioral finance theories are basically the incorporation of Social Sciences and financial behaviors. They involve psychology-based theories to describe the deviations in the market and market inefficiencies. These theories not only assess the changes but also assist in predictions.

It is evident that investor psychology can majorly affect their decisions and market outcomes. Financial advisors, therefore, incorporate behavioral finance insights while working with their clients. A thorough understanding of fundamental human tendencies can help financial planners achieve long-term goals.(30)

Collaborative Financial Planning

Financial planning is a crucial process that concerns almost all of an organization's operations. The forecasts and budgeting done in a financial plan must include the stakeholders' requirements, which will help the plan be efficient.

The traditional planning process typically faces challenges in bringing all the business processes on the same page. The data from all the departments being distinct from one other makes it difficult to plan and forecast expenses accurately. The lack of accurate data gives rise to unforeseen expenses, which then make it problematic to follow the budget created by the finance team.

To overcome all these problems, financial advisors are of the view that organizations must follow a collaborative approach while planning finances. The collaboration of all the stakeholders for planning and forecasting encourages enterprise-wide transparency. Collaborative financial planning helps organizational departments avoid working in silos. It brings together a real-time view of budgets and plans for all the stakeholders.(31)

Key Findings

- Financial planning is about a business plan's financial section.

- An integrated accounting system eliminates the requirement of keeping separate books of accounts.

- Budgeting helps businesses to keep their efforts aligned with their goals.

- Cash management can assist business owners in maintaining optimum cash flow for the smooth functioning of the business.

- It is a good way to have risk mitigation plans to avoid inconveniencies.

- Untimely payments and negligence in reporting transactions make financial planning difficult.

- Even the most efficiently done financial plans fail to predict the unforeseen costs.

- A financial plan is crucial when raising funds for the growth of the business.

- A financial plan shows a business's path to achieving all its financial goals.

- Maintaining a healthy cash flow is necessary to keep a business going.

- It is necessary for businesses to focus on liquidity to be ready for any emergencies.

- While preparing a financial plan, business owners must prioritize taxes.

- Small business owners should always plan for their retirement and make it a priority.

- Investing in professional help for financial planning is always a great idea.

Conclusion

Planning has become a priority for businesses now more than ever. And when finances are considered, it becomes even more important. Financial planning helps a business achieve all its financial goals. It makes the business prepared for any unexpected challenges that may arise.

The financial section of a business plan is crucial, and focusing on this will help a business work efficiently. A well-written financial plan will have future cash projections and contingency plans in place that ensure to tackle any obstacles.

We sincerely thank our Research Partners for their valuable insights.

References

- https://content.schwab.com/web/retail/public/about-schwab/schwab_modern_wealth_survey_2021_findings.pdf

- https://nscpolteksby.ac.id/ebook/files/Ebook/Accounting/Fundamentals%20Of%20Management%20Accounting%20(2009)/7%20-%20Integrated%20Accounting%20Systems.pdf

- https://www.investopedia.com/ask/answers/042215/whats-difference-between-budgeting-and-financial-forecasting.asp#toc-budgeting-vs-financial-forecasting-an-overview

- https://www.investopedia.com/terms/c/cash-management.asp#toc-ratios

- https://www.mckinsey.com/capabilities/strategy-and-corporate-finance/our-insights/the-six-types-of-successful-acquisitions

- https://www.thebalancemoney.com/is-it-important-to-track-my-expenses-2385679#toc-reasons-to-keep-track-of-expenditures

- https://www.gartner.com/en/finance/glossary/financial-reporting

- https://journals.telkomuniversity.ac.id/jaf/article/download/3717/1690

- https://www.investopedia.com/terms/i/investment-management.asp

- https://www.investopedia.com/terms/r/revenuerecognition.asp

- https://www.ibm.com/in-en/topics/risk-management

- https://www.hse.ru/en/edu/courses/219910559

- https://www.goodfirms.co/resources/turning-loss-into-strategic-gains-top-tips-b2b-experts

- https://www.forbes.com/sites/laurashin/2013/08/07/10-reasons-why-financial-plans-arent-just-for-the-1/?sh=4bb1ccffd7a3

- https://www.intuit.com/company/press-room/press-releases/2019/quickbooks-study-cash-flow-woes-mean-a-third-of-small-businesses-can-t-make-payroll-pay-bills/

- https://pub.abuad.edu.ng/Open_Access_Research_Projects_of_Universities_-_Batch_1/Accounting/ROLE%20OF%20FINANCIAL%20STATEMENT%20IN%20INVESTMENT%20DECISION%20MAKING.pdf

- https://ec.europa.eu/programmes/erasmus-plus/project-result-content/4d828916-38fa-4fb8-83d0-28f27ccb71be/budgeting%20and%20financial%20planning%20booklet.pdf

- https://pub.abuad.edu.ng/Open_Access_Research_Projects_of_Universities_-_Batch_1/Accounting/ROLE%20OF%20FINANCIAL%20STATEMENT%20IN%20INVESTMENT%20DECISION%20MAKING.pdf

- https://smallbusinesshq.co/benefits-of-financial-planning/#scrool_gte_4

- https://www.business.qld.gov.au/running-business/finance/essentials/track-performance

- https://www.chamberofcommerce.org/small-business-statistics/

- https://www.forbes.com/sites/forbesfinancecouncil/2022/09/15/mitigating-risk-in-your-financial-plan/?sh=42f90a047eb7

- https://www.forbes.com/sites/forbesfinancecouncil/2022/01/27/three-commonly-overlooked-considerations-in-your-financial-plan/?sh=3d4e73c33327

- https://www.nibusinessinfo.co.uk/content/importance-maintaining-accurate-accounts

- https://ec.europa.eu/economy_finance/publications/economic_paper/2014/pdf/ecp531_en.pdf

- https://www.goodfirms.co/resources/scenario-planning-objectives-benefits-methods-of-application

- https://smallbusiness.chron.com/list-problems-startups-face-21457.html

- https://ec.europa.eu/programmes/erasmus-plus/project-result-content/4d828916-38fa-4fb8-83d0-28f27ccb71be/budgeting%20and%20financial%20planning%20booklet.pdf

- https://www.statista.com/statistics/1176393/financial-advisor-usa/

- https://www.researchgate.net/publication/280086678_Understanding_Behavioral_Aspects_of_Financial_Planning_and_Investing

- https://saberpoint.com/wp-content/uploads/2019/04/SAP-CEP-Whitepaper.pdf