ABSTRACT:

Any individual, family, business, or large corporate house looking to meet their long-term financial goals knows the importance of investment management. Without sound investment management, capital and assets may erode over time owing to inflation, downturns, taxation, and extravagant expenses. The world has already witnessed how poor investments and bets in risky assets can wipe out the fortunes of individuals and businesses. The dot-com bubble of 2000, the housing market collapse of 2008, the 2014 oil-price plunge, and the cryptocurrency fall in 2022 are testimony to how investments can turn into losing streaks if left untamed.

Considering the current volatility of the global and domestic markets, investment management is more required than ever before. Targeted to maximize after-tax returns, investment management is crucial for achieving both short-term and long-term financial objectives. Investment management has today become a core function of the finance industry, with investment managers providing services such as portfolio management, asset allocation, securities market advisories, effective tax management, overseas investment guidance, etc. However, the investment management world is highly complex and is not without challenges.

Goodfirms’ survey titled: Investment Management - Types, Benefits, Goals, Challenges, and Opportunities attempts to find deeper insights into the world of investment management. The research aims to provide individuals and businesses with more clarity about current investment avenues, and the insights will help investment companies strategize better investment products for their clients. The survey will also identify current trends in the investment management realm.

Table of Contents:

Introduction

Survey and Data Analysis

- Fixed Investment Instruments (Fixed deposit)

- Real Estate

- Recurring Deposit

- Stocks

- Mutual Funds

- Insurance

- Bonds

- Debentures

- Cryptocurrencies

Top Investment Management Strategies

- Systematic Investment Plans (SIPs)

- Buy and Hold Investing

- Dividend Growth Investing

- Growth Investing (Short & Long-term)

- Quality Investing

- Passive/Index Investing

- Socially Responsible Investing

- Value-based Investing

- Active Investing

- Income Investing

- Averaging

- Contrarian Investing

- Green Investing

Key Factors Investors Consider When Selecting an Investment Avenue

Benefits of Investment Management

Challenges Faced in Investment Management

Other Insights from the Investment Management Survey 2023

Top Trends in Investment Management

- Increasing Interest in Alternative Investments

- Sustainable and Impact Investing

- Artificial Intelligence (AI) and Machine Learning

- Blockchain in Investment Management

- Big Data in Investment Management

- Emerging Investment Fintech Companies

- Customized Portfolio and Personalized Indexing

- Growing Investments in Quantum Computing Technology

Introduction

Investment management is a complicated and heavily dependent industry. Implications ranging from inflation, federal policies, monetary rates, credit reports, geo-political situations, etc., weigh down heavily on investment outlook. Also, investor sentiments substantially affect how any investment instrument will perform. Furthermore, critical and unexpected events like wars, pandemics, market collapses, etc., can add more complexity and woes to an already intricate field. Amidst all these challenges, the role of investment management is to mitigate investment risks, strategically manage investments, create balanced and defensive portfolios, and maximize output on investments.

While on the one hand, investors look for the highest returns on their investments, investment management firms are facing challenges like squeezed margins and pressure built by volatile investor sentiments. The current situation necessitates investment management firms to take a comprehensive perspective to revamp the investor experience, contemplating how financial data can be managed across the organization and amalgamating technology into investment decision-making.

This survey titled- Investment Management - Types, Benefits, Goals, Challenges, and Opportunities reveals valuable insights regarding the current state of investment management, including how investors perceive their investments, what are their primary objectives for investment, and also what are the most preferred investment avenues and products. The research further explains the key benefits of investment management and also highlights the challenges faced by investors and investment professionals. The survey also uncovers the top emerging trends in the investment management world.

Survey and Data Analysis

Goodfirms surveyed 815 investors, investment professionals, and businesses to understand their investment objectives, behavior, and strategies. Goodfirms also queried the participants about the challenges they face in investing.

Below are the survey findings and analysis:

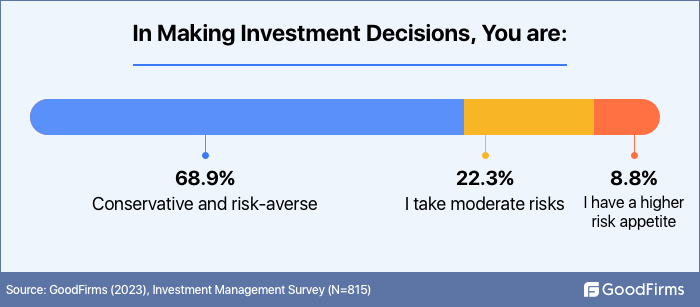

Risk Appetite and Risk Tolerance:

Risk appetite guides whether the investors will make hasty decisions, well-thought decisions, or strategic decisions when their portfolio is showing losses. The risk appetite quotient determines the course of action in case of a dramatic market fall.

68.9% of surveyed respondents identify themselves as conservative and risk-averse in investment. 22.3% of Goodfirms surveyees align themselves with moderate risk investment philosophy. 8.8% of our surveyees asserted having a higher risk appetite when it comes to investment.

“Your risk tolerance is an important factor to consider when building your investment portfolio. It refers to your willingness to take on risk in exchange for potential returns. It is important to have a clear understanding of your risk tolerance as it will determine how much of your portfolio you allocate to riskier assets, such as stocks, and how much to safer assets, such as bonds or cash”, says Jordon Scrinko, Founder & Marketing Director at Precondo.

The risk appetite or risk tolerance, the willingness of investors to bear financial losses, is mainly affected by the six factors:

- Age of the investor: Young investors generally have more risk and more return investment philosophy. On the contrary, older investors are less likely to take high-risk bets on their investments.

- Investment timeframe: A bigger investment horizon and timeframe allow investors to take more risks as they can sail through the dips that markets take without worrying about immediate outcomes. They can hold till the market stabilizes, consolidates, and surges back.

- Individual investor mindset: Fear and Greed, these emotions drive people’s investment decisions in markets. How capable an investor is of controlling and keeping these two emotions at rational levels also decides the risk appetite. Generally, investors who master the art of investment with clinical detachment from fear and greed take moderate and well-calculated risks based on their investment strategy.

- Disposable income: If the investor has higher income levels generating the surplus amount of disposable income, then the appetite for risk will be generally high. The income will not be required in the short term, and therefore, investors can take large investment bets with bigger timeframes.

- Financial knowledge: Investors who are well-versed in concepts like risk management, portfolio diversification, and other intricacies of the financial markets will generally have higher risk appetites owing to their ability to manage risks in a better way.

- Past experiences: Risk appetite also depends on how the investor’s mindset has been trained for risk-taking based on previous investment experiences.

Investment Objectives

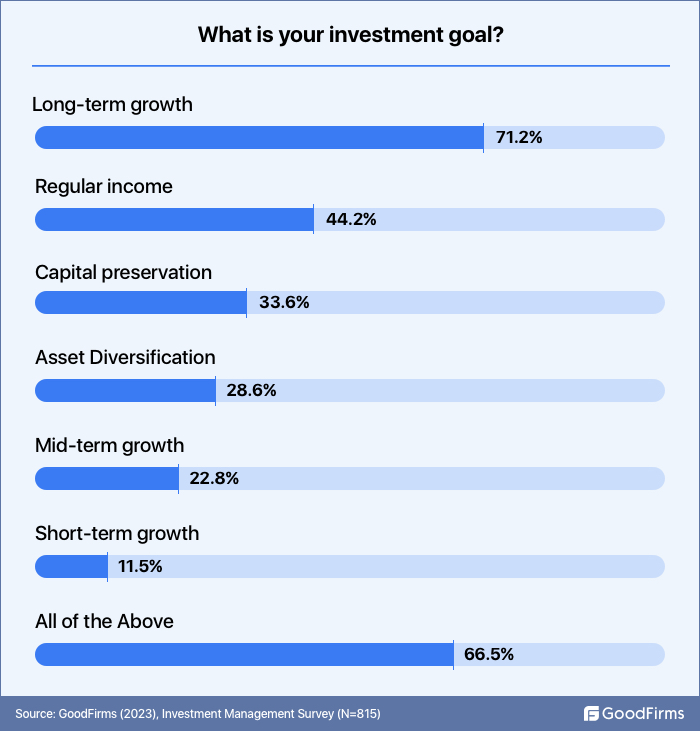

Long-Term Growth:

71.2% of the surveyees stated ‘long-term growth’ as their investment goal

The objective of long-term investors is to grow their investments over a period ranging from 5 years to 20 years and above. Long-term growth investments mitigate a lot of risks, provide investment assets room to grow fully, and enjoy the power of compounding. Most surveyed investors in this category revealed investing in blue chip stocks, index funds, government bonds, real estate, and gold. The goal is to get inflation-beating returns in the long term.

The recent 2023 report by investment banking giant JP Morgan forecasts the average global inflation rate over the next 10-15 years to be 2.60%.(1) Therefore, a long-term investor who actually gets 10% annualized returns in the next 10-15 years actually earns only 7.40% as inflation-adjusted returns.

Regular Income

44.2% of the surveyees stated ‘regular income’ as their investment objective

These surveyees aim to generate steady income on assets and investments. Most investors that chose regular income as their investment objective reported investing in fixed deposits with monthly or quarterly interest returns, dividend stocks, or real estate that provides them with rental income.

Capital Preservation

33.6% of the surveyees stated ‘capital preservation’ as their investment aim

Investors who strive for capital preservation aim to protect their assets from depreciation and devaluation and prioritize wealth safety over aggressive growth. Their goal is to keep earning returns that neutralize the effects of inflation and depreciation. These investors are risk averse and opt for low-risk investments such as bonds, FDs, and other conservative saving instruments.

Asset Diversification

Asset diversification is the investment goal of 28.6% of surveyees

Diversification focuses on spreading investments across various asset classes, industries, and geographies to hedge risk and create a balanced portfolio.

“Holding large and concentrated positions may expose us to losses.”-- Annual Report, Morgan Stanley.(2)

Rather than investing substantially in a single asset class, diversification can help mitigate investment risks. Surveyees who chose asset diversification as their prime objective for investment management strive to diversify their portfolio by allocating funds to various investment categories, including stocks, exchange funds, bonds, real estate, commodities, and debts.

Mid-Term Growth

22.8% of surveyees mentioned mid-term growth as their investment goal

The surveyed investors with mid-term growth objectives expect capital appreciation on their investments within a timeframe of 2-4 years. Most of them reported investing in balanced mutual funds and Exchange Traded Funds (ETFs).

Short-Term Growth

Short-term growth is the investment objective of 11.5% of surveyees

Investors looking for short-term growth usually invest in high-beta stocks, securities markets, and high-risk mutual funds. The goal is to get capital appreciation within weeks to a few months.

66.5% of surveyees reported all of the above investment goals depending on their current situation

These investors have all long-term, mid-term term and short-term goals in their minds. They diversify their investments and also go for capital preservation and appreciation. They also have certain investments that bring them a regular income. Overall, these investors have a highly balanced portfolio and a keen understanding of the investment world.

How do Investors Manage their Investments?

70.5% of surveyed respondents asserted investing on their own

7 out of 10 surveyed respondents manage their investments independently, without seeking professional assistance. This group of investors reported conducting their own research prior to making investment decisions. They also monitor their portfolio's performance and adjust their portfolio as per their own analysis of the ongoing market circumstances. While self-managing investments can save on fees, it may expose investors to potential pitfalls if they lack the necessary knowledge or expertise.

14.4% invest based on the advice of family and friends

Most of these respondents stated that they have someone in their family or friend circle who is really good at investment management. Therefore, these respondents invest based on recommendations from them. While this approach is based on a sense of belief in experiences and advice from trusted sources, it may not always result in optimal investment decisions. Unless the family and friends have the necessary expertise or knowledge to provide well-informed investment advice, investors trusting these sources can make mistakes that may cause them to lose their money.

5.1% of surveyed respondents have hired an investment management agency/firm

These respondents delegate their investment management to an investment agency. The surveyees stated that they are offered services like professional investment management, asset allocation, portfolio construction, real-time monitoring, 24/7 assistance, and foreign investment services by investment management firms. Generally, High net worth individuals (HNIs), Businesses, and organizations opt for investment management agencies to benefit from the expertise of a team of professionals while reducing the time and effort required to manage their investments.

2.8% have hired a Financial Advisor

A very small percentage of investors have hired a financial advisor to help manage their investments. These investors stated that they are provided with personalized financial advice, investment recommendations, legal financial compliance guidance, and active portfolio management by their financial advisors. Investors must check their financial advisor is a qualified and certified CFA (Chartered Financial Analyst) professional.

7.2% of respondents do not currently hold any investments

This group includes individuals who do not invest due to financial constraints, lack of knowledge, or personal reasons. Many of these also stated that they are not into investment as their parents take care of it, and they themselves do not have any personal investment.

Preferred Investment Types

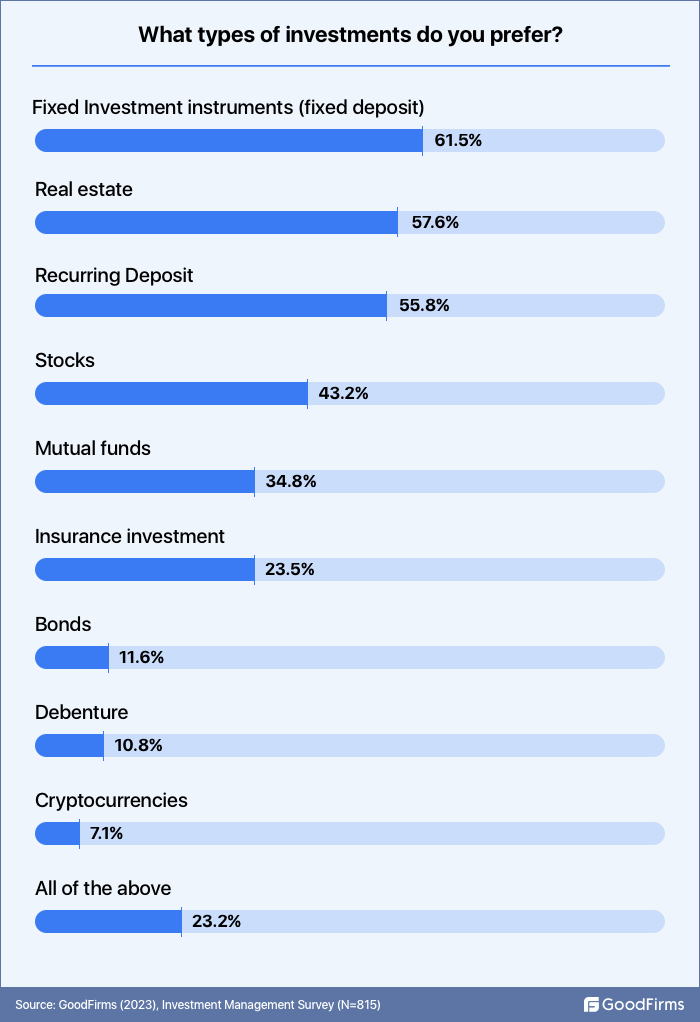

Fixed Investment Instruments (Fixed deposit)

61.5% of surveyed investors prefer investing in fixed investment instruments

A fixed deposit (FD), one of the most popular investment avenues, is an investment scheme available from banks and Non-banking Financial Companies (NBFCs). Investors deposit a fixed sum in the FD accounts and get ‘interest’ on the deposited money at a predetermined rate of interest (ROI). The FD rate of interest is higher than what is offered in savings accounts. However, premature withdrawal of the deposit incurs a penalty that differs between institutions. The interest is paid when the deposit reaches maturity or in accordance with the payment plan chosen, such as monthly, quarterly, bi-annually, or yearly.

Real Estate

57.6% of surveyed investors prefer investing in real estate

Property ownership in commercial or residential real estate offers attractive returns, loan-related tax-saving benefits, and diversification. Real estate is also used to generate income sources like monthly rental income or lease payments. Real estate is one of the most preferred long-term investments, and generally, buyers hold it for years before realizing capital gains on property.

Recurring Deposit

55.8% of surveyed investors prefer investing in recurring deposits

Recurring deposit (RD) is an investment product offered by banks and NBFCs which gives people the ability to invest small amounts regularly in return for a predetermined rate of interest. As opposed to a fixed deposit, which requires an upfront sum of money, an RD requires a fixed contribution to be submitted each month. When the RD’s term is over, the investors receive the initial investment plus the interest earned.

Stocks

43.2% of surveyed investors prefer investing in stocks

Investing in stocks/equity is when money is put into a business by buying shares of the company to obtain partial ownership through a stock exchange. People expect the value of these investments to go up, resulting in capital gains. Investors also receive dividends in certain dividend-paying stocks. If the equity increases in value, the investor will make money when they sell their shares at higher prices. However, if the stock value declines, investors lose their money. Since 1971, S&P 500 has delivered annual returns of 10%, considering reinvested dividends.(3) Historically, the stock market has returned the highest annual returns year after adjusting for inflation.

Mutual Funds

34.8% of surveyees expressed their preference for mutual funds as an investment

Buying high-priced stocks or other assets can be difficult for individual investors due to financial constraints. However, mutual funds allow investors to pool their money and invest as a group. The fund manager takes care of the complicated buying/selling process. The net value of mutual funds fluctuates every day based on changes in stock prices, commodity prices, or any other asset in which the mutual funds are invested.

Insurance

25.5% of surveyees prefer to invest in insurance products

Insurance is a great asset in dealing with unforeseen costs. Insurance products are gaining popularity due to digitization and tech upgrades in insurance products and offerings. The insurance sector also enjoys traditional positivity as a reliable investment destination. With life insurance, people get financial security should something happen to them. Insurance also comes with multiple tax advantages.

Bonds

11.6% of surveyees prefer to invest in Bonds

Including bonds in a diversified portfolio can add further stability to it. This type of investment provides a predictable income and allows for high liquidity when buying and selling in the secondary market. Furthermore, bonds are helpful when balancing out riskier components of a portfolio, such as equities. US federal bonds have been a favorite of institutional investors. The yield for a 10-year U.S. treasury bond is 3.48%. (Date: As of March 31, 2023.)(4)

“If you're young and just starting out in your career or starting a family and want to put away money for retirement or college tuition, then you might want to invest in something like a long-term basket of bonds,” says Ari Chazanas, President and CEO of Lotus West Properties, an investment firm.

Debentures

10.8% of surveyees prefer to invest in Debentures

Debentures are sellable securities that can be employed to obtain long-term capital without sacrificing equity. This type of debt is cheaper than equity or preference shares, and it provides investors with a fixed rate of interest. Investors can also buy convertible debentures that can be switched to equity shares after a fixed duration of time.

Cryptocurrencies

7.1% of the surveyees invest in Cryptocurrencies

Those who believe in the potential of technology have started to view cryptocurrency as an opportunity to gain significant profits. Even though the cost of cryptos has a limited history, they grant access to new pools of capital and liquidity through tokenized investments. Owing to its decentralized nature, cryptocurrency now enables people to transact value without any government or bank involvement, as it gives the power to own and store assets without a third party. Bitcoin, the most popular cryptocurrency, was not even worth $1 per Bitcoin till February 2011, and today (24th May 2023), it is trading at over $26500 per Bitcoin.(5)

Top Investment Management Strategies

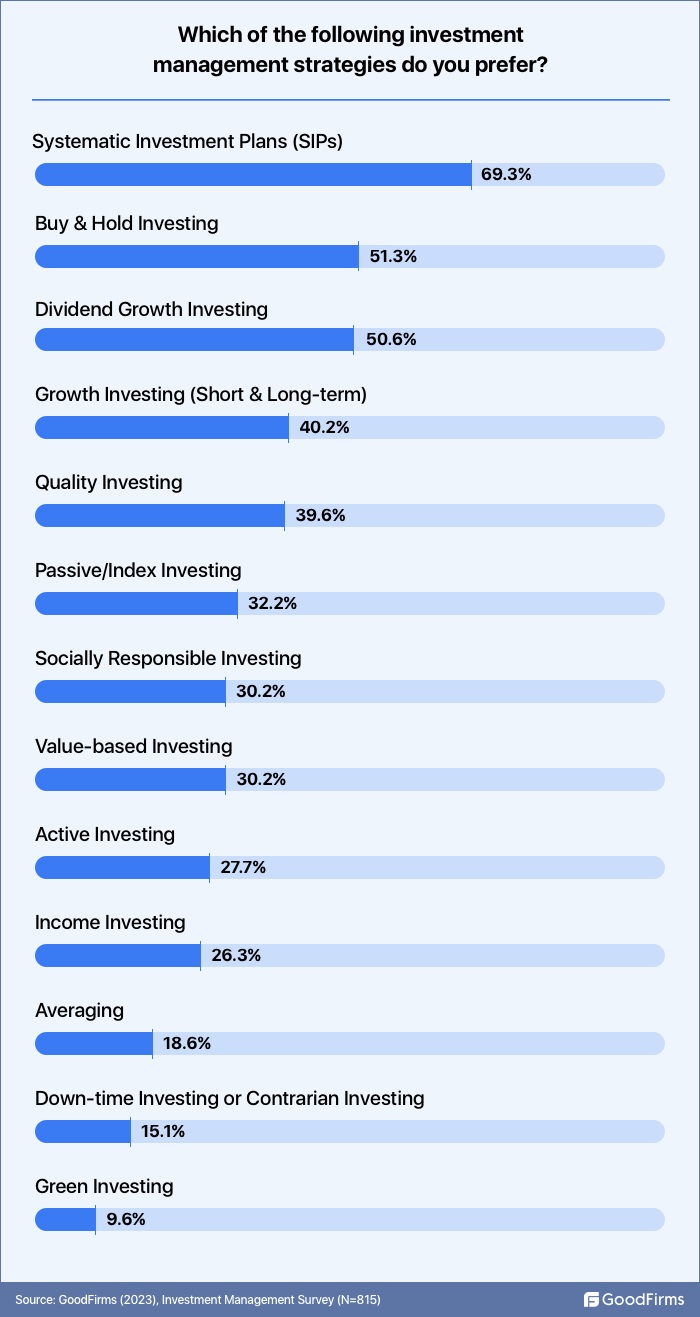

Systematic Investment Plans (SIPs)

69.3% of surveyed investors prefer systematic investment plans (SIPs)

Using a Systematic Investment Plan (or SIP) is one way to invest in mutual funds. This involves putting in a fixed amount of money at regular intervals, such as monthly, quarterly, or semi-annually. Consistent SIP investments generally result in very high returns over a longer duration (10-20 years). SIP is the most recommended investment method for new investors with less experience in the capital markets.

Buy and Hold Investing

51.3% of surveyed investors prefer a buy-and-hold investment strategy

Buy-and-hold involves purchasing equities or other investments for a longer period of time. This method of buying is unlike active investing, in which investors attempt to anticipate the stock market by selling shares when prices are high and buying when prices are low. Buy and hold is a conviction-based strategy where investors buy after a fundamental analysis of the equities they want to invest in. Long-term holding eliminates the risks posed by day-to-day market volatility.

Dividend Growth Investing

50.6% of surveyed investors prefer a dividend growth investing strategy

Dividend is a portion of profits that is distributed to shareholders. Investing in companies that consistently pay dividends is the dividend growth strategy. Dividend portfolios have provided competitive returns during times of market volatility. The dividends increase as the companies grow and increase their profits. Around half of our surveyees prefer investing in dividend-paying stocks.

Growth Investing (Short & Long-term)

40.2% of surveyed investors prefer a growth investment strategy

Growth investing is an investment style that focuses on companies that are expected to have higher growth rates. These businesses have demonstrated success regardless of the market situation and usually possess unique attributes and are able to outperform other companies. Investors are enticed by these companies due to their possible future growth, and as a result, the stock prices of these businesses are generally higher.

Growth stocks are often associated with businesses that have features that their competitors lack. This could include growth rates that surpass the market or other intangible factors such as a strong customer base, a recognizable brand, or a competitive advantage. Such stocks are typically found in newly emerging industries with a lot of room for growth. As a result of these desirable qualities, the price of a growth stock often reflects the confidence of investors in the company.

Quality Investing

39.6% of surveyed investors prefer Quality Investing

The strategy of quality investing involves searching for firms that possess the best features. Quality investing attempts to purchase companies that are financially sound, with solid revenues and strong balance sheets. Quality investing is focused on finding businesses that are proficient with capital. To ensure quality, investors look at characteristics such as a stable balance sheet, low price-to-earnings ratio, minimal debt, reliable cash flows, earnings per share, and margins.

Passive/Index Investing

32.2% of surveyed respondents are passive investors

Contrary to active investing, passive investors have the option of investing in index funds. Index-based funds provide more stable returns, though at a slower rate compared to active investors. The goal of passive investments is to slowly increase their wealth over time, with the understanding that markets usually result in positive returns in the long term. Passive investments require fewer trades, which keeps the fees lower.

“In recent years, passive investing has been gaining popularity, and investors have been choosing passive investment vehicles such as exchange-traded funds (ETFs) and low-cost index funds rather than actively managed funds,” says Salim Benadel of Storm Internet.

Socially Responsible Investing

30.2% of surveyees believe in and prefer socially responsible investing

Investment with a social focus, otherwise referred to as impact investing, socially responsible investing (SRI), or sustainable investing, places moral principles and social welfare ahead of financial gains. This strategy works to achieve both social progress and financial reward. An example of this is investing in renewable energy sources, such as wind and solar power. Another example of SRI is an investor wishing to help progress certain under-represented groups may choose to put his/her money into mutual funds that invest in businesses led by women or stocks in LGBT-owned companies.

“Environmental, social, and governance (ESG) investing has grown in popularity over the past few years. Investors are becoming more and more interested in matching their investments with their values and assisting businesses that place a high priority on sustainability, social responsibility, and ethical business practices,” says Jon Morgan, CEO of Venture Smarter.

Value-based Investing

27.7% of surveyees prefer value-based investing

Value investors buy stocks below their intrinsic value or book value and believe that at some point in time, markets reach a rational conclusion. This means that the undervalued stocks will be valued someday by markets. The greatest proponent of this philosophy was Benjamin Graham, whose seminal book ‘The Intelligent Investor’ is one of the most revered texts in the financial markets. World’s most renowned investor, Warren Buffet, also adheres to the value investing principle.

“It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” (Warren Buffet)

Value investing is against the EMH (Efficient Market Hypothesis), which states that the value of any stock is determined by its current market price and that all information about the stock is incorporated into its current share price.(6) This theory implies that markets are efficient enough to determine a stock’s price at any given point. However, Buffet and many other investment managers oppose the EMH theory and hold that markets are not rational at all times and therefore provide opportunities for value investing.

Active Investing

26.3% of surveyed investors prefer active investing strategies

The primary goal of an active investing plan is to exceed the performance of a benchmark index. This strategy involves frequent trading of securities so that short-term gains can be achieved. It is generally used when the desired returns must be greater than those of an indexed fund. Those who opt for this approach dedicate a lot of time to researching and trading stocks based on their forecasts of the future. This is a typical method that is followed by professionals.

Active investors constantly buy and sell assets (mostly stocks). They believe in the Greater Fool Theory(7), which states that in investing, one can ignore the valuations, EPS, and other financial data until there is a greater Fool who is ready to buy any asset class at a higher price than what you paid for. Active investors know that they will find someone to buy and keep trading until there is no remaining greater fool in a particular stock.

Income Investing

22.5% of surveyees prefer income investing

An income-investing strategy's primary purpose is to create a portfolio that furnishes a consistent flow of income. This income can be provided in many ways, such as dividends, bond yields, and interest payments. Real estate is a favored and lucrative investment for this type of portfolio, as it can render a steady income through renting out the property.

Averaging

18.6% of surveyed investors prefer averaging methods of investing

Investors with a long-term perspective often opt for the strategy of averaging down, which involves further investments in an asset once its cost has dropped after the initial investment. This is seen as a cost-effective means of building wealth. Individuals who favor this technique may reason that a stock that has decreased in value can be bought at a price lower than its actual value.

Contrarian Investing

15.1% of surveyed respondents prefer downtime Investing or contrarian investing during the recession, wars, etc.

Contrarian investors will go against the grain in order to capitalize on the markets. For instance, when pharmaceutical companies are in high demand, these investors may opt to invest in tech stocks instead. Furthermore, contrarians can spot when bullish sentiment could lead to a market crash and can also identify when an asset is being overlooked and could be the subject of an upcoming rally. Furthermore, investing during a downturn caused by events such as pandemics, wars, or trade wars is a part of the contrarian approach. Contrarian investing is the opposite of the Momentum Theory, which advises investors to go with the flow (buy or sell as per the ongoing trade momentum or trade direction).(8)

Green Investing

9.6% of the surveyees prefer green investing

Green Investment is currently one of the biggest opportunities in investment management today. The world’s leading economies have committed to setting the standard for green financial systems. Investors are also betting on green taxonomies in the financial world and capitalizing on Net Zero targets set by the world’s top financial and regulatory institutions.

“I’m a big advocate for climate transition, but it’s just that it’s a transition that’s gonna go on over a long period of time. I think one of the things we do as asset managers is meet the needs of capital allocators, and capital allocators are interested in allocating some capital, not all of their capital, towards technologies towards opportunities that are driving the sustainable transition, says David Solomon, the CEO of Goldman Sachs in an interview to CNBC.(9)

Key Factors Investors Consider When Selecting an Investment Avenue

91.5% of surveyed respondents consider investment safety before choosing the investment avenue

Investors seeking the margin of safety before investing evaluate the financial strength, credit ratings, volatility, investor perception, and overall stability of the investment avenue. Generally, government bonds, fixed deposit receipts, money markets, notes, bills, mutual funds, real estate, and commodities like Gold and silver are considered to be safe investments. Whereas stocks, and collectibles like NFT, cryptocurrency, Futures and Options, etc., are considered high-risk investments.

82.1% of surveyed investors evaluate the performance history of an investment avenue before investing

Investors consider the past performance of a fund or asset class to be a good indicator of its future performance potential. Investors compare the performance of the investment against the benchmark funds in the same category. For example, an investor planning to invest in mutual funds will compare the historical performance of the fund with benchmark indices like Nasdaq and S&P 500 and also with the performance of other mutual funds in the same category (small cap, mid cap, large cap, hybrid, etc.)

77.5% of respondents consider high returns as a critical factor when selecting an investment avenue

High returns are one of the prime factors that guide the investment decisions of the investors. The potential for high returns is an attractive feature for many investors. However, investments with higher returns often come with increased risk and volatility.

62.3% of respondents consider tax benefits as a factor in choosing an investment avenue

Some investments offer tax advantages, such as tax deductions, tax-deferred growth, or tax-free withdrawals. These benefits can enhance the overall return on your investment.

55.3% of respondents factor in Lock-in Period before investing

Some investments, like certain fixed deposits or tax-saving instruments, have a lock-in period during which you cannot access your funds without incurring penalties.

41.8% of respondents evaluate the risk-reward ratio before investing

This ratio helps you evaluate the potential return on an investment relative to the risk taken. A higher risk-reward ratio may indicate greater potential returns but also higher volatility and risk.

Investors must assess the risks associated with their investments and take appropriate measures to minimize their exposure to these risks. This can include diversifying investments and setting appropriate stop-loss levels, says Jack Lloyd, General Consultant - Marketing & Business Dev, Z Grills Australia.

11.2% of surveyed respondents consider the expense ratio before investing

The expense ratio is the amount of money that goes for fees and operational costs for running an investment fund. The expense ratio is generally between 0.5% to 0.75% of the total investment amount in actively managed funds. Investors have to give this sum as a fee to the investment manager or the agency that handles the fund. Some passive funds may charge as less as 0.02%.(10)

2.3% of surveyed investors consider investment objectives before investing

Understanding the investment's objective is vital to ensure it aligns with your financial goals, whether they are long-term growth, capital preservation, or income generation.

Our surveyees, mostly Gen Z ones (18-24) years, mentioned that their personal values also guide their investment decisions; they consider the happiness of others before investing.

Benefits of Investment Management

83.6% of investors stated diversification of funds as a prime benefit of investment management

Diversification saves investors from single investments failing badly. Diversification minimizes asset-specific risks by spreading the investment across multiple asset classes. A balanced portfolio consists of investments in bonds, stocks, mutual funds, real estate, debt, commodities, digital assets, and index funds. When economic or political situations change, they may have an adverse impact on certain asset classes.

“All institutional investors and pension funds use diversification as a wise approach, which typically entails acquiring various safe investments and assets to protect against various dangers. While most farmers focus on one or two crops, they often produce a variety of other crops. It is done so that even if one crop fails, it could still profit from the other crops. The same justification applies to other investments, says Oliver Andrews, an ardent investor, and editor at OA Design Services.

For example, an increase in Gold import duty will negatively impact domestic Gold investments as the prices would get higher and discourage new investments. But for existing investors, it will be a piece of positive news as their portfolio will scale new heights. Similarly, if the opposite happens, then Gold prices will move down and will cause a dent in the portfolio. Therefore, rather than investing in any single asset class, it is prudent to diversify as much as possible.

69.5% of the surveyees stated tax planning and savings as the top benefit of investment management

A rational investor would never indulge in tax evasion schemes; however, he/she will also try her best to minimize tax liabilities. Investors may seek deductions, rebates, and exemptions to reduce their tax dues. Investment management helps investors in planning their tax liabilities and allows them to save taxes. For instance, investment in tax-free bonds, healthcare insurance policies, green fixed deposits with tax benefits, etc., can help investors save taxes.

51.2% of surveyees consider access to professional expertise as the top benefit of investment management

Professional advice from asset managers and investment experts can increase the chances of better returns on investment. Professional investment advisors have knowledge of the asset classes and their intricacies, and they know what is trending, what can bring more returns, and which asset class one should avoid in a particular situation.

44.3% of surveyees attributed ‘potential for higher returns’ as the top benefit of investment management

The primary objective of many investors is to generate returns that can comfortably beat inflation and outperform the benchmark indices after tax deductions. Investment management is a strategic art of assisting clients in meeting the aforementioned objectives.

Also, while many investment classes are considered to be more secure than others, the importance of any asset class is determined by its ability to generate higher returns in the long term. Investment management helps clients identify the required asset classes for higher returns. From asset analysis, selection, and monitoring to reallocation and selling, investment managers strategize all investment actions that bring desired returns.

33.6% of surveyed investors assert ‘reduced risks’ as the top benefit of investment management

The world of investment is full of risks and volatility. There are investment risks like recession, inflation, interest rates, investment frauds, financial misinformation, and many other unexpected crises that may impact investment. Without professional investment management, investors may lose their hard-earned money. One of the major benefits of investment management is to safeguard the investors against potential risks.

33.4% of the surveyed respondents consider customized investment solutions (based on personal preferences and goals) as a sure-shot benefit of investment

Customized portfolio solutions are gaining traction among investors who prefer direct investing rather than ETFs. Investors find direct investing more profitable than ETFs, and many consider it will spearhead the next disruption in portfolio management. Direct investing portfolios are customized as per the personal preferences and investment objectives of individual investors.

28.9% of respondents stated access to exclusive investment opportunities is one of the significant benefits of investment management

Some of the investment products are accessible only via investment management firms. Especially big-budget investment sprees require the appointment of an investment banker to complete and legalize the transaction. Some private equity deals also happen only via designated investment management agencies.

24.6% of surveyed investors consider the ability to invest in socially responsible or sustainable investments as a top benefit of investment management

Socially responsible investment shuns investments in companies or projects that cause health hazards, environmental damage, etc., such as alcohol or cigarette companies, industries that pollute at a large scale, and gambling businesses such as casinos, gaming pubs, etc. Socially responsible investments are more inclined to put money in alternative energy resources and invest in companies that are known for ESG excellence. Sustainable investments favor projects that positively impact environmental causes.

Deloitte's 2023 survey of international C-suite executives revealed that almost every single CxO, regardless of industry, claimed that their business had experienced negative effects from climate change, thus making it a priority topic for C-level leaders in the upcoming year.(11)

22.5% of investors consider assistance with financial planning and goal setting as the advantage of investment management

Financial future planning is critical for meeting long-term financial goals, retirement planning, and meeting other financial obligations, including medical bills, education expenses, tax requirements, etc. Investors stated that they could better align their investments with their financial goals with investment management.

12.5% of investors reported other benefits of investment management, such as saving time, better cash flow management, improved documentation, etc.

Challenges Faced in Investment Management

77.9% of surveyees stated they lack knowledge or experience in investment management

Investment management is an intricate field. With a number of asset classes, financial instruments, and markets, it is difficult for a naive investor to choose appropriate investment alternatives. Inexperienced investors are also not fully aware of the available investment options and may stick to outdated investment avenues that may not bring the desired results. Lack of knowledge in the investment field can also affect their decision capabilities. In a reactionary market with continuously changing dynamics, investors that lack knowledge and experience are not able to filter the voluminous information that markets generate every day.

68.4% of surveyed investors struggle with finding the right investment opportunities

While investment markets are full of opportunities, finding the right one is difficult, even for seasoned investors. Markets are not easy to predict, and most of the major investment avenues are dependent on overall economic and socio-political conditions. For example, suppose an investor studies the fundamentals of the rubber industry and tire manufacturing and finds tire manufacturers are posting consistent profits for the last 4 quarters owing to their low expenditure on raw rubber imports from a neighboring country.

After a complete analysis of the industry and its future prospects, the investor buys stocks of tire companies. However, due to some adverse political developments, the neighboring country issues a ban on exports of raw rubber to other countries. The situation is a big blow to the tire manufacturing industry, and the stock prices are bound to come down.

56.5% of investors reported extreme market volatility as a major challenge

The daily fluctuations in the market refer to frequent changes in currency prices, stock values, bond prices, etc. The volatility can unnerve investors as it causes uncertainty and stress. The stretched downswings can also lead investors to choose to sell their invested holdings at a huge loss. There were 65 cases of volatility shocks faced by the United States and global markets between 2008 to 2020, including extreme volatility cases like the global financial crisis of 2008, China's slowdown, the Oil price drop, and the pandemic.(12)

50.6% of investors are susceptible to emotional decision-making

Logical investing, disciplined or rational investment, is opposed to emotional or impulsive decision-making. Even with all the data that investors have in their hands, they are still prone to emotional decision-making. Some of the scenarios of emotional decision-making are situations where the investors keep holding onto a loss-yielding investment (loss aversion). Biased investing is where investors tend to invest in stocks or investment avenues that they are emotionally attached to. Past experiences and personal beliefs also unconsciously guide investor decisions, making investors deviate from logical steps in favor of emotional ones.

48.4% of surveyed investors stated difficulty in assessing risks as their topmost challenge in investment management

All investment instruments are subject to market risks, credit risks, reputational risks, interest rate fluctuations, inflation risks, liquidity risks, and many more. Apart from it, there are other economic factors and political risks that may affect a particular investment. Assessing risks and managing a portfolio of investments to minimize risk is a daunting task. Around half of our surveyed investors find it challenging to assess risks in investing.

39.1% of surveyed investors face difficulty in understanding and interpreting financial statements and market data

Investors need to analyze financial information and documents like balance sheets, cash flow statements, sales data, income statements, etc., to understand the financial position and performance of a company. Apart from analyzing an individual company’s financials, investors have to study the industry data and overall market conditions by evaluating the macro data like industrial output, interest rates, employment data, etc., to make an informed investment decision.

24.2% of surveyees find it challenging to keep up with changing market trends

Markets are dynamic. Though the key macros like bond rates, overall economy, GDP, inflation, employment data, etc., may take some time to change, the micros, like demand and supply, taxation, and regulations, keep changing more frequently. The investment markets are evolving frequently, with newer trends introduced every now and then. Keeping up with the changes and adapting latest trends is not an easy task.

The main challenge associated with investment management is the complexity of the market and the need to stay up to date with the latest trends, says Eric Lee, Co-Founder at REIInsiders.

17.7% of surveyees find it challenging to understand and adhere to investment regulations

“Compliance is a challenge in and of itself as our government continues to pass new legislation that changes how we do business and what we must document,” says Jordan Taylor, FINRA Series 66 Licensed & SEC Registered Investment Advisor, Core Planning.

Investment policies and regulations vary country-wise. For example, in Canada, investment is regulated through Investment Canada Regulations (1985), in Kuwait, it is Investment Law (2013), in Mauritius, it is Investment Act 2001, in Saudi Arabia, it is Foreign Investment Law 2000, in South Africa, it is Investment Act 2015, and in the USA it is Foreign Investment Risk Review Modernization Act (2018).(13) With so many global acts and regulations concerning investments, investors, particularly Foreign portfolio investors, find it difficult to adhere to regulations laid down by each country.

Apart from the challenges discussed above, Goodfirms surveyees reported challenges related to data management, ensuring their financial data is safe from online attacks, adopting the latest technologies in the investment field, etc.

“We are subject to operational risks, including a failure, breach, or other disruption of our operations or security systems or those of our third parties (or third parties thereof), as well as human error or malfeasance, which could adversely affect our businesses or reputation.”

–Annual Report (Morgan Stanley)

Other Insights from the Investment Management Survey 2023:

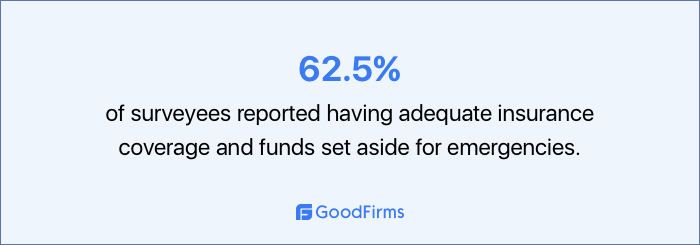

62.5% of surveyees reported having adequate insurance coverage and funds set aside for emergencies

Investors may pull out their funds from invested avenues if they need the money for emergencies such as medical bills, personal events, or other unforeseen expenses. Premature withdrawal of investment can cause loss to the investors. Therefore, keeping emergency funds aside to cover any short-term needs ensures that the investments won’t be touched till their full-maturity period. Emergency funds are critical to keeping investments safe from premature withdrawals.

81.2% of surveyed participants prefer investments with little or no fluctuation in value and are willing to accept the lower returns associated with these investments.

4 out of 5 investors prioritize capital preservation over higher returns that come with risk. Therefore, these investors avoid volatile investments and focus on investments that offer stable returns, such as Government treasury bonds, blue-chip stocks, fixed deposits, etc.

Only 11.5% of surveyees agreed to have been consistently profitable in their investment regimes.

The glamor, excitement, thrill, and promises that the investment world presents may deceive anyone. However, the reality is different. Investors are bound to make losses too. Only 11.5% of surveyed investors by Goodfirms accepted that they have been consistently profitable in their investment regimes. It means that over 85% of investors fail to make consistent profits in their investment endeavors.

Top Trends in Investment Management:

Increasing Interest in Alternative Investments

Alternative investments are asset categories that deviate from traditional investment types. These assets expand the scope for investment portfolio diversification. Some well-known alternative investments include venture capital, private equity, cryptocurrencies, commercial real estate, hedge funds, art and antiques, and commodities.

In recent years, there has been a growing trend of alternative investments in collectibles, NFTs (non-fungible tokens), cryptocurrencies, and private equity.(14)This is mainly driven by the desire for diversification, the potential for higher returns and the increasing accessibility of these assets through digital and technological advancements.

“Private equity and alternative investments, such as hedge funds, real estate, and private credit, are becoming increasingly popular choices among investors as a means of generating higher returns in an environment characterized by historically low-interest rates. If an investor is ready to accept a higher level of risk, however, these investments, which are often less liquid and carry a higher level of risk, might offer attractive returns,” says Pareen Sehat, Director of Well Beings Counselling.

It is crucial to note that these investments carry higher risks, complexity, and illiquidity compared to traditional investments. For example, investing in rare and valuable artwork, antique furniture or wine bottles, or collectible items like stamps, coins, etc., can be considered an alternative investment. However, valuation estimation and selling these items can be challenging due to their subjective nature and the limited number of buyers interested in specific collectibles.

Sustainable and Impact Investing

The inclination of investors toward environmentally responsible investments is growing, and investment firms are now offering ESG funds that take environmental effects, social responsibility, and corporate governance into account. Impact investing intends to generate positive and measurable social and environmental impacts alongside a financial return. This approach involves investing in companies that demonstrate a positive social or environmental impact and can be made across various asset classes, including cash equivalents, venture capital, and private equity.

“There is a rise in the popularity of ESG investing, which refers to the practice of investors wanting to place their money in businesses that are both socially responsible and ecologically sensitive. The increased awareness of the effects of climate change as well as the necessity of implementing sustainable business practices, has been driving this trend”, says Steve Pogson, Founder of FirstPier.

Artificial Intelligence (AI) and Machine Learning:

From deploying robo advisers that manage investment portfolios of clients to using algorithmic trading to predict and execute portfolio trading decisions, investment management firms are utilizing AI/ML tools to maximize returns and provide clients with better results.

“Suppose you're an investment manager responsible for managing a portfolio of stocks. Traditionally, you would spend hours analyzing financial statements, market data, and economic indicators to make investment decisions. However, with AI and machine learning, you can analyze all of this information in seconds, allowing you to make faster, more informed decisions. This can lead to better returns and more satisfied clients,” says Hayden Miyamoto, Co-Founder, Acquira.

While AI-based chatbots are personalizing client interactions, robo-advisors can give personalized advice to clients based on their risk tolerance, investment horizon, and objectives.

“We will probably see AI taking a larger share of strategy implementation and ideation with the new development of AI- now, you don’t need an expert in coding, you simply need someone who can prompt a large language model to write the code you need to implement your trading strategies,” says Hunter Watts, Founder of Monge Point Management.

Blockchain in Investment Management

Blockchain technology is gaining traction in the investment management industry with its decentralized, secure, and transparent nature that enables financial organizations and investors to better manage their investments. Blockchain is used to create digital tokens (asset tokenization) representing ownership of asset classes like real estate and commodities. In stock markets, blockchain is being used to settle securities transactions with shared and immutable ledgers. The technology also enables the execution of smart investment contracts. Decentralized investment platforms backed by blockchain tech are enabling investors to manage portfolios without relying on intermediaries.

“Investment management companies are increasingly turning to blockchain technology as a means to boost transparency and cut operating expenses. The ownership of assets may be tracked with the aid of blockchain, which can contribute to the reduction of fraud and the improvement of the accuracy of investment records,” says Shanal Aggarwal, Chief Commercial Officer (CCO), TechAhead.

Big Data in Investment Management

The usage of Big data analytics to identify trends and patterns in the market is growing, and investors are using big data to identify undervalued securities and anticipate market movements based on data analysis. By analyzing historical data, investors predict future scenarios and develop risk management strategies.

“Analyzing the sentiment of social media, news stories, and other data sources are all examples of what may be done in this regard to detect potential dangers and opportunities in the market. The analysis of large amounts of data can give investment managers a complete picture of how the market is currently trending,” says James White, Managing Director of Media First.

Emerging Investment Fintech Companies

Many investment financial technology companies are entering the investment world and breaking down the entry barriers to investment with their intuitive, low-cost, and easily accessible investment platforms. By leveraging technology, these companies make investment more affordable for people with limited resources, who can now invest even with small amounts. Investment fintech companies are revolutionizing the crowdfunding and peer-to-peer investment fields and promoting financial inclusion with a more diverse investment landscape.

“Fintech companies are allowing more people to easily participate in investing through digital-first, intuitive web and app platforms. Instead of gatekeeping investing behind investment advisors and archaic trading platforms, everyday people can learn about investing without any wealth requirements. Emerging investment financial technology companies are democratizing access to investing and allowing more people to build wealth through healthy, diversified, long-term investing strategies,” says Chen-Chen Huo, co-founder at Nexus, an investment platform.

Customized Portfolio and Personalized Indexing

A personalized portfolio is tailored to individual investors’ needs, goals, and risk tolerance. It is not the standard portfolio that is offered to all investors subscribing to any investment management agency. Personalized portfolio managers take into consideration investors' unique financial needs, situations, and tax requirements to create a bespoke portfolio that can offer better returns than the generic portfolio. Personalized indexing or SMA (Separately management Accounts) further makes changes in the portfolios that include general ETF stocks to accommodate stocks that are aligned with the investment philosophy of the individual investor. For example, if the ETF doesn’t have any companies that are inclined to SRI or ESG criteria, a portfolio manager will add other companies to make the ETF-based portfolio personalized for a client who wants to include SRI companies.

Growing Investments in Quantum Computing Technology

Quantum computing has evolved from being an idea to a technology on the verge of practical application. Though its commercial application by investment management agencies is still not available, the interest in this tech has been significantly growing among asset management companies. The technology has the power to deliver highly differentiated results, and therefore, many investment fintechs are investing in this potential technology.

Key Findings

- 68.9% of surveyed respondents identify themselves as conservative and risk-averse in investment

- 8.8% of our surveyees asserted having a higher risk appetite when it comes to investment.

- 71.2% of surveyees stated ‘long-term growth’ as their investment goal

- 44.2% of surveyees stated ‘regular income’ as their investment objective

- 70.5% of surveyed respondents invest on their own

- 14.4% invest based on the advice of family and friends

- 5.1% of surveyed respondents have hired an investment management agency/firm

- 2.8% have hired a Financial Advisor

- 61.5% of surveyed investors prefer investing in fixed investment instruments

- 57.6% of surveyed investors prefer investing in real estate

- 43.2% of surveyed investors prefer investing in stocks

- 34.8% of surveyees expressed their preference for mutual funds as an investment

- 91.5% of surveyed respondents consider investment safety before choosing the investment avenue

- 82.1% of surveyed investors evaluate the performance history of an investment avenue before investing

- 77.5% of respondents consider high returns as a critical factor when selecting an investment avenue

- 69.3% of surveyed investors prefer systematic investment plans (SIPs)

- 51.3% of surveyed investors prefer a buy-and-hold investment strategy

- 50.6% of surveyed investors prefer a dividend growth investing strategy

- 32.2% of surveyed respondents are passive investors

- 30.2% of surveyees believe in and prefer socially responsible investing

- 83.6% of investors stated diversification of funds as a prime benefit of investment management

- 69.5% of the surveyees stated tax planning and savings as the top benefit of investment management

- 77.9% of surveyees stated they lack knowledge or experience in investment management

- 68.4% of surveyed investors struggle with finding the right investment opportunities

- 56.5% of investors reported extreme market volatility as a major challenge

- Only 11.5% of surveyees agreed to have been consistently profitable in their investment regimes.

- Technologies like AI/ML, robo-advisors, blockchain, big data, and quantum computing are gaining prominence in the investment field.

Conclusion

The investment management field is shaped by several factors, such as market challenges, technological disruptions, and changing investor perceptions and expectations. Moreover, the attitude towards finance management, investments etc., is changing with every new generation. GenZ intends to be financially comfortable, and not be very wealthy. They are ready to invest in those that they care about. The future generations will have a different mindset. For investment management firms, it is important to optimize their processes, deploy high-end technology, and nurture talent that differentiates them from the competition. Investors, on the other hand, will be required to develop strategies to navigate the markets without getting biased or influenced by the noise (huge volume of unverified data, often contradictory information available from social media, news, investment forums, etc.).

Investors, looking for professional investment advice or services to efficiently manage their portfolios and assets can also hire financial planning companies.(15) These financial advisors analyze your assets and liabilities, evaluate your income, insurance requirements, tax obligations and future plans to come up with the best investment plans for meeting your objectives.

While the technology-intense new investment forms like alternative investments, AI-powered algorithmic trading, ESG options, etc., are gaining immense popularity, the traditional investment methods and avenues are still equally relevant. A balanced approach that allows investors to both reap benefits from the emerging investment options and also, at the same time, provides the security and predictable returns offered by conventional investments is required for success in the current global investment environment.

We sincerely thank our Research Partners for their valuable insights.

References

- https://am.jpmorgan.com/content/dam/jpm-am-aem/global/en/insights/portfolio-insights/ltcma/ltcma-full-report.pdf

- https://www.morganstanley.com/about-us-ir/shareholder/10k2021/10k1221.pdf

- https://www.forbes.com/advisor/investing/average-stock-market-return/

- https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value=2023

- https://www.marketwatch.com/investing/cryptocurrency/btcusd

- https://www.forbes.com/advisor/investing/efficient-market-hypothesis/

- https://www.investopedia.com/terms/g/greaterfooltheory.asp

- https://business.columbia.edu/sites/default/files-efs/pubfiles/116/stockbrokers.pdf

- https://www.cnbc.com/2023/02/28/first-on-cnbc-cnbc-transcript-goldman-sachs-chairman-ceo-david-solomon-speaks-with-cnbcs-andrew-ross-sorkin-on-squawk-box-today.html

- https://www.investopedia.com/ask/answers/032715/when-expense-ratio-considered-high-and-when-it-considered-low.asp

- https://www2.deloitte.com/content/dam/Deloitte/us/Documents/financial-services/fsi-climate-change-investment-strategy.pdf

- https://www.northerntrust.com/canada/content/dam/northerntrust/pws/nt/documents/investment-management/navigating-extended-periods-of-volatility.pdf

- https://investmentpolicy.unctad.org/investment-laws

- https://www.nasdaq.com/articles/alts-for-all%3A-the-growth-of-alternative-investments-explained

- https://www.goodfirms.co/business-services/financial-planning

Table of contents

- Introduction

- Survey and Data Analysis

- Top Investment Management Strategies

- Key Factors Investors Consider When Selecting an Investment Avenue

- Benefits of Investment Management

- Challenges Faced in Investment Management

- Other Insights from the Investment Management Survey 2023:

- Top Trends in Investment Management:

- Key Findings

- Conclusion